Economic views

2023 = 2022, v2.0

The same, but on steroids.

The Quick Take

- Prevailing systemic risks did not ring out on New Year’s Eve; the issues are all sticky and remain in play

- Inflation is still of grave concern globally and the Fed has indicated that it is relentlessly committed to bringing it inline

- The state of SA’s network infrastructure is chronic, with badly deteriorated energy, water and transport infrastructure posing an existential threat to our economy in the long term

The International Monetary Fund (IMF)’s biannual meetings always provide a useful synopsis of the critical economic issues occupying the minds of global policymakers, as well as offering an insight into underlying political dynamics, which often play a crucial role in shaping economic outcomes. The Spring Meetings this year were no different: They traced the evolution of the themes we focused on in the previous Corospondent instalment, including the developments in global inflation, the risks to growth of sticky prices, and the policy balancing act needed to return inflation sustainably to target while inflicting a minimum of economic damage. Global political dynamics remain in flux, viewed largely through the lens of Russia’s invasion of Ukraine. China’s reopening offers a bit of hope for a boost to global growth, while South Africa’s economic crisis has intensified.

INFLATION IS FADING, BUT NOT FAST ENOUGH

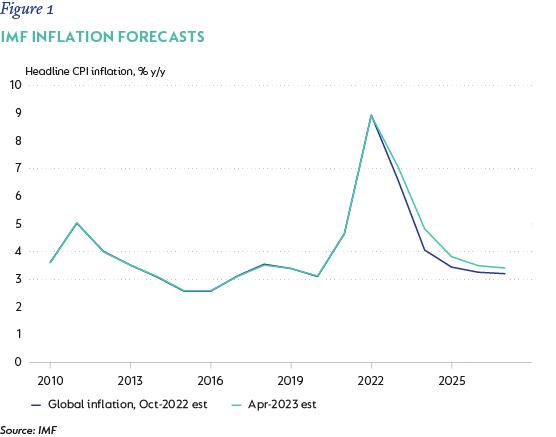

The most enduring economic challenge of 2022 was the relentless rise in inflation, which started late in 2021 and continued through 2022, during which time monthly inflation often accelerated at a rate well ahead of expectations. By early 2023, developed economy inflation appears to have peaked, although surprises to forecast numbers are still common (Figure 1).

In the US, moderating oil prices and the strong US dollar have helped ease transport costs, and inflation has slowed from 6.3% year on year (y/y) in January to 5.0% in March. In the EU and UK (with some quite large variation in the former by country), energy costs are concentrated in housing rather than transport, and a range of cost-of-living support from governments helped lower prices. This was further assisted by an easing of supply constraints and a warm winter. However, the progress has been hampered by a broad-based rise in food prices, which slowed the pace of moderation along with high wages, which have boosted core services costs. In the EU, headline inflation has slowed from 8.7% y/y in January to 6.9% in March. The UK is not enjoying the same relief and inflation pressure – especially from food prices – remains high, with headline CPI surprising at 10.1% y/y from 10.4% y/y in February. While off-peak, inflation remains high, and well above the central bank target.

The bigger challenge, though, is that core inflation has yet to peak. The combination of better-than-expected growth, resilient employment, and strong wage dynamics that helped the larger developed markets avoid an early-year recession, has also fueled broader services price formation. Looking ahead, inflation is still expected to moderate, but forecasts have been revised higher. The component drivers of the post-Covid surge in inflation have started to normalise, but normalisation is happening at a relatively slow pace, suggesting a long and uncertain road to pre-Covid inflation levels.

At the end of 2022, concerns that tightening monetary policy and the pressure on real incomes from the rise in inflation could tip both Europe and the UK into recession were high, despite tight labour markets. The subsequent activity data, however, was stronger than expected. In the UK, GDP growth in the first quarter of 2023 (Q1-23) was flat on the fourth quarter of 2022; and the EU eked out 0.1% quarter on quarter growth (q/q). This was against expectations for contractions in both cases.

In the US, the economy grew 0.6% q/q in Q1-23. Here too resilient domestic demand was the main driver, underpinned by low unemployment, healthy wage gains, and growth in corporate profitability.

THE BALANCING ACT CONTINUES

Central banks continued their strong commitment to returning inflation sustainably back to target ranges in the early part of the year, countering market optimism that rate tightening may be at or close to over. The Federal Reserve Board raised its funds rate another 25 basis points (bps) to 4.75%-5% in March, with Chairman Jerome Powell stating bluntly that US inflation remains too high and that the Monetary Policy Committee (MPC) remains ‘strongly committed to bringing inflation back down to our 2% goal’ with its forecasts suggesting additional hiking is in the pipeline.

The European Central Bank raised the deposit rate by 50bps to 3% and President Christine Lagarde opened the post-meeting briefing by stating that ‘inflation is projected to stay too high for too long’, but stopped short of the strong commitment to further tightening made by the Fed. The Bank of England added 25bps and sent a stronger signal that the time to pause was close when it met in March, but subsequent upside surprise to inflation data suggests this may have been premature.

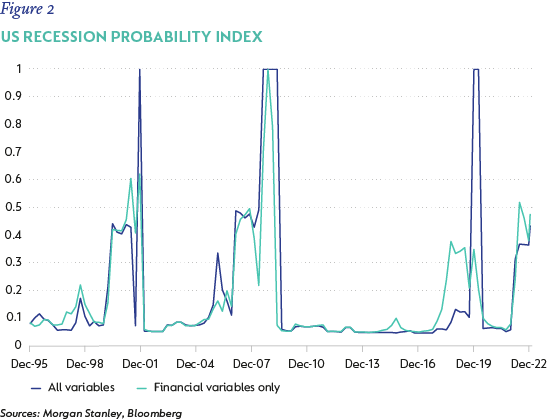

The failure of the Silicon Valley and Signature banks in the US, and uncertainty around the security of Credit Suisse in Europe, prompted a rise in financial market volatility and reintroduced concerns about broader financial stability. While swift moves to reassure investors and contain fallout ensued, credit standards, which were already tightening in the face of a maturing rate cycle, are expected to tighten faster from here. The risk of other failures will be an ongoing consideration for central banks in coming months.

Taken together, this complicates the outlook for monetary policy as central bankers continue to fight stubbornly high inflation in increasingly financially fragile economies. It also materially raises the risk to developed market growth into the second half of 2023. Central banks are going to find it difficult to navigate an appropriate policy path, given the delicate balance needed to contain rising core inflation amidst growth that has proven resilient to the material policy tightening already applied to date; and the uncertain impact on growth and inflation from an uncertain tightening in credit conditions.

Recession indicators remain quite elevated. A combination of moderating activity indicators and tightening credit conditions (currently, just at the margin) suggest the downside risk to Q1-23’s nascent recovery remains to the downside.

CHINA AND THE GLOBAL SOUTH

One undeniable bright spot is the strong initial reopening of China. After a protracted pandemic lockdown and an initial delay, the abrupt Covid-policy change in late 2022 has seen a surge in domestic demand, supported by strong export performance, which boosted Chinese GDP by 4.5% y/y in Q1-23. Growth forecasts have subsequently been upgraded, and Chinese policy support is expected to continue to provide accommodation to the recovery, giving some offset to the downside risk we see to the nascent recovery in global growth.

In parallel to China’s economic reopening, the shifting tectonics of geopolitical affiliations continue in the wake of the ongoing Russian invasion of Ukraine. As the conflict continues, Western commitment to assisting Ukraine has not wavered, although questions of how long this may last will grow the longer the conflict continues and will likely be increasingly shaped by political dynamics in home countries. What is emerging is a different form of ‘globalisation,’ in which South Africa (SA) is a marginal participant. The conflict in Ukraine has brought western, NATO and NATO-aligned countries closer together than they have been in several decades, dramatically improving regional security coordination. While differences between countries persist, there has been a renewed commitment to assisting Ukraine and strengthening the alliance. On the other side, several countries, mostly larger emerging markets, which are historically more aligned to Russia, have been resistant to outright condemnation of Russia, and have remained open to engagement and business. Along with China, India, and Brazil, SA has continued its commitment to and membership of the BRICS grouping.

