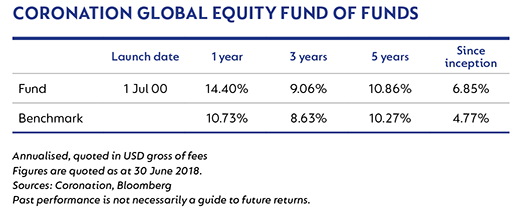

The fund outperformed the benchmark for the quarter, bringing the rolling 12-month gross performance to 14.4% against the 10.7% returned by the MSCI All Country World Index (ACWI).

The slight advance in the index somewhat masks the significant decline in emerging markets which fell 8.0% (in US dollar terms), and underperforming developed markets by 9.0%. The decline was most likely due to a combination of fears of a global trade war and US dollar strength as the Federal Reserve raised interest rates by a further 0.25% in June. The US president is stoking the flames of a trade war, not only with China but also with his allies in Europe and Japan, all of which have vowed to retaliate. This unsettled the market at times.

North America was the best performing region this quarter, rising 3.6%. The weakest return was from Japan which declined 2.8% (in US dollar terms). Europe also declined 0.9% (in US dollar terms) and the Vanguard Pacific ex-Japan Stock Index rose 1.8% (in US dollar terms). On a look through basis, the fund is overweight North America, equal weight to Europe and underweight Japan.

Among the global sectors the best returns were generated by energy (+11.9%), information technology (+5.6%) and consumer discretionary (+3.5%) stocks, while the worst performing sectors were telecommunications (-4.2%), financials (-5.2%) and industrials (-2.8%). On a look-through basis, the fund benefited from its overweight positions in information technology and consumer discretionary and underweight position in financials. An underweight position in energy and an overweight position in consumer staples have detracted from performance.

The strong returns this quarter were dominated by three of the underlying funds, Contrarius Global Equity, Maverick Capital and Egerton Capital.

Contrarius Global Equity generated alpha of 13.5% over the quarter, benefiting from its exposure to energy and consumer discretionary stocks. An example of the latter is Fossil which more than doubled over the quarter after strong sales in smart watches and a 5% year on year increase in sales. Twitter, a long-held position, also performed strongly, rising more than 50% over the period.

Maverick Capital benefitted from its positions in technology and healthcare. Shire, a pharmaceutical company that had been a drag on performance in quarters past, finally came through and rose 19% after a takeover by Takeda Pharmaceutical. Facebook, up 29% over the quarter, also added alpha as it recovered from its recent Cambridge Analytica woes.

Egerton Capital also benefitted from holding Facebook, but 21st Century Fox and Safran also contributed strongly to the positive performance. 21st Century Fox was subject to a bidding war by Disney and Comcast which drove the price higher while aircraft engine manufacturer, Safran, rose 24% after Airbus announced a strong order book and delivery schedule.

The US economy is strong but there are concerns about overheating in developed economies and the impact of consequent inflation. In addition, the potential for a global trade war and other geopolitical issues will continue to weigh on global markets and investors’ minds. However, we believe the key risk is the normalising of the interest rate cycle which is now underway in the US and will be followed in due course by the UK, Europe and Japan. After a decade of near zero interest rates, the potential for missteps is great and the fall-out could be severe. But, perhaps in recognition of this, central banks are proceeding cautiously and gradually. As such, although we are cognisant of stretched valuations, we believe the US and global economy will be resilient for the remainder of the year and we remain supportive of the markets. The risks will only increase into next year.

The second quarter of the year created even more uncertainty after the turbulent first quarter. Investors’ minds were increasingly occupied by the growing prospect of an intensifying trade war between the US and its major trading partners. President Trump and his administration seem intent on turning long-term allies into enemies, with their erratic but ongoing comments about putting America first with regard to trade. This has led to a series of tit-for-tat reactions from predominantly China. Even countries like Canada and trading blocs such as the European Union have resorted to reactive measures to try and drive home the fact that the US should behave in a responsible way in a global trading village. While one can contextualise these measures as relatively small in a global trading context, investors have been spooked as it is difficult to predict if and when these irrational actions will stop. In addition, down the line these actions have a direct impact on monetary policy and, as such, create more uncertainty.

With regards to the latter issue, we remain of the view that investors are too complacent about the potential level of normal interest rates in the long term. An analysis of the yield curve shows that while the US Federal Reserve (Fed) has clearly and continuously communicated its intention to increase interest rates two more times during 2018, only half of the market believes that to be true. In addition, the market only discounts a 10% probability of further rate hikes in 2019, while the Fed has indicated its intention (all other data points being equal) to raise rates twice during 2019. We are monitoring these statistics closely, as it could affect the equity risk premium in the medium term.

