Investment views

Saudi Arabia

moving away from being just another petrostate

The Quick Take

- The GFC saw stagnation in many countries – shifting the concentration of the EM Index to eastern nations

- A new addition to the EM basket, Saudi Arabia, has quietly been gaining weight for several reasons

- The Saudi government’s socioeconomic reforms are far reaching and aim to place Saudi firmly on the map as a business and tourism destination

- Vision 2030 comprises groundbreaking mega-developments that are transforming the country

The emerging market universe has evolved significantly since the launch of Coronation’s product range in this asset class in late 2007 with the launch of our retail-oriented flexible unit trust fund and in mid-2008 with the launch of our institutional-focused strategy. As an example, for the early part of these products’ histories, Brazil was by some distance the largest weight in the MSCI Emerging Markets Index, the benchmark against which our products’ performances are measured. After the 2008/2009 Global Financial Crisis (GFC) and the resultant popping of the commodity boom, Brazil yielded top spot to China, whose economy had grown strongly until the onset of the Covid-19 pandemic, with its weight in the benchmark peaking at close to 40% in 2021.

As a general principle, since the GFC, the overall direction of travel for the emerging market investment universe has been away from commodity heavy countries like South Africa, Brazil and Russia, towards East and Southeast Asia. With the removal of Russia after its invasion of Ukraine in February 2022 rendered it uninvestable, more than 70% of the benchmark is concentrated in China, India, the Republic of Korea and Taiwan.

A QUIET NEW ENTRANT IS GAINING WEIGHT

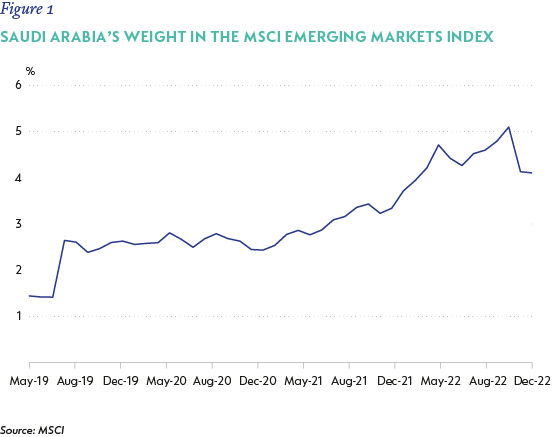

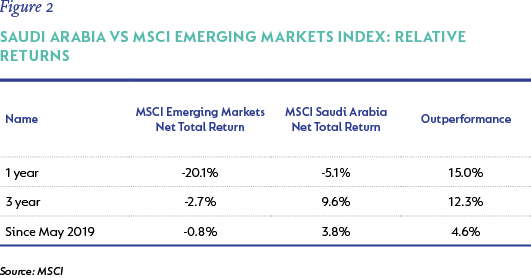

A recent interesting development is the largely unnoticed entry of Saudi Arabia into the investable emerging market basket, having been added at the end of May 2019 after meeting MSCI’s technical criteria for inclusion. Since that point it has grown from a paltry 1.4% to a peak of over 5% weight (Figure 1), partly due to the inclusion of additional companies/new listings and partly to the stellar performance of the Saudi market at a time when most global emerging markets have delivered poor returns for investors (Figure 2).

With Saudi Arabia now being a fairly significant market in the investment universe (it is the sixth largest emerging market weight, exceeding that of South Africa), it is worth exploring some of the investment options the country offers. Members of the Coronation emerging markets team made a maiden trip to the capital city of Riyadh in November 2022 to meet with Saudi corporates and came away with an impression of a country with a drive to transform itself within the next 10 years. Saudi is currently highly dependent on climate-destructive hydrocarbon sources for almost all its government income (and local energy generation) when the world is aiming to transition away from fossil fuels to limit the impact on the climate and overall environment.

Central to the country’s Vision 2030 reforms are a series of giga- and mega-projects[1] ranging in value from $20 billion to $90 billion, plus the somewhat futuristic NEOM, a city targeted to cover an area of 26 500 square kilometers (which would make it bigger than Rwanda and about 55 other recognised sovereign states) and that is expected to cost at least $500 billion. The economic reforms being pushed by the government will see the liberalisation of the economy to reduce the influence of the State, with an emphasis on localising industries and expanding the use of renewables.

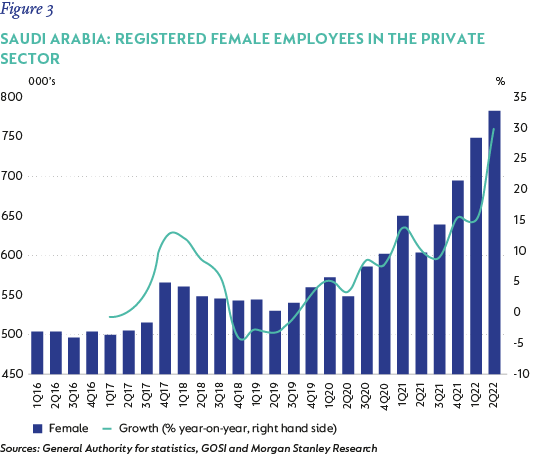

Given the highly conservative nature of the country historically, the biggest reforms on the social side have been to bring women into the mainstream economy, and to promote leisure and tourism. The social reforms commenced in 2016 and, in the few years since then, many aspects of Saudi’s society are almost unrecognisable from before. As indicated by Figure 3, female labour force participation has almost doubled to 30% (still very low and with much room to improve) and the absolute number of females employed in the private sector has increased almost 60%.

CONSIDERING THE FUNDAMENTALS

The team met a variety of companies across several industries, and some of the interesting ones are discussed below.

