Economic views

Emergent themes add shine to resources

Transformation through green initiatives and new demand sources

- Unprecedented supply restraint meets a strong demand outlook

- The move to a green economy is a boon for commodity prices

- Management teams are committed to returning cash to shareholders

THE FTSE/JSE RESOURCE 10 Index (JSE RESI) has more than doubled off its end-of-2015 lows. The index masks the performance of a number of its constituent shares, where the price rises have been even more spectacular. For example, Glencore, Anglo American plc and Kumba Iron Ore are up 120%, 650% and 1 934%, respectively. With good returns in the bag and healthy commodity prices, it begs the question why we still hold meaningful positions in the resources sector.

We believe that the commodity sector currently has several elements to it that are unprecedented versus historical cycles which, when combined, present a unique investment opportunity. We discuss these themes in more detail below.

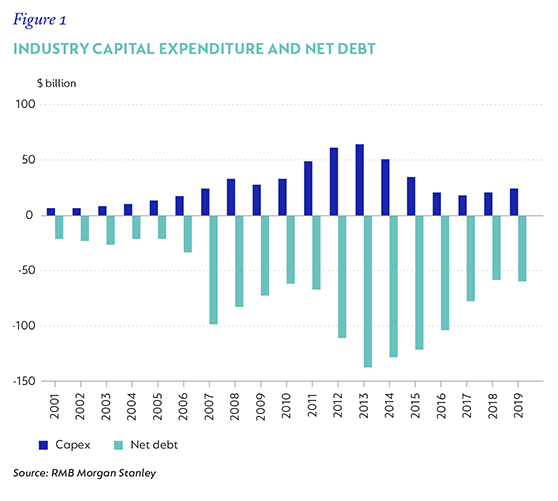

CAPITAL DISCIPLINE

If one considers the previous cycle ending in 2015, it played out broadly as follows: robust demand growth driven by China on which miners capitalised. They then extrapolated it into the future by living beyond their means (increasing debt levels and channelling it into capital expenditure to boost supply).

Gearing works in a rising price environment, yet increased gearing is a contributing factor to a deflationary price environment. Over-exuberant investment into volume growth in good or benign times sowed the seeds for oversupply (bad times). This came to a head when there was a wobble in 2015. A deflationary price environment ensued and collided with stretched balance sheets. Low prices and high debt are a toxic combination. The JSE RESI fell 61%, while Anglo and Glencore lost 80% and 72%, respectively. This led market commentators at the time to question the viability of many of these stocks. Glencore did a rights issue and Anglo American expressed a strong desire to do so.

This 2015 ‘near-death’ experience is firmly entrenched in the minds of mining executives, many of whom have retained their positions in their respective companies. However, they now appear to appreciate the risk of price deflation caused by excess leverage and supply growth, and understand that high gearing and mining companies are not very compatible.

On the back of 2015’s wake-up call, companies have started running conservative balance sheets. Rather than anticipating demand growth and bringing forward supply using leverage (basically using balance sheets to balance the market), they’re using retained earnings (and allowing commodity prices to balance the market). This places the miners on a firmer financial footing and the sector now lags cycles rather than leading them, resulting in far less slack in the system. Take the 2019 Brumadinho tailings dam disaster that saw Vale’s production drop by 34% (c.64 million tonnes). There was simply no alternative supply source able to fill the missing tonnes, which, when combined with stronger-than-expected demand, sent iron ore prices up 68% from January 2019 to today.

While we don’t expect this capital expenditure discipline to last forever, we expect it to continue as long as the current cohort of executives remain in place at the companies and/or while share prices remain at levels attractive to valuation-based investors.

CHINA IS GROWING STRONGLY

When it comes to commodities, the trajectory of the Chinese economy is critical, with c.50% of most commodities being consumed in the People’s Republic. Of the key commodities, roughly 75% of the seaborne iron ore market goes into China, followed by c.50% of copper and nickel, 32% of platinum group metals (PGMs) and 13% of crude oil. China is heavily dependent on key commodity imports given its lack of an in-country natural resources base. Metallurgical and thermal coal are slightly different, as China has large resources and only relies on imports for higher-quality product and where coastal plants find it easier and cheaper to import product than to transport it from the inland coal-producing regions.

But overall, China still makes up c.20% of the seaborne coal markets, more in line with Chinese GDP as a share of the world’s total at 19%. We expect GDP growth in China to continue slowing and the commodity intensity (consumption:GDP) of steel-related commodities to follow suit. Where we expect trend growth to be more resilient and, in some cases, to increase over the next 10 years, is in copper, nickel and PGMs, where moves towards a greener world have very positive implications for these metals.

