Overview

Coronation was founded in Cape Town, South Africa in 1993 by a group of investment professionals who left an established institution to start a dedicated fund management business. With zero assets and zero clients, their objective was to build a world-class, investment-led and independent fund manager. Today, Coronation is 34% employee-owned and a leading brand in the South African investment industry. We are solely focussed on asset management and have a track record of delivering competitive long-term returns to our clients for nearly three decades. An active investment manager with a long-term valuation-driven investment approach, Coronation currently manages $36 billion in client assets (as at end-March 2025).

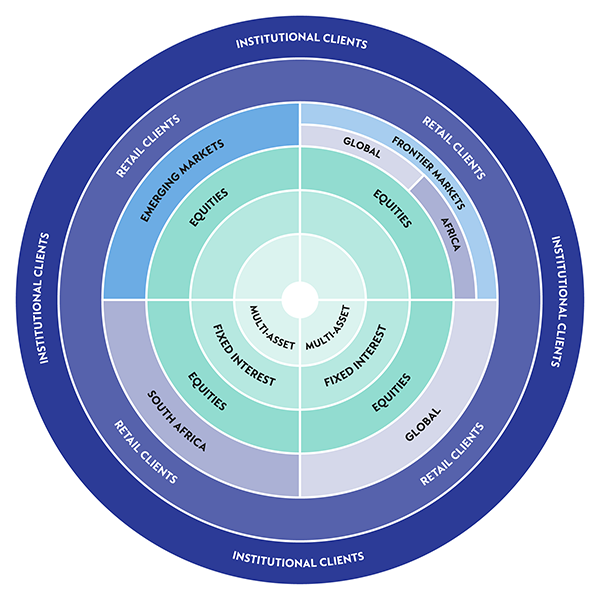

Our investment expertise extends across asset classes and geographies, with our longest-running strategies focused on specialist equity and multi-asset portfolios in global emerging and frontier markets.

We believe we are one of the largest and most successful managers of institutional and retail assets in southern Africa and offer both segregated and pooled investment vehicles. Our clients include pension and provident funds, medical schemes, unit trusts, banks, insurers and other fund managers. We also manage assets for a growing number of international retirement funds, endowments and family offices.

Video Channel

About Us

An investment-led, owner managed business that is committed to delivering long-term results for clients.

Watch Video

We have an integrated global investment team that is headquartered in Cape Town, South Africa. We have offices in London, Dublin, Johannesburg, Durban, Pretoria, and Namibia.

Global (excl USA) - Institutional

Global (excl USA) - Institutional