Personal finance

Corolab - Investing for income and growth

Navigate your retirement with the right strategy

Overview

As you move into or approach retirement, your investment needs change.

You’re no longer just growing a pot; you’re paying yourself a reliable income, most often from a living annuity. That shift brings a new mandate for your portfolio: still deliver inflation-beating growth over decades but also cushion the ride so withdrawals can continue through tough markets.

In short, the mix that worked preretirement (maximise growth) isn’t the same mix you need now (growth and reduced volatility, with liquidity for income).

This edition breaks down how your needs change, the new risks that come with drawing an income in retirement, and the Coronation portfolios built specifically for this purpose – Coronation Capital Plus and Coronation Balanced Defensive – with long, consistent track records of delivering on these needs across market cycles.

Why do your investment needs change in

For most of your working life you’re in accumulation mode. The job is straightforward: keep contributing, stay invested, and own enough growth assets (such as equities) so your savings can outpace inflation. In that phase, the portfolio’s mandate is largely to maximise long-term, tax-efficient growth.

As you approach (and enter) retirement, the job changes. You start drawing a regular income, most often from a living annuity. That pivot introduces new realities: markets can be bumpy at the same time you need cash, and the order of returns now matters more because withdrawals lock in gains or losses.

- Keep growing above inflation for decades. Retirement can last 25–30 years or more; your capital still needs growth engines.

- Manage short-term ups and downs so income can continue to be drawn comfortably. The portfolio must cushion volatility and hold enough liquid assets so you’re not forced to sell growth holdings at the wrong time.

In short: the mix that worked pre-retirement isn’t the same mix you need now.

What risks do you need to navigate in retirement?

A living annuity is often the most appropriate investment account from which to draw a regular income in retirement. It gives you flexibility and any unused capital can pass to your heirs.

The trade-off

Because you’re drawing an income each year, you face a new set of risks that must be managed continuously inside the portfolio. The following graphic offers a quick overview of these risks and what investors often underestimate when it comes to these risks.

1. Inflation risk – it’s the after-inflation outcome that matters

When planning for retirement, inflation remains one of the biggest long-term risks to your purchasing power. In South Africa, long-term inflation expectations may need to be revised lower from the 5%-6% range used for long-term financial planning purposes.

Using a lower assumption helps set more realistic expectations for future investment returns — since lower inflation usually means lower nominal growth. Ultimately, though, it’s important to judge your investments in real terms (after inflation) and stay prepared for periods when inflation can rise unexpectedly. A well-diversified portfolio with exposure to growth assets remains the best defence against this risk.

Who’s most exposed to inflation risk?

- Living annuity investors with too little growth exposure

- Life annuity buyers whose starting income doesn’t keep pace with CPI over time

The long-run impact of inflation (why it still matters)

While policy is shifting to anchor inflation lower over time, even “low” inflation quietly erodes buying power when you’re drawing an income for decades. The compounding effect is what bites.

- At 3% a year (a lower anchor): R1 today buys about 41c in 30 years

- At 6% a year (long-run planning assumption): R1 shrinks to ~17c after 30 years

- At 10% a year (a high-inflation scenario): R1 falls to ~5c over 30 years

That’s why a retirement portfolio still needs growth assets (to beat inflation) alongside defensive assets (to smooth the ride), even if the headline inflation target is lower.

