Investment views

China’s big food fight

Fast food, faster commerce

The Quick Take

- China’s ecommerce giants are spending aggressively in the battle for dominance in instant retail

- While food delivery is the frontier, the real war is for dominance of the quick commerce market

- JD.com’s recent entry has challenged the Meituan/Alibaba duopoly and unsettled investors

- Despite the noise, we see an expanding opportunity for multiple winners, both in China and globally

WHY FOOD DELIVERY WORKS

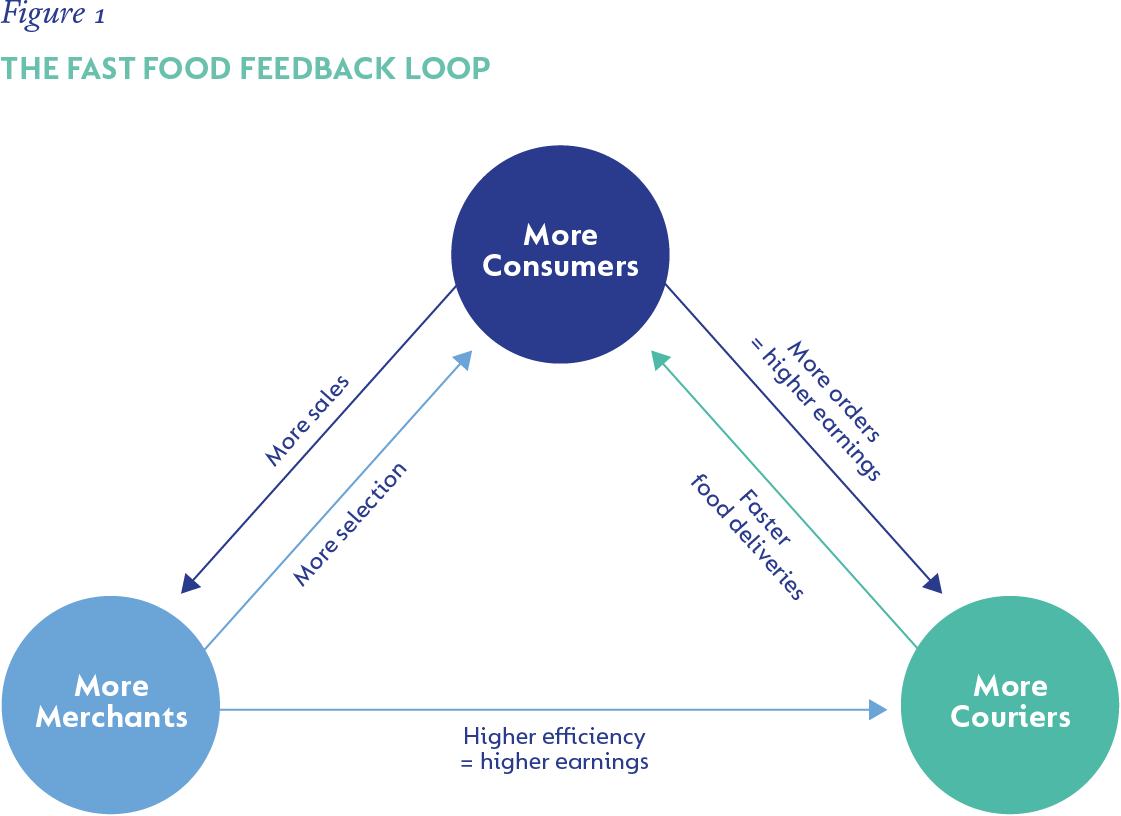

Food delivery is far more than convenience – it’s scale economics in motion. At its core lies a three-sided network connecting consumers, merchants, and riders (Figure 1). More consumers attract more restaurants; more restaurants improve selection and reliability, which draws in still more users. Rising order density, in turn, boosts courier utilisation and lowers delivery costs, creating a self-reinforcing loop of better service and stronger margins. Once established, this flywheel becomes difficult to replicate – the leader’s scale and data advantage compound over time, producing high barriers to entry and superior unit economics. It’s a business model that tends toward concentration, where density drives defensibility, and the largest player typically earns the bulk of industry profits.

CHINA’S BIG FOOD FIGHT

For most of the past five years, China’s food delivery market seemed stable. Meituan dominated with a roughly 70% market share, while Alibaba’s Ele.me held the remaining 30%. Consumers placed around 70 million orders per day on Meituan’s platform alone, making it one of the most entrenched consumer internet franchises in the world.

But 2025 has brought a fresh challenger into the ring – JD.com. Its entry has reignited an industry price war that is reshaping the competitive landscape. Subsidies across the sector now run into billions of US dollars per quarter, unnerving investors and raising questions about profitability. But a narrow focus on this near-term price war risks missing the bigger picture.

JD.com’s foray into food delivery is not really about food; it’s about protecting its ecommerce turf. Meituan has been growing its delivery service beyond restaurant food to include groceries, electronics, and household items, typically within an hour. Food delivery is no longer a stand-alone category; it’s the front door to instant retail, including categories that have long been the territory of traditional ecommerce players like JD.

For JD, launching “JD Takeaway” is as much a defensive move as it is an offensive one. Food delivery is a high-frequency use case that keeps consumers opening the JD app daily, which, in turn, drives traffic to its broader ecommerce offerings.

THE COST OF WAR

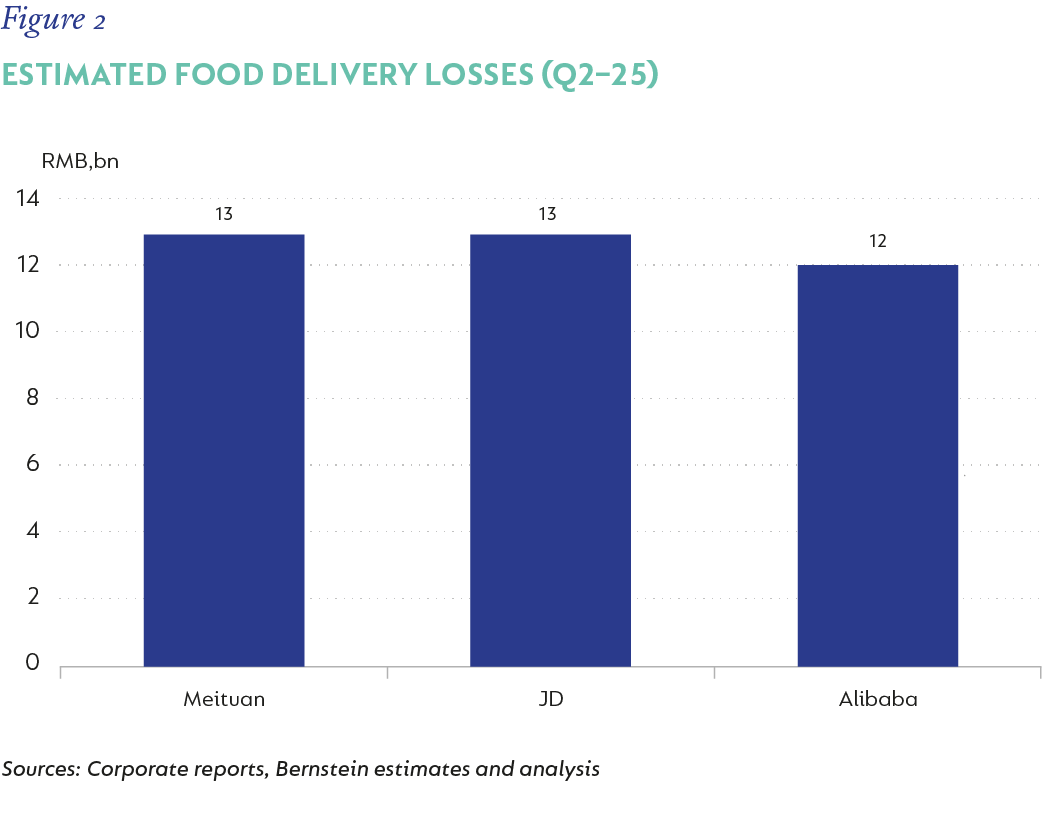

JD’s arrival has forced the established incumbents to respond in kind. Combined, Meituan, Alibaba (via Ele.me), and JD poured nearly RMB 40 billion (US$5.5 billion) into subsidies and promotional spending in the second quarter of 2025 alone. Losses are expected to widen in the third quarter, even as management teams signal that the “peak burn” may soon pass (Figure 2).