SOUTH AFRICA’S HOME-GROWN CRISES HAVE BROADENED, AND INTENSIFIED

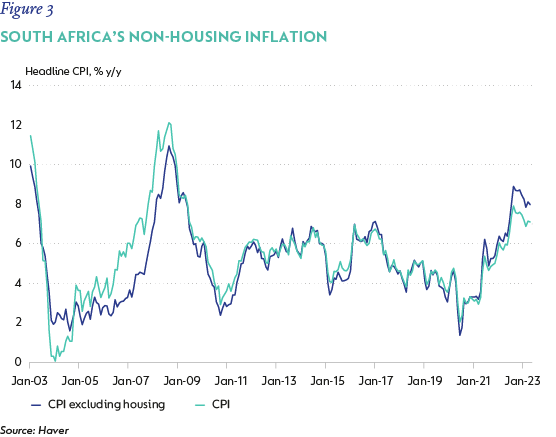

SA continues to follow some of the global trends discussed above. Headline inflation has also eased, with CPI at 7.1% in March from a peak of 7.8% in July 2022. However, much the same as our developed market peers, core inflation has risen steadily and at 5.2% is well above the 4.5% target, with signs of price pressures in critical components broadening, rather than narrowing. The impact of costs associated with loadshedding, has put pressure on food prices and core goods inflation, even as services costs remain muted in the weak demand environment. This is all exacerbated by the weak currency. We forecast headline CPI of 6.2% in 2023 and 5.7% in 2024, from 6.9% in 2022. Core inflation is seen as sticky at 5.3% in 2023 and 5% in 2024 (Figure 3) – reflecting the weak currency and high administered inflation.

The most critical development, however, is the intensification of the ‘home-grown’ crises that we highlighted as already maturing in 2022. The energy crisis in particular deteriorated visibly from October 2022, with a surge in high-stage loadshedding since December. The increased incidence of Stage 6 loadshedding, which means that up to 6 000 MW is cut from the grid and sees power outages twelve times over four days in tranches of six periods of two hours at a time and six periods of four hours at a time, is considerably more challenging to manage from a business perspective than the lower stages.

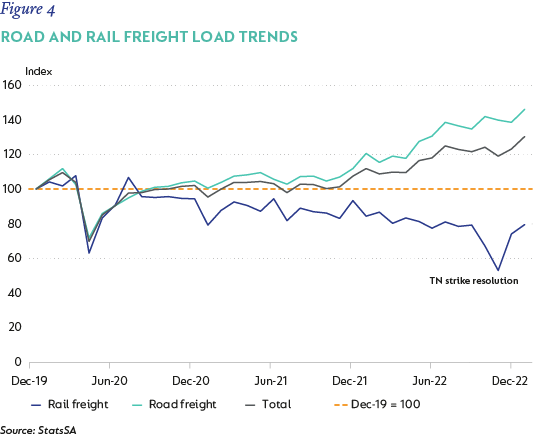

In addition, the emerging water crisis is attracting more attention, highlighting a range of system failures which threaten urban water security. Transport networks are also under increasing pressure as Transnet’s rail infrastructure is disintegrating owing to poor maintenance and theft, as road networks bear the brunt of placing rail load onto trucks (Figure 4).

Taken together, the failure of these critical network industries as economic enablers in the short term undermines growth and confidence. Over the longer term, it destroys growth potential and threatens fiscal sustainability and social stability. The intensification of these crises, however, now highlights just how difficult they are going to be to resolve. Not only does the infrastructure require massive and very expensive investment, but also comprehensive long-term planning, a shared vision and agreement, aligned ideological views, determined leadership, and highly competent implementation. Poor official coordination, disorganisation and misalignment are already creating delays to action needed to address these issues.

GDP contracted a deeper-than-expected 1.3% q/q in Q4-22, and high frequency data now suggest a mild rebound in Q1-23, despite ongoing power outages. But we expect GDP growth of just 0.6% in 2023 and 1.4% in 2024, with downside risk. This growth outlook as a background to above-target inflation will be challenging for the central bank, although we expect the MPC to remain committed to managing both headline and core inflation into the target range.