Against this backdrop, the MSCI All County World Index (ACWI) returned 0.5% over the quarter, resulting in the year-to-date number still being slightly negative. Over the last year the index return was 10.7%, slightly above the three-year annualised number of 8.6% per annum. Returns in local currencies were on average more than 2% higher, but the stronger US dollar curbed reported returns in that currency. The US dollar was on average about 4% to 6% stronger than most of the other major currencies. Among developed markets, Japan was the laggard by a modest margin. Given the increased concerns from investors about a possible full-scale trade war, it was no surprise that emerging markets underperformed their developed counterparts by over 8%, with more than half of this number being attributed to weaker currencies. The strategy has been somewhat sheltered against these moves given our decision to hedge the bulk of our emerging market currency exposures. Within the emerging market universe, Brazil was the notable underperformer, given the increasingly complex situation on the domestic political front. Over the last 12 months (and over longer time periods), developed markets have now marginally outperformed emerging markets.

Within sectors, energy was the standout performer this quarter given the stronger oil price. Financials underperformed given the trade war concerns and their potential impact on monetary policy. Telecommunication services were also weak. Over the last 12 months energy and information technology were the strongest sectors, with telecoms and consumer staples underperforming the benchmark by around 15% and 11% respectively.

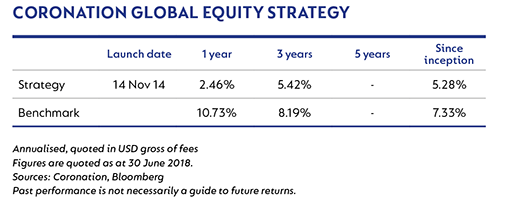

Our strategy slightly underperformed the benchmark over the quarter. The last 12 months have been tough in terms of relative performance. We remain ahead of the benchmark over the last two years, but still behind since inception. We continue to find value in the stocks we own, and in some cases have added to our positions.

Over the last quarter our most notable winners include stocks like Altice, Pershing and Imperial Brands, which have all detracted in the past. Other positive contributors were Facebook, Alphabet, KKR & Co. L.P. and Advance Auto Parts. Laggards included Porsche and Tata Motors (on the back of trade war worries), Intu Properties, the airline holdings on the back of a higher oil price and the Brazilian educational stocks as the economy continued to shrink in the face of political and economic crisis. Our two big tobacco positions, British American Tobacco (BAT) and Philip Morris, also detracted (discussed in more detail below).

Reflecting on the poor outcome of the last 12 months, it is clear that some of the portfolio’s larger positions have detracted meaningfully. Altice, the tobacco stocks, the US pharmacy retailers, L Brands and Tata Motors were the big negatives. In most of these cases the investment thesis still holds, and we continue to be encouraged about the prospects of these companies. The developments in the US pharmacy sector are being monitored closely, with the potential entry of Amazon in that space. Conversely, Amazon was our biggest positive contributor over that time.

In last quarter’s report we discussed our motivation for significantly increasing the strategy’s exposure to tobacco stocks. We continue to do more research and have increased our conviction about the prospects for this sector in the light of continued changes in consumer preferences for next-generation products (which include both vaping and heat-not-burn products). The strategy now has about 11% exposure to the sector, primarily in BAT, a stock we have worked on extensively given its dual listing on the JSE, and Philip Morris International, the owner of the iconic Marlboro brand outside of the US. Philip Morris’ share price came under significant pressure after investors were disappointed with its growth in heat-not-burn product sales in Japan. The sector is trading at a discount of over 30% to its historical average rating, and while we expect investor uncertainty to continue given all the news flow expected over the next few years, we think patient investors will be well rewarded.

More recently, we have also introduced Mondelēz International to the portfolio. This branded snack and confectionary group has been punished by investors worrying about branded consumer groups’ abilities to continue taking price increases in the light of the rise of instore brands and lacklustre US-packaged food sales growth. We think the market underappreciates the fact that only 25% of Mondelēz sales are in the US, with about 40% of group sales coming from emerging markets where its portfolio of brands is very strong and growing. The market seems to have lumped the stock with other US-centric names like Kraft and Campbell Soup where lethargic growth prospects have scared investors. In addition, the market also tends to price these stocks as bond proxies, and with the normalisation of longer-term interest rates, investors have shied away from holding consumer defensives. We consider this to be an opportunity to increase the strategy’s exposure to high-quality holdings like Mondelēz, (AB InBev) Busch InBev and Reckitt Benckiser.

Whilst the headlines would suggest a more cautious stance towards equities given the level of volatility expected by the market, we continue to be excited about the prospects for the stocks we own in the portfolio.

Global bond markets continued to come under pressure this quarter as investors further adjusted their interest rate expectations. Longer-term yields increased slightly in the US. In addition, the strength in the US dollar resulted in negative returns in dollar terms for most developed markets. The overall benchmark index returned -2.8% (in US dollars) over the quarter, resulting in a marginally positive return over the last 12 months. The US 10-year bond is now trading more than 50 basis points (bps) higher than a year ago.

Global property on the other hand had its best quarter in some years, returning 5.5% (in US dollars) over the quarter despite the strong US dollar. The US and Australian markets were the strongest (both yielding around 10% in local currency terms). The improved performance of this asset class was due to stronger than feared underlying profitability from real estate investment trust portfolios in markets such as the US, as well as a slight rerating as investor concerns about the demise of physical property in light of continued online penetration dissipated somewhat. These portfolios continue to trade at attractive valuation levels in our opinion, despite the stronger quarter. The global property benchmark index returned 6.3% over the last 12 months, significantly ahead of global bonds.

