Investment views

Rigour and nimbleness needed when positioning through a crisis

- SAGBs sold off aggressively in March 2020 as the country’s risk of entering a debt trap increased significantly, triggering a downgrade in its credit rating to sub-investment grade.

- In light of this, we performed a considered evaluation of the state of affairs to ensure that our portfolios were correctly positioned.

- Our response included a detailed fiscal analysis and research into the implications of a possible debt trap.

- We concluded that SAGBs provided the best value at the long end of the yield curve. The recent flattening of the yield curve and rallying in bond yields have justified our position

THE DRAMATIC SELL-OFF of South African government bonds (SAGBs) at the end of March 2020 presented an unprecedented challenge for portfolio managers. The goal was to find the best long-term value for clients, given the very real possibility that the country may enter a debt trap at some time in the future. The country also lost its last investment-grade rating.

In addition, listed credit continued to compress aggressively as the increased liquidity in the system struggled to find a home. We had very little exposure to credit in our portfolios at the time. The combination of a further steepening of the yield curve and compression in credit spreads left our portfolios at the bottom end of the ranking tables. Adding to the woes, our switch out of illiquid assets that didn’t trade daily (i.e., listed credit) into highly liquid assets that were marked to market daily increased the volatility of our portfolios to well above historical norms.

This represented a significant test of the quality of our investment research, the rigour of our process, and our discipline to make unemotional, informed decisions. We concluded that SAGBs in the 15-to-20-year area of the yield curve offered the best risk-adjusted value over the long-term. While this appeared to be a contrarian view at the time the recent flattening of the yield curve and rally in bond yields have justified this position.

The period from June 2020 to December 2020 saw increased underperformance in all our fixed income portfolios. During this period, we continued to shift our portfolios in line with our view on valuation. Coronation’s unique team-based approached allowed us to leverage off a diversified spread of senior, well-experienced individuals. Our investment thesis was broken down and reconstructed several times from countless perspectives.

It was ultimately the discipline and rigour of our research process that informed our views. We follow a bottom-up, valuation-driven research process. This enables us to identify assets that are mispriced relative to their underlying fundamentals. The pricing of risk is fundamental to our research process. This is particularly important in fixed income, where the risk of a permanent loss of capital can change suddenly. Asset pricing must have a sufficient margin of safety to provide a buffer against a deterioration in fundamentals and increased market volatility. A high level of conviction is needed to make uncomfortable contrarian decisions. At the same time, one needs the discipline to interrogate the investment thesis objectively, and the humility to concede defeat when facts change.

A decade of good returns

Up until a few years ago, the possibility of the SA government defaulting on its debt obligation was so remote that it was not a material consideration in portfolio management. In the last ten years, the 8.25% return from SAGBs comfortably outpaced inflation at 5%, cash at 6% and even inflation-linked bonds at 6%. For almost eight out of those ten years, listed bank credit provided an additional sweetener of around 1.5-2% above SAGB returns, with very low volatility due to technical factors in the local credit market. The resultant double-digit and seemingly stable return from the asset class saw an acceleration of flows into interest-bearing funds, with sector-wide AUM more than tripling over the last decade.

Listed credit played a major role in our fixed income portfolios for much of the last decade. After the Global Financial Crisis (GFC), local SA banks found themselves in need of capital. This presented an ideal opportunity to invest in bank bonds at real yields of more than 6% (equivalent nominal of 11%). Our investment thesis at the time was premised on local banks having limited subprime exposure and strong underlying fundamentals, which insulated them from global conditions. The problem they faced was that market sentiment was poor, which is why the opportunity manifested.

A few years later, banks found themselves in a similar situation, as the transition to Basel 3 required them to issue subordinated debt instruments that could be written to zero before equity went to zero. This came amid the collapse of African Bank, which limited investor appetite for these instruments. The big four banks had limited short term lending exposure which cushioned them from the contagion. In addition, the valuation of these instruments put them in line with, if not slightly above our ROE expectations for banks, which made them a great investment for our client’s portfolios. For the next 15 to 18 months, we were among the minority of investors who invested in these instruments as spreads continued to widen at primary auctions. In the years that followed, spreads on these instruments halved, vindicating our view on fundamentals and the margin of safety in valuation. We started to actively reduce our holdings from the last quarter of 2019.

