THERE IS NO simple way to sum up last year. A year that felt like a decade, and indeed, where a decade’s worth of change transpired. But I do believe that a great place to start is thanking all frontline healthcare providers and essential service personnel for their tireless work during this daunting time. To all these exceptional people, Coronation, along with all South Africans, thank you and convey our deep sense of gratitude for your commitment, bravery and sacrifice.

This time last year, we were heralding the start of a new decade, and a virus that was to change the shape of human history had yet to be named globally. One long year later and the world is reeling from the devastating impact of this once-in-a-century pandemic, bringing with it the twin shocks of a health and an economic crisis, the depth and extent of which are unlikely to be understood for some time yet.

It was a year filled with life lessons – we learned to adapt to new and unexpected events and navigate a new way of working, staying connected to our work colleagues and clients while juggling our home lives and schooling our children. There have been worse years in history, but for many of us, 2020 marks something we have never experienced before in our lifetimes. For those of us privileged enough to keep our jobs, the transition to working from home was instant – we simply had to figure it out and get on with it. Parents across the world, no matter their means, hustled to home-school their children.

We dialled in for Governor Andrew Cuomo’s daily Coronavirus briefing and binge-watched The Queen’s Gambit, Bridgerton and The Last Dance – thankful that Netflix kept them coming.

Chilling and horrific scenes of refrigerated trucks lining the streets of New York, overflowing hospitals everywhere and scary charts that kept ticking up became part of our lives and fuelled our anxiety, shock and sense of devastation.

Added to this, and in stark contrast, was the maddingly mundane and boring routine of being stuck in your home during the lockdown periods. It made the year feel akin to the movie Groundhog Day, in which Bill Murray plays a weatherman who finds himself inexplicably living the same day over and over again … which brings me to reflect on my most useless purchase from last January – the 2020 year planner.

ZOOM, ZOOM, ZOOM

In my January 2020 On Point, I noted that one of the standouts of the previous decade was the rise of technology, with platforms such as Netflix and Spotify changing the face of how we consumed media content. Fast forward one year, and where would we have been without applications such as Zoom, Microsoft Teams and online entertainment? I had never heard of Zoom before and almost instantaneously, it felt like everyone was using it (from my four-year old nephew doing online classes to my 74-year-old mum trying to stay in touch with everyone). And that’s because virtually everyone was on Zoom. From a daily user base of 10 million in December 2019, Zoom’s daily usage skyrocketed to 300 million by April 2020, and its market capitalisation exceeded that of the world’s top seven airlines combined! Zoom and MS Teams are, no doubt, one of the pandemic’s success stories.

And while they have played a critical role in keeping us connected to our own teams, employees and clients, these virtual interactions are no long-term substitute to the nurturing that a relationship receives from direct human interactions. And, of course, face-to-face interactions have the added benefit of never having the awkwardness of being halfway through an eloquent answer (in my view) and hearing the words, “Kirsh, you’re on mute!” AGAIN!

At times, the helplessness coupled with the isolation felt intense. It was a year of struggle, but also one that offered many insights and opportunities to be grateful for. What did we learn? We slowed down, we reconnected with those who matter the most, we talked and listened, and spent real time with our children, we gained an appreciation for how badly we were abusing our planet and the urgent need to take action now to prevent being caught unprepared for yet another disaster. We learned that to tackle our world’s most intractable problems requires significant collaboration and a more authentic, inclusive approach. I hope that, when we return to some form of normal, we never forget these valuable lessons.

COLLABORATION

The onset of the pandemic certainly highlighted the urgent need for co-operation – on an international scale as well as between the public and private sectors. This need was accentuated as the development, procurement and distribution of vaccines became the focal point of all nations. What is now clear is that the massive international co-operation that was demonstrated in the development of the vaccine must continue in the race to inoculate enough people to stem the ongoing pandemic. For the world to return to pre-pandemic levels of activity and to restore ailing economies, all nations must become ‘Covid-19 safe’ and this will demand intense levels of collaboration and coordination globally. Yet, while the pandemic has highlighted this need, it is not the only ‘event’ that requires this shift towards a multilateral approach.