Commodities were mixed over the quarter, with the oil price being the stand-out performer, increasing by 13%. Gold was down 5.5%, erasing all its gains towards the end of last year, and ending the last 12 months almost flat. Platinum was also down 8.5% during the quarter.

The strategy marginally outperformed its benchmark over the quarter. The last 12 months have been tough in terms of relative performance. We remain ahead of the benchmark over longer time periods and since inception. We are excited about the prospects for the positions in our portfolio, but caution against too high expectations given where the various asset classes are trading.

The strategy’s asset allocation made a marginally positive contribution to performance over the quarter given the strength in the property sector. However, over the last 12 months, asset allocation detracted, as we remained underweight equities which performed the best in relative terms. This was to some extent compensated for by our overweight position in property.

In terms of underlying asset class attribution, our equity holdings slightly underperformed their equity benchmark over the last three months, while the 12-month period was very tough. (refer to prior commentary for detail)

Our property holdings underperformed the benchmark over the quarter, but did satisfactorily over the last year. Credit performed well both over the shorter and the longer term, but our physical gold position detracted, based on a weak gold price. Our decision to hedge some of our currency exposures added to recent performance given the underlying strength in the US dollar.

Prospects for the various asset classes are subdued in our opinion, and investors should calibrate their expectations accordingly. Nevertheless, we keep finding exciting opportunities in the various categories, and whilst mindful of overall portfolio risk, we are selectively including some of these in the portfolio.

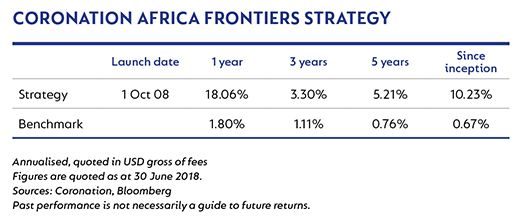

In what was a very weak past few months for emerging markets (MSCI Emerging Markets Index -8.0% for quarter), the strategy returned -9.3% (gross of fees). The largest detractors over the period were the Brazilian education stocks, Kroton and Estácio, which together detracted 2.4%. Porsche (-0.56%) was the only other stock that detracted by more than 50 bps. The main positive contributors were YES Bank (+0.50%) contribution), Airbus (+0.37%) and Naspers (+0.36%). Over the past five years, the strategy is slightly (0.8% per annum) behind the market (gross of fees), partly due to the recent tough period and partly due to a very good year in 2013 (19.3% alpha) dropping out of the five-year base. Over seven years, the strategy has outperformed the market by 2.1% per annum (gross of fees). The strategy has also just reached its 10-year track record (launched on 14 July 2008) and since inception it has outperformed the MSCI Emerging Markets Index by 4.0% per annum (gross of fees).

The Brazilian education stocks, after being significant positive contributors in both 2016 and 2017, have been large detractors in 2018 so far. We wrote extensively about Kroton in the April 2018 commentary but given continued poor performance of the Brazilian education stocks and their impact on the strategy’s returns, we believe it worthwhile to briefly touch on them again. Even after appreciating by 20% so far in July, Kroton is still down 39% (in Brazilian real) year-to-date and down 23% over the past one-year period. In contrast, Estácio, while having declined by 20% this year, has appreciated by 70% over the past one-year period. Estácio’s performance this year has been broadly in line with the average Brazilian consumer stock - in other words its poor performance is largely due to macro factors (rising US rates, Brazilian politics/economic concerns driven in part by the truckers’ strike and upcoming elections in October). Kroton’s performance, besides being impacted by macro factors, has also been impacted by company-specific factors, as one would expect to be the case given the differential in performance between Kroton and Estácio.

During the quarter, Kroton reported their first-quarter results, and while these results were in line with expectations they reduced their earnings guidance for the year (in contrast, Estácio’s results and outlook were ahead of expectations). Kroton also announced the acquisition of an education publishing/K12 school business (Somos Educação) at what appears to be a high price. These two events as well as general economic concerns (and education industry concerns) resulted in the share coming under more pressure. Kroton is already far more efficient than Estácio (c. 30% EBIT margins versus. c. 15% EBIT margins for Estácio) and as such do not have this lever to pull.

As is typically the case when a large strategy holding is going through a tough period and is impacting the strategy’s performance, we spent a significant amount of time on Kroton over the past several months with the aim of assessing whether the investment case still holds or not. Besides spending half a day in São Paulo meeting with several individuals from Kroton’s management team earlier this year, in the past few months we have had separate calls with Kroton’s CEO (twice), CFO, Head of Campus and Head of K12, to assess the Somos transaction as well as discuss both the shorter- and longer-term challenges and opportunities for Kroton. In addition, over recent months we have spoken with competitors (Estácio and others), former industry executives as well as three local Brazilian funds (two are shareholders and one has a negative outlook on Kroton as we believe there is value in understanding different views). Our conclusion from all this work is that while Kroton is facing a tough year or two ahead, the long-term prospects remain very attractive: an underpenetrated market in a fragmented industry with the biggest players (Kroton is the number one player and Estácio (number two) having the opportunity to take market share in what is a scale business, and a new growth driver in the form of entry into the K12 schools market where the market size is more than double that of the tertiary education market. On the Somos acquisition, while the price does look high at face value, there are synergies that can be extracted to bring the acquisition multiple down. Somos’s most recent results (post the announcement of the acquisition) showed a 40% increase in profits, which brings the acquisition multiple down further. Furthermore, the asset brings diversification to Kroton as well as good cash generation with lower student defaults than in the tertiary sector. Somos provides a platform for a quick leap into Kroton’s planned K12 expansion as it takes Kroton from having two schools to having 44 schools, which in turn makes it the largest operator in the K12 private market. Kroton now trades on less than 10 times 2018 earnings with a 4% dividend yield (Estácio’s valuation is not dissimilar.) which we believe is very attractive given its favourable long-term prospects. Today 5.4% of the strategy in total is invested in the Brazilian education companies, with 3.5% in Kroton and 1.9% in Estácio.

