Investment views

Buyer beware

IPO learnings from frontier markets

- New listings may set hearts racing, but reason must intervene

- Companies list to the seller’s advantage

- Keep in mind the industrial cycle

- Experience can unlock opportunity

WE HAVE ALL been there. Your heart begins to beat a little quicker, you press forward, leaning closer, the fear of missing out starts to reveal itself as you eye the ‘competition’. Will you get lucky, or has the chance passed you by? Whether it’s a glimpse of a celebrity or your favourite sport star, the chance to get free tickets to a show or simply waiting to catch the bouquet or garter at a wedding, we all have those moments when we get caught up in the hype and excitement of the crowd. Initial public offerings (IPOs) can evoke similar reactions in the investing public, often to their detriment.

When it comes to IPOs, investing in global frontier markets is no different to investing elsewhere. They have a way of grabbing your attention, whether you want them to or not. The phone begins to ring incessantly with ‘well-meaning’ bankers looking to provide updates on the latest hot listing, and diaries fill up with meeting requests from investment analysts wanting to share their views. Company management meetings become more frequent as they crisscross the world on roadshows aimed at charming investors. Post listing, it’s amazing how these roadshows dry up. If the IPO is large enough, they can capture the hearts and minds of the general public. Uber drivers, distant relatives and old school friends suddenly want to talk about the new listing, while daytime TV and the Twittersphere is filled with so-called experts sharing their opinions.

At Coronation, we are typically more reserved when it comes to IPOs. Some can be good investments, but most often the risks outweigh the reward. Of the 67 capital raises above $25 million in global frontier markets over the past three years, we have participated in five.

LESSONS LEARNT

There are many reasons why the barrier to investing in an IPO should be higher than simply purchasing shares on the secondary market, but here are a few key lessons that we have learnt from 26 years of investing around the globe and, more recently, in our Global Frontiers Strategy:

- The inside edge

- Timing matters

- Understanding the industrial cycle

- The hype seldom works in your favour

- It’s the length of track record that counts

THE INSIDE EDGE

IPOs involve insiders (founders/executives/ private equity investors/financial institutions) selling shares to outside investors. Typically, these insiders are intimately involved in the business, either through direct management or via a seat on the board. They know the business better than anyone else … and they are choosing to sell. To make matters worse, they get to set the price and date of the listing. Unlike purchasing shares on an exchange where both buyers and sellers have access to similar information, the price is market determined and timing is up to the buyer; with IPOs, the insiders have a clear information advantage over potential buyers. It’s like playing poker with someone who has already seen all the cards in the deck.

TIMING MATTERS

Have you ever been to a Sunday afternoon show house? There are flowers everywhere, freshly baked bread in the oven and everything is neat and tidy. It is the very picture of suburban bliss. The house has been dressed up to sell.

Contrast this with surprising a friend with a visit. While it will no doubt depend on your friend, chances are that there would be dishes in the sink, the bed might not be made, muddy paw prints probably trace a line down the passage and toys might be littering the floor. It could even be the very same house, just different timing. Companies come to market when they feel that ‘market conditions are favourable’. What that means is that the sellers feel that the market conditions are favourable – to them. And by inference, less favourable to the buyer.

Insiders know exactly when the IPO will occur, with many months’ notice. It is unsurprising then that management teams do their very best to ensure that everything looks great by the time the IPO date arrives. In many ways the companies trading year in and year out on stock exchanges look like your friend’s house, while IPOs always seem to end up feeling more like a show house.

A stock-specific example of ‘favourable timing’ in global frontier markets was the recent listing of an oil marketing company following two years of very strong profit growth in Morocco. While the company operates in several markets, the business was heavily reliant on its Moroccan business, which made up approximately 30% of total earnings before interest, tax, depreciation and amortisation (EBITDA). Fast forward six months and significant regulatory headwinds emerged that severely undermined the profit pool in this market, cutting the Moroccan EBITDA by over 50% as a result. The timing of the IPO was certainly favourable to the sellers. Coronation did not participate in the IPO due to valuation concerns given the regulatory risk in the business.

