THE CORONATION GLOBAL Emerging Markets Strategy returned +20.9% during the second quarter of 2020 (Q2-20), which was 2.8% ahead of the +18.1% return of the benchmark MSCI Emerging Markets Total Return Index. The one-year return of the Strategy is now marginally positive at +0.3%, which is 3.7% ahead of the benchmark’s negative return of -3.4%. Over more meaningful longer-term periods, the Strategy has also outperformed – by 3.2% p.a. over three years, 2.2% p.a. over five years, 3.6% p.a. over 10 years and by 4.3% p.a. since inception almost 12 years ago.

For Q2-20, the largest positive contributor to performance was the second-largest premium Chinese baijiu company, Wuliangye Yibin (+1.0%), followed by the Latin American e-commerce and payments company, Mercado Libre (+1.0%), the no. 2 e-commerce retailer in China, JD.com (+0.9%), the no. 2 food retailer in Russia, Magnit (+0.8%) and the no. 1 search-engine operator in Russia, Yandex (+0.7%). In terms of detractors, there were only two stocks that detracted by more than 0.5% – Philip Morris (-0.8%) and Tencent (-0.8%) – the latter as a result of us not owning Tencent (directly) in the Strategy. The Strategy does, however, have large positions in Naspers and Prosus (whose main asset is its 31% stake in Tencent and which trades at a substantial discount to the value of its stake), and the positive contributions from these two slightly more than offset Tencent’s negative attribution. There was no specific reason for the c.9% decline in Philip Morris during the quarter and we continue to own the stock (3% position). We believe that on a c.7.5% 2021 free cash flow yield and with a 6.7% dividend yield, it is very attractive.

Corporate engagement and outcomes

We sold two stocks during the quarter: KB Financial (Korean bank) and Hero MotoCorp (Indian motorbike manufacturer). Both were small positions (1% and 0.5%, respectively) and the risks in both had increased, in our view, at the same time as other attractive opportunities where we have higher conviction were opening up. We also reduced the 58.com (the leading online classified business in China) position materially, from 5% of the Strategy to 1%. In early April, a private equity group made a bid for the company at a 20% premium to the then-share price. In our view, the offer price materially undervalued the business and we also held the view that the CEO (who subsequently joined the private equity consortium) was conflicted, as he was both buyer and seller in the transaction and, as such, should not be able to vote on the transaction from a corporate governance perspective. We wrote two letters to the Board of 58.com, as well as a letter to Tencent’s Board (which owns a 20% stake in 58.com) and engaged with other large shareholders who shared our view.

We also spent time in dialogue with the firm that was providing an independent valuation to the 58.com Board and explained our rationale (with extensive back-up) as to why we believed the offer significantly undervalued the company. Unfortunately, the Board of 58.com, on advice from the special committee and the valuation firm, deemed the offer fair and the CEO indicated he was going to vote his shares in favour (which legally he is entitled to do). Given his 44% voting stake, it became clear that the transaction was in all likelihood going to go through. As such, we started reducing the position and added to other existing holdings that we believed were attractive at the time, including Naspers, Alibaba, Netease, Tencent Music Entertainment and Taiwan Semiconductor.

Hong Kong Exchanges & Clearing

The only new buy during the quarter was a small (0.5%) position in Hong Kong Exchanges & Clearing (HKEx), which is the monopoly stock exchange operator in Hong Kong. The HKEx is effectively a gateway to China, as 70% of the Hong Kong market is made up of Chinese businesses. Stock exchanges are generally very good businesses in our view, and the HKEx is right up there among the best, as its monopoly gives it pricing power and resultant high margins (earnings before interest and taxes [EBIT] margins are around 67%, which are among the highest margins for an exchange globally). As a result of this and its relatively low capital intensity, HKEx generates a high return on equity (north of 20%) and converts 100% of its earnings into free cash flow. The revenue line of the HKEx has a number of positive long-term drivers, including, rising equity markets and Chinese stocks over time; increased southbound activity (mainland Chinese investing in the Hong Kong market); increased northbound activity (institutional investors accessing the Chinese mainland markets through Hong Kong, which is increasing as China A shares start being included in the MSCI and other emerging market indices); ongoing initial public offerings; the increasing rate of US-listed Chinese companies doing secondary listings in Hong Kong (JD.com and Netease both announced secondary Hong Kong listings in the past few months); increased derivative activity (in recent months the HKEx was awarded the contract for 37 MSCI futures indices, which the Singapore Exchange had the rights to); and, lastly, increased ‘velocity’ (more trade in existing listed shares).

In addition to the above, the listing of China A share futures contracts looks likely to happen in the short to medium term, which will provide an additional lift to the top line. As a result of these factors, in our view, the HKEx should be able to grow its revenue by around 13% p.a. over the next few years. The cost base of an exchange is largely fixed, which results in positive operational gearing with a rising revenue line. and, thus, margins should expand, resulting in earnings growth of around 15% p.a. Free cash flow growth will also be around 15% p.a. over the next few years due to the fact that 100% of earnings are converted into free cash flow. The HKEx trades on a c.3.5% 2021 free cash flow yield, which we think is attractive, given the quality of this asset and the free cash flow growth of c.15% p.a. over the next few years.

Coronavirus has naturally had an impact on all businesses globally. In some cases, this is likely to only be a short- to medium-term impact, but in other cases a long-term impact will be felt as well. For most businesses, the impact has been/will be negative, to varying degrees. One clear exception to this is e-commerce, where there has been a positive impact, largely as a result of increased use of e-commerce by consumers (for obvious reasons), resulting in an acceleration of e-commerce penetration. This acceleration results in higher earnings and free cash flow generation in the nearer term which, in turn, results in higher fair values for these businesses due to the time value of money (near-term free cash flow is worth more than free cash flow further out). The Strategy has a number of investments in emerging market e-commerce assets, including 5% in Alibaba and 4.3% in JD.com (the no. 1 and no. 2 e-commerce businesses in China, respectively), and a smaller 1.3% position in Mercado Libre (the effective Amazon of Latin America) which, in our view, is a great asset and which we have owned for a number of years, but have been reducing more recently because of valuation.

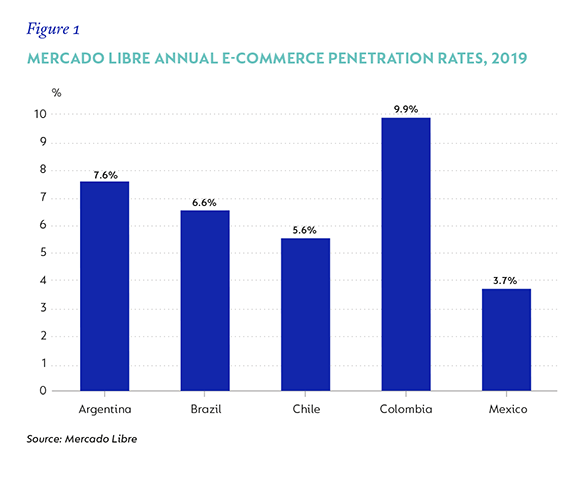

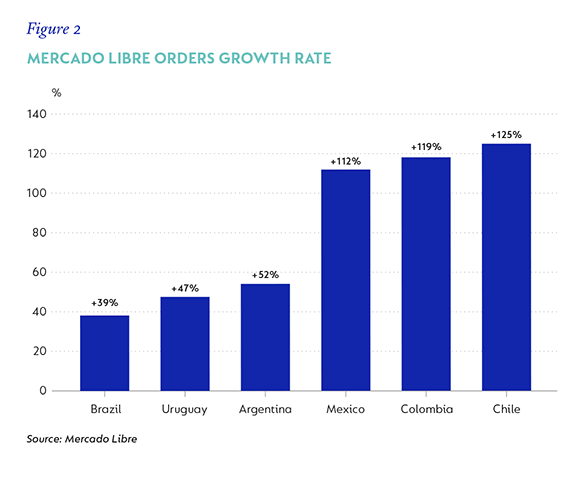

Figures 1 and 2 are a good illustration of the current acceleration of e-commerce adoption, as well as the massive opportunity still ahead. Figure 1 shows the current online penetration rates in Mercado Libre’s main markets (Argentina, Brazil, Chile, Colombia and Mexico, where Mercado Libre is either the no. 1 or no. 2 e-commerce operator). The average penetration rate in Latin America is around 6.5%, which is among the lowest in the world (developing countries are in many cases at 20% to 30% online penetration and increasing, and China, as another reference point, is currently at 23%). Figure 2 shows the year-on-year (y/y) growth in Mercado Libre’s businesses by country for the two-month period of April and May 2020, with growth rates ranging from 40% to 125%. This represents a significant acceleration in orders compared to what was being seen pre-coronavirus. What is clearly happening is that existing users of e-commerce are using it more due to lockdowns but, as importantly, there are also many first-time users entering the system, which is resulting in an acceleration in overall penetration. History shows that this (online penetration) doesn’t reverse, and as such provides a significant and sustainable boost to the likes of Mercado Libre.