A client recently asked us whether, because we focus so much on the long term in assessing businesses and making investment decisions (five years and longer), we miss short-term data points. It is a valid question. The above discussion (12 Kroton-related calls with both management and outsiders in a three- to four-month period) hopefully answers the question to some extent. We do indeed focus on the long term (and in an increasingly short-term focused world, we firmly believe that truly taking a long-term view is a key competitive advantage) but we do also spend a large amount of time assessing every new (and short-term by definition) development – whether that is an earnings release, an acquisition or some other event including macroeconomic events – and what they mean for both the short-term and long-term earnings streams of the business.

A sharp decline in short-term earnings (next one to two years) does have an impact on the long-term value of any business, although in many cases the impact is far less than the extent of the share price decline.

As such, while we are primarily concerned about the long-term (five years and longer) earnings stream, the next one to two years’ earnings, even though they are short-term, are important for us to understand. We model all businesses on five to six years and it is this earnings stream that determines our fair value. Within this five- to six-year period we will naturally model the next one to two years’ earnings. To summarise, even though our focus is firmly on the long term (five years and longer), we certainly do not ignore the next one to two years’ earnings. In addition, with cyclical assets we always build in a down year into our five- and six-year modelling period, as even though we may not know when such a down year will manifest, we know that it inevitably will.

Magnit, the number one Russian supermarket retailer by profits, has been the other main detractor from performance over the past several months, although it was a positive contributor over the quarter. During the quarter the company announced the potential acquisition of a pharmaceutical distributor, owned by a related party. The proposed acquisition was a big concern for us as:

- We feel that management’s time is better spent on addressing current issues in the core food retail business which is underperforming;

- We question whether it is necessary to own a distributor in order to start rolling out a pharmacy strategy (which was the rationale given by Magnit management at the time of the announcement); and

- Most importantly, we had corporate governance concerns regarding the transaction (the distributor for sale is owned by a related party, which had only recently bought a 10% stake in Magnit).

As a result, we had calls with a few other large shareholders. We drafted and sent a co-signed letter to the board expressing our collective concern about the transaction. We also held calls with the (independent) chairman and vice-chairman of Magnit as well as another independent director. We were encouraged by their constructive response to our concerns and how they intend to approach this and other issues. At the subsequent board meeting a few weeks ago, the CEO of Magnit (Khachatur Pombukhchan) tended his resignation and Olga Naumova was appointed in his place. Naumova recently joined Magnit as an executive director from X5 Retail, where she was head of X5’s convenience business, Pyaterochka, which makes up c. 80% of X5’s group revenue. She is largely credited with turning around this business (and hence the X5 Retail Group) over the past five years. With a new board, a new management team (besides the CEO, the new highly regarded CFO is also from X5 and one of the new directors, ex-Lidl UK CEO, is also involved in an executive role) and a still fragmented Russian food retail market, we believe that Magnit is very attractively valued at current levels and it remains a top 10 holding.

There were three new buys during the quarter: Phillip Morris International (4.7% of strategy and the largest new position), AB InBev (2.1% of strategy) and YUM China (1.0% of strategy). Having previously sold out, we also added 1% positions in each of Alibaba and Altaba after reassessing Alibaba’s fair value following a few related meetings and results announcements with additional disclosure. In terms of sells, we sold out of five positions (all of which comprised less than 1% of the strategy as at end March):

- YUM Brands (reached fair value);

- Puregold (reached fair value);

- Hering (close to fair value but with increasing risks in Brazil);

- Reckitt (better global consumer staple opportunities); and

- Steinhoff (which was down to a seven bps position at the time of sale and where our view was that the probability of there being no equity value increased as various assets continued to be written down).

In terms of other sells (reducing positions), we reduced the JD.com position (still 3.4% of strategy, but wanting more of a balance between JD.com and Alibaba), the Heineken and Unilever positions (still 3.3% and 2.0% of strategy respectively, but buying other even more attractive consumer staples like Phillip Morris), and Airbus (still very attractive and a 3.2% position, but getting somewhat closer to fair value). In terms of other buys, we added to the Ping An Insurance, Femsa, TSMC and Cognizant positions after share price declines in all of these with no change to what we think the businesses are worth.

