Investment views

Mobile money in frontier markets

- Mobile money businesses often thrive in frontier markets where large unbanked populations and pragmatic regulators support their development.

- The transaction ecosystem created by these businesses allows for the addition of a huge number of auxiliary services, creating the potential for significant earnings growth.

- Such businesses tend to trade on much lower multiples than developed and emerging market peers.

- The combination of below-normal earnings and low multiples creates a very compelling investment opportunity.

It is easy to know what a frontier market is when you are in one, but defining it from beyond its borders proves somewhat more elusive. Frontier markets are typically economies where the usual consumer brand suspects are largely absent. Large-scale production-type multinationals such as Heineken, Anheuser-Busch InBev and British American Tobacco may have taken root, but familiar consumer brands such as Starbucks, McDonalds and KFC have yet to establish extensive footprints in the somewhat virgin market territory.

While these marketsare frequently viewed as quite fragile and high risk, it is quickly becoming apparent that certain business models work far better in a frontier market than in a developed one, allowing investors some very interesting return opportunities. One such opportunity is mobile money (MM).

In the June 2017 edition of Corospondent, we wrote about the parallels between two MM businesses, bKash in Bangladesh and M-Pesa in Kenya. These businesses have done well for us over time and, despite optically high near-term multiples, we still believe they offer value, and we continue to hold both companies in our Africa and Global frontier market portfolios.

MM businesses in frontier markets are fascinating subjects. It is an industry born from a marriage of consumer need, legacy high-cost banking infrastructure and exceptional technical innovation, and one that produces fast-growing, profitable businesses. Globally, the MM industry processed $1.3 billion a day in 2018, with the number of registered MM accounts increasing to 866 million, making MM the leading payments platform for the digital economy in several emerging and frontier markets [1].

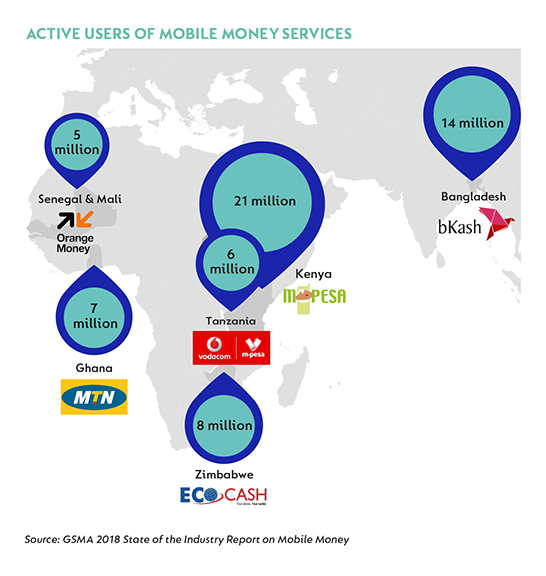

In 2018, there were 272 mobile money businesses across 90 countries. Of these, 62 had more than one million active users, compared to only 13 in 2013 [2]. Having investigated a number of payments businesses globally, there are a few that stand out for us: M-Pesa in Kenya and Tanzania, EcoCash in Zimbabwe, Orange Money in West Africa, MTN MoMo in Ghana and bKash in Bangladesh. These markets have a few things in common that have supported the growth of MM, the most significant in our view are the following:

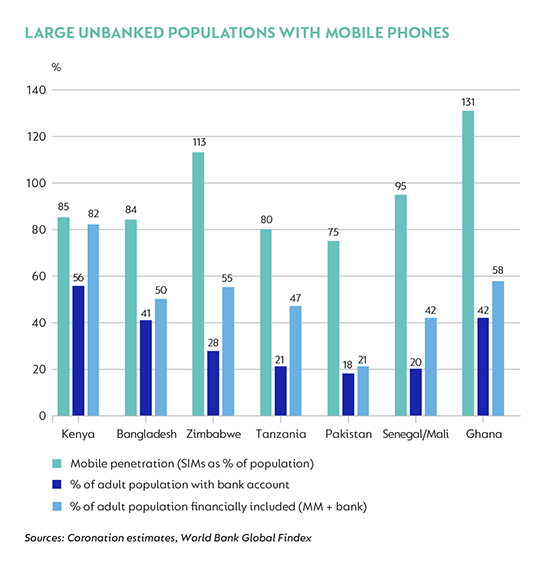

(1) Large unbanked populations that are in dire need of convenience and an affordable, secure way to complete very simple transactions

An inadequate legacy banking system in frontier economies renders a large percentage of the population unbanked, while mobile telephony has enjoyed huge penetration. Mobile phones play a central role in the lives of these users, creating higher levels of trust in mobile services than elsewhere.

(2) Pragmatic regulators with an approach that enables financial access

When paired with a supportive regulatory system, a fertile environment is created for the formation of formidable mobile financial services businesses that can grow from concept to profitability in a very short space of time and, in so doing, aid in the financial inclusion – and consequent economic liberation – of millions of people.

