Economic views

The debt mountain

“If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has.” – Economist John Maynard Keynes

- The level of global debt is staggering at c.$11trn, up from $8trn at end-April

- QE measures have reached unparalleled levels, far exceeding those seen during the 2008/09 GFC

- Developed markets are more resilient when it comes to repayment and should stage rapid recoveries

- Many emerging markets went into the Covid-19 crisis on the back foot and will struggle to bounce back; we may see sovereign defaults

“If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has.” – Economist John Maynard Keynes

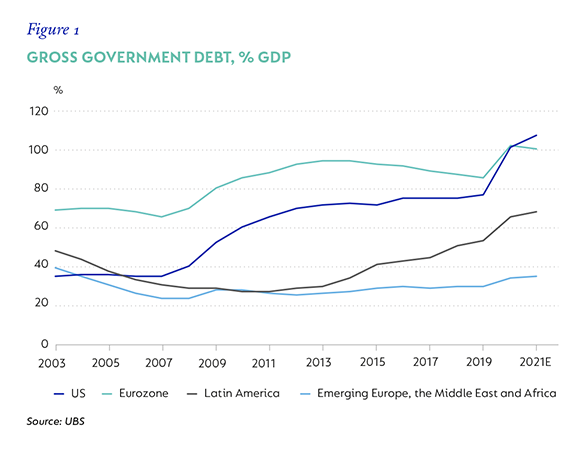

THE INTERNATIONAL MONETARY Fund (IMF) estimates that average public debt will rise by almost 20 percentage points of global GDP to above 100% in 2020. In advanced economies, this is pegged even higher at 131.2%, while in emerging markets the estimate is lower at 63.1% (Figure 1), but this is arguably more worrying given fewer policy resources and possibly more lasting economic damage in the wake of the Covid-19 pandemic. This increase in debt raises a plethora of difficult questions about debt sustainability, mitigating policies, the challenges of funding and the risk of default.

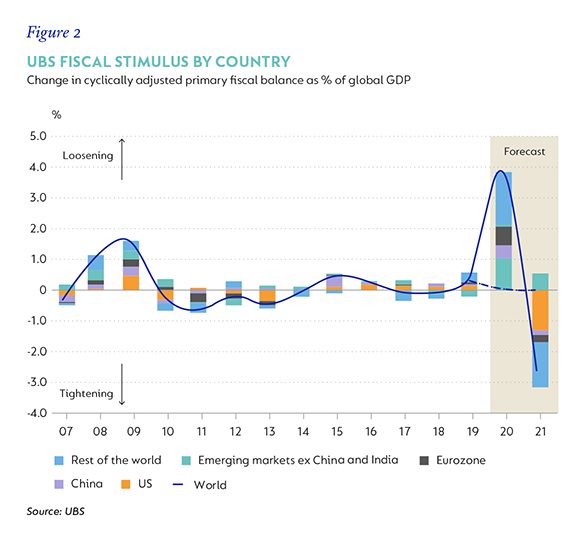

The spreading pandemic prompted swift policy responses from governments and central banks. At the time of writing, fiscal efforts to mitigate the social and economic impacts of the pandemic have reached $11 trillion globally, amounting to 3.8% of global GDP. This is up from $8 trillion at the end of April 2020 (Figure 2).

About half of this ($5.4 trillion) reflects additional expenditure and lost revenue that directly affect government budgets. The remainder is made up of various forms of liquidity support, including loans with guarantees – which may or may not fall to governments to fund in due course. These measures have certainly helped save lives, protect livelihoods and cushion businesses from the sudden loss of income, but they all have fiscal recourse. While some fiscal support programmes are intended to be self-destructing and should contribute to some consolidation in fiscal deficits, the risk is that a long, disrupted recovery will require extended fiscal support for vulnerable households, healthcare and companies.

HOW WORRIED SHOULD WE BE?

This magnitude of global debt accumulation puts us in unchartered territory, and naturally raises concerns about its sustainability. There are a number of considerations here and there is no ‘one size fits all’, as challenges facing developed and emerging markets differ. It’s hard to know what to monitor. The ratio of government debt to GDP doesn’t tell us a great deal about sustainability. It measures the stock of debt to the flow of GDP (output) and gives us a measure and context for what ultimately must be repaid. But what matters, especially in the short to medium term, is a country’s ability to service its ongoing debt obligations, and this is a function of interest and growth rates, and what then influences the stock of debt along the way.

Throughout history* there have been five things that have combined to reduce government debt ratios: i) economic growth; ii) substantive fiscal adjustment/austerity; iii) default or restructuring; iv) a surge in inflation; and v) a steady imposition of financial repression. The latter two are only applicable to local currency denominated debt, but historic episodes of debt liquidation have been owed to a combination of these factors.