A WORLD ON FIRE

As we struggled to come to grips with the Covid-19 world, time did not stand still, and 2020 was a year of unprecedented events. The year was already off to a devastating start as Australia was ravaged by crippling bushfires that raged for over two months and decimated over 180 000 square kilometres. And this was just one of the extreme climate-related events that were to mark 2020 – one of the hottest years on record. As the year progressed, Siberia, the US and the Amazon’s Pantanal wetland also fell victim to wildfires that raged out of control, leaving havoc in their wake. Add to these catastrophic events wide-spread mega-storms, flooding and chronic drought, and it is clear that climate action must be front and centre of global government policy – both from a humanitarian and an economic perspective. One of the many things that was revealed as the world went into lockdown was the decrease in air pollution in major cities across the world – a powerful testament to the impact of human activity on the environment. As an investor and responsible corporate citizen, we are therefore focused on constantly deepening our understanding of the impact of climate change and engaging with government, civil society and our investee companies.

I CAN’T BREATHE

The name George Floyd looks set to enter the history books as record of a moment that fuelled a global movement. The tragic murder of George Floyd sparked an upsurge in the Black Lives Matter Movement and civil rights demonstrations across the world, exacerbated by soaring joblessness, increasing poverty levels and the effects of on-going trade tensions. The world’s voices were anything but muted.

It brought into sharp focus the level of embedded social inequity and centuries’ long racial schisms in the US. Along with highlighting to governments the urgent need to redress some of their policies, it also intensified the commitment by corporates across the world to break blind social biases and actively address diversity and inclusion in the workplace.

This brings me to my recommended reading from our recent summer holidays in South Africa – Range by David Epstein. I have been a fan of Epstein since watching his TED talk on sports performance in 2014. In this fascinating book, he argues that what the world actually needs is more people who embrace diverse experiences and perspectives while they progress in their lives and careers. This book feels almost like the opposite to the high degree of specialisation argued for in Malcolm Gladwell’s book, Outliers. Indeed, it also contrasts our real-life experiences where the last few decades have been dominated with a view to creating more and more specialists in different areas. Epstein uses examples from a multitude of arenas. His reasoning is that the world requires both generalists and specialists for different domains, and that the true value of generalists exists in volatile and rapidly changing environments – much like the one the world finds itself in right now.

For me, his ideas help explain some of the reasons behind Coronation’s success over the years and its ability to deal with the challenges presented by the pandemic with stealth, agility and empathy. An effective culture is both consistent and strong. It embraces change, and learns and adapts from experiences over time. Our diverse collection of individuals and integrated culture have always been a key part of who we are. Today is no different.

SUSTAINABILITY MATTERS

Wirecard, the German electronics payments company where $2.1 billion went missing, is arguably the corporate fraud of the decade. The collapse leaves uncomfortable questions for regulators, auditors and others who bear the responsibility of protecting investors’ money. This, together with the many other corporate governance failures over the past decade, re-iterated the urgent need for increased active stewardship by investors. A confluence of this and other significant issues like systemic risk, diversity and inclusion, and climate change has given rise, as it rightly should, to the increased call by investors for greater consideration to sustainability measures in their investment portfolios. We welcome and expect to see this trend continue to gather even more momentum over the next five years.

In this regard, the Principles for Responsible Investing (PRI) assessment is an important yardstick for us, as it helps us measure where we stand in comparison to the rest of the market and, importantly, highlights areas for improvement. Last year, we achieved the highest PRI rating of A+ in all categories, scoring well above the median global manager in every category. We are also continuously deepening our commitment to being effective stewards of the assets that we manage for our clients and are a signatory to a variety of voluntary codes and organisations, notably the Task Force on Climate-Related Financial Disclosure and Climate Action 100+. We’ll be publishing our annual Stewardship Report for 2020 at the end of March this year, which will give detailed insights into our stewardship activities during last year.

STATE OF PLAY

In March, the S&P 500 lost a third of its value in the steepest decline in its history – hardest hit were the BEACH stocks (bookings, entertainment, airlines, cruises and casinos, and hotels), as travel and mobility restrictions brought international tourism to its knees. And, by April 2020, 22 million US citizens were unemployed – a harsh reality that was mirrored across the globe. By October 2020, the world was deep in recession and the economy had contracted by a whopping 4.4%.

However, the early policy response by governments was stunning, with monetary stimulus of epic proportions being pumped into the economy, and, by August, markets were rallying. At the time of writing, the world looks set for a strong, if not uneven, recovery, buoyed by breakthroughs in the vaccine space. South Africa, as with many emerging markets, having entered the pandemic weighed down by grave systemic challenges, can expect a slower and somewhat more painful recovery.

