Investment views

Emerging market exchanges and the rise of retail investing

Promising long-term growth seen in emerging equity markets

- Emerging market securities exchanges have attractive business models with strong tailwinds

- These exchanges are being boosted by a surge in retail equity investors

- Declining rates and the search for yield should support emerging market exchanges over time

- Emerging market exchanges offer high revenue growth coupled with economies of scale

THE PAST QUARTER saw significant attention drawn to retail investors in the developed world and how their coordinated activities resulted in wild swings in the prices of heavily shorted shares. GameStop, a perennially loss-making seller of new and used video game consoles and titles, was the most prominent example of heavily shorted companies experiencing a massive spike in its share price due to a buying campaign. In emerging markets, we haven’t experienced anything quite so exciting. However, the long-term trend of greater retail participation in several countries off a very low base is something we have highlighted before. We like the business models of securities exchanges, as they tend to dominate trade in their local markets and are akin to a local monopoly. If run correctly, they can build significant moats around their respective businesses and earn very high returns on capital, while generating cash that is distributed to shareholders. The primary driver of these high returns is scale, as the majority of costs are fixed in nature. As volumes increase – either through new listings or through greater turnover (liquidity) of existing listings – the incremental profits on these volumes tend to fall through to the bottom line. In our coverage list, most exchanges earn margins (measured at EBITDA* level to improve comparability between different exchanges) well in excess of 50%.

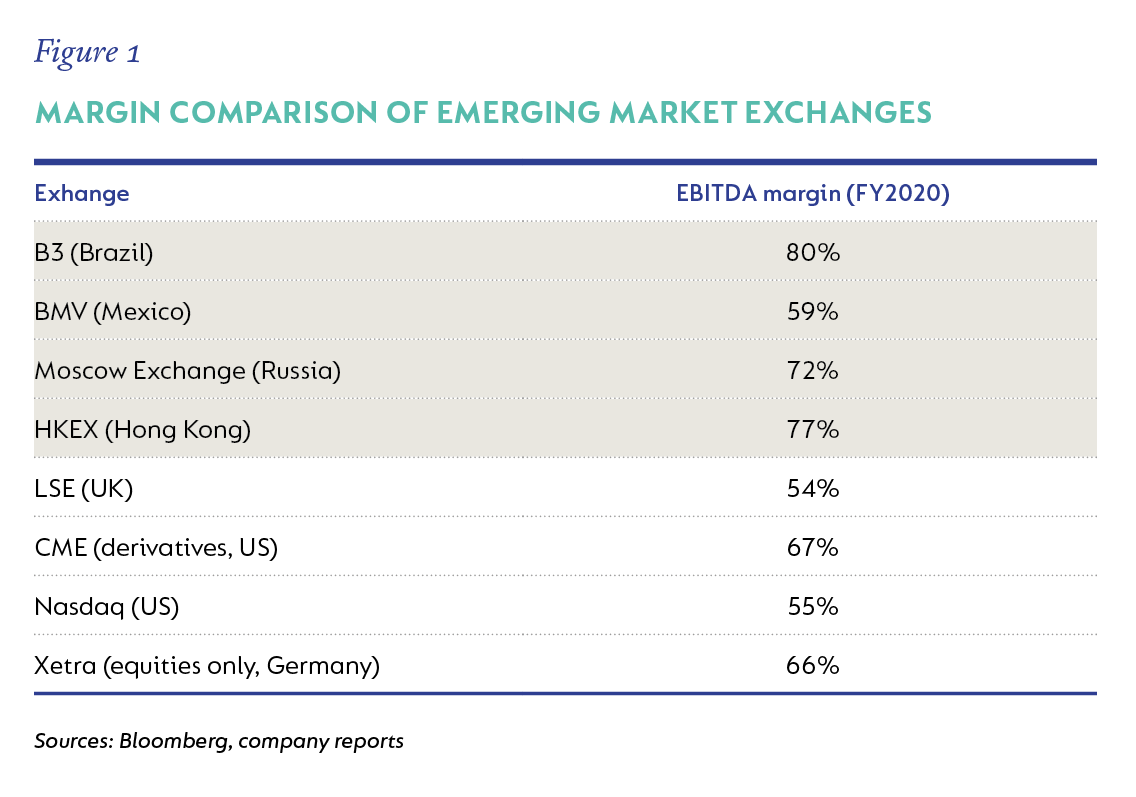

Figure 1 shows the margins of the four exchanges covered in this article, as well as selected peers in the developed world. Strictly speaking, one cannot compare margins between exchanges to measure relative efficiency, because what the various exchanges offer to clients differs from jurisdiction to jurisdiction. Some offer just equities trading, whereas others may also offer derivatives and fixed-interest products. Some provide data services and security custody, both of which offer very high margins. What should be apparent, however, is that even in highly competitive jurisdictions like the US and Europe, where firms have any number of exchanges from which to choose, high profitability is the order of the day. In this article, we highlight a few emerging market exchanges, set out why we like them and briefly touch on how retail investing is impacting their business.

