Investment views

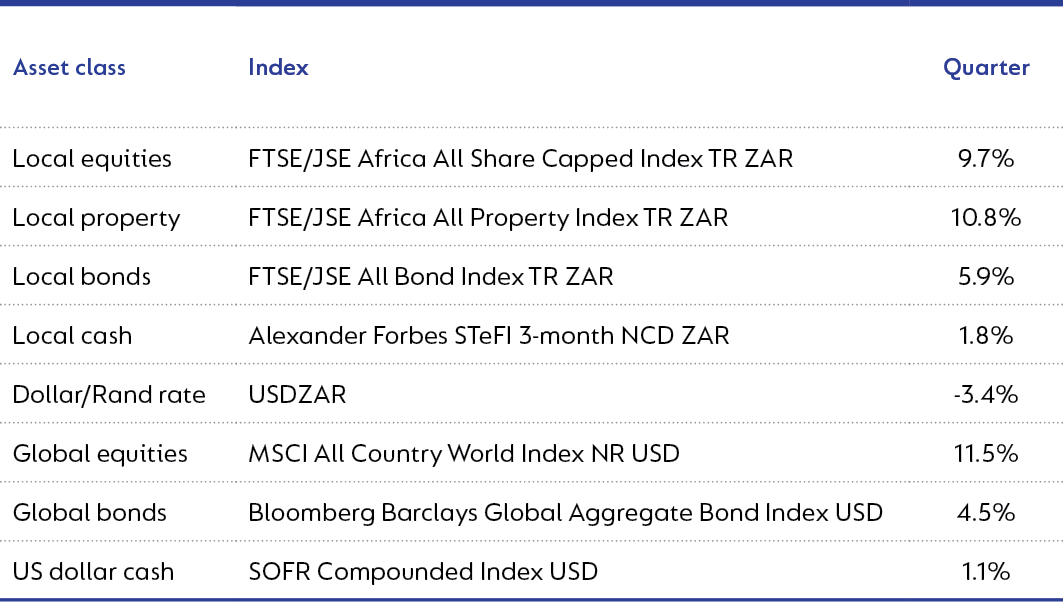

After an initial negative reaction to the Trump administration’s “Liberation Day” tariff announcement in early April, US and global equity markets rebounded strongly, despite the lingering uncertainty about the impact that more volatile US policy will have on global growth. Our multi-asset and global funds were well-positioned for this environment and outperformed their respective benchmarks as well as peer group averages.

Domestically, the adoption of a lower inflation target is increasingly likely with CPI remaining below 3%. The South African Reserve Bank cut the policy interest rate to 7.25% during May, but real (inflation-adjusted) rates continue to be elevated. The local economy remains moribund, with GDP increasing by only 0.1% in the first quarter of 2025. While the rand appreciated against the US dollar over the quarter, it continued to weaken against the euro and pound sterling, serving as a reminder that the domestic fiscal and growth outlook remains challenging.

More information on specific funds' positioning and performance will be available on our website later this month.

Global (excl USA) - Institutional

Global (excl USA) - Institutional