The scale of the spending is breathtaking. Subsidies in a single quarter now exceed what Prosus is paying to acquire Just Eat Takeaway (€4.1bn), or what DoorDash is spending on its purchase of Deliveroo (£2.9bn) – two landmark transactions in the global food delivery sector.

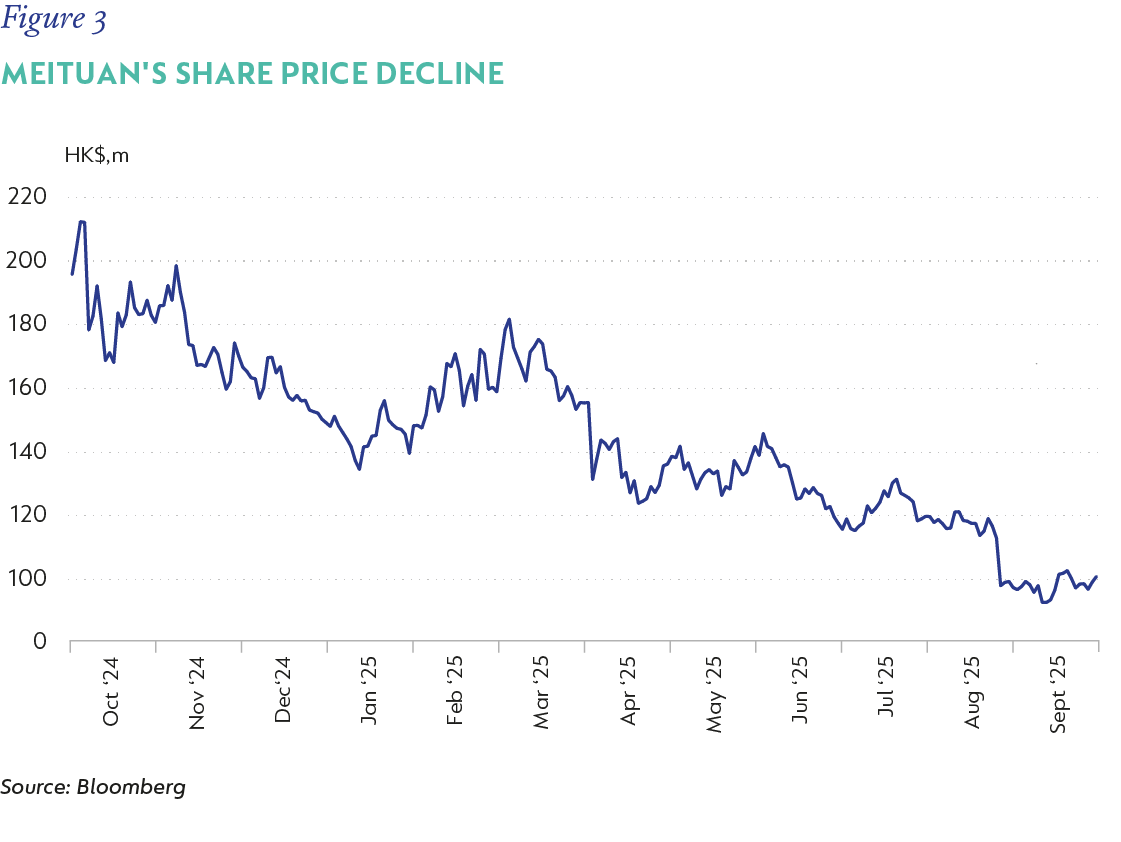

Unsurprisingly, investors panicked, and Meituan’s share price has halved from above HK$200 late last year to just under HK$100 at the time of writing (Figure 3).

WHAT’S REAL, WHAT’S BUBBLE TEA?