BRAZIL

The original São Paulo Stock Exchange was founded in 1890. Today, B3 is the result of the 2017 merger between BM&FBovespa (derivatives and equities) and Cetip (over-the-counter [OTC] derivatives, banking instruments, liens and loans), which created a multi-asset, vertically integrated exchange. B3 is the largest cash, equities, derivatives exchange and depositary company in Latin America. The services it offers range from exchange trading, clearing and other post-trade services. Also on offer is the registration of OTC transactions, such as those evidencing vehicle and real estate loans. B3 has become a stronger business post-merger due to three factors: 1) diversification, 2) economies of scale, and 3) reduced risk of competition. As the sole exchange in Brazil, B3 enjoys a monopoly position with high barriers to entry, leading to strong underlying returns on invested capital and much-better-than-average free cash flow generation.

The current B3 CEO, Gilson Finkelsztain, joined in 2017 from Cetip when the two companies merged. He had an excellent track record at Cetip, materially outperforming BM&FBovespa’s revenue and earnings-per-share growth, while simultaneously taking the company from a net debt to a net cash position. Like all exchanges, B3 is a high fixed-cost business. Consequently, its margins are materially geared toward increasing volumes on the exchange, and B3 has undertaken to share the upside on increasing volumes with customers in the form of reduced pricing. By deliberately foregoing some pricing power, they have therefore made it more difficult to be disrupted.

Brazil’s capital markets offer significant growth potential. The country’s ratio of stock market capitalisation to GDP is low while corporate leverage is at reasonable levels and should benefit from lower interest rates. Additionally, derivatives and securitisations are still in their early stages, and the proportion of equities and alternative investments in the retail and asset management industry is low.