THE INDUSTRIAL CYCLE

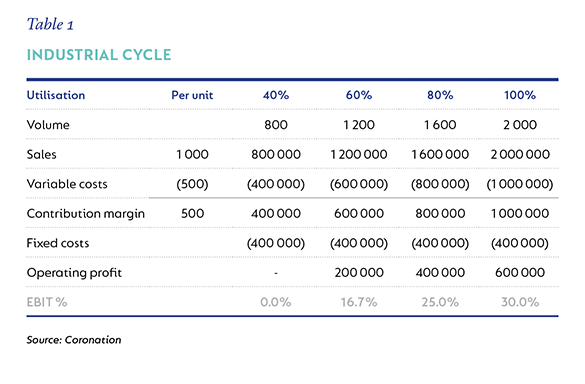

The industrial cycle sees a business build a factory, steadily increase unit sales until the factory becomes capacity constrained, and then build another factory as the cycle starts again. As utilisation of the factory increases, so too will the level of profitability. This is because the company’s fixed costs are spread over a larger volume of units – which is economies of scale at work. Table 1 captures this dynamic well for a fictitious factory. It shows how operating profit margins increase as the volume of units produced rise from 40% of capacity to 100%. Margins rise from 0% to 30% as utilisation increases.

IPOs are often used as a way for a business to raise money to expand capacity when existing capacity starts to become constrained. Phrased differently, when businesses operate at somewhere between 80% and 100% capacity, they often look to list. This also happens to be when operating margins are at cyclical highs, when management can show a few years of improving profitability and the results look strong. This is well and good, provided the buyers of the IPO understand where the business is positioned in the industrial cycle and then value the business using a lower, through-the-cycle margin forecast. Our experience has been that this is typically not the case.

The investment bankers forecast margin expansion into perpetuity and management teams give a multitude of reasons why ‘this time it’s different’ or why the high margins are here to stay. A few years down the line, the new factory is built, and overall utilisation has fallen, margins decline (not because of bad management but simply due to the industrial cycle at work) and share prices come under pressure. Our experience has been that this is the time when you want to be buying the now out-of-favour, recently listed company.

A global frontiers example is a food company in Egypt that listed a few years ago. The company released three years of annual financial statements that provided margins from 2011 to 2014. They showed steady improvement as utilisation increased by close to 100%. Post listing, 2015 and 2016 saw capacity increase by 50%. Utilisation, and with it, margins, fell significantly into 2017 before both picked up in 2018. While there was no doubt many factors at play here, the industrial cycle certainly made an impact. Coronation did not participate in the IPO, due in part to our view of the level of normal profitability we used in our valuations.

THE HYPE SELDOM WORKS IN YOUR FAVOUR

Every day, stock exchanges around the world facilitate trades in the thousands of companies listed globally. All but a handful of trades occur with little fanfare, marketing or hype.

The story of IPOs could not be more different. A string of analysts, advisers, brokers, bankers and company representatives are readily available to walk you through the investment case, five-year plans and reasons why this is too good an opportunity to be missed. The level of noise surrounding an IPO is deafening, but just because it’s front of mind doesn’t mean it’s a good investment. Often the overlooked, unloved, boring and forgotten stocks represent the true bargains.

It seems that nothing captures the investing public’s attention quite like the IPO of a technology stock. The hype surrounding the listings in the dotcom bubble of 2000 are legendary. In more recent history, high-profile listings like those of Facebook, Twitter, Alibaba and Uber have dominated headlines.

In our global frontier markets universe, Jumia, the so-called ‘Amazon of Africa’ has been the subject of similar hype. This was especially so after listing at $14.5 a share, the share price quickly moved up to almost $50 in a matter of weeks, before giving back all the gains. Jumia now trades below its listing price. While we would have loved to have participated in the IPO (and then sold close to the peak) we did not, due to concerns around the business model and once again the margin of safety being too low.

IT’S THE LENGTH OF TRACK RECORD THAT COUNTS

Listed companies publicly disclose financial statements each year. The longer they have been listed, the longer the history of results becomes. By reading these reports and analysing the financial statements through the years, an investor can observe how the business performs through the economic cycle; in good times and in bad. They can observe some of the culture of the business, how capital is allocated and how management teams treat shareholders and their other stakeholders. While anyone operating in financial markets knows that past performance is no guarantee of future success, the past does provide valuable insights into a business.