Strong positions

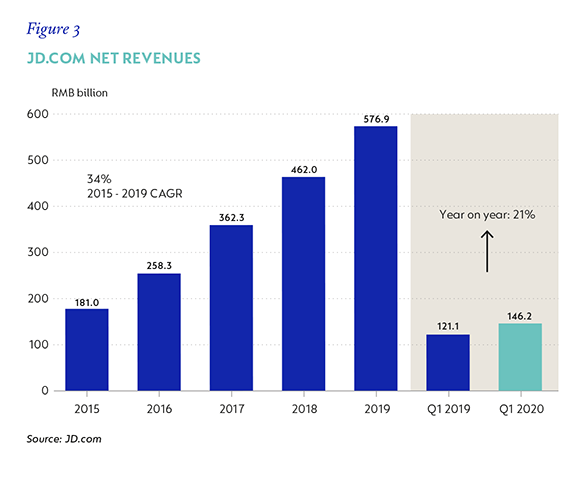

JD.com has been a top 10 holding in the strategy for the past six years since it first listed. While there have been disappointments along the way, throughout this period we have continued to believe that this is a great asset with a very promising future. More recently, this view has started to come to fruition and JD.com’s share price is up 70% this year. Since its listing in 2014, it has now given a return of 20.8% p.a. compared to the 2.2% p.a. return of the MSCI Emerging Markets Index. Even after the strong share price performance, and partly due to the dynamics described above, we believe JD.com is very attractively valued and it remains a large position in the Strategy. Figures 3 and 4 show JD.com’s revenue growth over the past five years – 34% p.a. in US dollars. This business has clearly delivered, in contrast to the widely held market view that JD.com is unable to compete with Alibaba. It also shows the most recent reported quarter’s growth (quarter to 31 March 2020, which coincided with the peak of coronavirus in China). In this particular period, revenue grew by 21%. In addition to this, JD.com guided for revenue growth of 20% to 30% for Q2-20 (to end-June).

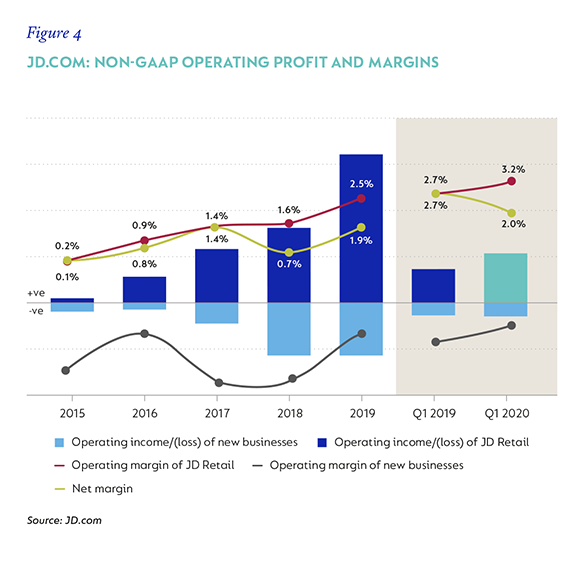

As importantly as the strong revenue growth is the progression of profitability (operating profit margin) over time, which is shown in Figure 4. The top line shows the operating profit (EBIT) margin of JD.com’s core retail e-commerce business, which was 0.2% in 2015 and has been slowly increasing over time to reach 2.5% by 2019. It then took a further step up to 3.2% in the first quarter of 2020. The second line shows the group EBIT margin (which comprises the core retail e-commerce assets as described above and the smaller, still loss-making, third-party logistics business). Here too there has been a continual improvement over time, with margins going from 0.1% in 2015 to 2.0% in Q2-2020. In our view, group margins are still well below being at a normal level and will increase over time to closer to 5% to 6% (compared to 2% currently). JD.com now trades on c.30 times 2021 earnings. However, embedded in this is a 2.5% EBIT margin. If one were to put a normal 5% margin onto the 2021 revenue line, then the multiple halves to 15 times earnings. We don’t believe that JD.com will get to a 5% margin next year (it will take a number of years still), and this exercise is merely to illustrate how attractive JD.com still is. In summary, current 2021 profits are still far below normal, as revenue will grow at 20%+ for a number of years ahead and the margin will expand significantly over time, in our view. For this reason, looking at shorter term valuation metrics is not particularly meaningful. In conclusion, we believe that JD.com is a growth business, but at a value price, which is that rare combination that is very difficult to find.

Magnit is another long-held position (and a 3% position in the Strategy today), which has been a disappointing investment in more recent years, but where green shoots have started to come through. Magnit is the second-largest food retailer in Russia (no. 1 is X5 Retail, which is also a Strategy holding). Supermarkets have generally been beneficiaries of coronavirus due to stockpiling ahead of lockdowns; this, however, is a one-off, short-term positive impact and should not be capitalised into perpetuity, in our view. In its most recent results (Q1-2020), Magnit finally showed a significant turnaround in like-for-like sales (which have been negative for the past few years). Like-for-like sales (in other words, sales growth in existing stores, excluding new store openings) grew by 7.8%. Even stripping out a c.2% positive impact from coronavirus as described above (stockpiling), like-for-like sales were +5.8%, a very healthy number and an indication that store refurbishments and a better offering are starting to pay off. Total sales grew by 17.6% y/y, which was also a significant acceleration from the high single-digit sales growth shown in the past few years. Importantly, this accelerated sales growth did not come at the expense of margins; there was in fact a slight increase in margins resulting in 21% operating profit growth.