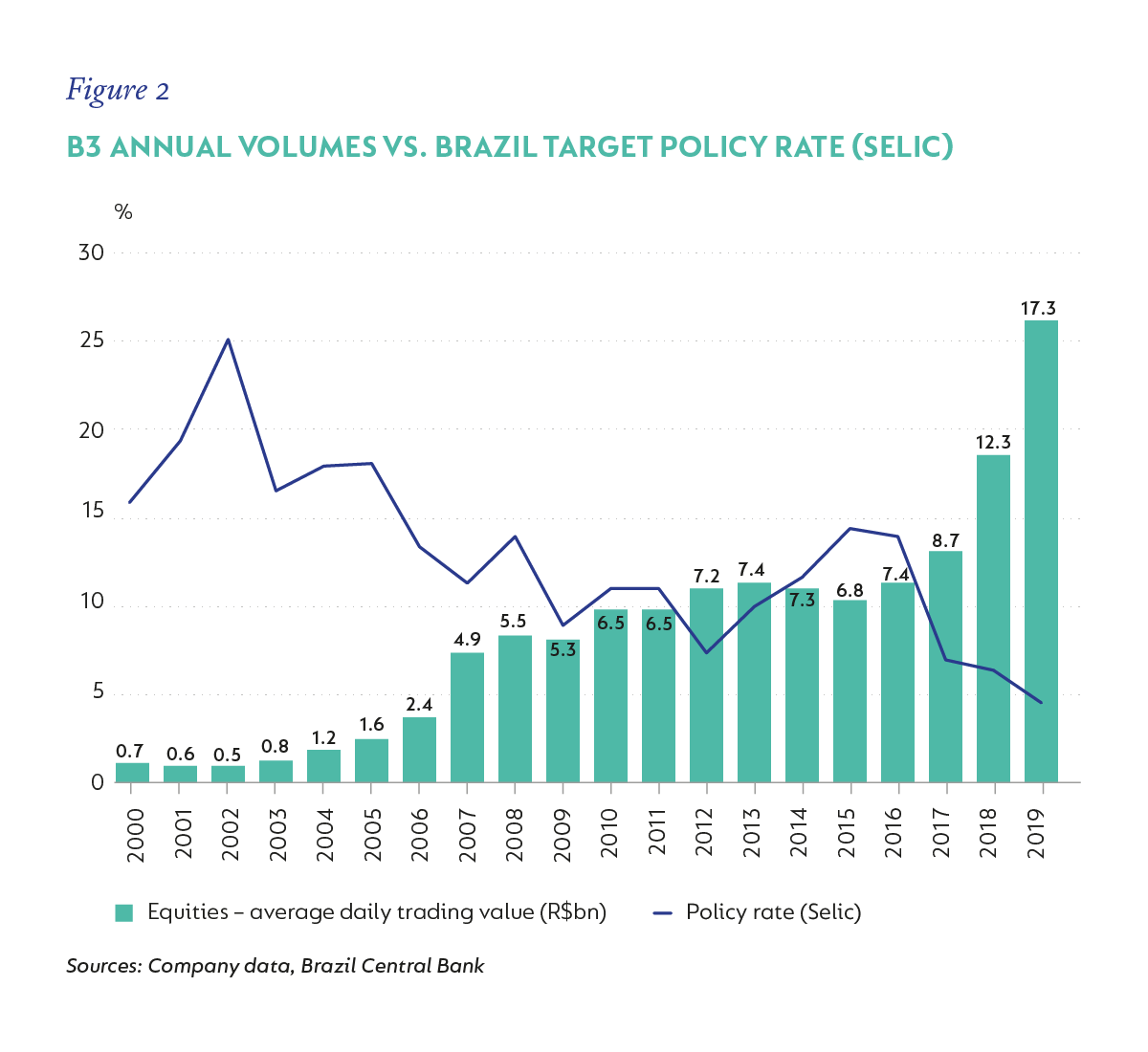

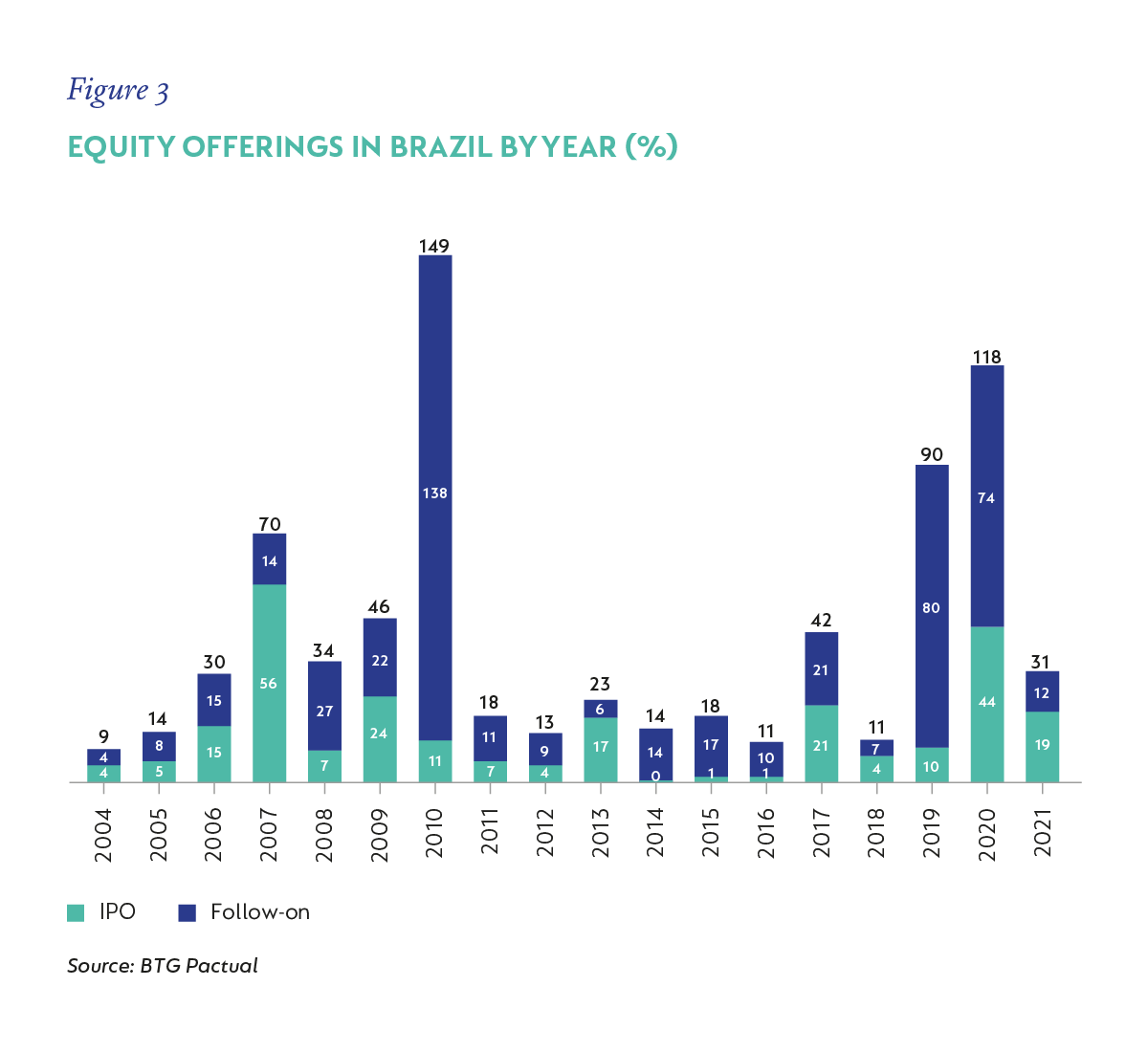

A big historical disincentive for retail investors to be in the equity markets was the easy money that could be made in the fixed-interest market, due to Brazil’s very high real interest rates. This was a throwback to the measures taken to tame inflation in 1994 after periods of on-off hyperinflation in the preceding decades. As interest rates have declined without an uptick in inflation, retail investors are being enticed into the capital markets and daily liquidity has improved (see Figure 2). The improvement in equity market conditions has resulted in a virtuous cycle whereby more companies have come to market to raise equity, in spite of cheaper borrowing costs (see Figure 3).

MOSCOW EXCHANGE

The Moscow Exchange is the largest exchange in Russia and trades the full suite of products, including equities, bonds, foreign exchange, derivatives and commodities. The business has seen explosive growth in recent years for a number of reasons.