MOBILE MONEY BUSINESS AS INVESTMENTS

Some of our best investments have been when we have paid a low multiple on low earnings. For the MM businesses we like, both these metrics hold true.

Current earnings are low

The profitability of MM businesses in the very early stages of their lifecycle is a characteristic that is often in stark contrast to what we see in developed markets. International payments businesses are lossmaking, whereas our estimates indicate that EcoCash and M-Pesa, for example, have net profit margins in the region of 20%.

Across MM businesses, we believe there is significant potential for earnings growth driven predominantly by margin expansion. Over the long term, the true value of these businesses lies in the payment and transaction ecosystem being created. Once this ecosystem is established, there is almost no limit to the auxiliary services that can be added. Services such as loans, insurance products, merchant payments, utility payments, salary disbursements and even asset management services can easily be added – all of which usually come with very high margins. Current levels of earnings are therefore well below what we believe to be normal.

M-Pesa in Kenya serves as an example of this dynamic. In 2012, traditional person-to-person transfers accounted for 95% of revenue. By 2018, this had dropped to 74%, as M-Pesa had added loans, insurance products and an e-commerce business to its platform. Product proliferation is one of the key drivers of the significant margin expansion witnessed over this same period. M-Pesa has also packaged its capabilities into a targeted value proposition in DigiFarm, an M-Pesa platform that currently allows around one million farmers to access funding and sell their goods.

The opportunity to add to the ecosystem once it is established is remarkable. Alipay, the payments platform of billionaire Jack Ma’s Alibaba, is arguably the most successful global mobile financial services provider. Over time, it has added food ordering, ride hailing, insurance and investments products to its offering, supporting its valuation of $150 billion.

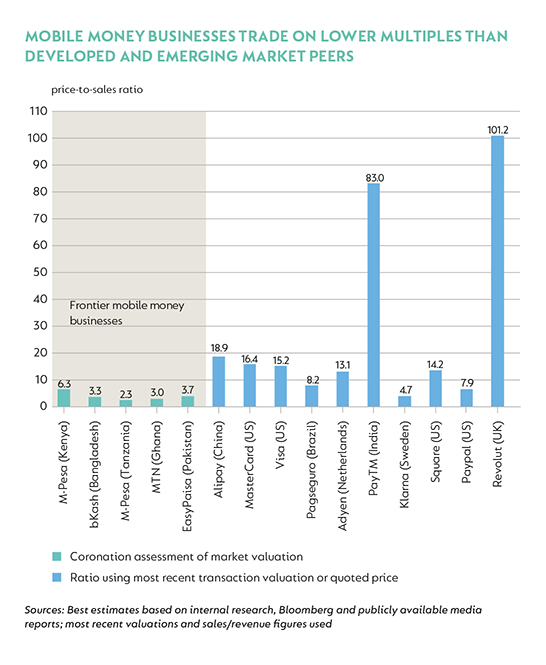

Multiples are attractive

What really excites us as value investors is that these businesses tend to trade on much lower multiples than developed and even emerging market peers – you get a whole lot more mobile bang for your buck. The graph below shows this by comparing the price-to-sales (P/S) ratios.

One of the reasons we believe MM businesses trade at such large discounts in frontier markets is that they are not listed separately. The only way an investor can access such a business is by owning the parent company, usually a telecommunications company or bank, which typically trade on lower multiples. Given the higher-quality income stream and the growth potential of MM businesses, we believe they should trade on higher multiples. However, the nascency of these businesses mean that they are a small part of current earnings, so often very little attention is paid to understanding the quality of these earnings.

A case in point is bKash, the largest MM business in Bangladesh, which is 51% owned by private commercial bank BRAC Bank. In 2018, Alipay acquired a 20% stake in bKash in a deal that valued bKash at $700 million. The implied P/S ratio of this valuation is 3.3 times, well below that of peers, even those in frontier markets.

bKash currently has around 30 million subscribers; multiple times that of its closest competitor and compared to only 48 million formal accounts held by banks in Bangladesh. This scale creates a network effect that continues to attract more users and service providers to the ecosystem. The growth opportunity is extraordinary: revenue per user is still only about half of what we see in more mature markets such as Kenya and the profit margin is much lower, because bKash continues to invest in the business.

We believe the Alipay deal should be transformative for bKash. Alipay brings with it years of experience, more sophisticated technology and a new dimension to customer acquisition, which is shifting the business even further towards a revenue growth model rather than a profit-driven model.

As a comparative, when looking at the valuation of mobile network operator Safaricom in Kenya, we estimate that the market currently assigns a value to M-Pesa in the region of $4 billion. We see no reason why bKash should not be worth as least as much as M-Pesa – Bangladesh’s population is more than three times that of Kenya, with only 41% of adults having a bank account, compared to 56% in Kenya.