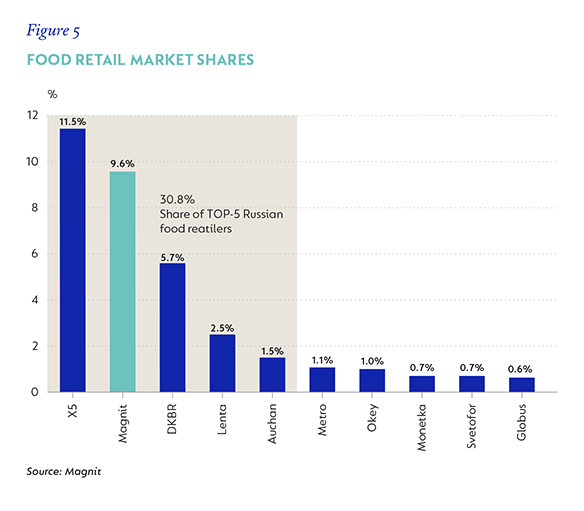

In addition to the improvement operationally shown by Magnit, the long-term opportunity in Russia for the scale operators (X5 Retail and Magnit) is still significant, in our view. As shown in Figure 5, the no. 1 operator, X5 Retail, still only has 11.5% market share (the no. 1 in developed markets typically has 20%+ market share), and the no. 2, Magnit, has 9.6% market share. The third-largest food retailer in Russia is a long way behind (with 5.7% market share) and the fifth largest has only 1.5% market share. The top five have a 30% combined market share. The share of the top five in developed markets is typically in the 50% to 70% range. In our view, the two biggest operators will continue to take market share over time, notably from the informal market and the smaller operators. With increased store roll-outs and the resultant scale come increased buying power and the ability to reinvest in price, which in turn make it harder for the smaller operators to compete. On our numbers, Magnit trades on a 5.5% free cash flow yield to December 2021 and a 6.5% dividend, which is very attractive, in our view.

E-commerce positioned for growth

While the fall in markets globally in March was very quick and severe, so too has been the rebound over the past few months. The world, and emerging markets, are by no means out of the woods, even if global equity markets seem to be behaving as such. We expect difficult times ahead in a number of emerging markets, particularly those with poor country balance sheets and weak economies, such as South Africa and Brazil, and we have been very selective with stock selection in these countries. China is emerging as one of the better-off countries – partly because it was ‘first-in’ with coronavirus, partly because it locked down hard and early, and partly because the underlying economy was reasonably strong pre-coronavirus and has attractive fundamentals. 36% of the Strategy is invested in China (41% if one includes Naspers, whose largest asset [c.80% of our Naspers valuation] is its stake in Tencent). A large part of the Chinese exposure is in internet businesses that have structural growth drivers and which have continued to grow, even through the coronavirus (Tencent [through Naspers and Prosus], Alibaba, JD.com, Netease and Tencent Music Entertainment), as well as in selected assets in other attractive industries where penetration rates are low, including premium branded spirits (Wuliangye Yibin), insurance (Ping An) and education (New Oriental Education).

India is the second-largest country exposure (9.7% of the Strategy), with 6% of this being invested in financials (Housing Development Finance Corporation [HDFC] and HDFC Bank). While India is suffering economically because of its hard lockdown, we believe that both HDFC and HDFC Bank, while also clearly being impacted, will take market share from weaker players and emerge even stronger at the other end. 2.5% of the Strategy is invested in two of the Indian IT services companies (Tata Consultancy and Infosys). Russia is the third-largest exposure by country (9.6%), with four investments: the no. 1 and no. 2 food retailers, X5 Retail and Magnit (a combined 5% position), Yandex (no. 1 in search, with various other assets, including taxi ride hailing, food delivery, e-commerce and online classified advertising; a 2.9% position) and Sberbank (1.6%). Developed market exposure is currently 15.5%, which is lower than its 12-year average exposure of 17%, due to us finding better risk-adjusted opportunities in emerging markets at the moment. The weighted-average upside to fair value in the Strategy is currently c.34%, which is below its long-term average, but as a counter, the overall quality of stocks comprising the Strategy is higher than it has been historically, in our view. The five-year internal rate of return for the Strategy (five-year forecasted earnings growth + dividend yield +/- rating change) is currently around 13%, which is attractive, in our view.

Disclaimer

United States - Institutional

United States - Institutional