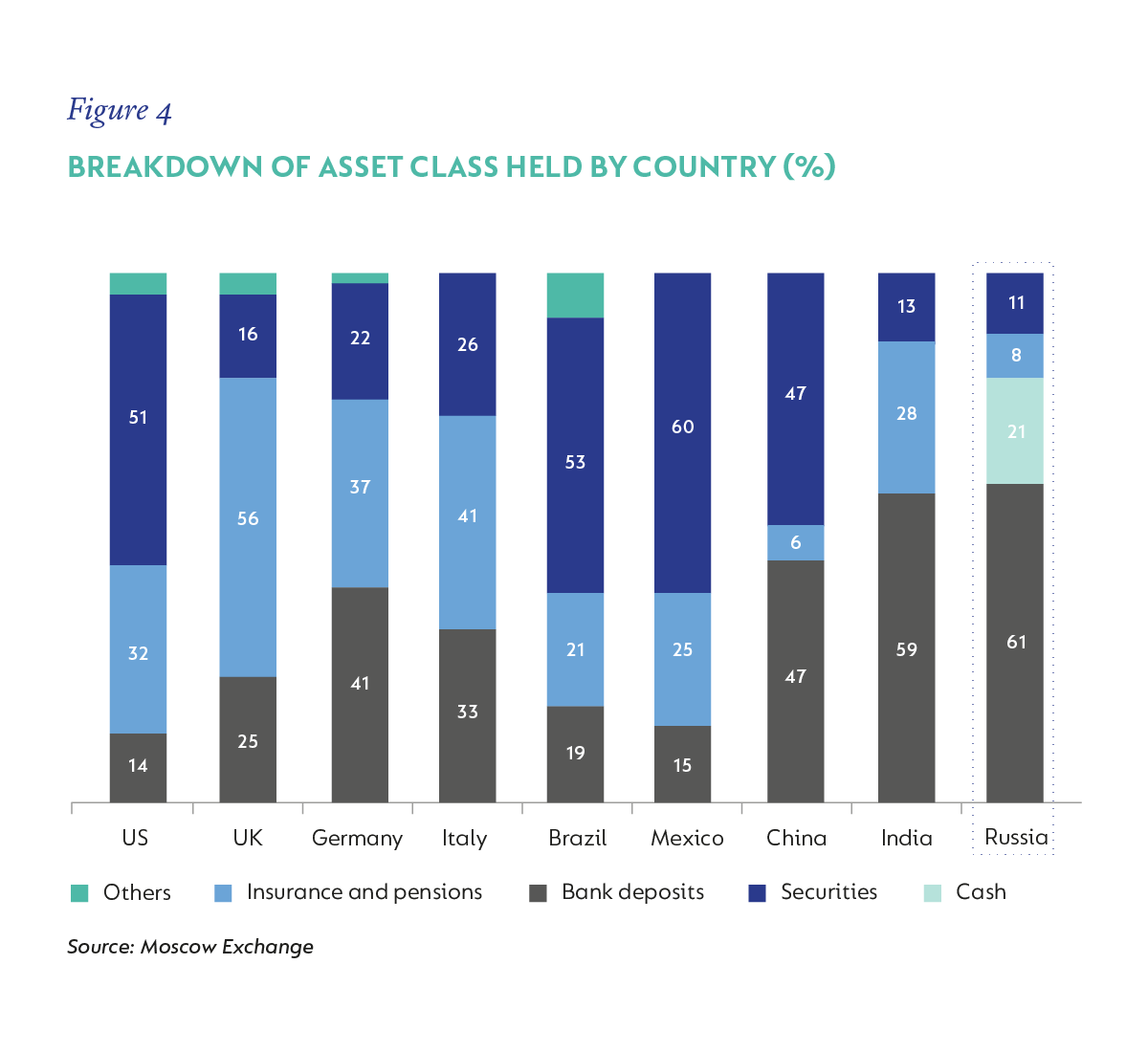

As with Brazil and other emerging markets, declining rates in Russia have led to a search for yield. Investors can no longer earn a decent yield by holding their assets in cash deposits at banking institutions, as rates in Russia have declined from a high of 17% in 2014 to just 4.5% today. The average bank deposit yields just 2.5%. As a result, the country has seen a steady flow of assets from bank deposits to the markets, but this structural tailwind still has a long way to go. Russia’s entire stock market capitalisation is RUB6 trillion ($78 billion), in contrast with bank deposits of RUB34 trillion ($444 billion). Expressed as a percentage of GDP, which is the more meaningful metric, Russia’s ratio of stock market capitalisation to GDP is only 5%, compared to over 100% in the US. Equity ownership is still extremely low in Russia, with most Russian investors holding a far greater weighting in bonds and other interest-bearing instruments relative to other countries (see Figure 4).

