Economic views

Cautious Medium-Term Budget sends consistent message of fiscal consolidation

- The MTBPS needed to strike a balance between short-term revenue windfalls and increased demands for expenditure within a fragile framework. We think it achieved this.

- All big expenditure decisions were delayed to the Budget Speech in February 2022, but National Treasury nonetheless made cautionary provisions for extra spending.

- The messaging stuck prudently and necessarily to the consolidation playbook.

Delivering the medium-term budget policy statement (MTBPS) in South Africa’s current economic and political climate is not a task for the faint-hearted.

Finance minister Enoch Godongwana’s maiden MTBPS was delivered just more than a week after the drubbing of the ANC at the ballot box, amidst yet another long stretch of national load shedding and growing anxiety about the risk of a fourth wave of Covid-19. Against this background, the MTBPS needed to strike a delicate balance between acknowledging a near-term improvement in the fiscal position because of better than expected revenue gains and a large number of long-term, largely unquantified expenditure demands within a fragile framework. We think Minister Godongwana achieved this balance and clearly showed that a pragmatic and cautious stance is necessary to achieve a sustainable fiscus in the future.

Despite this, the clear caveat is that all the big (and tough) decisions have been delayed to the Budget Speech in February next year. Great uncertainty remains around the expenditure baseline specifically related to public wages, additional income support and future payments to SOEs. The Minister’s tough and consistent stance is welcome, but ongoing uncertainty will keep markets cautious.

A MATERIALLY IMPROVED STARTING POSITION

National Treasury expects the main budget deficit to be 6.6% of GDP in the current fiscal year (compared to -9.0% at the time of the February 2021 Budget) with in-year additional expenditure of R77.3bn related to additional social support and transfers after the unrest in July 2021, as well as the unallocated public sector wage bill and additional spending for the Presidential Jobs Initiative and vaccines. These were partly offset by R17.9bn in savings elsewhere.

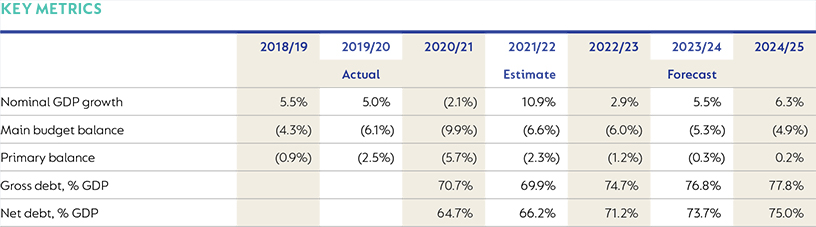

The deficit is expected to narrow further to -6% of GDP in 2022/23 towards 5% in the outer year. Importantly, the baseline anchors itself to a primary surplus in the final year of the framework, in line with the Budget.

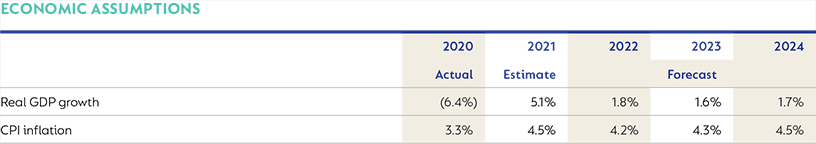

Underpinning these forecasts are relatively conservative economic and revenue projections. National Treasury forecasts GDP growth to slow from 5.1% recovery in fiscal 2021/22, to 1.6% over three years, and for nominal GDP growth to moderate quite sharply from 10.9% this year to 2.9% next year and to about 6% over the outer years (see Table 1 and 2).

Following an estimated revenue over-run of R120.3bn this year, revenue growth is forecast to broadly match the rate of nominal GDP growth. These assumptions, in our view, leave room for upward revision in the coming years, which creates some potential additional fiscal headroom.

VERY FEW NEW BASELINE EXPENDITURE ALLOCATIONS

The MTBPS made very few additional expenditure allocations. Big-ticket items, including wages, a new social benefit for income support, any additional allocations to SOEs or local government were deferred, recognising that these demands are, as yet, unquantified.