To underscore this, we have just seen the resumption of loadshedding and the corruption trials of 2019/2020 continue as hard truths come to light. On a positive note, it appears that the administration is committed to bringing the perpetrators of these injustices to book, which will send a strong signal of good governance and may go some way to restoring confidence domestically and internationally. You can read a detailed global and South African commentary by our economist Marie Antelme on our website if you missed the e-mails that we sent you earlier this month that included her outlook for the year ahead.

BUSINESS UNUSUAL

As with any crisis, there are embedded risks and opportunities, and at Coronation, our investment team doubled down to ensure that your portfolios were positioned to benefit from the buying opportunities that presented themselves while remaining resilient to the risks. You will have by now received the Q4-20 strategy comments from your Client Fund Manager, outlining portfolio activity and positioning. Overall, in what has been an otherwise very bleak environment, I am delighted that performance across all our portfolios was strong over both the short and the long term.

Another strong performance year

- Specialist South African Equity: Our South African Houseview Equity Strategy has generated an absolute return of 10.2% for 2020, finishing the year 9.6% ahead of its benchmark.

- Emerging Markets Equity: Our Global Emerging Markets (GEM) Strategy delivered an absolute return of 24.8% in US dollars, finishing 6.5% ahead of its benchmark.

- Multi-asset class funds: Our South African Global Houseview Strategy generated a return of 11.9%, which translated into 6.4% outperformance of the benchmark.

- Absolute Return funds: Our South African Global Absolute Strategy, which has a dual objective of delivering real returns while preserving capital over shorter-time horizons, delivered a strong performance in 2020, finishing the year with a real return of 5.6% for investors.

- Our Global Equity Fund: Our Global Equity Strategy finished 2020 delivering a strong absolute return of 15.5% in US dollars, in line with the market.

Adapted client service

- We managed to move all our client interactions, report backs and due diligences online, finishing the year with a greater number of client interactions than in 2019. We transitioned our thought leadership conference, Talking Investments, onto a virtual plat-form through a series of webinars involving subject matter experts from around the globe. These were a real highlight and exceptionally well received by our clients and a broader community of investors.

In fact, through this platform, we doubled our reach in our continued efforts to keep our clients informed of relevant and important content. If you missed these or would like to listen to recordings again, we’ve made them available on our website.

New product offerings

I am excited to announce the following enhancements to our product offerings:

- Sustainable Global Emerging Markets Strategy: We launched our Sustainable Emerging Markets Strategy at the outset of November last year. This Strategy invests in emerging markets equities using the same investment philosophy and approach as our current emerging markets strategy. However, this portfolio looks to exclude from the investment universe companies that do not meet specific environmental, social or governance criteria. This means excluding companies that are materially exposed to tobacco, controversial weapons, thermal coal, coal-based power and tar sands. The strategy is managed by Suhail Suleman and Lisa Haakman.

- International Equity Strategy: This actively managed Strategy looks to deliver superior returns by investing in a diversified portfolio of high-conviction stocks of companies located outside the U.S. The Strategy was launched at the outset of December last year and is managed by Neil Padoa and Gavin Joubert.

New-look Corospondent

- The last year has offered us much insight into the communication preferences of our readers. For this reason, we have decided to deliver Coronation’s thought leadership insights when available and on a more regular basis, rather than curating a full magazine at the end of each quarter. All our articles will continue to be available online for use at a time convenient to you.

Our commitment to South Africa

Covid-19 has been a humbling experience for us all, as we have been challenged to make significant adjustments to our lives in the face of overwhelming uncertainty and against all odds. The plight of underprivileged and marginalised communities has been even more grave, but what has been heartening is how civil society joined forces with government and the NGO sector to provide relief funding under the auspices of the Solidarity Fund and other well-coordinated schemes.

It is with great pride that I can share that Coronation ranked first in the private sector in terms of payroll donations to the Solidarity Fund, and, overall, we contributed R13 million to Covid-19 relief efforts, including feeding schemes, support for educators and learners, and cash donations to various charitable organisations. It is an honour and a privilege to work with people and for a company that, along with our clients, cares deeply about the communities in which we operate.

MADAME VICE PRESIDENT

No review of the past year would be complete without reflecting on the 2020 US presidential election. What a nail-biting week it was as the world watched and waited for the results to pour in, agonisingly slowly.

But incumbent President Donald Trump refused to accept defeat, asserting that this could only happen in a ‘rigged’ election. While social media giants like Twitter and Facebook inserted banners indicating to followers that his claims were not proven, no one expected that they would give rise to the violent mob that stormed the Capitol building on 6 January 2021.