2. Longevity risk — making your money last

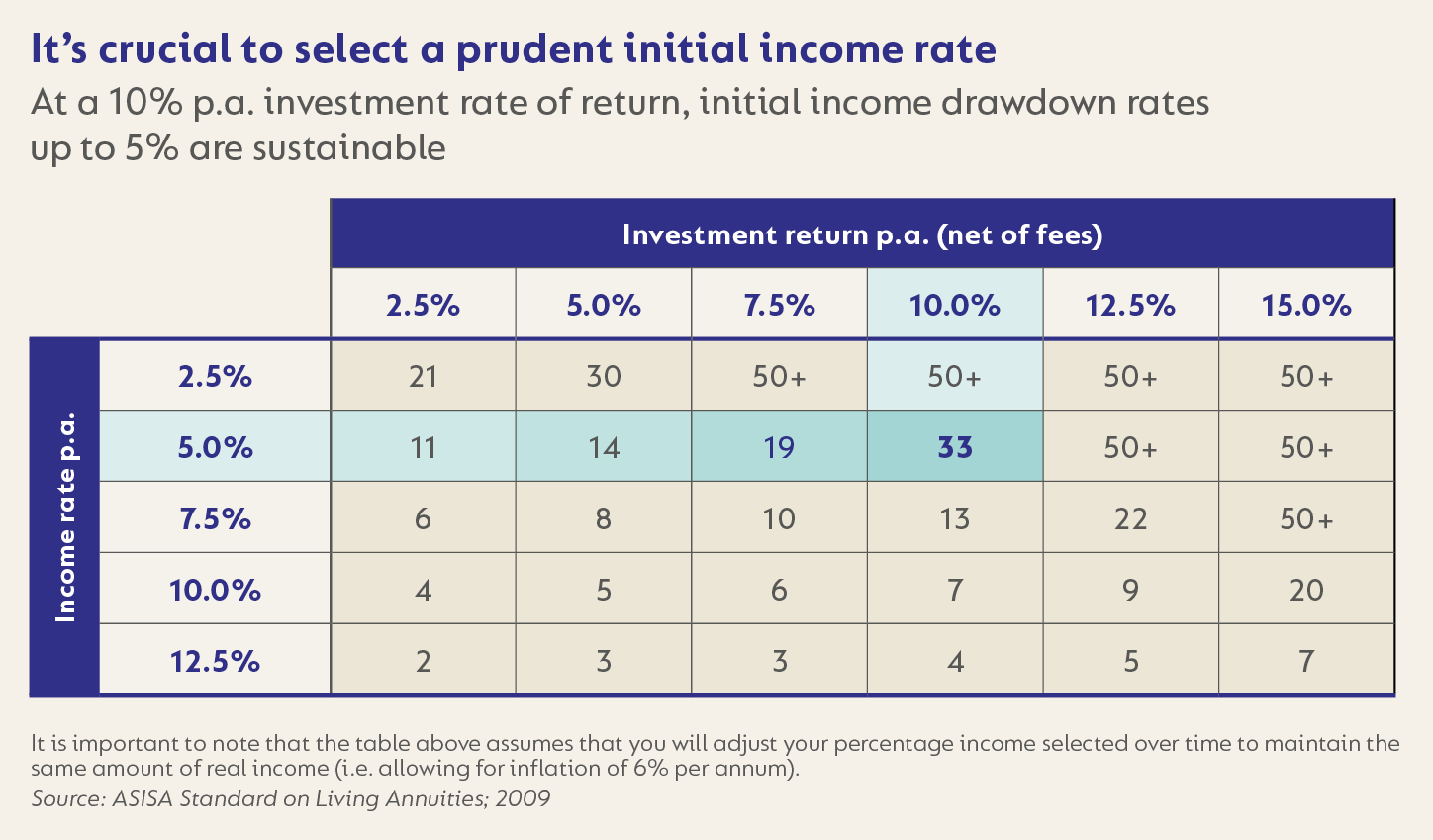

A 60-year-old should plan for ~30 years in retirement; that requires a portfolio with sufficient asset exposure and a sensible starting drawdown. As the table shows, at ~10% net annual return, a 5% starting drawdown is typically sustainable for ~33 years; at 7.5% returns, the same 5% draw may last only ~19 years—a sharp drop that underlines how important return assumptions and drawdown discipline are.

(See the drawdown table for details.)

3. Sequence-of-returns risk — when timing hurts

Two portfolios can earn the same average return, yet end with very different outcomes once withdrawals start. Poor markets early in retirement can permanently dent capital because you’re selling (when you withdraw) into weakness.

Managing volatility and keeping enough liquidity for income in down markets makes a meaningful difference: in our illustration, the portfolio that cushioned early losses ends with ~40% more capital than the one that didn’t.

What this means for your portfolio

In retirement, you need a multi-asset, valuation-led portfolio that balances growth (to beat inflation) with defensive assets (to smooth the ride) and offshore diversification. That’s the design behind Coronation Capital Plus and Coronation Balanced Defensive—built for living-annuity investors to help sustain real income over decades while managing the bumps along the way.

Choosing the right fund for your living annuity

As we have explained earlier in this document, once you start drawing an income, your investor needs split into two:

- keep growing above inflation, possibly over decades, and

- keep the ride steady enough for you to withdraw a regular retirement income over the long term.

A living annuity portfolio must therefore achieve the above two objectives.

Same toolkit, different emphasis

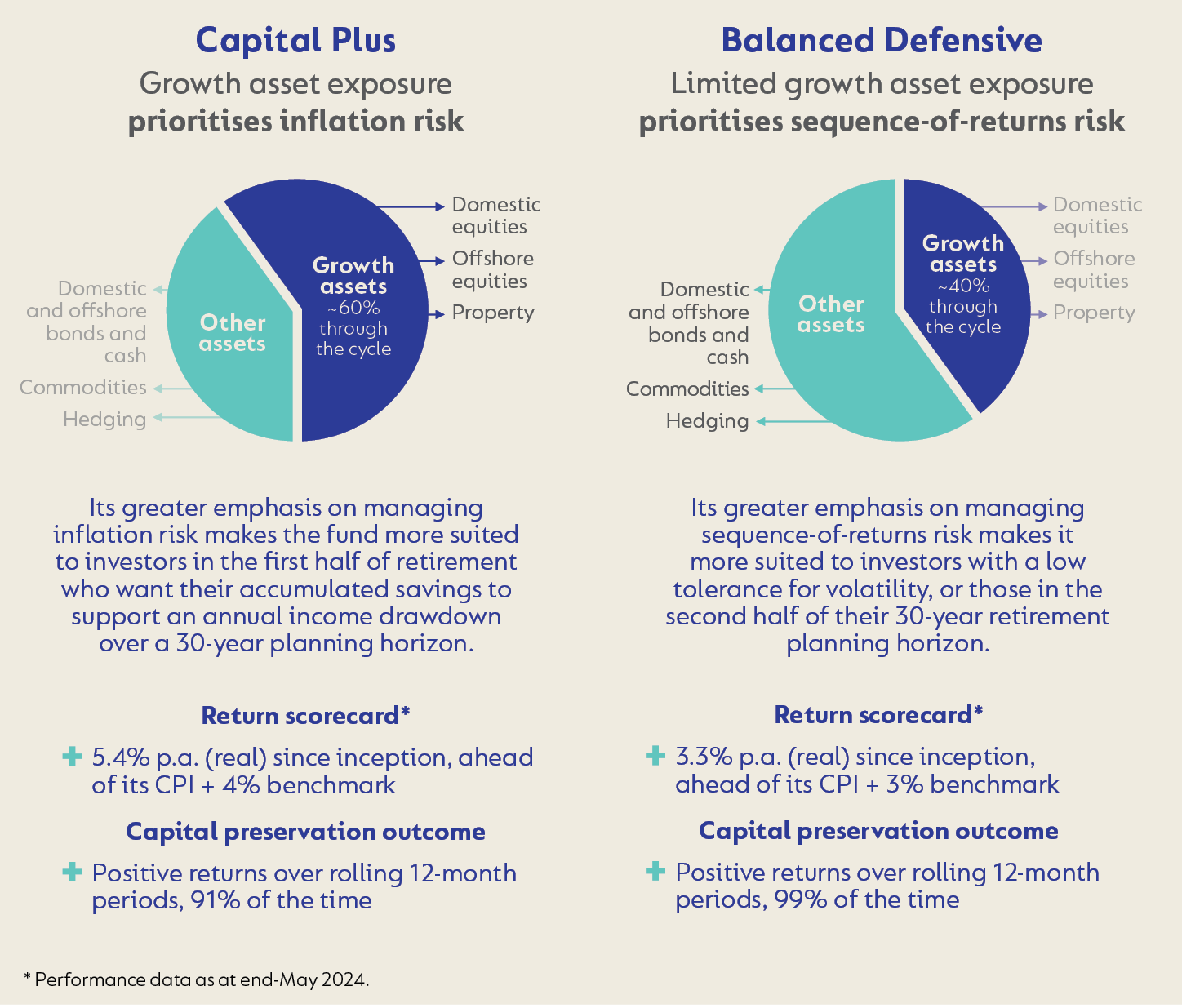

Both Coronation Capital Plus and Coronation Balanced Defensive are multi-asset funds designed for living annuities. Each manages the three key retirement risks — inflation, longevity, and sequence of returns — but with different levels of emphasis.

Both keep enough growth assets to help your money last, while holding defensive assets such as South African bonds, inflation-linked bonds, cash, and selective hedges to cushion the impact of weak markets early in retirement.

How to use these funds?

If inflation defence is your main concern and you can handle some volatility, lean toward Coronation Capital Plus.

This fund is best for the first half of retirement or for investors who need higher real growth while being able to tolerate some market ups and downs.

If smoother withdrawals matter most, lean toward Coronation Balanced Defensive. Many retirees may choose to blend the two (for example 60/40 or 50/50) and review annually with their adviser as drawdown needs and market conditions evolve.

This fund is best for investors with lower tolerance for volatility, or who are in the second half of their retirement.

Putting risk management to the test

The case study below shows how a multi-asset fund with sufficient growth assets and global diversification, such as Coronation Capital Plus, can support a prudent drawdown over decades.

Case study: sustaining a 5% drawdown over the long term

What we tested

R1 million invested in Coronation Capital Plus (our flagship living-annuity portfolio) since launch in 2001, drawing 5% a year (fixed, not increased for inflation).

What we found

Over 24 years to end-September 2025, Capital Plus (moderate risk, higher growth-asset exposure):

- Ended at ~R10m nominal (about 9× the starting capital) after paying income; and

- Paid ~R1.2m in cumulative income (nominal).

Adjusted to today’s money (after inflation), the portfolio:

- Ended at ~R1.5m real, and

- Still paid ~R1.2m cumulative (nominal) along the way.

Why it matters

Maintaining sufficient growth exposure (guided by valuation) is what protects purchasing power over the decades. Defensive assets (bonds, ILBs, cash and selective hedges) help steady the journey, so you’re not forced to sell growth at the wrong time.

What if you didn’t have growth above inflation?

If a portfolio only kept pace with inflation (~0% real return) while paying a fixed 5% income each year, inflation would do far more damage to both the remaining capital and the real value of income. Over long periods, real outcomes would be materially lower versus a portfolio that compounds above inflation.

Real growth is the difference between merely keeping up and moving ahead.

Key take-outs from this exercise

It is clear that Coronation Capital Plus, the fund with appropriate levels of growth asset exposure, is much better at supporting long-term investment growth than Coronation Strategic Income, delivering 5 times the initial capital amount invested, compared to Coronation Strategic Income’s 2.6 times initial capital. And that is even after the retiree has withdrawn more than double the initial capital amount invested (>R2.3m) by way of a retirement income.

This further illustrates the crucial role that growth assets fulfil in providing protection against the eroding effects of inflation, and if managed through a risk-conscious lens can allow for a smoother return path that enables its investors to stay the course.

Why Coronation Capital Plus remains a compelling choice for living annuity

Investors

The Fund balances growth for inflation defense with defensive assets for a steadier path, helping investors keep drawing an income—calmly—through different market conditions. Its multi-asset approach blends local and global shares, bonds, property and cash in a single, well-diversified portfolio. It aims to smooth the ride when markets are volatile while still growing your capital over time. For investors drawing an income, that balance means a steadier experience and a better chance of your savings lasting through retirement.

Managing your income level on an ongoing basis

Further to setting a sensible starting income and choosing a fund with appropriate growth exposure, here are some pointers that you can consider to keep your drawdown on track with a few guardrails. Each year:

- Index for inflation. Start with last year’s rand income and add inflation. This is called the modified withdrawal rule.

- Loss-year stop. If the portfolio had a negative return and the inflation increase would push today’s withdrawal rate above your initial withdrawal rate (IWR), keep income flat this year. This is called the capital preservation rule.

- Guardrails check. Work out today’s current withdrawal rate (CWR) = this year’s income ÷ current portfolio value. Compare CWR with your IWR:

- Prosperity (upside): If CWR is more than 20% below IWR, give yourself a 10%

- Capital preservation (downside): If CWR is more than 20% above IWR, cut income by 10% this year. (Apply this downside guardrail mainly in the first 10–15 years of retirement.)

That’s it: inflation as the baseline, a loss-year pause, and two simple guardrails to keep withdrawals sustainable.

Conclusion

Retirement changes your investment needs. You still need growth that beats inflation, but you also need a steadier path so withdrawals can continue through rough markets. A living annuity gives you the flexibility and legacy benefits; the difference comes from the multi-asset portfolio you use to fund it.

Coronation Capital Plus and Coronation Balanced Defensive are built for this stage. Both manage the three big retirement risks (inflation, longevity, and sequence of returns) through one integrated, valuation-led process. The tilt differs by need: Capital Plus prioritises inflation defence with more growth assets and offshore diversification; Balanced Defensive prioritises a smoother income path with more defensive assets. Many retirees use a blend and review the split each year.

Our commitment is simple: manage to your needs. We size growth and defensive assets deliberately, trim when prices run ahead of fundamentals, add when value appears, and use protection only when it’s worth paying for. The goal is the same in every market - sustain your real income and protect your plan over decades.

If you need assistance to identify the right mix that fits your drawdown and comfort with ups and downs, speak to your adviser. We’ll do the rest: a disciplined, diversified portfolio managed for the realities of retirement, so your income can keep up with life, not just with prices.

United States - Institutional

United States - Institutional