Investment views

Portfolio construction amid rising global inflation

Taking money offshore may be popular, but, at present, South African opportunities are still more attractive.

The Quick Take

- The typical investments available to protect one from inflation are not functioning as expected.

- The South African Reserve Bank is one of only a few central banks globally that have responded appropriately and timeously to rising inflation.

- SA inflation is currently well below inflation in many developed markets.

- Against this backdrop, SA equities and SA government bonds offer compelling investment opportunities compared to developed markets.

A POPULAR QUESTION investors are currently asking is which risk we consider the most concerning. In an environment where there is a war between major powers on the European continent, collapsing tech share valuations, Chinese clampdowns on the private sector and zero-Covid lockdowns, one is quite frankly spoilt for choice in naming risks. But, for me, the risk of rising global inflation certainly tops the list. Unlike the attention-grabbing risks just mentioned, inflation is insidious and, therefore, most dangerous in impacting the real returns investors ultimately receive.

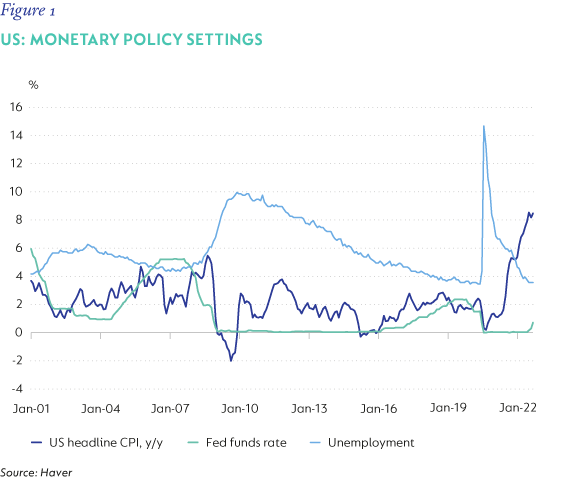

Inflation in the Western world has returned to levels not seen since the early 1980s. As a result, there are very few politicians, central bankers, and, importantly, investors who have worked in an environment of high inflation. Moreover, interest rates have generally been exceptionally low ever since the Global Financial Crisis (GFC) in 2008 (Figure 1), so there is a large cohort of investors that have only known exceptionally low interest rates associated with low inflation. We believe that central banks in developed economies failed to normalise policy rates in the wake of the GFC, lulled by low inflation, even as the underlying economic recoveries gained momentum.

In an inflationary environment where interest rate hikes will have to follow, the implications for investors are now significant.

THE PROBLEM WITH THE TRADITIONAL TOOLS TO DEAL WITH INFLATION

In an environment of inflation, especially where policy rates are negative in real terms, the best way to protect real capital is often through owning real assets: commodities and companies or properties that can pass inflationary increases on and grow earnings through an environment of rising costs. The problem currently is that the exceptionally accommodative monetary policy (being low policy rates and quantitative easing to suppress the long end of the interest rate curve) means that the valuations of many of the real assets are already priced, on average, for perfection. Until recently, global equity markets were at all-time highs, residential property prices in major cities are all trading near all-time highs, and most commodity prices are close to their peak values. The conundrum now is how to protect against the known inflation risk when many of the traditional tools appear to already be priced for it.

Traditional financial theory will tell you that as inflation rises, central banks will respond by hiking interest rates, and bond markets will adjust nominal yields to account for the higher expected levels of inflation. However, over the recent past, none of the large developed economy central banks responded to rising inflation, initially diagnosing it as “transitory” and hence continuing with very accommodative monetary policies. The normally powerful bond markets, which would have signalled policy error by pushing yields up, were tamed by massive quantitative easing programmes, as central banks artificially suppressed yields by providing huge amounts of liquidity (mainly in dollars, euros and pounds) and by aggressively buying longer dated bonds. The enormous amount of debt issued by countries to provide relief during the Covid-19 lockdown period may now inhibit them from allowing interest rates to rise sufficiently to fight inflation as the rise in the cost of debt may prove to be unsustainable. The conundrum is thus complete. We know inflation is rampant, but the typical investments available to protect one from inflation appear to be either priced inappropriately or not behaving as they should.

However, South Africans have not experienced the mania in capital markets nor become reliant on the largesse of the South African Reserve Bank (SARB), as happened in other regions. While there are very few institutions left in the country that we can point to with pride, the SARB remains one of the shining lights of our economy. Despite immense pressure under differing regimes, it has remained fiercely independent and, even during the Covid-19 crisis, refrained from the excesses seen in other regions. Maintaining a somewhat tighter policy stance undoubtedly made life tougher in the short term but has clearly left the local economy in a much stronger position with lower inflation and better-anchored inflation expectations.

OUR PORTFOLIO RESPONSE TO RISING INFLATION AND RISING INTEREST RATES

With no quantitative easing policy in place, the real yields on South African government bonds (SAGBs)are significantly positive, offering investors meaningful real returns. This high risk-free rate, combined with an absence of artificial monetary stimulus, has seen our equity market remain very cheap by global standards. Despite coming through the Covid-19 crisis in generally good shape and reporting better- than-expected results, the majority of SA listed companies are trading on exceptionally low ratings and offering dividend yields well in excess of cash returns. This has provided us with an opportunity to buy SAGBs providing real returns as well as being overweight SA equities with the prospect of solid earnings underpinned by high single-digit dividend yields.

While it is popular currently to be taking more money offshore, given the recent change in Regulation 28 to increase the foreign asset limit for SA retirement funds, we believe now is not the time to be switching aggressively from very cheap domestic assets into more expensive global markets, where inflation is out of control and interest rates will keep rising.

One of the big advantages of our domestic equity market is the high weighting to resource companies. In previous periods of high inflation, the resources sector showed the ability to grow in real terms, and we believe this time will be no different. Resource shares currently make up the largest sectoral exposure of our equity portfolio.

While rising inflation and interest rates are negative for many industries, another sector that stands to benefit is the local banking industry. Higher rates, especially from a steepening yield curve, tend to benefit banking margins significantly. While this is normally offset by higher credit losses, after the provisioning from the Covid-19 period, and generally tepid loan growth of the past few years, we expect a muted uptick in bad debts, resulting in most of the margin benefit dropping to the bottom line.

As the above narrative indicates, it is important to know what equity you are exposed to when rates and inflation are rising. There will certainly be winners and losers, and many sectors that have benefited from the tailwinds of accommodative monetary policy will now be facing headwinds and vice versa. Being exposed to equity means one will still be exposed to the volatility of share price moves as markets digest the impact of higher interest rates and inflation. However, over time, we believe that investors will be rewarded as real earnings are achieved and passed through as cash returns.

In our global portfolios, we have not yet gone overweight global equities, nor have we considered any exposure to global bonds as yet. With most sovereign debt still offering negative real yields, despite the recent move up in nominal yields, this asset class remains unattractive. Within global equities, we believe there is significant opportunity to generate alpha through skilled stock picking, given some of the extreme price moves that we have seen. This makes the argument for increasing global equity exposure slightly more compelling, even though overall market levels are not as attractive as locally.

AN UNCOMFORTABLE BUT NECESSARY RESET

While the current economic reset is uncomfortable, it is an important step in the normalising of markets. For too long, interest rates have been at or close to zero, accommodating inappropriate levels of risk taking. As such, global capital markets, where many business models and asset classes were sustained by “free” money, are being recalibrated. Those businesses and asset classes with sustainable and defensible free cash flow will continue to thrive, and much of the excesses of the past decade will be cleared out. Expect plenty of volatility in the short term, but a focus on the long term should continue to deliver appropriate returns for investors.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional