The reality of 2022 is in stark contrast to the high expectations for the global economy at the start of the year. The outlook was for a promising recovery in global growth as the world exited pandemic restrictions. Expectations were for a more normalised supply chain environment and a recovery in the service sector that would help build on the strong post-Covid GDP rebound we saw in 2021. However, these prospects were rapidly re-set as we moved into the second quarter of 2022 (Q2-22), driven by a polycrisis - the spread of the Omicron variant in China, which triggered lockdowns and disruptions across the country; Russia’s invasion of Ukraine and the ensuing sanctions; the war-induced surge in commodity prices, which impacted inflation expectations; and the resultant faster trajectory for normalising interest rates and policy tightening from central banks.

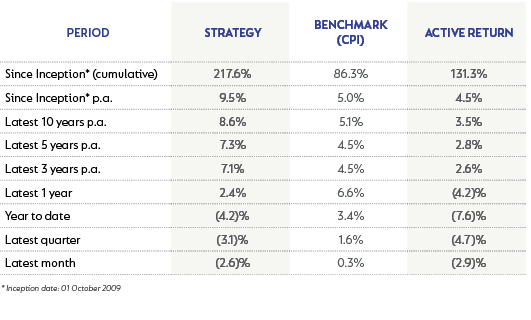

The Strategy’s performance as at 30 June 2022 is shown below:

With the anchor of low, steady interest rates on asset class pricing removed, almost all major asset classes posted substantial losses in Q2-22. South African (SA) asset classes, although cheap to begin with, fared better than global asset classes, but did not manage to escape the carnage completely. The FTSE/JSE All Share Index delivered -11.7% for the quarter (its worst quarterly return in 20 years) and the All Bond Index delivered -3.7%. These sharp, negative moves in global and domestic asset classes, together with a rising inflation benchmark, has meant that the Strategy’s quarterly return was -3.1% and +2.4% for the year. While the Strategy protected capital over the last 12 months, it did not manage to meet its inflation plus target return. Importantly, the Strategy has achieved real returns over longer time periods.

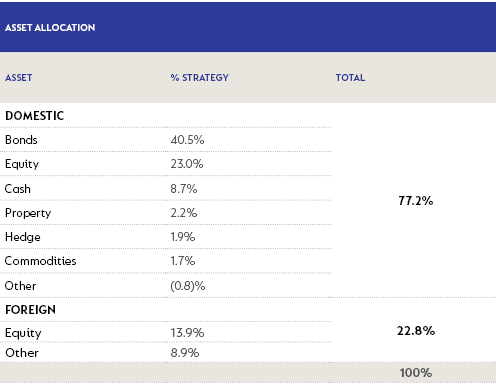

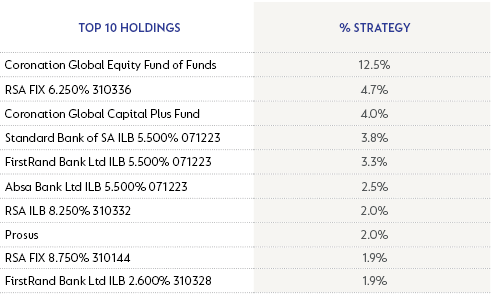

The Strategy’s global exposure has been the largest detractor from performance over the year. We have been sitting below the maximum offshore allocation allowed in the portfolio (currently at 22.8% of Strategy) for some time now as we felt that domestic assets were relatively more attractive. Despite this low offshore allocation, the performance of the Coronation Global Equity Fund of Funds (12.5% of Strategy) and the Coronation Global Emerging Markets Fund (1.8% of Strategy) has contributed negatively to the Strategy performance over the last year. This was partly offset by our exposure to the more defensive Coronation Global Capital Plus Fund (4.0% of Strategy) and our global equity put protection. With global equity markets now offering better value, we have raised our offshore exposure. We have not tilted too aggressively as we still think SA assets are cheap and offer the highest potential of delivering the targeted inflation plus returns for investors in the Strategy.

Domestic assets have contributed positively to the Strategy’s performance thanks to good equity and bond selection over the last year. Within SA equity, positive contributions have come from British American Tobacco, Anglo American, FirstRand, RMI and Shoprite. The last three shares in particular highlight the opportunity for quality, domestic businesses to deliver good returns for investors despite a tough domestic macro-economic outlook.

In the quarter, the largest contributor to outperformance was our large position in Naspers/Prosus combined, as positive action from Naspers to address the large discount it trades at has been implemented. The share ended the quarter up 36%. At their March results (which were released mid-June), Naspers noted the desire to focus on profitability in the rump assets and the crystallization of value here, on top of growing net asset value per share on a go forward basis. The kicker was the announcement of their intention to implement an open-ended buyback programme, funded by orderly selling down their Tencent stake. This is a course of action we actively pushed at both the executive and board level. Given the vast discounts Naspers/Prosus trade at, the outcome of the above is that shareholders will increase their Tencent shareholding on a per Naspers/Prosus share basis. This is a very positive step and has been the primary driver of subsequent share price performance. We continue to believe that Naspers/Prosus are attractively valued versus their underlying assets and look forward to further developments in realising this value.

From a fixed income perspective, SA government bonds still trade at historically high yields and are elevated compared to their emerging market counterparts. SA has benefited from a significant terms of trade boost that provides more breathing room for the fiscus. The SARB will be under pressure to normalise rates at a pace similar to that of major global central banks, but the current premium in bond yields remains excessive and yields have a significant risk buffer to absorb higher local inflation and higher US bond yields. Our local bond weighting has remained steady, with our selection providing healthy real yields for the Strategy.

Our asset allocation and top 10 holdings as at 30 June 2022 are shown below:

The events in the first half of the year proved that the future is difficult to predict, and we expect that the uncertainty and volatility we have seen so far in 2022 will continue to be a feature for the rest of the year. The vicious de-rating of global equities and bonds are providing us with additional choice and opportunities to diversify at much more attractive valuations than we had a year ago. At the same time, we continue to see good value local investment prospects that can deliver the inflation plus returns the Strategy is mandated to provide. With the recent changes in the Regulation 28 rules, the Strategy will have the ability to make significantly higher offshore allocations than before (45% vs 35%). These regulatory changes will not be the primary driver of the Strategy’s asset allocation decisions. As always, we will have a considered mix of domestic and offshore exposure with the suitable selection of income and growth assets to deliver the Strategy’s return objectives at the appropriate level of risk. Based on our return expectations for the various asset classes at our disposal, we continue to believe that the Strategy remains well positioned to deliver on its inflation beating mandate in the medium term.

Global (excl USA) - Institutional

Global (excl USA) - Institutional