The automatic debt dynamics (the equation** that explains how government debt is accumulated) shows that while the cost of debt is below the growth rate (r-g), governments can shrink their stock of debt, as long as the primary deficit isn’t growing. This is because the numerator is growing more slowly than the denominator. If the differential becomes positive (interest costs rise above the rate of growth), government will add to the debt stock unless it cuts spending elsewhere (the primary balance moves into surplus), forcing the numerator to grow more slowly.

These dynamics tell us three things: i) that it is useful to look at debt service costs relative to growth rates or revenues (which is also methodologically cleaner because it measures a flow to a flow); ii) that while interest rates are below growth rates, governments can continue to service debt reasonably comfortably; and iii) that governments can reduce the stock of debt through time by reducing expenditure, with the help of lower debt service costs.

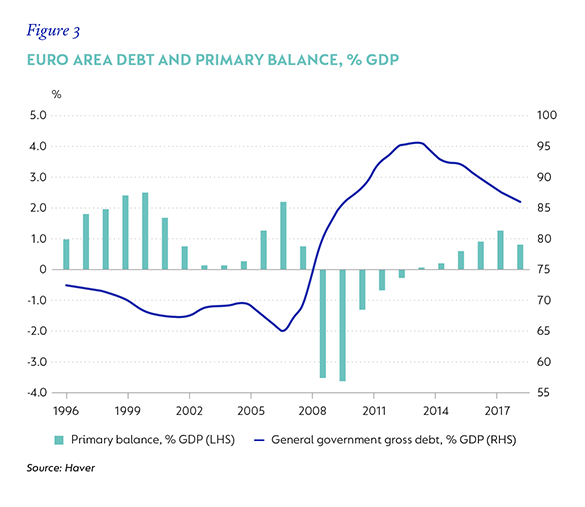

Indeed, this is what a few developed markets successfully achieved in the post-Global Financial Crisis (GFC) period. Germany saw debt stock fall from 81.1% of GDP in 2012 to 59.8% in 2019, the UK saw debt stabilise at about 80% of GDP and the US was able to slow the pace of accumulation because growth rates outstripped borrowing costs, despite persistent deficits (Figure 3). For this happy dynamic to continue after this crisis therefore requires interest rates to remain low long enough for GDP growth to recover which, in turn, will certainly require central banks to continue to play their part in repressing the cost of government borrowing.

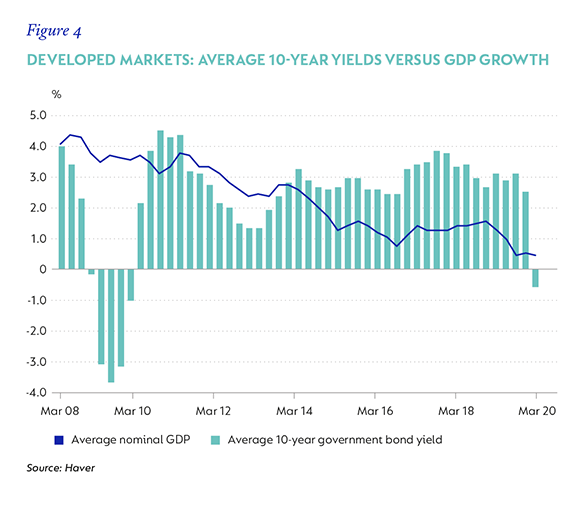

Central banks have again dusted off the toolkit and aggressively revived quantitative easing (QE) policies, especially in developed economies, and, more recently, new ‘QE’ ventures by emerging markets. The nature of these programmes differs but, essentially, in developed markets where policy rates are at or near zero, QE targets the expansion of the monetary base through the purchase of financial assets, mostly government bonds, but across asset classes in some economies. In the absence of inflation, the expansion of the monetary base lowers the cost of money (interest) - Figure 4.

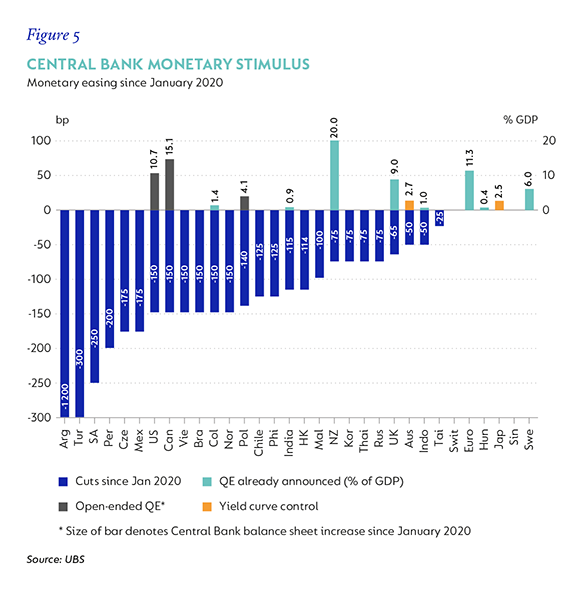

In emerging markets, the stated intent is different, and is more generally aimed at rectifying market dysfunction and providing bond market liquidity through the unsterilised purchase of government bonds. Here emerging market central banks are signalling a willingness to be buyers of last resort during periods of market stress. Figure 5 shows that UBS estimates 15 out of 40 economies covered have announced some form of QE, with the large developed-economy central banks committing to purchase assets in amounts unimaginable just a few months ago.