Financial services

A large proportion of Saudi’s investable universe comprises the banking sector. Due to its limited free float, the largest Saudi stock in the benchmark is not Aramco, the country’s listed monopoly oil extractor, but Al Rajhi Bank. The next largest stock is Saudi National Bank.

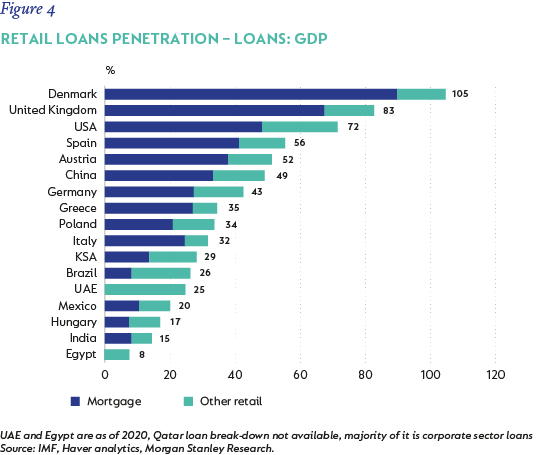

We see upside potential here as Saudi Arabia has credit penetration in line with other middle-income countries, but retail loans have significant room to grow with respect to both mortgages and general loans, which is an attractive growth area when considered in the context of Figure 4.

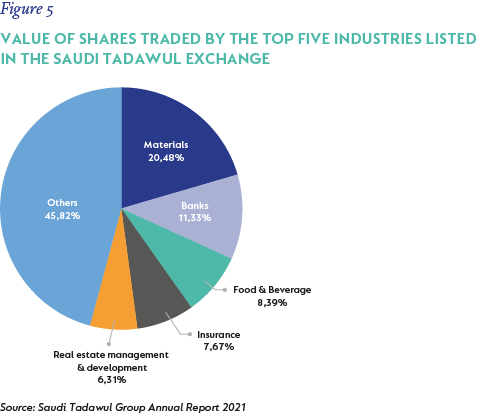

The country’s main stock exchange is itself listed, with Saudi Tadawul Group being the 11th largest exchange in the world by market capitalisation as per their 2021 Annual Report (boosted somewhat by Aramco’s market capitalisation). Of interest is that, in contrast to many other emerging market exchanges that are dominated by single sectors, no individual industry segment accounted for more than 20.5% of value traded in 2021 (Figure 5).

The gym sector

One of the most interesting case studies we came across were far-reaching developments in the gym sector. Prior to the recent socioeconomic reforms and the consequent removal of many restrictions placed on women once they left their homes, the gym industry was male only; there were simply no female gyms available outside of a tiny set of private, highly exclusive establishments. When female gyms were at last permitted in 2018, there was a huge influx of capital into the sector, which came to a screeching halt on the outbreak of Covid. However, Leejam Sports Company, the largest gym operator in the country, has developed a range of gyms at different price points (and hence differing facilities) for both men and women. They coped reasonably well during Covid and have started expanding again. With more than 150 sites, they are the largest owners of swimming pools and squash courts in the country.

Membership penetration is still fairly low across the populace, but the geography and climate of the country suggest that membership could be much higher than countries with similar income and demographics. Saudi is a vast desert with punishing heat across most of the country almost year-round. This gives little scope for other forms of physical activity like running, hiking and cycling, all of which have been growing in other countries at the expense of gyms in the post-Covid environment. The Saudi government wants to encourage greater sports participation amongst the youth to prevent health-related issues that are common in ageing and sedentary populations.

As mentioned earlier in the article, the final sector worth highlighting is renewable energy and desalination. Local developers like ACWA Power compete with the likes of KEPCO and Samsung (Korea) and Mitsui (Japan) to develop greenfield renewable power and desalination plants. Part of Vision 2030 is to have 60 gigawatts (GW) of renewable power coming onstream by that year. This will require several mega-projects as it will almost double existing annual output. For context, 60GW of generation capacity is more than the entire generation capacity of the likes of Argentina, South Africa or Malaysia. The country offers several advantages for solar generation since there is limitless land and decent sunshine all year round. The aforementioned ACWA Power has delivered solar projects with an all-inclusive cost of as low as one US cent per kilowatt hour (kWh). The typical cost is around 2.6c/kWh, a fraction of the wholesale energy price in other countries and competitive even in a country that pulls oil out of the ground for less than $10 a barrel. Due to the energy intensive nature of desalination, the low energy costs in Saudi Arabia means desalinated water can be delivered at a cost of $0.53 per cubic metre (1 000 litres).

CONCLUSION

Saudi Arabia has shaken off its historical label as a highly conservative patriarchal society at a pace that has surprised outsiders. Although there are many expatriates present in the country, at 25% of the population, Saudi Arabia is very different from other Gulf micro-states like the United Arab Emirates and Qatar, where locals are a minority of the population. The social reforms are therefore unlikely to be as extensive in Saudi Arabia as in some of its smaller neighbours. The big challenge facing the country will be to survive in a possible post-fossil fuel world.

Having spent most of its budget historically on subsidising the local population to keep the cost of living down, the new strategy of getting the majority of the population into gainful employment through education and investing heavily in infrastructure is somewhat similar to that undertaken by China through the 1990s and 2000s. The longer that oil prices stay at current levels, the more likely this strategy is to be successful. We will continue to monitor the local equity market for potential investments in our emerging market fund range and highlight these in our quarterly commentaries going forward.

[1] Loosely defined, these are massive-scale urban developments focused on putting Saudi on the tourism map and include renewable energy plants, theme parks, health and sporting facilities, zero-carbon cities, and record-breaking skyscrapers, to name a few.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

Global (excl USA) - Institutional

Global (excl USA) - Institutional