For the nine-and-a-half-year period since inception of the strategy in July 2008 and until January of this year, we had on average a 1% exposure to tobacco companies. The reason for this was two-fold:

- Concern over the very long-term prospects for these businesses (declining volumes, increasing regulation and even more health awareness); and

- Valuation (they had benefited from the general upward rerating of all consumer staples).

Over the more recent past there have been two key changes. First, the development of successful reduced risk products (vaping and heat not burn (HNB) devices) has meant that for the first time in decades far safer alternative products are available and as a result total tobacco or nicotine consumption has started to increase instead of decline. Secondly, sharp declines (c. 25% this year) in the share prices of both BAT and Phillip Morris International (PMI) have brought their valuations down - BAT to c. 13 times December 2018 earnings and a 5.1% dividend yield and PMI to c. 16 times December 2018 earnings with a 5.3% dividend yield. As such, we believe that for the first time in several years these stocks are now very attractive and BAT and PMI (both of which have high emerging market exposure: 43% and 55% respectively) are 5.3% and 4.7% positions in the strategy.

The tobacco companies still have many of the qualities that have always made them very good businesses – most importantly pricing power, stable earnings, very high return on capital and high free cash flow conversion. In addition, they now have attractive long-term growth prospects in our view, due to having reduced risk products in their portfolio that provide an attractive, healthier alternative to traditional cigarettes. In summary, the two main categories of reduced risk products (vaping and HNB) do not involve burning, and it is largely the burning (combustion) and subsequent release of chemicals of traditional cigarettes that create the health issues. By avoiding combustion, the risk-reduced products eliminate the biggest issue with traditional cigarettes, which in turn is what makes them appealing. Both BAT and PMI have vaping and HNB products, with BAT being the global leader in vaping and PMI the global leader in HNB, with their IQOS (I Quit Ordinary Smoking) product. In our view, there is room for both products as they have different appeals, and being global leaders respectively, there is a high probability of BAT and PMI taking disproportionate incremental market share and hence increasing their overall global market share.

PMI’s next generation products (NGP) already contribute 13% of the group revenue and PMI have an aspiration to grow that to c. 40% of revenue by 2025 through a c. four to five times increase in NGP total revenue from $4 billion to c. $18 billion. To put this $18 billion into context, PMI’s total group revenue was $29.7 billion in 2017.

In terms of other new buys within the strategy, AB InBev has gone from being a market darling (‘great management team’) to being very much disliked (‘only cost-cutters’), and the share price has followed this sentiment. Perhaps the truth is somewhere between these two extremes, but in our view global beer remains a very attractive industry (oligopolies in many markets, strong brands, premiumisation opportunities, stable earnings, high return on capital and amongst the best free cash flow generation of any business). There are two gorillas in this industry, AB InBev and Heineken, both of which have attractive long-term prospects. We continue to rate the AB InBev management team highly, and believe that what they may not know about branding or segmentation (which is very little according to the bear view) can be learnt from the SABMiller (SAB) assets that they acquired or be brought in. AB InBev have a globally diversified business, with a strong presence in Africa (both South Africa and the rest of Africa), Brazil, Colombia, Mexico, China and the US. Almost 60% of profits come from (lower-consuming and hence faster-growing) emerging markets. AB InBev trades on c. 19 times 2018 free cash flow (with SAB revenue and cost synergies still coming, Brazil profits below normal, and Africa and China growing at a rapid rate) and with a 4% dividend yield, which we believe is attractive for an asset of this quality.

YUM China is the Chinese business that was spun out of YUM Brands (global owner of KFC, Pizza Hut and Taco Bell). The company has c. 8 000 outlets in China (McDonalds as a reference point have 2 600 outlets and Burger King have 800) and continues to roll out 500 to 600 new restaurants a year. The vast majority (80%) of these outlets are KFC, with the balance largely being Pizza Hut. The royalty percentage paid by YUM China to its parent is far lower than industry norm, which in turn means higher margins and a higher return on capital can be achieved. The fundamentals of a big brand fast food restaurant chain are generally attractive (convenient and affordable, defensive earnings stream and very good free cash flow generation). In addition, with still low penetration, YUM China can continue to roll out stores in China for many years to come in our view. The fast food groups have been successful at addressing the needs of a more health-conscious consumer (a clear long-term risk) with expanded menus. Home delivery has also become an important driver (16% of KFC’s and 23% of Pizza Hut’s sales in China are now deliveries). The company has a strong balance sheet (net cash c. 10% of market capitalisation) and will continue to generate a lot of free cash flow in the years ahead - a large part of which could be applied to share buybacks. There is also opportunity for margins to expand in our view. All-in, we believe that YUM China is a high-quality business that can grow earnings by c. 15% per annum over the next five years and, at around 22 times free cash flow one year out, is attractive at current levels.

Members of the team continue to travel extensively to enhance our understanding of the businesses we own in the strategy, their competitors and the countries in which they operate, as well as to find potential new ideas. In the quarter there were trips to Russia, South Korea, Taiwan and Singapore. In the coming months various members of the team will visit China, focusing on Chinese internet companies which remain the industry where the strategy has its main exposure to China. The weighted average upside to fair value of the strategy at the end of June was an attractive c. 53%.

After a strong start to the year, the markets across Africa were weak over the past three months. Morocco (-12.3%), Nigeria, (-9.7%), Egypt (-9.3%) and Kenya (-9.0%) all recorded large declines during the quarter. Against this backdrop, the strategy’s gross return was -5.9% during the quarter, while the JSE Africa ex SA Top 30 Index was -6.6%.

On the African continent, many great businesses have globally recognised companies as majority shareholders. Multinational companies such as Nestlé, Heineken, AB InBev, Vodafone and BAT all have subsidiaries listed across Africa. We hold a number of these subsidiaries in the strategy. We believe the relationship with the multinational parent offers a number of real benefits, both to the subsidiary company and to minority shareholders:

- These companies have access to the world class brands of the parent, as well as access to the latest technology and operational best practices.

- Multinationals often have strong balance sheets, deep pockets and access to favourable lending terms. We have recently seen an example of this in Nigeria where the lack of forex availability resulted in serious problems for local businesses. During this time, many international parent companies provided hard currency financing to their subsidiaries which allowed them to continue with their operations.

- The parent company offers an additional level of governance and oversight. Governance standards are typically good as these subsidiaries must follow the (usually stricter) standards required by the parent’s listing in more developed markets.

There are also several South African companies who control businesses across Africa. Our experience with these companies in South Africa, together with our interactions with local management teams, helps us to form a better view of the individual businesses and their strategies.

What really excites us are the valuations of many of these businesses. While the subsidiaries in Africa typically offer higher growth than the parent companies, they often trade on lower multiples. A case in point is Standard Bank, where two of its subsidiaries, Stanbic Holdings in Kenya and Stanbic IBTC in Nigeria, are positioned in the top five holdings of the strategy.

Standard Bank clearly views these two banks as attractive investments. In March 2018 it announced it would increase its stake in the Kenyan subsidiary from 60% to 75% and in June 2018 it increased its stake in the Nigerian subsidiary from 53% to 64%.

Over the past 12 months Stanbic Holdings (Kenya) was up 33% while Stanbic IBTC (Nigeria) rose 37% in US dollar terms. As two of the largest positions in the strategy, these two companies made meaningful contributions to performance. Despite the strong share price moves, we still view these banks as attractive. Both trade on single-digit price earnings multiples and current valuations do not reflect the earnings growth we expect to see over the next few years. Both these banks have excellent corporate banking divisions, but the profitability levels of their personal and business banking divisions are still low. As the personal and business banking divisions gain scale, they should start to contribute meaningfully to earnings and will help to lower funding costs for the corporate and investment banking divisions. As a result, we believe that the earnings are still below average for these banks.

While we like to own the subsidiaries of large multinational businesses, it does not mean that we will own these businesses at any price. There are many examples of companies we would love to own, but where valuations are simply too high. In addition, a business that is majority owned by a multinational can at times be a double-edged sword.

We have seen instances in the past where parent companies have taken actions that are in the best interest of the group rather than the subsidiary. We are very cognisant of this risk and often engage with management teams on the topic, but up to now our experience has been that the benefits of investing alongside a strong multinational usually outweigh these risks.

Over the life of the strategy, these businesses have been large contributors to performance and we still hold a number of them in the portfolio. These are just some of the businesses in the African universe that are currently very attractively valued. By owning these businesses that trade well below our assessment of intrinsic value, we believe investors will be rewarded over the long term.

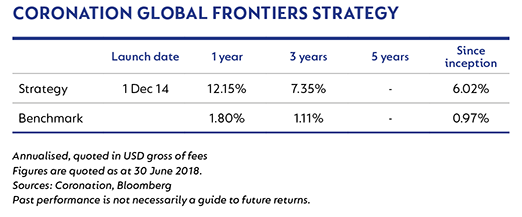

The past three months was very tough for frontier markets. The fund’s gross return was -7.5% while the MSCI Frontier Markets Index was down 15.2% over this period. Ukraine (+29.7%) was one of only a few markets with a positive return over the past quarter. Morocco (-12.3%), Pakistan (-10.5%), Nigeria (-9.7%), Egypt (-9.3%), Sri Lanka (-6.3%), Bangladesh (-3.5%) and Kuwait (-0.9%) all declined, but the most significant contributors to the negative performance in frontier markets came from two markets – Vietnam and Argentina.

Over the past three months the stock market in Vietnam was down 16.8%. In the previous quarter’s commentary, we said that while we like the macroeconomic fundamentals of Vietnam, we found valuations simply too expensive and therefore had no exposure to Vietnam.

The largest decline during the quarter was in Argentina which was down a staggering 41.6%. The Argentine peso has been under extreme pressure this year, particularly over the past three months, and the currency alone accounted for almost 30% of the country’s negative performance.

Argentina is the largest constituent of the MSCI Frontier Markets Index, while Vietnam is the third largest. We have highlighted many times in the past that we size investments based on the return opportunity on an absolute basis, irrespective of the size of these investments in any particular benchmark. This is clearly demonstrated by the fact that we held no investments in Argentina or Vietnam during the quarter.

