Aspen Holdings (Aspen) is a true South African success story. It listed on the JSE in 1998 via a reverse listing into Medhold. Shortly after the listing, it launched a hostile takeover of SA Druggists, acquiring a manufacturing plant in Port Elizabeth and the old Lennon drug business, a pioneer in generic medicines.

Today, Aspen is a supplier of branded and generic pharmaceuticals in more than 150 countries across the world, as well as consumer and nutritional products in selected territories. Through a series of astute acquisitions, it has transformed itself from a domestic company into a global, geographically diversified pharmaceutical company. It has also integrated into manufacturing and operates 26 manufacturing facilities at 18 sites across six continents. Its successful integration allows it to leverage its scale to reduce manufacturing and production costs, thereby protecting gross margins – an important attribute as Aspen operates in a highly regulated industry where government usually controls product price increases.

Aspen focuses primarily on niche therapeutic classes such as anticoagulants, anaesthetics, high potency and cytotoxic products as well as infant nutritionals. These products have several common traits. They are highly specialised and are difficult to manufacture, which protects Aspen from the threat of Asian competitors that tend to focus on simple, long production run products like antibiotics. They are also highly cash generative and post patent, which reduce the risk of a revenue falloff from generic competition. All product portfolios are supported by a globally integrated, end-to-end value chain that spans product development, manufacturing, distribution and regulatory compliance.

The business has an enviable track record of earnings delivery, generating high returns and throwing off significant cash. It is managed by two of the country’s most entrepreneurial managers, Stephen Saad (CEO) and Gus Attridge (deputy CEO), who together own 16% of the company, aligning their interests with that of shareholders. Saad has not sold a single share since listing.

Although Aspen operates in a highly regulated industry, this risk is to some extent mitigated by its extensive geographic footprint, with key markets being Latin America, Europe (West and East), South Africa, Africa and Australasia. There is a significant opportunity to unlock value through bedding down the recent anticoagulant and anaesthetic acquisitions and simplifying the current complex manufacturing process, thereby reducing costs. As both products are primarily dispensed within hospitals, there are scale benefits as the acquisitions bolster the product basket that sales representatives can use to call on specialists. Aspen has a publicly stated target of delivering at least R2.5 billion of operating income from these initiatives by 2019. They are currently tracking ahead of budget in terms of both quantum and timing, which is material in the context of current group operating income of R9.2 billion.

Furthermore, this business is ripe with optionality, none of which is reflected in the current share price but is encompassed in the company’s strategic activities, including:

- The successful launch of Orgaran, a low molecular weight heparin product that is very high margin as it is difficult to produce, in the US;

- The successful launch of infant nutritionals in China (or if Aspen decides to dispose of its infant nutritional division, it is rumoured it would fetch between $1 billion to $1.5 billion); and

- Concluding future acquisitions as multinationals look to exit their tail-end products. (Aspen has a phenomenal track record of concluding value-accretive deals.)

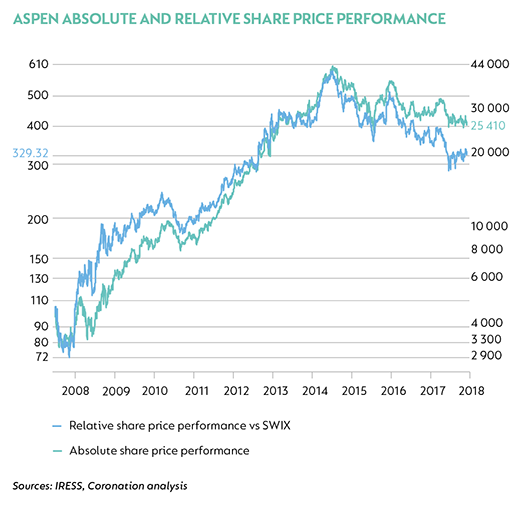

However, despite its fantastic track record and favourable growth prospects, the share has derated significantly, declining by 42% from its peak and underperforming the Shareholder Weighted Index (SWIX) by 47%, as shown in the graph below.

So what exactly spooked the market regarding the Aspen investment case? I will address some of the market’s key concerns below:

A highly acquisitive business model, funding acquisitions using debt

Aspen embarked in earnest on its globalisation strategy around 2009 when it concluded the first of three transformational deals with GlaxoSmithKline (GSK). Post 2009, it globalised at a rapid pace, concluding several large acquisitions with Pfizer, Merck, AstraZeneca and Nestlé.

Investors should rightly be skeptical of companies adopting a ‘roll-up’ strategy whereby they are simply acquiring earnings. However, each of Aspen’s acquisitions has been strategically sound in our view. Aspen has extracted significant synergies through lowering the cost of goods sold by insourcing manufacturing and simplifying complex production processes. Furthermore, it has invested in its sales force and managed to arrest product declines and grow overall volumes, primarily as these products are rolled out in emerging markets where per capita use is low relative to developed markets.

Aspen is a highly cash-generative business. Members of the management team are significant shareholders and have behaved like true owner-managers over the years. They believe in Aspen’s long-term prospects and that its equity is undervalued, and are rightly reticent to issue shares, preferring to fund acquisitions from debt.

Aspen has an internal free cash flow conversion (FCF%) target of 100% of earnings and has exceeded this level historically. FCF% has deteriorated in recent years as many of the large, global deals were consummated over a relatively short period of time, which resulted in a significant absorption of inventory. Site transfers also adversely impacted FCF%, with Aspen shifting production to new sites where it will be able to manufacture products at a cheaper price. This switchover requires the holding of buffer stock to avoid stock-outs – something frowned upon by both customers and regulators alike. Working capital is a significant area of management’s focus and FCF% should improve significantly going forward, which will allow the business to deleverage. This was evident in the most recent financial results, which saw FCF% improve to 92% of earnings.

A low effective tax rate

Aspen’s current effective tax rate is around 18%. It has declined meaningfully since 2009, the time of the first large, global acquisition. The decline also coincided with the establishment of Aspen Global (AGI), an entity registered in Mauritius. AGI employs more than 220 people and performs the following group functions:

- Conducts due diligence on all prospective deals;

- Arranges funding for deals;

- Acquires product portfolios from multinationals and owns the intellectual property for all products acquired;

- Assists with all regulatory and compliance matters, especially as these products are launched in new territories; and

- Assists with product transitioning from multinationals to Aspen as well as site changeovers.

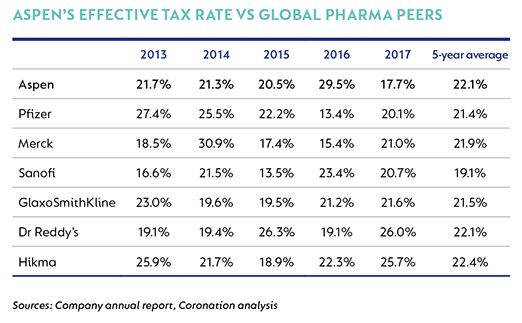

It is important to note that AGI owns the global brands; other Aspen companies are thus effectively distributors of these products in various territories around the globe. Consequently, Aspen transfers price to ensure that its pricing is competitive globally. Transfer pricing is a common practice within global pharma and Aspen’s tax rate is not out of line compared to other global pharmaceutical companies.

Aspen’s tax structures are not aggressive – they are well within the confines of Organisation for Economic Co-operation and Development (OECD) principles and are compliant with the necessary tax legislation. The South African Revenue Service conducted an international transfer-pricing audit on Aspen a few years back. It subjected the group and its tax structures to significant scrutiny and found them to be compliant. It is also important to note that AGI acquired these products from third-party multinationals at the time of acquisition by Aspen. There have not been any off-balance sheet structures or acquisitions from related parties, a consistent theme since the first GSK transaction in 2009. Furthermore, there are no outstanding tax claims or investigations in respect of AGI.

A high intangible asset balance, the majority of which is not amortised

Aspen has a high intangible asset balance – R60 billion out of R116 billion of total assets and an equity value of R42 billion. About 88% of these intangible assets are deemed to have an indefinite useful life, which means they are not amortised but tested annually for impairment.

Unlike conventional multinationals, Aspen is not a research and development company. Instead, Aspen’s competitive advantage is to acquire and take over manufacturing of technically complex products in specialist areas. Its track record of manufacturing excellence and uninterrupted supply makes it a partner of choice for multinationals looking to exit tail-end products. This strategy derisks Aspen from the boom-bust cycle of new molecule launches.

All products that Aspen acquires are post patent, which means they have already been amortised by the originator over the patent period. As a result, Aspen’s accounting treatment is not directly comparable to that of an originator company amortising products that are still under patent protection. The carrying value of Aspen’s intangible assets is conservatively struck considering:

- Impairments over time have been minor due to Aspen’s established track record of arresting and then growing once declining products and reducing costs of manufacture.

- Intangible assets have never been revalued higher; they can only be impaired.

- R60 billion of intangible assets support R90 billion of revenue – Aspen’s carrying value implies conservative valuations relative to earnings generated from its acquisitions. Elsewhere in the industry, transactions regularly occur where pharmaceutical products are acquired at significantly higher multiples.

Regulatory risk: Investigations into excessive pricing in the EU and UK

Aspen is currently under investigation for alleged abuse of dominance and excessive pricing. This relates to products that have a minor contribution (less than 3%) to group revenue so any potential impact is likely to be insignificant. More importantly, these allegations should be viewed in the context of these products not having a price increase for nearly three decades. As a result, these products should either be priced for viability or discontinued. The fact that no new competitor products have been launched post these price hikes indicates that current pricing is not excessive, and Aspen is not earning super profits. Furthermore, the allegations are contradicted by the Italian regulator’s recent approval of a generic product that sells at a higher price than Aspen’s product.

Heightened risk aversion has caused investors to ignore Aspen’s fantastic track record and the ability of its management team to create value for shareholders. This has resulted in indiscriminate selling of its share, creating a disconnect between the current share price and its intrinsic value. Aspen trades on an attractive one-year forward PE of 13.5x and 10x our assessment of normal earnings. It offers compelling value and investors who are able to set emotion aside and cut out the noise have a high probability of being rewarded handsomely.

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

Global (excl USA) - Institutional

Global (excl USA) - Institutional