The main budget non-interest expenditure (everything excluding debt service costs) was revised up by R31.9bn and R29.6bn over the next two years, most of which was put into a clever line item – the “unallocated reserve” of R72 billion over the next three years. These allocations can be used to meet agreed expenditure as this happens (say, once a wage agreement is struck) but impose a limit on what is available.

Risks to the baseline abound. The most immediate is the public sector wage agreement, for which an allocation of R20bn over the Budget was made (implying 0% y/y). In addition, the outcome of the Constitutional Court’s judgement on the Labour Appeal Court’s decision that the 2018 wage agreement was unlawful could add R35-40bn to the compensation baseline. We are cautiously optimistic about Minister Godongwana’s ability to navigate communication in the thorny arena of the public sector bargaining council but expect some additional allocation to be made.

The MTBPS recognises the need for additional income support but also stuck to the current agreement by which the social relief of distress grant will end in March 2022. We expect a new agreement to emerge, but Godongwana emphasised in his speech that 27.8 million South Africans are already social grant recipients. This is 46% of the population. The detailed budget highlights that "any new spending commitments can only be funded by closing existing programmes to free up revenue or improvements in revenue collection". Specifically, these need to be "fully and appropriately financed" to safeguard the fiscal baseline and "evaluated against existing priorities". This is a pragmatic approach to a necessary intervention and suggests to us that further support will emerge, but with due consideration for the fiscal cost, the long-term objectives of employment growth to alleviate poverty and the already well-established programs in place.

On state-owned enterprises, only Denel was given additional funding of R2.9bn, and R11bn was provisioned for SASRIA. Importantly, the Minister told Parliament that poorly managed SOEs have failed to enable economic development in the way they are intended. Moreover, they have become a considerable burden to the fiscus, and as a priority, need to be assessed for restructuring or be 'let go' where they are not strategically relevant. This signals a more tight-fisted approach to SOE bailouts going forward.

A little disappointingly, while reference was made to progress with Eskom’s unbundling, no provisions were included, and no preparatory comments were made about further announcements related to a debt solution. Resolving this uncertainty remains crucial to growth-enhancing reform.

The funding that is needed by distressed municipalities and local government is another area of considerable risk. Here too National Treasury is reviewing processes by which capacity building and direct intervention can facilitate an improvement in financial risk and operational delivery. No additional funding has been made available, although some future spending (potentially quite large) seems likely as large arrears have built up (exacerbated by Covid-19), and increasingly hamper the ability of entities to deliver services.

DEBT AND SERVICING COSTS ARE STILL A MATERIAL CHALLENGE

Years of large deficits – set to continue even under improved circumstances – has led to a large build-up of debt, and importantly a heavy debt servicing burden. Debt to GDP is expected to moderate temporarily from 70.7% of GDP to 69.9% in the current fiscal year and then resume a more modest accumulation to 77.8% in the outer year of the framework. While this is not an alarming stock of debt for an emerging market in a post-Covid-19 world, South Africa’s financing costs are very high. We currently spend 4.4% of GDP on debt services, and this is set to rise to 5.1% – meaning 20c of every Rand is spent on servicing debt.

The sustainability of this position is very uncertain. Credible, enabling growth reforms will be needed (especially with regards to electricity) to see the burden of high borrowing costs ease.

CONCLUSION

Minister Godongwana held the line on consolidation and achieving a primary surplus over the Medium-Term Expenditure Framework, consistent with the commitment made in the February 2021 Budget. He succeeded in striking a balance between short term revenue windfalls and increased demands for long-term expenditure commitments within a fragile framework. The very cautious tone and the commitments made to sustainable expenditure were rightly conservative, and the ongoing focus on required reforms was appropriate.

The unallocated reserve is a clever attempt to provide a cushion for a large number of unknown expenditure allocations and should strengthen the Treasury's bargaining position. This, together with the modest revenue assumptions, is an effort to offset considerable unquantified expenditure risk. Even though the near-term baseline is considerably improved on Budget expectations, it remains fragile, and markets will continue to be sceptical until some of the uncertainty is resolved.

Disclaimer

United States - Institutional

United States - Institutional