Investment views

Opportunities amidst the volatility

A disciplined approach delivers over the long term

The Quick Take

- 2021 was a difficult year for emerging markets, including Coronation’s Global Emerging Markets Strategy

- While short-term performance can be volatile, we remain focused on the long term

- Our investment approach has delivered excellent returns to investors since inception

- We aim to capitalise on the many compelling opportunities currently available

THE 2021 CALENDAR Year was certainly a tough year for emerging markets, and Coronation’s Global Emerging Markets (GEM) Strategy was no exception. There seems to be little respite in the first two months of this year. Even though we remain long-term in our outlook, it is natural to feel pressure when short-term performance is poor.

During these periods, it is critical to step back, understand what has happened, and consider the historical context of our Strategy. We have been here before and understand that it is part and parcel of delivering meaningful long-term outperformance to our clients.

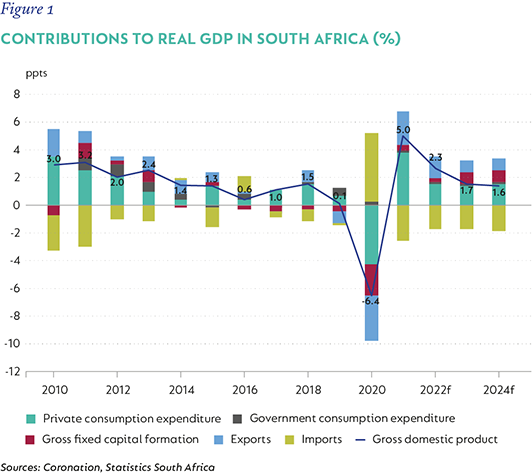

Historically, periods of short-term underperformance have been followed by significant recoveries in performance. At the low point in 2015, for example, the Strategy was 12% behind the benchmark on a rolling one-year basis. (See Figure 1.) However, this was followed by two successive years of significant outperformance, more than compensating investors. 2018 was similarly a tough performance year, but we saw many of our investment views come to fruition in 2019, delivering massive outperformance of 21,4%.

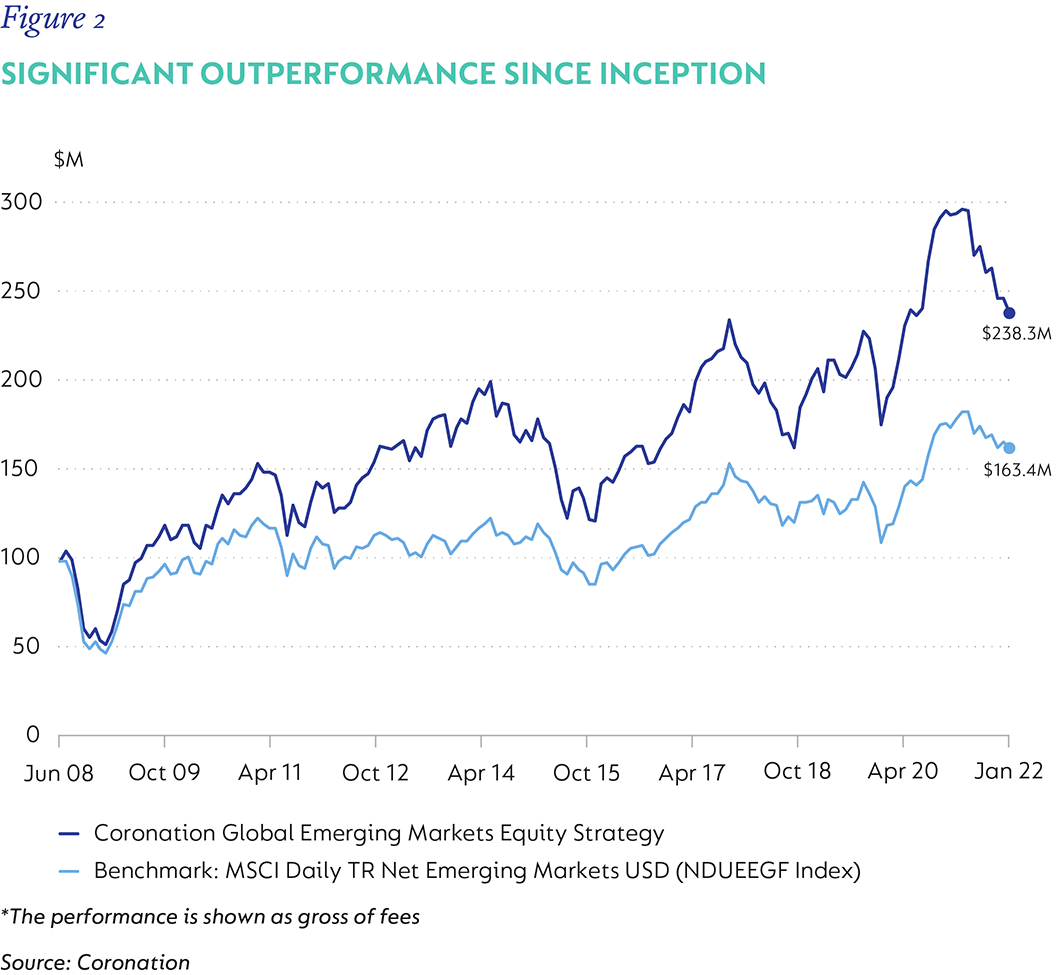

It is also important to emphasise that the investment approach that has delivered this exemplary track record has remained unchanged, and the Strategy continues to be managed by the same people since its inception in 2008. Achieving superior outcomes for our clients through a full investment cycle has always been our main priority and we have achieved this by remaining dedicated to our disciplined, bottom-up, valuation-driven approach to investment. The success of this approach is evidenced by the Strategy’s significant outperformance of the MSCI Emerging Market Index by a cumulative 75% since inception in 2008. (See Figure 2.)

One of the by-products of an approach like ours is that due to our portfolios looking completely different to the benchmark, their relative returns tend to exhibit higher short-term volatility than funds that closely resemble the benchmark.

We are mindful that there are good reasons for our portfolio to look different from the market indices. This is part of the unique value proposition we offer investors. Only the most attractive investment opportunities find their way into our concentrated portfolio of around 50 to 60 thoroughly researched stocks. Our exposure to securities that are not in the benchmark is typically around 40% and our active share, which is the best gauge of how actively we manage the portfolio, is typically above 80%.

We tirelessly re-examine our positions

When some of our investment positions go wrong, it is our job to separate the noise from those changes that could have a material impact on the value of a business.

Over the last year, we did just that. Our entire team of portfolio managers and analysts went to ground, so to speak, and re-evaluated the investment cases of all affected stocks. New Oriental Education, which was one of the Strategy’s high conviction ideas at the time, is one such example. The surprise regulatory changes in China, which effectively converted the Chinese tutoring industry into a non-profit sector, served a devastating blow to this business, costing us 2,9% of relative performance in 2021. Although we allow for the possibility of regulatory changes in our analysis, we did not foresee such a drastic outcome. We exited the position after these changes were announced, given the permanent change to the prospects for the company (and the industry as a whole).

We also spent a significant amount of time re-evaluating the cases for the Chinese internet stocks, as this sector also was the subject of significant regulatory changes that affected the various players to wildly differing degrees. When one evaluates the relative performance impact of our exposure to Chinese internet stocks, including the impact of those stocks that we did not hold (or held but were underweight), this sector was a fairly small detractor from overall performance (around -0,5%) for the 2021 calendar year. This surprisingly small impact was due to the fact that we avoided many of the stocks that did particularly poorly, which offset most of the negative contribution from the stocks we did own.

An unusual detractor last year was the more than 1300 stocks in the benchmark that we did not own – the “zero weight” positions. These cost us 3,3% of relative performance. Historically, the Strategy has benefited from these zero weights, and they have positively impacted relative returns. We believe that many of these businesses represent less compelling investment opportunities compared to other opportunities that have been available to us. Over significant periods of time, we expect that our decision to not own many of these stocks will contribute positively to outperformance for our clients’ portfolios.

A portion of the market that has been getting a lot of attention are those growth stocks whose share prices are significantly influenced by the market’s expectation that they will grow their market share and revenues long into the future, at which point they will start generating high profits. Examples include SEA (pan-emerging market gaming and ecommerce) and Coupang (Korean ecommerce). These businesses have been able to raise funding quite easily in the last few years. However, with interest rates starting to rise, markets are questioning their ability to fund their growth, and how profitable they are likely to be over the long term. We have endeavoured to factor these risks into our investment decisions and were disciplined about not buying such stocks until their share prices had fallen substantially – in some cases by more than 50% from their 2021 peaks. This has resulted in a Strategy exposure of less than 5% to these stocks.

Throughout this challenging performance period, we have remained focused and anchored by our disciplined investment approach and the long-term intrinsic value of the underlying companies. We actively monitor and manage the portfolio at all times and have been recycling capital to the most attractive investments as and when they arise. Some of these portfolio actions may cause short-term pain, but historically the same actions have delivered compelling results when the cycle turned.

Our current portfolio reflects our best risk-adjusted investment ideas found in emerging markets today and continues to look very different to market indices.

Our current portfolio

While low prices do not guarantee high future returns, they certainly provide fertile ground in the search for above-average returns. It is still our view that selected stocks in the internet sector in China remain very attractive. The regulatory interventions have largely been finalised, but share prices have not recovered and valuations are, therefore, looking very attractive.

A few of the internet companies are actually long-term beneficiaries of the regulatory reforms introduced last year. For example, JD.com has previously been negatively affected by anti-competitive behaviour from the market leader, Alibaba. The regulatory reforms were thus a positive for them. In our view, JD.com has many years of high revenue growth ahead of them, and they will benefit from the normalisation of margins – which are currently a fraction of what is achievable in a mature phase. The current share price does not capture this potential and on the back of a re-evaluation of the investment case, we decided to add to our position in JD.com. Our exposure to JD.com is now one of the biggest differentiators of our Strategy.

Our largest single exposure is to Tencent, via Prosus and Naspers, which we believe to be materially undervalued. Tencent is the most attractive asset in China, with a formidable gaming franchise generating one-third of profits outside the country. Adjusted for the market value of its various stakes, Tencent is trading at its lowest valuation relative to history in the last ten years. We own Tencent via Prosus as Prosus’ stake in Tencent is worth more than Prosus’ market capitalisation. This gap has widened in spite of efforts by Prosus’ management to address the discount. In addition, Prosus also has other assets, which in our view are underappreciated by the market.

Needless to say, we are very aware that our Russian exposure is impacted by tensions in that region. However, our Strategy is exposed to a diverse range of good quality businesses that should withstand potential shocks to the system, and we are confident that they can do well despite the tension. Our Russian holdings have different earnings drivers. Lukoil, for example, may be a beneficiary of potential outcomes of conflict, such as rising oil prices and a weakening Ruble. The Russian food retailers Magnit and X5 Group are two more examples of companies with resilient business models. Over the last few years, these retailers worked hard to shift to almost exclusively domestic supply chains, thus insulating from complications if imports were to be restricted.

We continue to monitor each individual holding from a risk and potential return perspective and are very cognizant of the portfolio’s overall exposure to Russia. There are no guarantees, but Russia’s commitment to a largely orthodox economic policy framework provides us with a degree of conviction that asset prices will recover strongly when the current round of political tension subsides. It may take some time, but we are confident that these stocks will contribute positively to our Strategy’s returns in the quarters or years ahead.

Emerging markets remain attractive

Last year was a difficult year for emerging markets relative to other asset classes. However, they currently offer compelling value to long-term investors, and entry prices are attractive. Providing a tailwind for these attractive valuation levels is the fact that emerging market countries, with their young populations, urbanisation and rising income levels, are able to support businesses to grow earnings at high rates for many years to come. In comparison, some global markets are still expensive, even after the recent sell-off.

Despite the relative attractiveness of emerging markets, their weight within the MSCI All Countries World Index is currently only around 12%. We believe that a standalone emerging markets allocation is hugely beneficial to an investment portfolio, and we would advocate for a higher allocation to emerging markets that more closely resembles their share of global economic activity.

We are also strong believers in active investing and believe it is critical in order to exploit the inefficiencies on offer in this asset class. As with all active investing, choosing an experienced manager with a long-term record of producing superior returns for investors is essential.

Coronation has been managing money from an emerging market for almost 30 years. This background and experience have equipped us with unique insights on emerging market investing. We believe this sets us apart from peers in the global marketplace, leads us to build differentiated portfolios and has contributed to the success and outperformance we have delivered over meaningful time periods.

While these periods of underperformance are uncomfortable, they offer excellent opportunities to long-term investors. There is significant value embedded in our current GEM Strategy, with the weighted average upside to our own assessment of long-term intrinsic value being around 80%, compared to a historical average of 45%. We are committed to our long-term, bottom-up, active investment approach and are confident that the Coronation GEM Strategy will provide superior returns to our investors over meaningful periods of time, just like it has done in the past.

Disclaimer

Global (excl USA) - Institutional

Global (excl USA) - Institutional