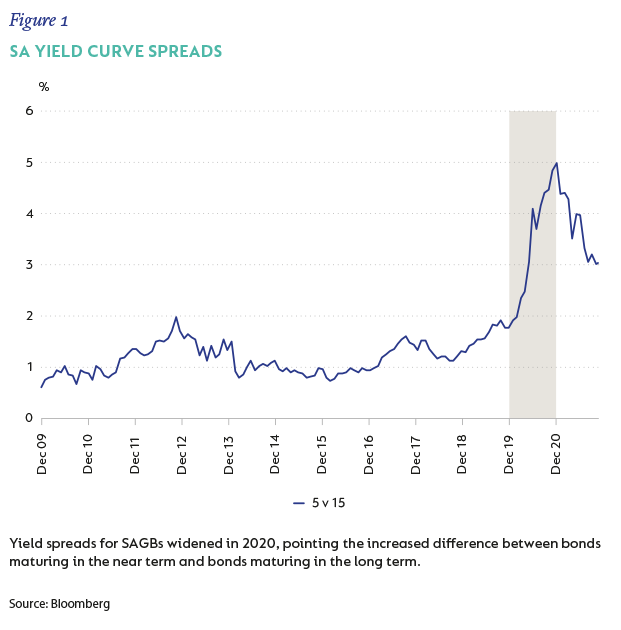

The shape of the SA yield curve remained stable after the GFC, with brief periods of steepening or flattening depending on changes in the local monetary cycle or global risk sentiment. In addition, with a larger part of the issuance profile being lobbed out to the longer end of the curve (greater than 15 years), the underlying composition of the All Bond Index (ALBI) also shifted in that direction (40% of the ALBI is made up of SAGB’s with a maturity of greater than 15 years).

Deterioration, Covid-19 and eventual downgrade

“In the midst of every crisis, lies great opportunity.” - Albert Einstein.

Over the past decade, low growth coupled with poor decisions and wasteful expenditure due to poor governance structures led to a steady deterioration in the government’s financial position. Although this looked likely to change when Cyril Ramaphosa took over the presidential reins in 2018, the hidden damage done to many state entities meant that fiscal support had to be extended. Government finances continued to tether on the cusp of sub-investment grade.

The appointment of Tito Mboweni as finance minister in 2018, his promises around wage bill freezes and other actions to heal SA’s financial position was perceived very positively by the market and provided support for the longer end of the yield curve. Unfortunately, this was all derailed by the Covid-19 pandemic.

Around the world, the economic lockdown measures that were announced to contain Covid-19 saw many businesses close, unemployment increase, and economic growth come to an immediate halt. Governments were forced to step in and support their citizens and economies. This was the last thing the ailing SA economy could afford. South Africa (SA) lost its last investment-grade rating at the end of March 2020, sending bond markets into free fall and causing the yield curve to steepen viciously. SA’s cost of funding skyrocketed. The South African Reserve Bank stepped in to support the bond market to provide temporary relief. However, the probability that SA would enter a debt trap had increased tremendously, and this weighed on bond yields.

At Coronation, we understand that crises are often fuelled by emotion and irrational behaviour, which means asset prices sometimes move to irrational levels that provide unbelievable opportunities for clients’ portfolios. But one first needs to have a deep understanding of the fundamentals and assess whether the price of the asset warrants an investment given the heightened risks and expected returns.

Interrogating the investment thesis

“There are no secrets to success. It is the result of preparation, hard work and learning from failure.” – Colin Powell, former US Secretary of State.

Forecasting government finances is an incredibly difficult task at the best of times and is generally done from a top-down perspective due to the complexities associated with forecasting the prospects for individual sectors of the economy. The integrated nature of Coronation’s investment team is one of our critical strengths. In the midst of the Covid-19 crisis, all of our equity analysts re-evaluated and remodelled their expectations for company earnings in light of the pandemic. These earnings expectations provided an almost real-time update to our modelling of SA’s fiscal position, including estimated tax revenues. This detailed fiscal analysis was one of the key reasons for our high conviction to reduce our long end positioning at the start of the crisis and increase it aggressively as commodity prices pushed higher when economies started to reopen.

However, this analysis alone could not provide the confidence needed to significantly increase our bond holdings (especially in the longer end of the curve) given the concerns that SA could enter a debt trap. Our investment team remained split on this as a possibility over the next five to ten years. The high level of bond yields and the steep yield curve was just a relative observation. It provided no direction on whether prevailing levels were justified given the underlying fundamentals.

Our fixed income team studied the history of sovereign defaults to understand, firstly, the preconditions for a country to enter a debt trap, and, secondly, what happened when a country did indeed enter one. We used this information to determine if our valuation adequately priced in the risk of default.

Preconditions for a country to enter a debt trap

A debt trap occurs when a country can no longer grow out of its debt stock and increasingly has to borrow just to service interest expenditure. This point is reached because the starting stock of debt is already high, the government has a primary deficit, and the nominal cost of borrowing is higher than the nominal GDP growth rate. Our research concluded that SA was not in a debt trap, but the longer the cost of borrowing remained higher than the nominal growth rate, the quicker that point would approach.

Traditionally, there are two types of debt crises. An external crisis is probably the most widely known. It is when a significant proportion of sovereign debt is denominated in a foreign currency. Due to a loss of confidence by foreign investors, large capital withdrawals from the country precipitate a weakening in the currency, rendering foreign exchange reserves insufficient to meet debt requirements. It was immediately obvious that SA, with about 10% of its debt denominated in a foreign currency, did not fit into this category.

Conversely, a domestic crisis occurs when most of a country’s debt is denominated in local currency, and there is a sudden slow-down in growth. The country tries to spend its way out of the crisis, but the cost of funding increases exponentially making the cost of higher growth unachievable. This is generally accompanied by a few attempts to lower the cost of funding through financial repression (large rate cuts and quantitative easing).

SA had strong parallels with a domestic crisis. Our conclusion was and still is, that if a debt trap was to occur it would be more than five years away. The main reasons for our conclusion were both economic and technical. On the economic side, cyclical tailwinds from commodity prices provided SA with a lower than initially expected starting debt load. On the technical side, SA’s average debt maturity was very long dated (12 years) relative to other emerging markets (8 years) and all fixed rate, meaning there was room for National Treasury to reduce funding costs by shortening the term of issuance and introducing floating rate issuance. This would bring the cost of funding closer to cash rates, which were almost 6% lower than bond yields. In addition, local bank ownership of SAGBs was around 20%, which was much lower than other emerging markets like Brazil where the number sits closer to 40%. These factors provided us with comfort that even if the economic tailwinds subsided and the government abandoned all hope of reining in the fiscal deficit, there were still several levers that could be pulled to stave off a debt crisis. However, if SA were to enter a debt crisis, there would be very few ways to escape and is worth exploring.

What could happen in the event of a debt trap

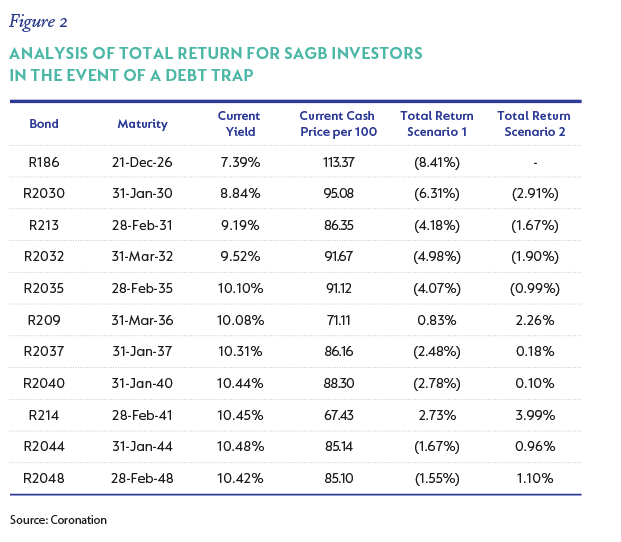

Once in a debt trap, a country’s options become very limited. Having been unable to accelerate growth sufficiently, countries seek the assistance of an international institution like the International Monetary Fund (IMF). This often happens where the external debt burden is unsustainable but can also occur where aggregate debt is overwhelming. Should SA be unable to raise long-term growth sufficiently, we considered the implications of seeking IMF assistance. In every historic instance when the IMF intervened, it has come with the price of austerity, reforms, and a haircut on the current debt load of around 40-60%. Using this template, we then ran a total return analysis for two scenarios.

In the first scenario, we modelled SA managing to avoid a debt trap for the next four years, but in year five, the country is forced to take a 50% haircut on its debt. In the second scenario, SA manages to avoid a debt trap for the next six years but in year seven is forced to take a 50% haircut on its debt. We continually update this analysis, and it helps inform our ongoing decision-making. The results in the figure 2 are based on current information.

The results are quite surprising and against general intuition, which believes that the safest place on the yield curve is in the nearer maturities. There are two reasons for this. Firstly, bonds with a maturity of more than 15 years currently trade at high yields. Secondly, their current cash prices are low, which means that in the event of a haircut, the write-down of capital is lower. The longer SA avoids a debt trap, the more attractive these returns from the long end are. Our conclusions from this work remain as follows:

- Despite the negative news flow, cyclical economic factors provided good breathing room.

- Government was trying to right the ship, albeit slowly.

- National Treasury had numerous levers they could still use to lower the cost of funding before we entered a debt spiral.

- A debt trap could be avoided for at least the next five years.

- The yield on offer in the 15-to-20-year area of the bond curve offered attractive risk-adjusted return prospects.

- In the event that a debt restructuring was required, clients would be protected by the current lower cash prices in the 15-to-20-year area of the curve.

This work provided us with confidence and conviction to increase our holdings to SAGBs in the 15-to-20-year area of the curve across all our portfolios within Coronation. Our multi-asset funds went to their highest ever holding in SAGBs while our specialist fixed income portfolios increased their holdings in 15-to-20-year to well above ALBI weightings.

We saw the tide start to turn in early 2021 as bond yields compressed, led by the 10-to-15-year area of the curve, which saw the yield curve flatten. Our portfolios had a dramatic turnaround in performance and continue to enjoy those tailwinds at present.

Despite paring back some of our exposure in the second quarter of 2021, we remain underweight credit and overweight duration in the 15-to-20-year area of the curve. Valuation still suggests a significant risk premium embedded in SA assets and the yield curve. We remain proactive and continue to interrogate our underlying assumptions, and stand ready to adjust the positioning of our portfolios should the facts change.

Disclaimer

Global (excl USA) - Institutional

Global (excl USA) - Institutional