OVERVIEW

Coronation Strategic Bond has a proven track record of consistently outperforming bond markets. The actively managed strategy invests across all the different fixed income instruments. It has a flexible mandate with no duration or term restrictions. It invests in the traditional fixed interest assets, but can also have exposure to listed property, preference shares and inflation-linked bonds (ILBs), which are typically excluded in most specialist mandates. This flexibility allows the strategy to maximise every opportunity in the SA fixed interest space. The strategy aims to offer better returns than the JSE ASSA All Bond Index (ALBI) over the medium to long term.

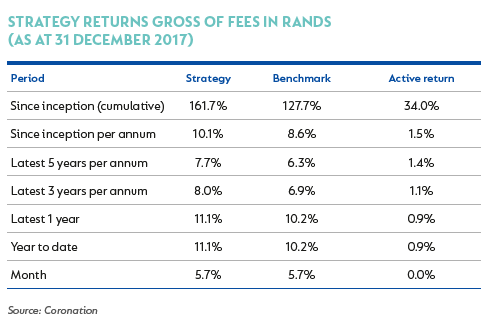

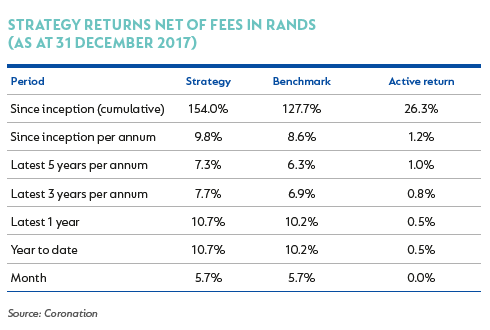

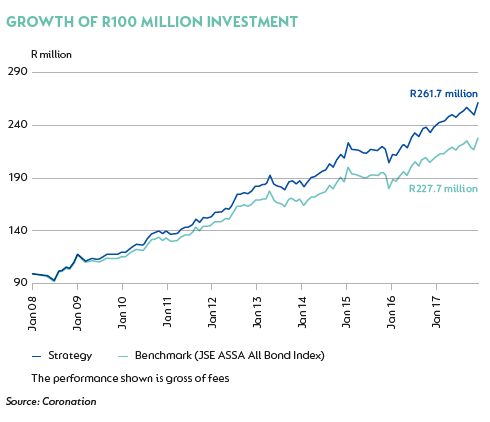

COMPELLING TRACK RECORD

The Coronation Strategic Bond strategy has delivered a gross annualised return of 10.1% (9.8% net of fees) since inception in 2008. The strategy has outperformed its benchmark (the JSE ASSA ALBI) by 1.5% per annum (1.2% per annum net of fees).

PORTFOLIO CONSTRUCTION

The portfolio is positioned according to a long-term strategic market view, but this is balanced by taking advantage of shorterterm tactical opportunities when the market lags or runs ahead of that strategic view.

As an actively managed strategy, investment opportunities across the full spectrum of potential return enhancers are considered. These include duration and yield curve positions, inflation-linked assets as well as yield enhancement through credit enhanced assets. Coronation’s highly rated fixed interest investment team is quick to take advantage of opportunities as they present themselves in a changing environment.

Coronation’s own proprietary fundamental economic and fixed income research forms the backbone of the investment process. Returns are maximised by actively combining a top-down approach (deriving the macroeconomic view which drives the bond investment cycle) and a bottom-up approach (generating a fair value for bond yields) in portfolio construction.

A portfolio with the required targeted modified duration and yield curve position is constructed by the careful selection of individual instruments on the basis of the expected return they can contribute to the performance of the fund. We make use of derivatives for risk management when optimal to do so.

ASSET SELECTION

Projected total returns for each instrument in the strategy’s universe are calculated based on Coronation’s view of the overall future direction of interest rates, the shape of the yield curve going forward and expected changes in credit spreads for particular bonds over the course of the following 12 months.

These factors are balanced against their liquidity and credit risk constraints; for example, due to its higher tradeability and low-risk nature, a government bond will carry a higher inclusion limit than a nongovernment bond.

Coronation maintains a very conservative approach to credit risk; the strategy aims never to put capital at asymmetric risk. Credit selection is primarily focused on mitigating downside risk. We combine detailed analysis with rigorous pricing techniques, drawing from the knowledge and experience of our broader investment team during this process. Our aim is to ensure that the credit spread adequately compensates us for the underlying risk of the entity.

Detailed proprietary research is conducted on issuers and structures to determine their full spectrum of risks and to determine a fair value for the assets, both at issue date and during the life of the instrument.

Our property investment strategy includes fundamental analysis of individual counters. We invest where we believe the total return as a result of our fair value yield and distribution growth (together with a healthy margin of safety) is superior to that of the other investable asset classes.

Coronation incorporates environmental, social and governance factors when evaluating investments. For debt securities, we assess the impact on issuer cash flows and the ability to repay debt, and require additional credit spread to compensate for the risk. Governance factors such as corruption and political risk can also affect sovereign issuers’ willingness to repay their debt.

CURRENT POSITIONING

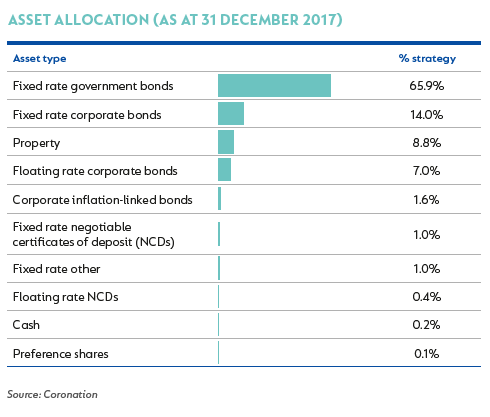

In Coronation’s view, the strategy’s current neutral positioning in government bonds reflects appropriate levels of caution, given the risks in 2018 emanating from potential policy inaction and the possibility of SA’s exclusion from the Citigroup World Government Bond Index.

SA government bonds should benefit from renewed optimism and contained inflation. However, given the aforementioned risks, at current levels, these bonds are trading at their fair value; we require more attractive levels to enter overweight positions.

The strategy’s yield remains attractive relative to its duration risk and it is invested only in assets and instruments that we believe have the correct risk and term premium, to limit investor downside and enhance yield.

The strategy reduced exposure to corporate credit over the second half of 2017 as spread-tightening rendered certain issues unattractive. However, we continue to maintain holdings in those issues where we see selective value.

In the listed property sector, the current weighted average yield of 7.9%, when combined with its projected 5% to 7% annualised distribution growth over the next few years, results in an attractive total return relative to long bond yields.

The strategy maintains higher than normal holdings in listed property counters that offer strong distribution and income growth with upside to their net asset value valuations.

ILBs had a tumultuous year, underperforming bonds and cash considerably. Given the current implied market breakeven inflation levels, we still see little value in ILBs with a maturity of greater than seven years.

The volatility of the FTSE/JSE All Bond Index (ALBI) represented above may be materially different from that of the Strategic Bond Fund. In addition, the holdings in the accounts comprising the Fund may differ significantly from the securities or components that comprise the FTSE/JSE All Bond Index (ALBI). The FTSE/JSE All Bond Index (ALBI) has not been selected to represent an appropriate benchmark to compare the Strategic Bond Fund’s performance, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognised index.

The content of this factfile and any information provided may be of a general nature and is not based on any analysis of the investment objectives, financial situation or particular needs of any potential investor. As a result, there may be limitations as to the appropriateness of any information given. It is therefore recommended that any potential investor first obtain the appropriate legal, tax, investment or other professional advice and formulate an appropriate investment strategy that would suit the risk profile of the potential investor prior to acting upon such information and to consider whether any recommendation is appropriate considering the potential investor’s own objectives and particular needs. Neither Coronation Fund Managers Limited nor any subsidiary of Coronation Fund Managers Limited (collectively “Coronation”) is acting, purporting to act and nor is it authorised to act in any way as an advisor. Any opinions, statements or information contained herein may change and are expressed in good faith. Coronation does not undertake to advise any person if such opinions, statements or information should change or become inaccurate. This factfile is for information purposes only and does not constitute or form part of any offer to the public to issue or sell, or any solicitation of any offer to subscribe for or purchase an investment, nor shall it or the fact of its distribution form the basis of, or be relied upon in connection with any contract for investment. The value of the investments may go down as well as up and past performance is not necessarily a guide to future performance. Coronation Fund Managers Limited is a full member of the Association for Savings and Investment SA (ASISA). Coronation Asset Management (Pty) Ltd (FSP 548) and Coronation Investment Management International (Pty) Ltd (FSP 45646) are authorised financial services providers.

United States - Institutional

United States - Institutional