The word ‘insurrection’ was never one that I would have expected to be used when describing the US. So the world, along with most Americans, sat and watched in horror as events unfolded on the day that marked the worst breach of the Capitol since the War of 1812.

There are many theories about why this happened. Is it because a large percentage of the electorate is gripped by a fear of a rapidly changing world and a sense of panic around the loss of control – in both economic and social terms? Or is it simply what happens after years of being fed false information unchecked? Maybe it’s a combination of a large number of different forces all acting at once? Regardless of the reason or reasons, there is no doubt that those responsible must be held accountable. Not to do so would undermine the rule of law and the foundations upon which democratic governments function.

Which is exactly why we saw the unprecedented second impeachment of a US president – a week before the inauguration of Joe Biden and Kamala Harris.

Their inauguration last week was a surreal affair. The state of both the pandemic and the events of 6 January meant it was a quiet affair where 200 000 flags replaced what would normally be people on the mall. And yet, there was something about the usual cheering crowds being replaced by a quiet solemnity on the day that lent it more gravitas.

I was both thrilled and emotional to watch Vice President Kamala Harris sworn in as the first female, African-American and person of South Asian descent to serve in this role. And I take great delight in what felt like a historical and huge moment for me, seemed normal and obvious for my young daughter. And that’s exactly how it should be.

Yes, things can certainly change.

HEARTFELT THANKS

The pandemic has taken its toll on many families and communities. We have lost friends, loved ones and so many individuals who returned to their frontline roles, continuing their service in our communities despite the risks that they faced every day. My thoughts go out to anyone who has been tragically affected. It is indeed a hard start to a new year in which everything feels the same.

At Coronation, we exist only because of our clients. We are deeply grateful for your ongoing business, and as always, our key focus is on delivering excellent long-term investment performance and offering world-standard client service.

In the long lens of history, we may well go on to talk about what our lives were like before ... before Covid-19, before masks, before lockdowns, before … in a time when we could engage in long conversations face to face and when a hug summed up all the emotional support and affirmation we needed. I am hopeful that we will get there again. But until then, I wish you and your loved ones the courage and resilience to move forward.

And I leave you with the powerful words of the 22-year-old US National Youth Poet Laureate Amanda Gorman, whose poem “The Hill We Climb”, delivered at the US Presidential inauguration, felt like a fitting way to capture this moment in time.

“… even as we grieved, we grew. That even as we hurt, we hoped. That even as we tired, we tried. That we will forever be tied together, victorious …The new dawn blooms as we free it. For there is always light, If only we are brave enough to see it. If only we are brave enough to be it.”

Until next time, stay safe and be kind to one another

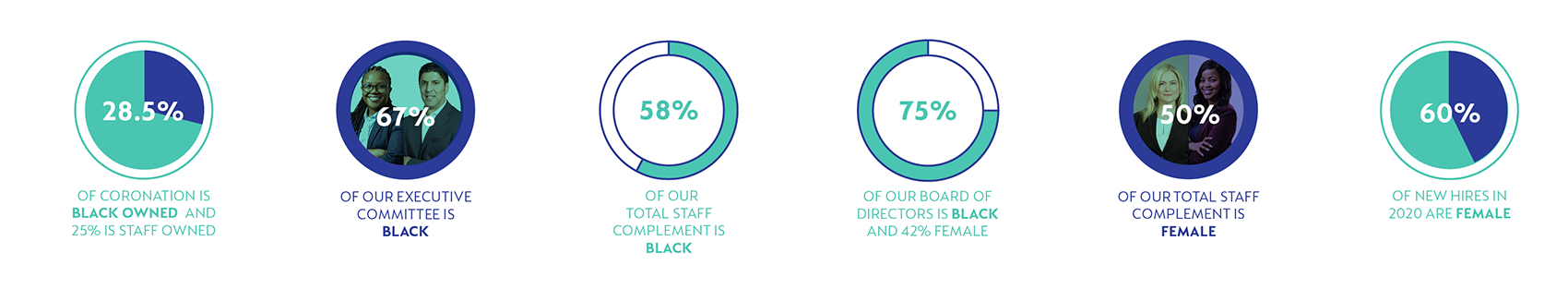

Figures as at 31 December 2020; transformation figures refer SA-based employees

Disclaimer

United States - Institutional

United States - Institutional