Beneath the panic, however, lies nuance. Much of the recent order growth has been fuelled by unsustainable giveaways, such as free milk tea (bubble tea) promotions, rather than sticky, recurring dinner orders. Analysts note that while Meituan’s share of total orders has dipped below 70%, its share of gross transaction value (GTV) remains steadier, because its platform captures higher-value meal occasions.

In other words, not all orders are created equal. A heavily subsidised bubble tea is unlikely to displace Meituan’s dominance in takeout meals, where timeliness, reliability, and breadth of restaurant options matter far more to consumers.

WHY BACKING THE LEADER MATTERS

As outlined earlier, food delivery is a classic three-sided network where the densest rider fleet, the broadest merchant selection, and the deepest consumer habit reinforce each other. Meituan has all three. With more than seven million riders and c.10 million merchants on its platform, Meituan claims industry-leading fulfilment times, averaging close to 30 minutes.

Beyond takeout, Meituan also runs a powerful in-store business that spans restaurant reservations, reviews, and travel bookings – the Chinese equivalent of combining DoorDash, Yelp, OpenTable, Booking.com, and more. This “super app” positioning gives it multiple entry points into consumer decision-making, which, in turn, makes it harder for rivals to dislodge.

THE 30-MINUTE IMPERATIVE

Quick commerce represents the fastest-growing frontier of ecommerce. Next-day delivery is losing appeal as consumers shift to the promise of near-instant gratification. If you can get fresh groceries, a new phone charger, or even an iPad delivered from a nearby store within half an hour, why wait even a day for a warehouse shipment?

Food delivery players have the local infrastructure, dense courier fleets, algorithmic dispatch systems, and hyperlocal merchant relationships that traditional ecommerce logistics lack. This renders the overlap unavoidable. Meituan is pushing into retail categories, while JD and Alibaba are being pulled into food delivery in order to participate in the next wave of ecommerce evolution.