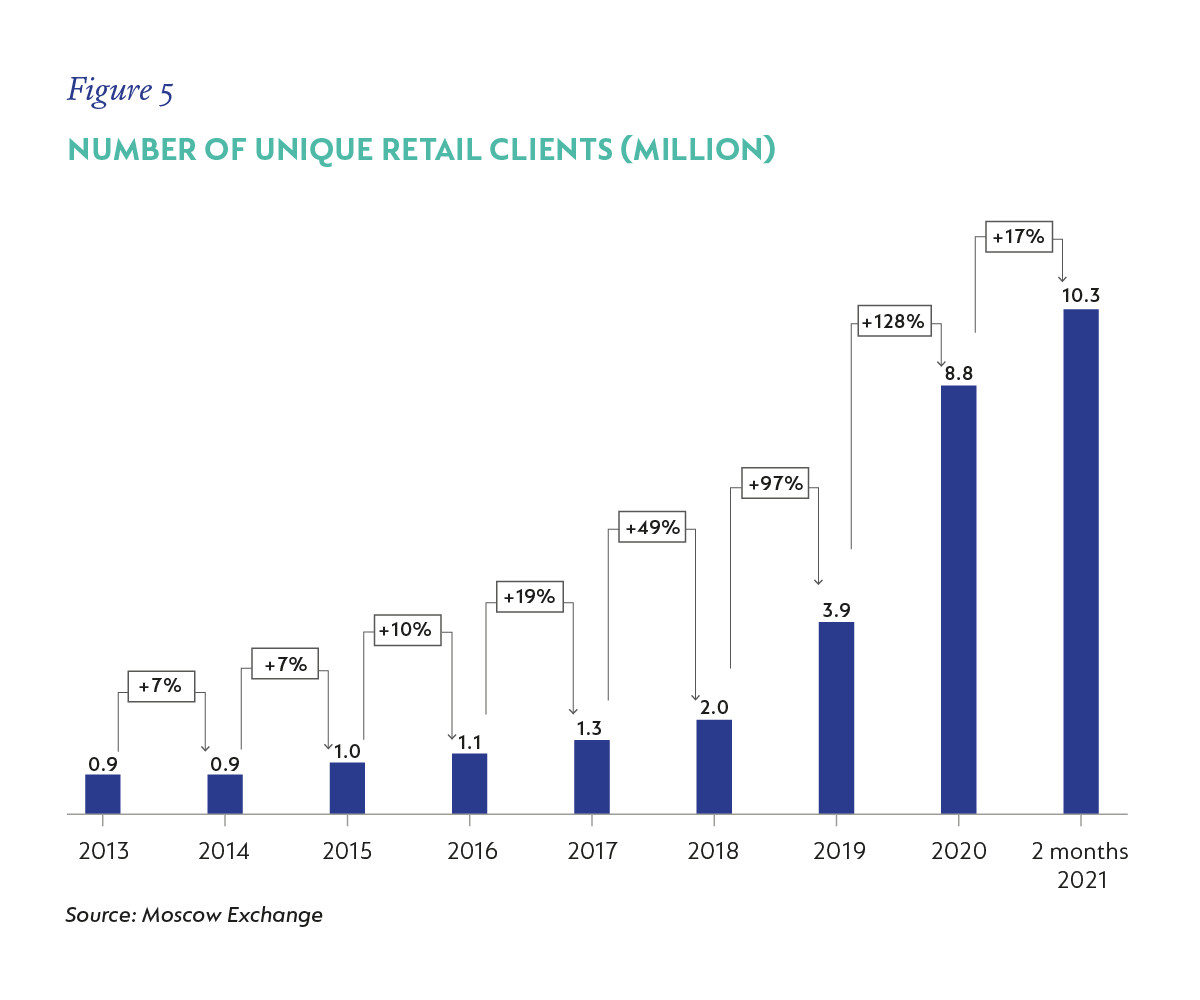

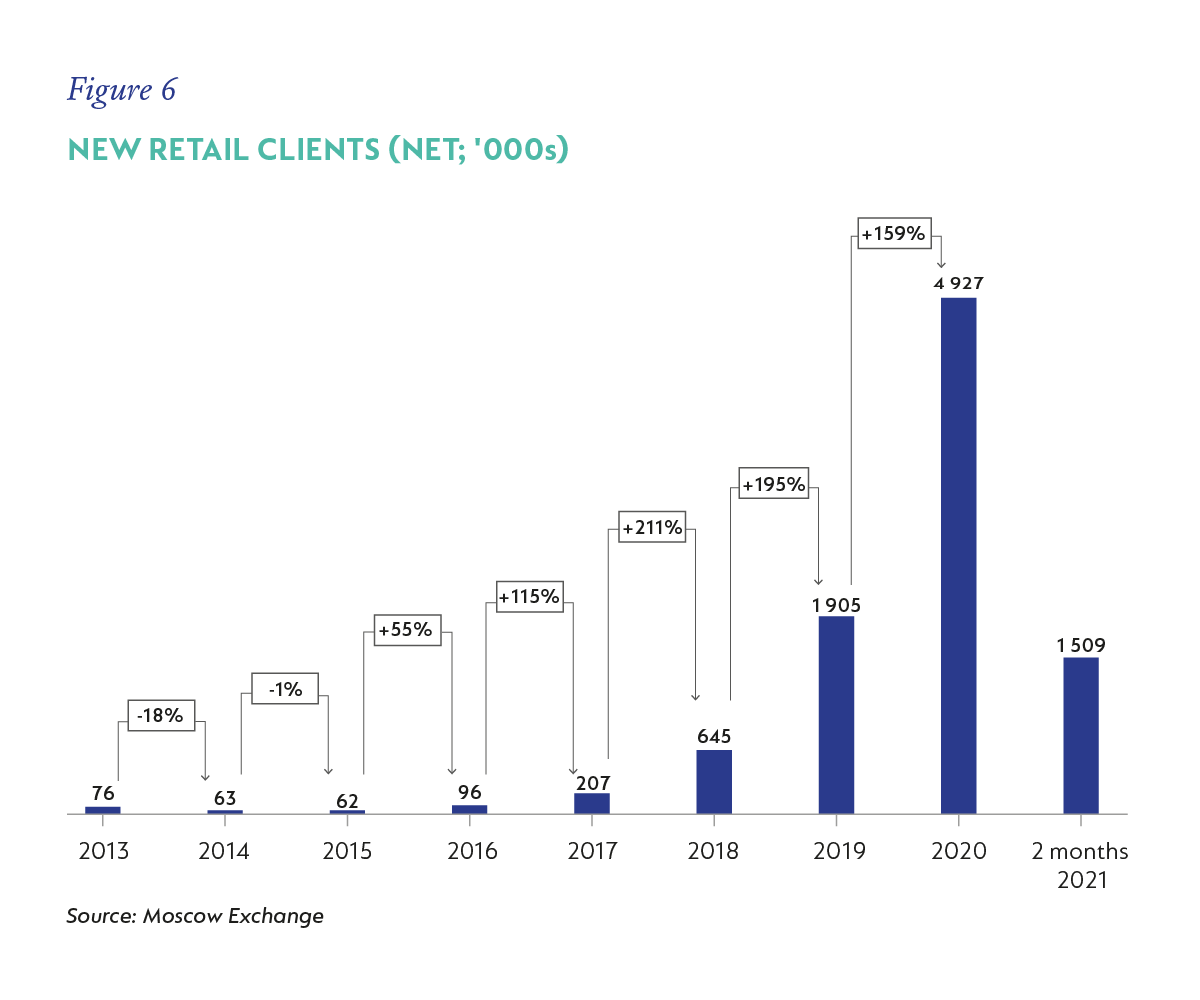

With retail trading accounts continuing to grow and rates forecast to rise by only another 50 basis points (bps), the trend of wealth flowing into equities is set to continue (see figures 5 and 6). Adding to the attraction are increased listings in Russia, with a number of companies previously only listed in London now choosing to list in Russia too. This includes the Tinkoff Group, and a number of recent IPOs in Russia, such as Fix Price and Ozon.

The market in Russia is still immature and, although the Moscow Exchange has the capability to trade a vast array of products, these products lack the critical mass to really take off and be meaningful.

We expect this to improve with time. Institutional ownership is also low, as there are few tax incentives to save in a regular manner for retirement. This may be more difficult to change, however, as asset manager fees are quite high and have not adjusted to compensate for the decline in available yields.

HONG KONG EXCHANGES

As with many other exchanges around the world, Hong Kong Exchanges (HKEX) has seen a significant increase in trading activity over the last six months. Average daily volume grew by 50% in 2020. And, in the first few months of 2021 to date, it is 119% higher than the comparable period in 2020. Although many of the drivers of this increase are common to other exchanges around the world, and are arguably cyclical in nature, Hong Kong benefits from structural growth and a few unique factors.

First, increased tension between China and the US, and the subsequent threat of the potential de-listing of Chinese companies from US exchanges, has prompted many of these firms to seek a secondary listing in Hong Kong. This so-called ‘homecoming’ has bolstered Hong Kong’s position as a listing venue. This is particularly prevalent with technology companies that originally listed in the US in search of higher valuations and to overcome restrictions on super-voting shares that were generally discouraged in Hong Kong. Over the past year, high-profile names, such as Alibaba, Netease and JD.com, have tapped Hong Kong for a secondary listing. While the bulk of the liquidity in these names is still concentrated in the US, the incremental impact on Hong Kong has been very positive. For example, these three stocks already comprise 14% of Hong Kong’s total market capitalisation.