GREEN CREDENTIALS

Miners are arguably transforming themselves into an ESG*- positive industry, spending billions of rands on initiatives such as community programmes, staff training and land rehabilitation, among others. Particularly over the last decade, we have seen a significant decrease in injury and fatality rates in the local mining sector.

The other critical point that perhaps gets overlooked is that you can’t make energy-intensive industries greener without the use of certain commodities. Put differently, decarbonising the world requires the use of number of commodities.

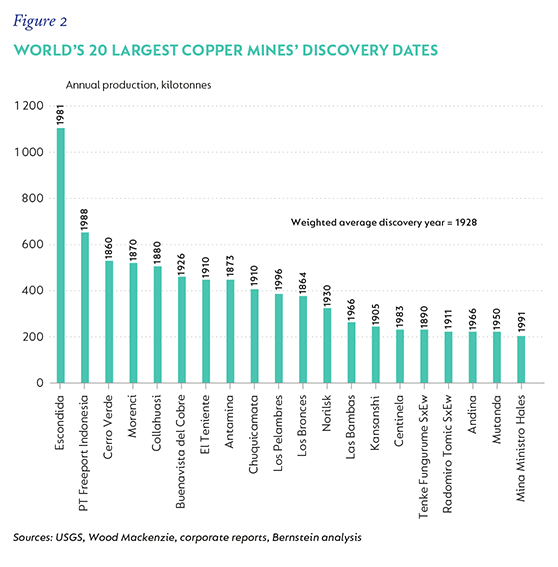

Reducing carbon dioxide (CO2) emissions requires either a decrease in the population or for the existing population to use less energy. Both scenarios seem unlikely. The alternative is to focus on energy efficiency and reducing the CO2 intensity per unit of energy generated through low (or no) carbon power generation. Indeed, it is in the latter area where much of the action is taking place today. Two areas of focus are the vehicle drivetrain and electricity production. In both cases, copper is a critical component, given its unrivalled thermal and electrical conductivity.

The vehicle drivetrain is in the process of shifting away from fossil fuel (oil) as a power source to electricity. A typical electric vehicle (EV) requires 150 kilograms of copper. Based on our inhouse assumption of a 25% battery electric vehicle penetration by 2030, combined with mass-hybridisation, this decarbonisation of the drivetrain would require an additional 4.3 megatonnes of copper and 1 150 kilotonnes of nickel. This incremental demand represented 19% and 49% of the 2019 supply base for copper and nickel, respectively, enough to push these markets into material deficits in the years to come.

Efforts are also under way to transform the electricity mix away from fossil fuels such as coal and towards greener energy sources such as wind and solar. Wind and solar require multiples more copper per unit of power than coal and traditional sources (they require this for increased cabling, as well as generators, inverters and transformers). Investment firm Bernstein estimates that copper demand from wind energy will require an additional megatonne per annum of copper by 2030.

The PGMs also benefit heavily from the shift towards cleaner air and general decarbonisation. In the medium term, PGMs will benefit from increased regulatory pressure on car manufacturers to reduce emissions, with large fines for non-compliance. Adding palladium or rhodium to the catalyst of an emissions treatment system is a natural solution for vehicle and catalyst manufacturers. Longer term, the PGM complex stands to benefit from the arrival of the hydrogen economy, at least a few decades after it was first heralded.

The last 12 months have seen a step change in political will to tackle climate change from most political parties globally as well as large corporates. The most recent stimulus response out of Europe is a clear example, with a continental ‘net zero’ goal by 2050 and tens of billions of euros committed to the cause. China has also committed to being net zero by 2060.

There is broad consensus that to fully decarbonise, there is a large role for hydrogen to play across a raft of industries. Fuel cells can be used to power ships, heavy- and light-duty vehicles and even buildings, not to mention the burning of hydrogen for heat in heavy industry such as steel and cement manufacturing. Platinum in particular is vital in several elements of a hydrogen-based economy.

We should point out, however, that we aren’t thematic investors. We don’t see a bullish story for copper simply because it’s green. Rather, it’s about a new source of incremental demand adding to a constrained supply base. We don’t see this as incompatible with a reasonable outlook for thermal coal, which suffers from muted demand growth, virtually no new mine investment and prices that render half the industry unprofitable – a situation that we don’t think will persist.