In June 2018 the MSCI announced that Argentina will be upgraded from the Frontier Markets Index to the Emerging Markets Index in May 2019. This announcement is in stark contrast to the current economic environment in the country where the currency moved from around ARS 20 to the dollar to almost ARS 29 to the dollar over the past three months, interest rates were increased to 40% and the country was forced to go to the IMF for a $50 billion financing deal.

While this upgrade sounds positive for portfolio flows, it is not necessarily the case. Argentina will move from the largest country in the MSCI Frontier Markets Index, to an almost irrelevantly small constituent of the Emerging Markets Index. Two years ago, MSCI announced that Pakistan would be upgraded from Frontier to Emerging effective May 2017. We saw the stock market in Pakistan posting strong gains in the run up to the inclusion, but this was followed by a large decline over the following year when the country did not get the large expected portfolio inflows from emerging market investors.

Whether or not a specific company is included in the MSCI Frontier Markets Index does not change our view on that business. These announcements have virtually no impact on the underlying fundamentals of businesses and is an example of the inefficiencies that exist in financial markets. Frontier markets in particular are susceptible to this and present opportunities for bottom-up, valuation-driven investors willing to take a long-term view. Even though Pakistan is no longer in the official MSCI Frontier Markets Index we continue to hold the businesses in Pakistan, which we find attractive.

We visited a number of countries during the quarter, but our visit to Pakistan was one of the highlights. The stock market has been under pressure over the past year, driven by concerns over the political environment and currency. However, the meetings with individual companies showed that many of these businesses are performing well. A number of these businesses now trade well below our assessment of fair value.

One example is Bank Alfalah, the leading retail and small and medium-sized enterprise (SME) bank in Pakistan. The growth potential for banks in Pakistan is significant. There are only 20 million bank accounts in a country with almost 200 million people and the loan to GDP ratio (below 20%) is low compared to other frontier markets and extremely low compared to more developed countries. As the leading retail and SME bank, we believe Bank Alfalah has the potential to grow ahead of the market. Its strong Islamic banking franchise will help to keep the cost of funds low and it has opportunities to reduce the cost to income ratio after reorganising certain internal operations last year.

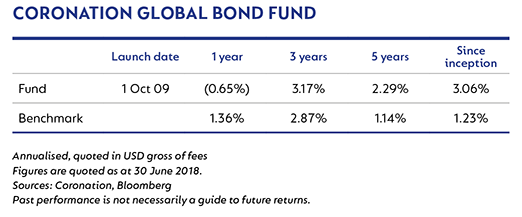

For the most part, core developed government bond markets posted modest gains in local currency terms while peripheral and Eastern European markets posted negative returns. Emerging market debt was particularly weak and losses were compounded by weaker currencies. Corporate bonds underperformed government bonds once again as credit spreads continued to soften. The US dollar strengthened against all currencies compounding losses in US dollar terms for unhedged positions. The fund returned -4.57% for the quarter and -0.65% over the last 12 months, against a return of -2.78% and 1.36% respectively for the Bloomberg Barclays Capital US Aggregate Bond Index.

The economic narrative has become more complex in recent months. Central banks, led by the US, have begun to scale back asset purchases and rising policy rates and tighter financial conditions are beginning to have an impact. China too is feeling the effect of less credit growth adding to the headwinds for emerging markets. Meanwhile, the US administration’s recent trade tariff hikes have added to investors’ concerns that a broader trade war may develop. In the near term, US growth will be supported by fiscal expansion and the Fed will continue to tighten monetary policy as the output gap closes and wealth effects buoy consumers. A more meaningful slowdown remains a risk in late 2019 or early 2020.

US bond yields rose as high as 3.1% in mid-May, prompting talk of a breakout to the upside before falling back below 3% and ending the quarter at 2.85%. The Fed raised the Fed funds rate by a further 25 bps as expected in mid-June (upper bound now 2%), the latest dot plot was deemed to be slightly hawkish as it suggests two more moves are likely in 2018.

With short rates rising and markets acknowledging the potential for a slowdown in late 2019, the yield curve continued to flatten. While Europe and Japan resisted higher short rates, the rise in US short rates and a flatter curve has meant higher hedging costs for overseas buyers. With US issuance set to rise substantially in the wake of US tax cuts, and the runoff of the Fed’s balance sheet expected to accelerate, bonds hedging costs look set to rise further. Ultimately, this raises the prospect of higher US yields as foreign demand wanes.

Despite being wary of longer-dated valuations, the US Treasury’s current bias towards shorter-dated issuance may continue to contribute to a bearish flattening of the yield curve. With US breakeven rates of inflation relatively stable (despite higher oil prices), movements in the yield curve have manifested themselves in higher real yields. The real yields on a five-year inflation linked instrument at 0.7% are at the highest level since 2009. The fund reduced its exposure to US government bonds during the quarter as it funded increased exposure to corporate bonds and emerging markets. The fund also switched a portion of its fixed-rate exposure into five-year inflation-linked securities.

European investors have had much to deal with over the last three months with politics finally spilling over into markets. The Eurozone now has to contend not only with Brexit but a new Italian populist government which looks set to use domestic issues as a bargaining chip in the wider Eurozone reform debate. Migration has become a hot topic (especially for the coalition government in Germany) and individual states’ attitudes to the subject are a reminder of just how divided Europe remains on many issues.