THE BOUNDLESS APPETITE FOR INSTANT DELIVERY

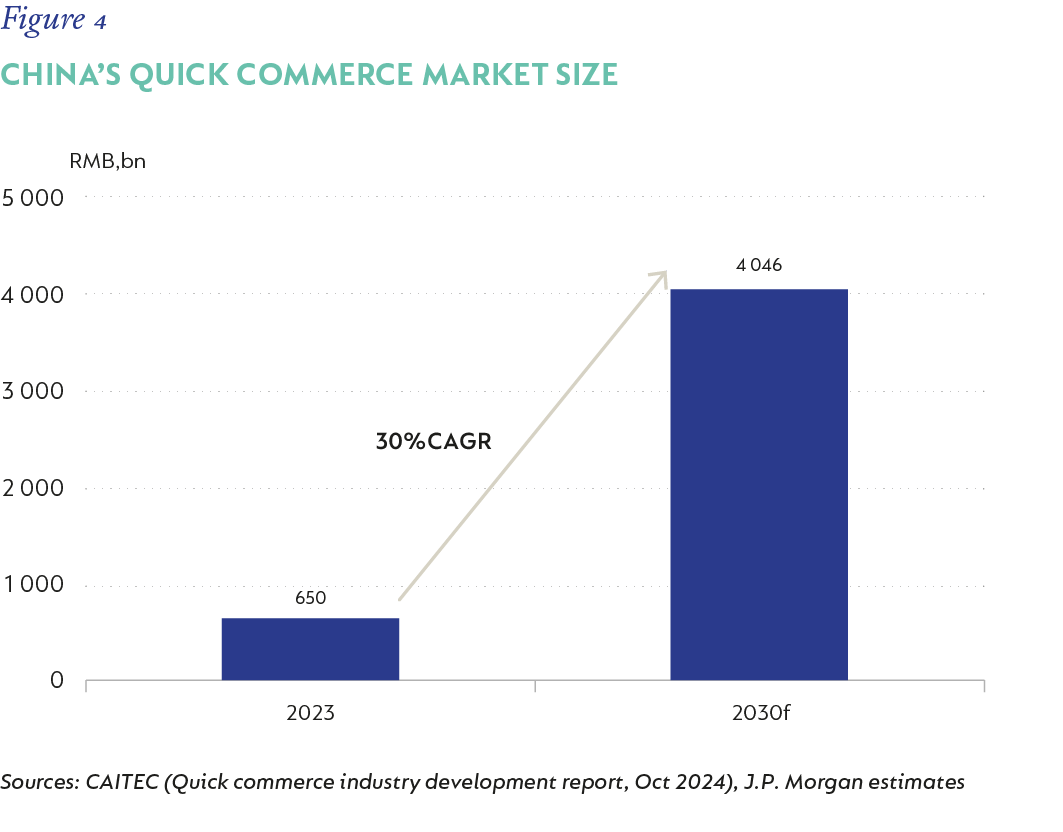

Despite investor anxiety, one encouraging reality is that the addressable market is likely far larger than once thought. China is already the world’s most extensive food delivery market, thanks not only to its population size but also to higher penetration compared to many other countries. And yet, the real growth story lies ahead (Figure 4), as the expansion into groceries, retail goods, and other “quick commerce” categories opens a substantially larger addressable market to online fulfilment.

Whether delivered by a courier on a scooter, dropped from a drone, or ferried via autonomous robots, the idea of instant fulfilment is reshaping consumer expectations of commerce.

MORE THAN A ZERO-SUM GAME

Yes, the subsidy war is ugly, and losses will likely deepen before they improve. But history suggests caution before declaring Meituan’s moat broken. It still commands loyalty, superior unit economics, unrivalled density, and the flywheel of an integrated local services ecosystem spanning in-store dining, travel, and reviews.

Longer term, the “food fight” may prove less about dividing a fixed pie and more about expanding into a much larger one, with enough to satiate several winners.

WHY WE’RE HUNGRY FOR MORE

Our investments in this industry are not tied to a single company or geography. Instead, we’ve built exposure to a diversified set of market leaders that are best positioned to capture the rapid expansion of food delivery into broader quick commerce:

- Eternal (India): India is the world’s third-largest grocery market, but 95% is still sold informally and with online penetration far below global benchmarks. Eternal is the market leader, driving the shift to online sales, providing consumers with more choice and lower prices than traditional “kirana[1]” stores. Quick commerce has already overtaken Eternal’s restaurant delivery business and, with penetration still extremely low, the growth runway remains enormous.

- Grab (Southeast Asia): As the regional leader in both ride-hailing and food delivery, Grab benefits from the high prevalence of two-wheeler mobility in Southeast Asia. This enables its rider fleet to operate flexibly across verticals − delivering meals one hour and transporting passengers the next − driving higher utilisation, lower idle time, and stronger unit economics. Its GrabMart offering is scaling quickly, positioning it as a strong contender in Southeast Asia’s on-demand retail. The unique data gleaned from customer purchase frequency and restaurant economics are also leveraged to provide financing in an under-banked financial services market.

- Delivery Hero (Global): Operating in around 70 countries, Delivery Hero is the leader in markets that together account for roughly 90% of its global order value. The company is already achieving industry-leading profitability in its most mature quick-commerce markets, and we continue to see significant value in the sum of its parts. For example, its stake in the listed subsidiary Talabat − the market leader across eight countries in the Middle East − is worth more than half of Delivery Hero’s total enterprise value, despite contributing only a mid-teens share of overall orders.

- Meituan (China): China’s market leader, which, on our estimates, trades on a single-digit multiple of 2027 earnings, adjusted for net cash (about 20% of market capitalisation, currently), and half the price it was just months ago.

- Prosus (Global Portfolio): Prosus provides indirect exposure to multiple delivery platforms worldwide, including Brazilian leader iFood, and recently acquired multinational, JustEat Takeaway. With Prosus trading below the value of the stake it holds in Tencent, investors are effectively getting all the food delivery (and other internet) assets for free at the current share price.

Taken together, these positions give us broad exposure to one of the most game-changing consumer internet developments of the decade: the evolution of food delivery platforms into full-scale quick commerce ecosystems. What began with a hot pizza arriving at your door is now becoming the backbone of how consumers order everything, from groceries to gadgets, in under an hour.

[1] Informal corner grocery store

United States - Institutional

United States - Institutional