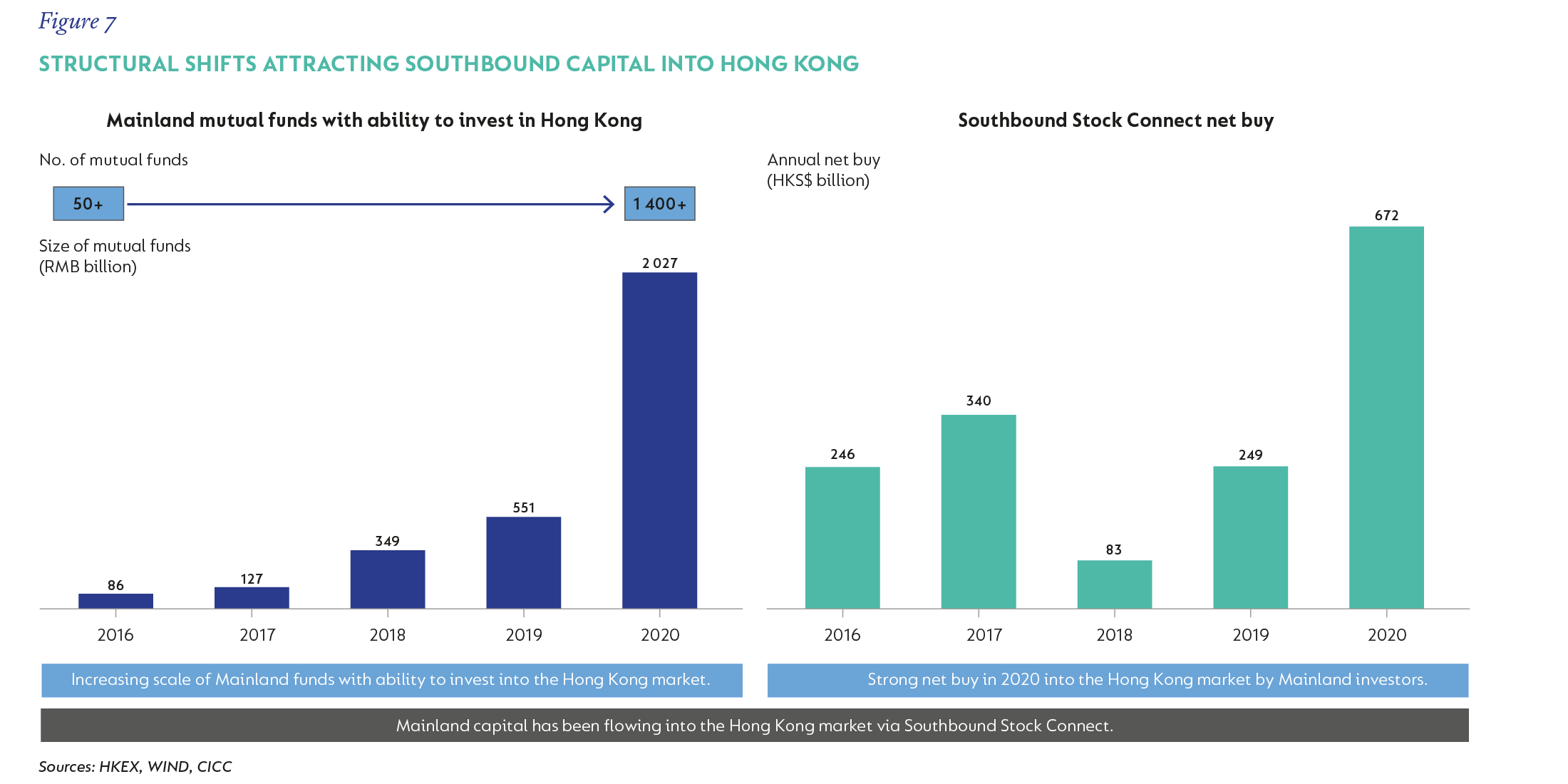

Secondly, greater demand for Hong Kong-listed stocks from Mainland China investors has led to a substantial increase in Southbound Stock Connect flows. Stock Connect is a mechanism by which Hong Kong enjoys mutual market access with Mainland China, enabling foreign investors to trade shares listed in Shanghai and Shenzhen, and Chinese investors to trade shares listed in Hong Kong.

In our view, these flows represent structural rather than cyclical growth, as the number of Chinese mutual funds authorised to invest into Hong Kong has grown materially, seeing a fourfold increase between 2019 and 2020 (measured in assets under management). Southbound trading grew by 90% in 2020, and by close to 200% in the first few months of 2021, and now accounts for 30% of the volume traded in Hong Kong.

The financial impact on HKEX from the growth in Southbound trading is slightly less pronounced. Unlike in a domestic transaction, HKEX earns revenue on only one leg of the transaction (the Shanghai and Shenzhen exchanges earn revenue on the other side), and typically does not earn clearing revenue. Nevertheless, the flows and revenue from Stock Connect are entirely incremental to HKEX and a very attractive line of business. Like the other exchanges mentioned in this article, incremental revenue with little additional cost will tend to pass straight through to the bottom line, further bolstering profitability.

Tempering the good news, though, is the recent decision by the Hong Kong regulator to increase stamp duty on stock transactions from 10bps to 13bps, with higher transaction costs risking a reduction in demand for trading in Hong Kong. While this is a legitimate concern, we think it’s unlikely to derail the underlying growth in the market. Hong Kong does not have a base of high-frequency algorithmic traders that would be much more sensitive to transaction costs.

MEXICO

In Mexico, Grupo BMV (Bolsa Mexicana de Valores) is the dominant securities exchange, hosting >85% of equity transactions. The company is the second-largest equities and derivatives exchange in Latin America, offering an integrated market for shares, derivatives and OTC fixed-income securities.

The equitisation story in Mexico is at an earlier stage than in some of the other emerging markets discussed here. There are only 500 000 retail stock trading accounts open, which is less than 1% of Mexico’s population. In comparison, north of the border in the US, the recent equity craze among retail investors has boosted penetration to 50% of the population. Scarred by two serious financial crises in recent decades and due to low levels of GDP per capita, Mexico’s financial system is substantially less developed than its northern neighbour.

The country also lacks the types of strong innovating businesses, such as Robinhood in the US, XP in Brazil and TCS in Russia, that would foster retail investor education. However, in recent years, regulatory incentives and digitisation initiatives by banks have generated a growing trend of financial inclusion, which should promote greater retail investment participation. Grupo BMV is also promoting financial education in cooperation with high schools and universities. Currently, cash equities represent just 8% of the group’s revenue mix, but their contribution has the potential to grow.

Meanwhile, the Mexican Congress recently passed a major overhaul of the country’s pension system that, among other provisions, raises workers’ total contributions from 6.5% to 15% of salary (with additional contributions mostly borne by employers). This is expected to raise assets held by pension funds (Afores) from 35% to 56% of GDP by 2040, which should benefit the domestic securities market. Grupo BMV will benefit on various fronts from this reform as it should support trading, clearing and custodial revenues, as well as assist capital raising by businesses over time.

Finally, like many other global peers, Grupo BMV is planning to grow sales generated from data sales. These have grown from 8% to 11% of the revenue mix in four years and management is investing further in the segment. Despite these long-term tailwinds, the market is concerned about the competitive intensity fueled by BIVA, a small challenger exchange launched in 2018, and potential regulation aimed at supporting a more competitive market.

CONCLUSION

The overall theme that should be apparent from the examples above is that the runway for long-term growth in equity markets in emerging markets is very promising. Financial systems have strong tailwinds driving higher participation in equity markets, and we expect these to persist for many years ahead. Where exchanges are trading at attractive valuations, we will invest in them selectively.+

*Earnings before interest, taxes, depreciation, and amortization

Disclaimer

Global (excl USA) - Institutional

Global (excl USA) - Institutional