Our inflation forecast remains above both consensus and that of the SARB over two years. We believe that while loadshedding persists, some related pass-through is likely. In addition, we are seeing more evidence of imported goods prices responding to the weaker currency, something that has been muted for a long time. Inflation expectations by all respondents to the Bureau for Economic Research’s survey remain above 4.5% over all periods, ranging from one year to the longer term. This raises the risk that trade unions and businesses will embed higher inflation into longer term agreements, as wage and price-setters in the economy. Lastly, SA is likely to return to a structural current account deficit after a period of surplus. This represents a fundamental source of weakness to the currency, but also implies that SA will need to continue to attract foreign capital. We expect the central bank to raise interest rates further in coming months, but, over the longer term, we believe these factors will see real interest rates closer to 2% than the longer term 1%-1.5% trend.

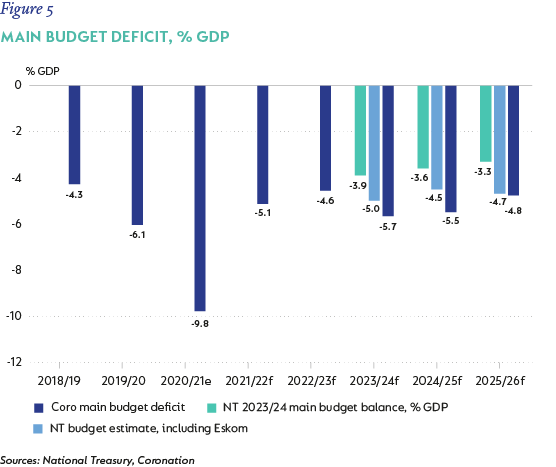

Inflation and interest rate dynamics remain uncertain, but the bigger risk is that low growth renders Government’s fiscal position much more fragile. In February, the Minister of Finance presented the 2023/2024 Budget, detailing a steady consolidation of the post-pandemic fiscal deficit from -9.8% of GDP to -4.5%e in 2022/2023. More importantly, National Treasury expects to achieve a small primary (non-interest) surplus, which it intends to grow through the medium term. Treasury also projects ongoing consolidation in the budget balance towards a -3.3% deficit in 2025/2026. These fiscal dynamics, coupled with the planned debt relief granted to Eskom, are expected to drive debt incrementally from 68% of GDP to a peak of 73.6% in 2025/2026, and then a slow fall (Figure 5).

There are many challenges to achieving this happy outcome, but the two most important are the allocation of expenditure to areas of socioeconomic and political vulnerability, and the economy’s ability to achieve growth sufficient to sustainably support the fiscus. National Treasury’s baseline budget forecast adheres to its commitment to containing compensation growth, to retiring the social relief of distress grant in 2024, to holding general spending to below-inflation rates over time and to severely limit additional funding for State-owned entities (SOEs). While contingency provisions are made should decisions be taken that compromise these commitments, the scope of potential cost of slippage (especially in light of the crises noted above!) suggests these are likely to be inadequate.

We expect expenditure to grow faster than Treasury’s baseline, especially in areas related to compensation and social support. The precarious state of national infrastructure under the ambit of SOEs seems likely to need additional fiscal support in addition to greater private sector participation, while failing municipal service delivery and finances raise the risk of requiring greater (conditional) financial support over time. This, in our view, will lead to larger deficits than estimated in the budget, with limited scope for consolidation, despite National Treasury’s best efforts, and an inextricable rise in accumulated debt in the absence of stronger growth.

‘ROCKY RECOVERY’

The IMF raised its growth forecasts for 2023, but the World Economic Outlook characterised the outlook for the year ahead as a ‘rocky recovery’ with ‘risks tilted firmly to the downside’. This is a perilous time for SA’s economy. Getting a few things ‘right,’ will go a long way to easing current constraints and restoring the confidence necessary as a bolster for investment and long-term growth. Critical in the short term is an aligned action plan to systematically address some of the factors that have exacerbated the energy shortage. The next step is adherence and commitment to a clear, longer-term energy investment plan. Many of the building blocks to this are in place, but urgent, disciplined, and dedicated execution is key.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional