PERFORMANCE AND FUND POSITIONING

The Fund increased by 17.5% in the second quarter of 2025 (Q2). This was a pleasing result and marks a good first half to the calendar year, building on a solid 12 months to end June where the Fund has increased by 29.4%. This performance is now filtering into the medium-term numbers, with the Fund up 17.6% p.a. over the past three years.

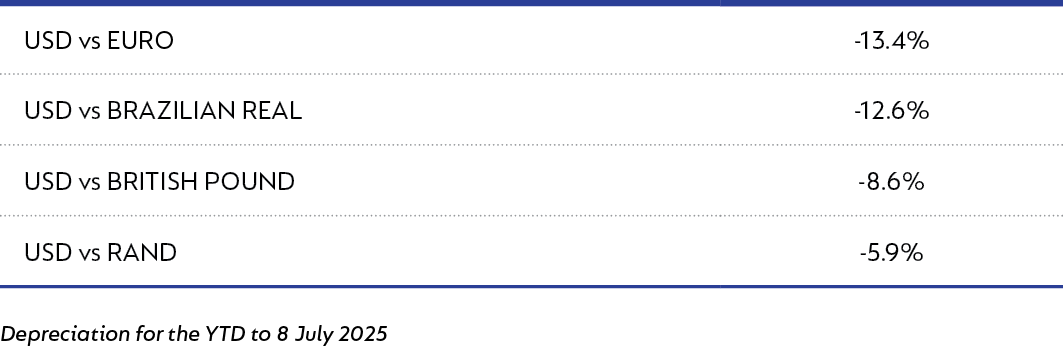

For the last 15 years, the US dollar (USD) and US stock market have outperformed pretty much everything, but this trend appears to have started shifting in 2025. Firstly, the USD has weakened against numerous currencies in the year to date (YTD) as depicted below:

Secondly, the S&P 500 Index, whilst near all-time highs, has materially underperformed other world indices YTD:

This does not spell the end of the US, but the breadth of returns is improving, and it is encouraging to see previously overlooked parts of the market slowly starting to be recognised again. At Coronation, we have always been bottom-up, stock pickers. Therefore, it is encouraging to see fundamental factors slowly reasserting themselves against what could previously be characterised as a momentum-driven market. The US had benefited from this momentum and now represents 70% of the MSCI World Index, with many global investors not really looking outside of the US because, until recently, you didn’t have to, thanks to the returns generated by US markets.

The flip side is that whilst non-US markets have started to perform this year, there are still many overlooked non-US businesses, in our view. If there were to be a sustained shift of capital away from the US, even at the margin, this could have fairly significant implications for capital flows into other parts of the market, due to the high starting point of US allocations. The flexibility of the Fund allows us to allocate capital to where we deem to be the highest risk-adjusted returns on offer. While we are happy with the medium-term results this approach has delivered, the Fund still contains what we deem to be very attractive investments in a diverse set of geographies. To put this in context, the weighted average equity upside of the Fund at the time of writing is 51%, with the weighted equity five-year expected internal rate of return (IRR) being 15%, supported by attractive valuations as the weighted equity free cash flow (FCF) yield for stocks owned is just under 5%. Over the past three years, the Fund has generated a positive return of 17.6% p.a., 6.6% p.a. over five years, over 10 years a return of 6.0% p.a. and, since inception more than 26 years ago, 8.8% p.a.*

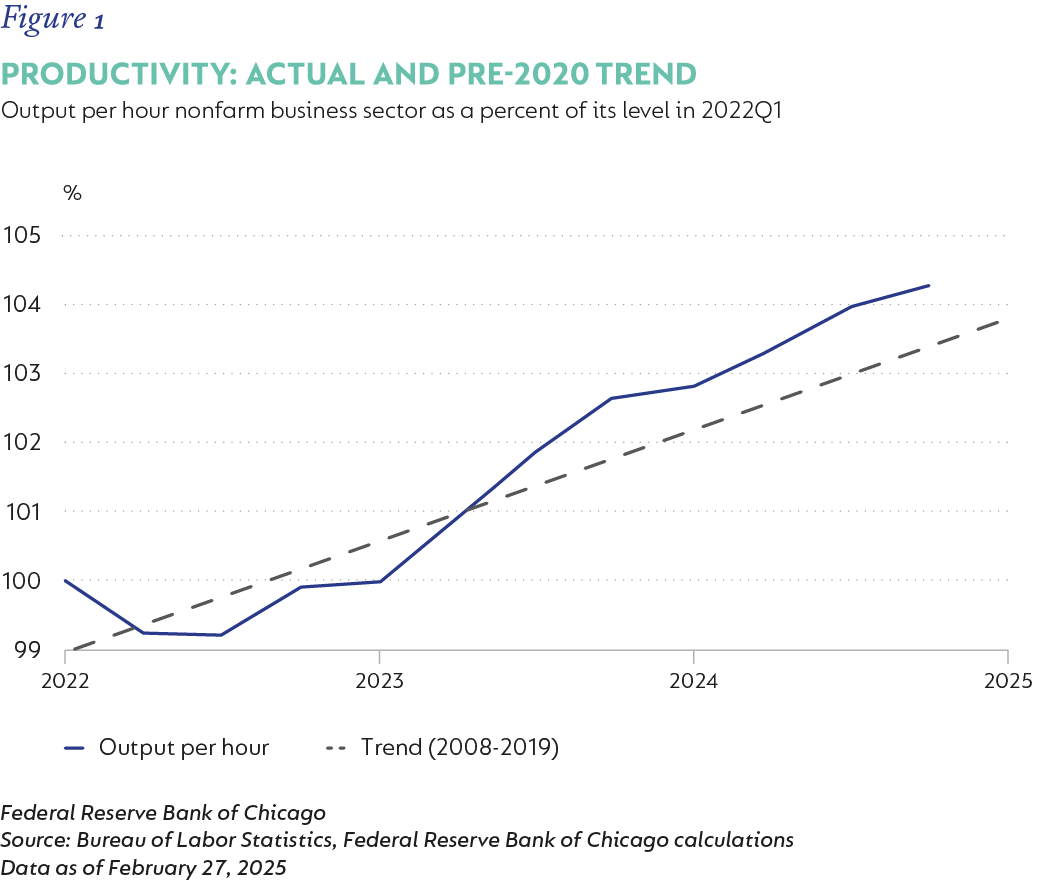

The world continues to face numerous risks, notwithstanding fairly buoyant markets. The US is still pursuing an aggressive tariff agenda, there remains a war between Russia and Ukraine, tensions in the Middle East remain high, and the US and China continue to aggressively compete, with the issue of Taiwan’s sovereignty remaining unresolved. There is, however, a countervailing narrative to these geopolitical risks, which is most likely contributing to optimistic markets: this being AI and the productivity it can drive both within business and society. Some industry insiders are calling it “the next internet”. The impact of AI on both society and business is something which will continue to be debated with no clear conclusions just yet, but there is emerging evidence that productivity improvements are starting to be seen in the US.

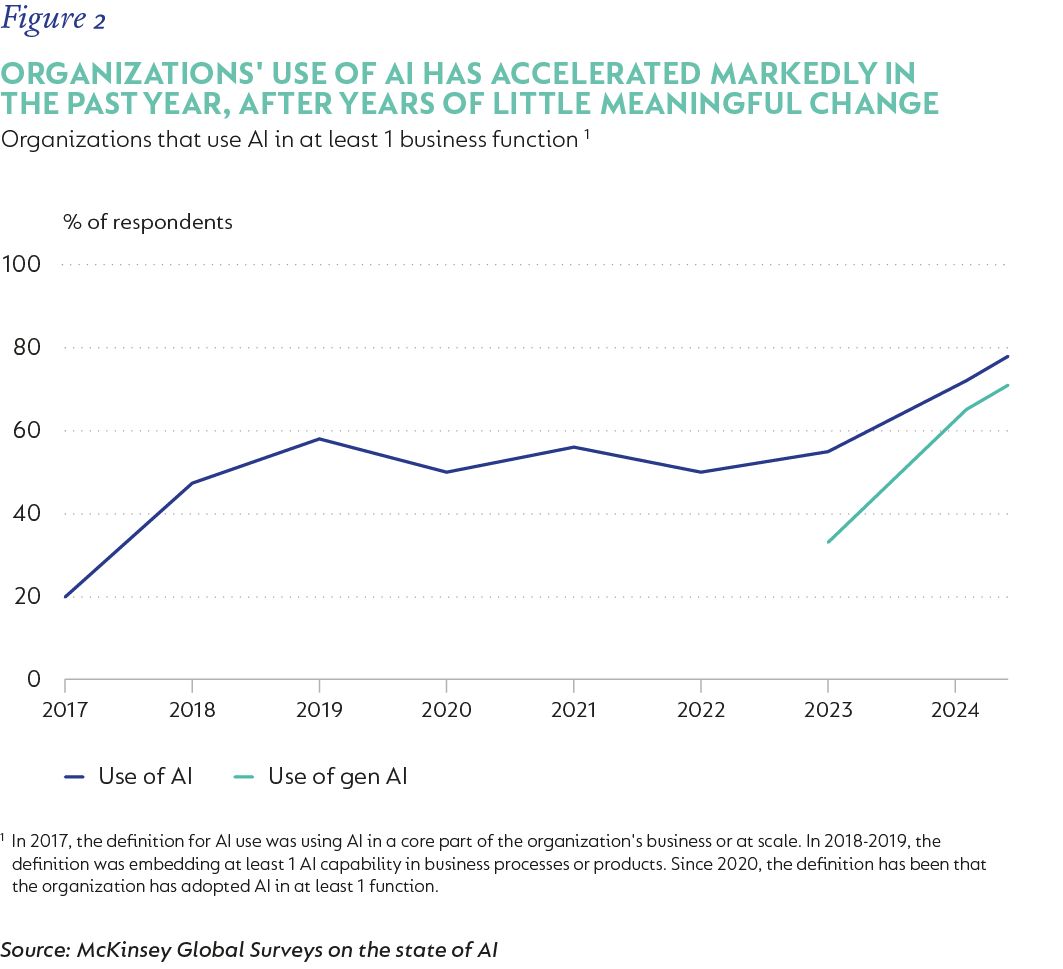

Considering the dire fiscal situation for many developed market countries, improving productivity, which could result in higher GDP growth, appears to be the only sustainable solution to reduce debt-to-GDP levels, as it is becoming quite clear that governments are not pursuing austerity to deal with their deficit problems. There is also increasing evidence that AI adoption is inflecting, and whilst knowing the exact implications of this technology trend is inherently difficult, we think it is fair to assume that AI is not a fad and has durability and is being infused into numerous businesses as depicted in the adjacent graph.

The investment implications of this change are that, naturally, with any technological shift, there are companies that find themselves on the right side of this shift and others that don’t, and then new companies are created to take advantage of the changing landscape. For the Fund’s holdings, we are consistently questioning the impact of AI on their respective businesses to determine the potential effect, but at the same time, recognising the range of outcomes remains broad. Thus, it is even more imperative to invest with management teams who are agile and open-minded in their thinking so as to adapt to the landscape as it evolves.

During the quarter the largest positive contributors were Auto1 (+47%, 1.41% positive impact), Nu Holdings (+34%, 1.07% positive impact) and Siemens Energy (+97%, 0.93% positive impact). The largest negative contributors were JD.com (-19%, 0.46% negative impact), Brava Energia (-25%, 0.34% negative impact), and Wizz Air (-22%, 0.31% negative impact).

The Fund ended the quarter with 80% net equity exposure, roughly 700 basis points higher than the prior quarter. At the time of writing, this equity exposure is now 78%, as we reduced equity exposure into buoyant markets that had staged a rapid recovery after tumbling in early April. Whilst there remain numerous attractive stocks which continue to be held by the Fund, we are looking to further reduce equity exposure as prospective risk-adjusted returns have reduced. As has been a feature of the Fund since inception, having the flexibility to both increase and reduce equity exposure has allowed value to be added when equities are depressed or when valuations are elevated, making equities less attractive. This process remains driven by our valuation-focused investment philosophy, which is based on bottom-up research to determine a fair value of a business that can then be compared to its publicly-quoted price.

Notable new equity purchases or increases in positions were Elevance Health, LPL Financial, and Eternal Ltd. Elevance Health (Elevance) is one of the largest health insurers in the US, serving approximately 46m members. The healthcare industry is currently going through a tough period as utilisation has increased with lagging price adjustments, therefore leading to what we deem to be cyclically low margins for Elevance, due to elevated medical loss ratios. This has been further compounded by significant regulatory noise which, based on our analysis, won’t have a material impact on Elevance. Both of these factors have created what we deem short-term cyclical headwinds allowing us to purchase the business on 9x forward earnings, which should grow at a high teens rate as margins normalise.

LPL Financial is an advisor-mediated marketplace which provides advisors with front-, middle- and back-office support. They service approximately 30 000 advisors, representing ~$1.8 trillion in assets, which continue to grow as they take market share from larger banks which provide less flexibility and financial opportunities to advisors. The business trades on 17x forward earnings but should deliver high teens earnings growth supported by structural growth tailwinds.

Eternal Ltd is an Indian food delivery business that has also rapidly grown a quick commerce business. The quick commerce arm has expanded from selling merely grocery items to many other SKUs, which increase basket sizes and improve unit economics. The food delivery business operates in a duopoly with Swiggy, with both being profitable and rational while growing at a mid-teens rate. This growth is expected to continue for many years due to the immaturity of the Indian economy and the formal food delivery sector. The quick commerce business is close to breakeven but is growing the top line at over 100% as they rapidly expand the dark store base, which is supported by India still having approximately 90% informal retail penetration. The quick commerce players offer both a highly convenient service, which is priced attractively, and thus, we think there are decades of growth ahead for these businesses. Current earnings are depressed due to quick commerce investments, so the near-term multiple is not very relevant. Thus, we focus on the fair value upside, which represents 30% at the time of writing. In the context of a generally expensive Indian market, it is a rare occurrence to have this level of upside.

The Fund continues to hold bond exposure, which now sits at just over 7% at the time of writing, split between sovereign and corporate bonds. This bond exposure is slightly down compared to the prior quarter as most sovereign bonds remain unattractive, especially those of developed markets, with corporate bonds not presenting a vast array of opportunity beyond the small specific exposure we currently have. We continue to hold our bond exposure in Brazilian government bonds which now represent 3.2% of the Fund at the time of writing and still yielding approximately 14% in Brazilian real. These bonds have rallied, and we have reduced our position by approximately 100 basis points since the prior quarter; however, they remain attractive as Brazil boasts one of the highest real yields globally. Outside of the Brazilian government bonds held, we continue to hold a collection of foreign corporate credit, which in aggregate is providing us with a weighted yield in hard currencies of just under 6% which remains attractive. We have limited exposure to real estate, with the balance of the Fund is invested in cash, largely offshore.

OUTLOOK

2025 is shaping up to be a highly volatile year, with market sentiment shifting rapidly in response to daily headlines. This is further compounded by the Trump administration driving an increasing level of uncertainty in the global economy. The administration appears like they want to make material changes to the global landscape and America’s role in it, which, like any large change, comes with material risk, with the initial evidence suggesting the level of analysis and appreciation for a complex global system being overlooked. Notwithstanding this increased risk, periods of volatility like we have seen this year provide opportunity, and thus we remain excited about the prospects for the Fund as we continue to uncover and own attractive stocks and bonds, and whilst at times asset prices and their underlying fundamentals detach, they generally align long term. Things can change quickly, and thus our focus remains on uncovering attractively priced assets versus trying to time markets - a core principle of Coronation and how the Fund has been run since its inception more than 26 years ago.

*Note that this is a new fund and, as such, does not yet have a track record for the relevant periods. As it is the dollar-denominated version of the same investment strategy deployed historically in the management of the rand-denominated Coronation Global Optimum Growth [ZAR] Feeder Fund, we show the track record of the latter portfolio, converted to US dollars, to indicate historical results achieved by the Strategy.

United States - Institutional

United States - Institutional