Europe’s relationship with the US is also under strain as evident at a recent G7 summit. The imposition of tariffs (and subsequent retaliations) alongside the funding of NATO remains a live issue. Italian bonds performed poorly (down 5.2% in the last three months) in the wake of the Italian government’s formation with yields experiencing unprecedented moves (two-year yields rose from 0% to 2.75% before ending the quarter at 0.67%). In the predominant European countries, yields fell as the European Central Bank (ECB) remained dovish on rates, predicting rates would remain at current lows at least through the summer of 2019. The central bank also announced its intention to reduce new asset purchases from the current €30 billion a month to €15 billion in the fourth quarter and complete purchases at the end of the year. Existing maturities will continue to be reinvested for an extended period with the market speculating that the ECB will skew those purchases into longer maturities thereby maximising the duration impact of their actions. Within the UK, Brexit wrangling dominates the headlines with definitive progress lacking much to the annoyance of the business community. The Bank of England is inching closer to raising rates once again, with the result being that current bond yields look unappealing.

Emerging markets struggled throughout the quarter with local currency debt particularly weak as investors unwound carry trades. Turkish bonds lost 10% in value, Indonesia 6% and Brazil 5%. Emerging market currencies endured a particularly harsh sell-off, the JP Morgan Emerging Markets Currency Index was down 10% during the quarter, with Argentina down over 30% and the South African rand, Turkish lira and Brazilian real down around 14%. Hard currency emerging market debt fared better but also succumbed to the wider sell-off in credit markets. The spread on the JP Morgan Emerging Market Bond Index widened from 3.2% to 3.9% during the quarter.

The fund added to local currency positions in South Africa and Turkey and switched some inflation-linked exposure into fixed-rate exposure in Mexico. The fund also invested in local currency instruments in Indonesia and India via AAA-rated dual currency notes. The fund added hard currency dollar exposure via Qatar and Kenya and reduced its South African dollar bonds in favour of local currency holdings.

Credit spreads continued to widen in the second quarter with the weakness spreading from short, high-quality instruments that bore the brunt of the widening in Libor during the first quarter to longer-dated and lower-rated names in the last three months. European corporate bonds were particularly weak in June on the back of developments in Italy and the prospect of fewer asset purchases from the ECB. Financials suffered more than corporate credit, especially within Europe despite fears over rising trade tensions. The US high yield markets proved to be an exception with the high oil price lending support to the shale producers. This has meant the ratio between US high-yield spreads and investment grade is at its tightest since the financial crisis. Much of the sell-off was flow related as selling emerged on the back of exchange-traded fund outflows or managers reducing exposures, which help explain why cash markets widened more than hedging instruments such as credit default swaps. The fund increased its exposure to a number of credits during the quarter, including Redefine, Cromwell, Intu Properties and Remgro convertibles. Within fixed-rate instruments, the fund invested in new issues from FirstRand, Barclays Africa and Growthpoint, and added to MTN and Investec.

Within foreign exchange markets, the US dollar outperformed all other currencies with the Fed’s Broad Dollar Index up 5.6% over the quarter. There has been much debate as to the drivers of the dollar’s move – are we seeing some realignment due to interest rate differentials, is this flow driven as investors flee riskier asset classes such as emerging markets, or is this reflective on some form of liquidity squeeze brought about by a shortage of dollars? The reality is it is most likely a bit of all these factors and US dollar speculative positioning is now somewhat extended, arguing for some let-up in the dollar’s recent strength.

With significant outflows from equities and emerging market bond funds and investors’ appetite for risk having swung into deeply bearish territory, there is a strong likelihood that recent trends will abate in the short term. The caveat may be a continued escalation in trade tensions that contribute to a further weakness in riskier assets classes and drive investors into perceived safe havens. The recent weakness in the Chinese currency has led some to speculate that China could utilise its currency to partly offset tariff increases. A more plausible explanation is that China has allowed its currency to readjust lower to realign it more closely with its trading partners, which have recently weakened against the US dollar. China is also battling to offset the tightening in one part of the economy brought about by its clamping down on excessive leverage by supporting other sectors of the economy via reductions in banks’ reserve requirements and enhanced liquidity operations.

The fund is now underweight in developed markets (US dollars, euros, British pounds and yen) and overweight in emerging markets where we have increased our exposure into the sell-off. Our principal positions are in Mexico, South Africa and Turkey, with smaller positions in Indonesia, India and the frontier markets of Argentina and Egypt.

The fund remains underweight duration, predominately though a low duration position in Europe and no Japanese bond exposure. In the US, we are broadly neutral with a bias towards the five-year area of the curve. The fund has added to its credit exposure and this now constitutes around half of the fund. Emerging market exposure has increased further as weaker exchange rates have made opportunities more attractive. As a result of the increase in corporates and emerging markets, the overall yield of the fund has increased considerably. We continue to hold a number of convertible bonds where we think the spreads are particularly attractive. We have previously expressed a view that volatility would increase as central banks remove stimulus, and we see no reason to expect that to change.

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

Global (excl USA) - Institutional

Global (excl USA) - Institutional