These programmes typically see the central bank buying fixed-income assets – mostly government bonds – in the secondary market from banks, and crediting the banks with reserve money held by the central bank. This encourages the banks to reduce unprofitable, low (or negative) interest-earning deposits at the central bank, and to either on-lend into the economy or buy more government paper. This theoretically creates a virtuous cycle of demand for government bonds, and hopefully facilitates economic growth.

There is also more to QE than just the provision of a bid for government paper. Most central bank assets are in fact owned by their governments (although this is not the case with the Federal Reserve Board or the South African Reserve Bank, but this doesn’t materially change the arrangements), and central banks transfer interest payments on the debt they hold to the taxpayer (government) after expenses. This effectively means that the debt held by the central bank costs the government very little and, on balance, reduces the funding cost. Moreover, this debt is more likely to be rolled over than redeemed. Taking central bank holdings of government debt into account may be a better indication of what the ultimate cost to the taxpayer will be.

SO MUCH FOR THE THEORY, CAN IT WORK?

Year to date, the large developed-market central banks have, with credibility, successfully managed to help lower interest rates, and their balance sheets have expanded in line. The process has been supported by demand for less risky assets, as well as general expectations that inflation will remain low because of the combined impact of low oil prices, income loss, excess capacity and much wider output gaps. Such success is less evident in emerging markets where interest rates at the long end of the curve are generally not back at pre-crisis levels. These economies face several challenges in this regard, but perhaps the most important factor is that, in many cases, the pandemic has hit those that were already weak and will struggle to recover (undermining efforts to reduce r-g). South Africa is a case in point, but India, Brazil, Mexico, Argentina and Turkey are all in this position to varying degrees. Also, the fiscal positions of these countries have deteriorated since the GFC and the inflation-targeting credibility of the central banks may be questionable.

Taken together, these factors may make markets uncertain about long-term efficacy of such an intervention as concerns about fiscal dominance increase. Governments will therefore either have to consolidate aggressively, with painful growth repercussions, or may risk defaulting on their debt. Market concerns about the risk of such outcomes are therefore more visible in emerging markets where, on average, long-term interest rates are well above short-term rates, and curves are steeper.

Again, South Africa is a very visible example. We have concentrated here mostly on domestic debt, but external debt stock adds to the challenge for many emerging economies and low-income poor countries (LIPCs). Here, external debt had risen ahead of the crisis, and now, for many countries, in the moment of the crisis (the IMF has granted emergency funding to 77 countries to date). While some external debt is extended on favourable terms, much carries market-related interest rates. Taken together with weaker currencies and large domestic debt obligation, external debt is another risk to developing economies servicing debt burdens and their ability to facilitate a growth recovery. With this in mind, the crisis has prompted a new discussion about emerging market debt.

From 1 May 2020, the G20 suspended repayment of official bilateral credit by the world’s poorest countries. There are also growing calls for the cancellation of some external debt accumulated by emerging markets and LIPCs, and a number of criteria have been put forward. While this discussion might end in some debt forgiveness, it’s hard to see that it will be sufficient to materially change the debt dynamics for the larger emerging markets, and may carry long-term, adverse funding repercussions.

WHAT WORKS NOW MAY NOT BE A LONG-TERM SOLUTION

Finally, another risk to the global debt strategy hides in the wings. The successful monetisation of developed market government debt has been possible because inflation has remained very low. This may continue for a while, but may not last. Given the sheer size of monetary expansion in developed markets, coupled with the combination of targeted income-related fiscal support that may remain in place until labour markets recover, and central banks are actively targeting higher inflation, supply disruptions could see inflation accelerate. In emerging markets, weak growth and fragile fiscal positions, failed QE, weaker currencies, supply shortages and rising commodity prices could all contribute to higher prices.

For a while, central banks may also tolerate higher inflation, and continue funding the governments with some success. History tells us that in all periods of post-World War II, debt liquidation has been characterised by financial repression in some form, along with rising inflation*. But this is unlikely to be the case for developed and emerging markets alike – history also suggests that such crises materially raise the risk of sovereign default. +

* Carmen M Reinhard and M. Belen Sbrancia “The Liquidation of Government Debt”, IMF working paper WP/15/7.

** (1+r) (1+g) (1+i*)*(1+e) * (1+g)* (1+ π) dt – 1 + dt –* 1

where g is real GDP growth rate, r is the real weighted domestic interest rate, π is the GDP deflator, i* is the weighted nominal interest rate on fx debt, e is the currency depreciation, d is local currency debt/GDP and d*is fx debt/GDP.

United States - Institutional

United States - Institutional