At Coronation, we will regularly analyse 10 or even 20 years of a company’s operating history and financial performance as we evaluate investment opportunities. IPOs do not afford us the same opportunity, as historic financials for the past three years are typically all that is disclosed. Management teams are aware of this, and they know when the IPO is scheduled to take place. Optimising the financials over a fairly short period of time is not difficult – capex can be delayed, sales pushed onto distributors and discretionary expenditure postponed. As a result, it’s tough to really know what you are buying when it comes to IPOs.

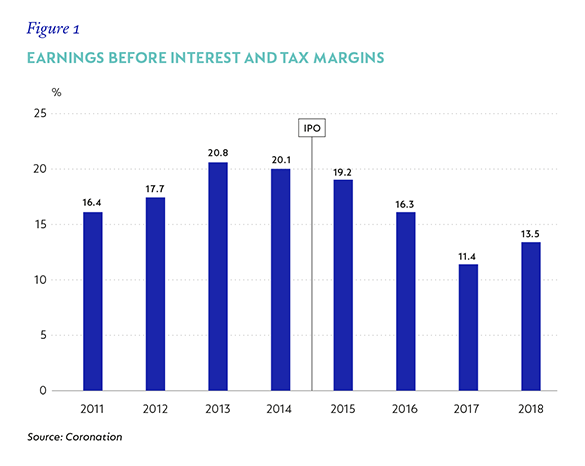

Take another look at the EBIT margins in Figure 1 – by providing only three years of financial history (which is actually pretty good for an IPO) the margins shown capture a very limited period in the company’s life. It’s difficult to know whether the 16% low in 2011 or the 21% high in 2013 are normal. Analysing the business today, over a fuller eight-year cycle, shows that the through-the-cycle average is most likely somewhere around 17%. This is well below the 21% shown at the time of the IPO.

OPPORTUNITY KNOCKS

While the issues listed here are significant, they are not insurmountable, and every so often an opportunity crosses our desk that has a sufficient margin of safety to warrant a position in our portfolios (even after adjusting for the concerns raised here). The important thing to understand is how the very nature of an IPO works against the buyer and in response, to increase the required return needed to invest. Two examples of recent listings in Egypt in which we have participated are Ibnsina Pharma and Cairo for Investment and Real Estate Development (CIRA), the latter which, despite its name, is the largest private-sector education provider in the country. Both listings came to the market at valuations that were attractive, despite the risks mentioned above.

Ibnsina Pharma is Egypt’s second largest and fastest growing pharmaceutical distribution business. The business has a very strong management team headed up by co-founders who, together with the chairman, own a collective 33% of the company. They are very much aligned with shareholders. The business has succeeded by focusing closely on the 40 000 pharmacists they serve, leveraging their country-wide distribution network, and ensuring that they were well positioned to capture the rapid growth in Egypt’s pharmaceutical sector. While we participated in the IPO, we were only allocated a fraction of the shares we applied for due to the high demand the listing attracted. We subsequently doubled our position through buying in the market in the days following the IPO, despite the share increasing strongly, as the margin of safety was large. The share is up almost 100% since listing and results continue to be strong.

CIRA runs 19 schools across Egypt and a university. The company is growing strongly as existing facilities are being expanded and new schools are being added. The business model focuses on providing high-quality but affordable private schooling to the middle class by teaching a variety of international curriculums.

Despite being the largest private-sector educator, the company’s market share is still only 0.1% and the business has a long growth runway ahead. Given the rate of expansion, the biggest risk is the ability of management to execute and ensure that the new schools adhere to the high standards of the existing offering. While near-term valuation multiples were not cheap, our long-term valuation methodology meant that we could value the many years of compounding ahead of the company, which, when coupled with strong cash generation and high returns, made for a compelling investment opportunity. CIRA is up almost 90% since the IPO.

We often get a client or a colleague asking whether we had participated in a particular stock’s IPO, usually regarding a high-profile listing that has increased in value (think Jumia once it was in the $30 per share area). In these moments we are reminded of the wise words of Warren Buffett:

“I worry much more about the things that I do than the things that I don’t do. I missed all kinds of opportunities in my life. You just want to make sure that you’re on the side of the house when you bet rather than bet against the house. You don’t really have to worry about, you know, what’s going on in IPOs, or people making money. People win lotteries every day, but there’s no reason to have that affect you at all.”

IPOs are simply another investment opportunity that may or may not be attractive. The idiosyncratic risks of the listing process, though, do require a little bit of extra care and thought.

Disclaimer:

Global (excl USA) - Institutional

Global (excl USA) - Institutional