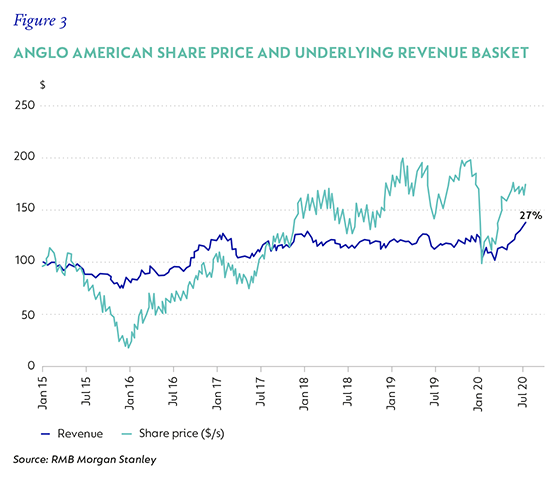

ANGLO AMERICAN

The Anglo American of today is very different from the one of 2015. Aside from the balance sheet (which is now strong), the company has disposed of a number of smaller, higher-cost operations, leaving it with a few large, low-cost, long-lived assets. This has seen return on capital employed improve. We expect further improvement as two key greenfield assets come into production, being Quellaveco (copper) and Woodsmith (crop nutrients). These projects, alongside a number of brownfield expansion opportunities, give Anglo American the most attractive growth profile of its peers over the next few years.

Anglo American’s portfolio is well diversified across commodities and geographies. The company has a differentiated portfolio compared to its peers, owing to its exposure to PGMs and diamonds (PGMs are discussed above and below). The outlook for diamonds is the most promising it’s been for some time. While 2020 will be exceedingly tough for De Beers, 2021 onwards should see material improvements to the diamond markets owing to current supply discipline, the closure of Argyle (a large Australian diamond mine that has come to the end of its life), and improvement in demand as lockdown restrictions ease globally and on the back of increased diamond marketing by De Beers.

Anglo American has invested meaningfully in technologies to reduce its energy and water use at its assets. These investments are close to bearing fruit. In addition, Anglo American’s exposure to copper, nickel and PGMs (over two thirds of normal earnings) positions it well to contribute to the decarbonisation journey we’ve been discussing.

Anglo American trades on seven times our assessment of normal earnings. This is compelling, given its favourable commodity mix and low-cost, long-lived positions in many of these commodities.

PGM STOCKS

We still see meaningful upside in the PGM sector, coupled with the potential for outsized cash returns in the short term. Northam Platinum is a small, growing PGM miner with a highly experienced and entrepreneurial management team. Investments in new, low-cost production at the bottom of the commodity cycle has put Northam in an excellent position to capitalise on this period of high prices. Production growth across three assets over the next few years should drive earnings and cash returns to shareholders, an area where Northam has been exemplary in committing to returning all surplus cash.

Impala Platinum has the potential to return even more cash to shareholders in the medium term, given the steady-state nature of its production and improved operational performance in recent years. Solid delivery by the management team has set the business up to be extremely cash generative in this environment, and we believe they will take further steps in the next 12 months to return shareholder capital. Northam and Impala are the two largest PGM positions within our equity portfolios.

GLENCORE

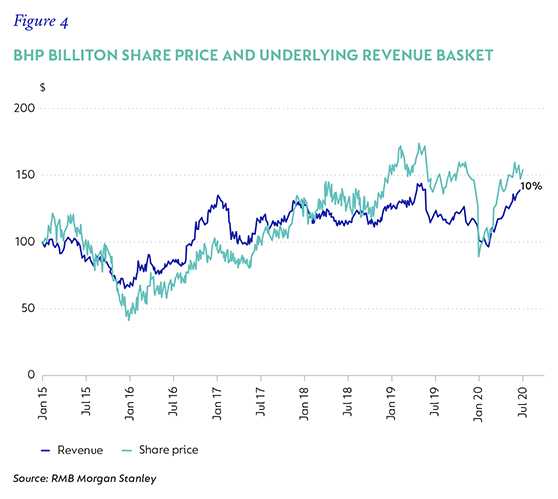

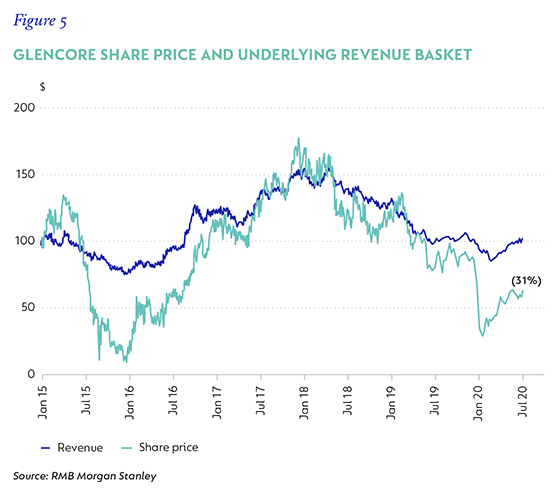

Glencore is one of the few companies whose free cash flow has been (and will likely continue to be) higher than accounting earnings. As such, a focus solely on accounting earnings misses just how cash generative Glencore is. At spot prices, Glencore trades on a 14% free cash flow yield and we see upside to most of Glencore’s key commodities (copper, nickel and coal). Furthermore, Glencore has been good at returning large portions of this free cash flow to shareholders. We think figures 3 to 5 are instructive. First, they highlight the relative weakness that Glencore’s commodity price basket has experienced versus Anglo American and BHP (largely owing to its larger coal exposure and the fact that it does not produce any iron ore).