RISKS - THE THREAT OF PAYMENT APPS

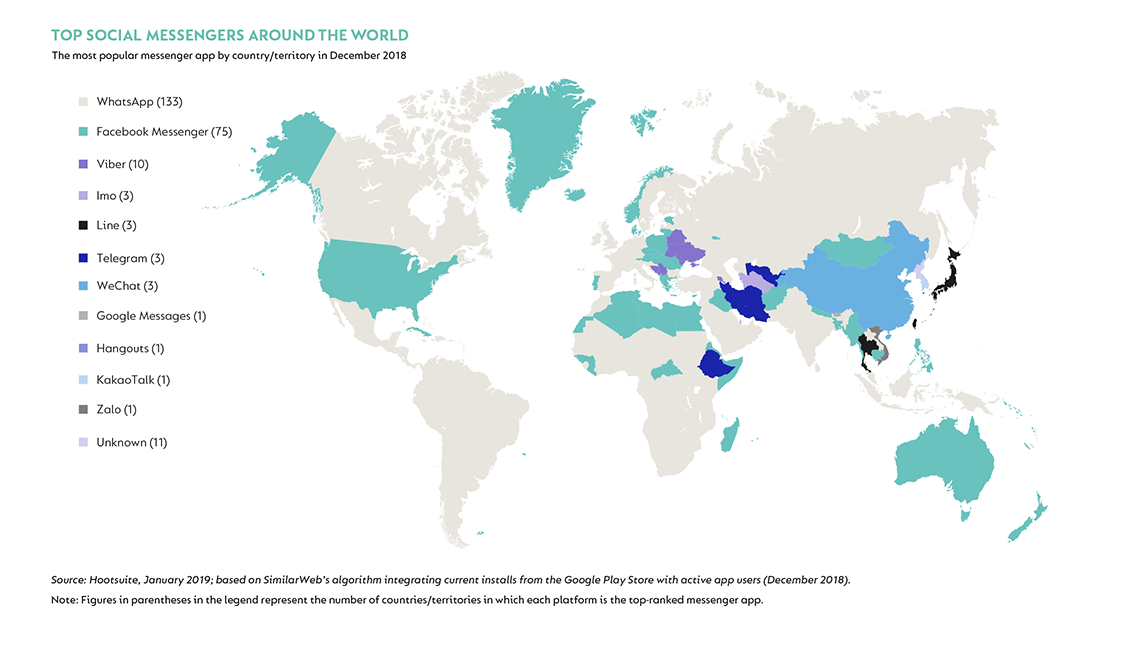

When building an investment case, we spend a lot of time investigating the risks. Regulation is the most obvious risk associated with payments businesses and, indeed, financial institutions more generally. But a risk that is perhaps less widely appreciated is disruption from messenger apps such as WeChat, WhatsApp and Facebook that are entering the mobile payments space.

Messenger apps have the same ability to leverage their existing platforms (which already capture consumer attention and enjoy an established degree of trust among users) when introducing mobile payment services This is what KakaoTalk is doing in Korea and WhatsApp in India, and what Line is now hoping to do in Japan, Taiwan and Thailand.

The graph below shows the most popular social messaging apps around the world, with a number of these either already offering payment services or likely to soon develop a payment offering (WhatsApp, Facebook, Line, WeChat and KakaoTalk).

One of the key constraints messenger apps face in frontier markets is transferring money into the user’s mobile wallet. MM players use large agent networks that physically receive deposits and process cashouts – in Bangladesh, bKash now has more than 200 000 agents doing this. Messenger apps typically partner with banks when launching payment functions and require users to link their bank card – therefore requiring a bank account. This is what WhatsApp is doing in India, where 80% of the adult population has a bank account, compared to 41% in Bangladesh. The lack of bank accounts in your typical frontier market is therefore problematic for messenger apps.

The extent of smartphone penetration in frontiers markets presents another barrier. While mobile phone penetration is typically high, smartphone penetration is much lower, explaining the success of MM businesses that leverages unstructured supplementary service data-based (USSD) technology for feature phones.

In frontier markets, we have seen several case studies of collaboration rather than competition. In Africa, a recent partnership between WhatsApp and telecommunications network provider MTN has allowed MTN customers to recharge airtime and check their bank balances using the WhatsApp platform. We have also seen large players such as mobile and online payment platform Alipay partner with MM businesses. In addition to bKash, Alipay purchased 45% of Easypaisa, the largest MM player in Pakistan. In Kenya, Alipay has partnered with Safaricom to allow customers to use M-Pesa when paying on Alipay’s online retail service, AliExpress. It targets around 100 000 traders in Kenya who source goods from China each month.

While messenger apps and large players such as Alipay pose a risk, partnering with MM businesses that have large, established ecosystems that already benefit from network effects likely makes more strategic sense than meeting them head on.

Over the past 25 years of investing, we have learnt time and time again that the combination of low earnings and low multiples can result in very rewarding investments for our clients. We believe MM businesses are already showing these same signs and will be multi-year compounders, making them among the most compelling investment opportunities in our universe.

1 & 2 GSMA 2018 State of the Industry Report on Mobile Money

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

United States - Institutional

United States - Institutional