We are bullish on the prospective outlook for Glencore’s commodity basket, and, as mentioned, also on EV metals, which make up almost half of our normal profits.

Another point to note is how weak Glencore’s share price has been relative to its commodity price basket. This decoupling started at the time that the US Department of Justice (DoJ) announced it was investigating Glencore. We note that the investigation likely centres on Glencore’s holdings in the Democratic Republic of Congo – an issue which predates the company’s listing.

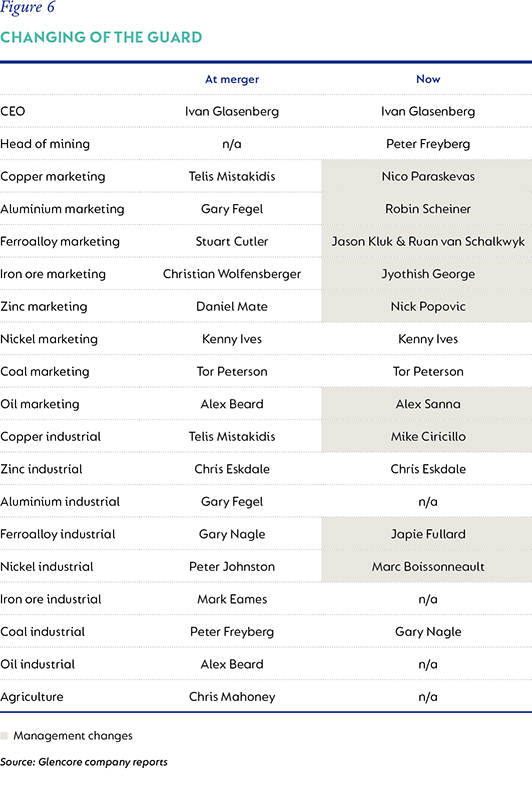

We also note that Glencore’s compliance department has grown notably since listing (from five members at listing to 150 now). If you make the assumption that the underperformance relates to the investigation and that Glencore would have performed in line with its commodity price basket but for this, the market is pricing in a c.$16 billion fine – over eight times higher than the highest fine the DoJ has levied in its history under the Foreign Corrupt Practices Act. We think the market is too penal in its assessment here. We also think the transition away from the old guard of management to new management – a process that has been under way for years and is nearing its conclusion – is not fully appreciated by the market, as highlighted by Figure 6.

EXXARO

In our view, Exxaro’s coal business is mispriced by the market. The bulk of earnings comes from Grootegeluk, one of the lowest-cost, longest-lived coal mines in South Africa. The company’s fixed-price contract supplying Eskom (with inflationary escalations) ensures a high degree of margin and cash-flow stability. We are also bullish on thermal coal exports, where margins and cash flows are anything but stable. The seaborne thermal coal price trades deep into the cost curve and is unlikely to be sustained at current low levels. Asian demand growth for thermal coal is offsetting European demand declines. A lack of willingness to build and fund new coal mines means supply is under pressure. As such, we expect thermal coal prices to increase.

If you exclude Exxaro’s stake in Sishen Iron Ore Company (Kumba Iron Ore’s only operating subsidiary), you are not paying anything for the coal business, which generates over R10 per share in annual earnings. While there is a risk around capital allocation errors as Exxaro spends outside of its core competency on clean energy initiatives, we view these as more than priced in. Exxaro’s core competence is as a coal miner and returns from green investments are typically lower than lower than those earned from mineral extraction.

TO CONCLUDE

The commodities sector is displaying remarkable supply restraint in the face of healthy margins and incentive prices in several commodities. The decarbonisation of the world that will take place over the next few decades is incredibly positive for metal demand and stands to produce strong price outcomes when combined with supply, which is yet to respond meaningfully. On top of this supportive earnings environment, management teams have committed to delivering material capital returns to shareholders, made more attractive by historically cheap starting valuations.

* Environmental, social and governance factors

Disclaimer

United States - Institutional

United States - Institutional