International Portfolio Update - July 2016

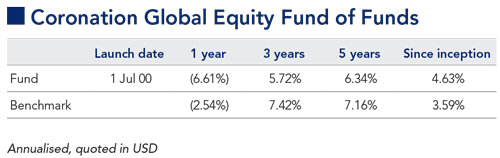

The fund advanced 1.4% over the quarter, ahead of the benchmark return of 1.0%. This brings the rolling 12-month performance to -6.6% against the benchmark return of -2.5%.

North America was the best performing region, rising 2.4% (in US dollar terms), while Europe performed the worst, declining 2.3% (in US dollar terms). Japan advanced by 3.6% and Asia Pacific ex-Japan declined 0.7% (both in US dollar terms). The fund’s regional positioning had a negative impact on performance during the quarter.

Among the global sectors, energy (+9.7%) and healthcare (+5.2%) generated the highest returns, while utilities (+3.3%) and materials (+3.2%) also delivered strong returns over the quarter. The worst-performing sectors were consumer discretionary (-4.5%), financials (-3.0%) and information technology (-2.9%). On a look-through basis, the fund was negatively impacted by an underweight position in energy, consumer staples and utilities, and an overweight position in the consumer discretionary and information technology sectors.

The majority of the fund’s underlying managers performed very well over the quarter, allowing the overall portfolio to finish ahead of the index.

Contrarius Global Equity has had a very strong quarter, benefiting from positions in commodity-related holdings, most notably gold, which performed well over the three-month period. Kinross Gold (+43.8%), IAMGold (+87.3%) and Fortescue Metals (+37.2%) are examples of strong investment performances.

Coronation Global Emerging Markets also generated strong alpha this quarter, benefiting from mergers and acquisitions activity in the Brazilian for-profit education space, most notably Kroton (+19.6%). Strong returns from Naspers (+8.7%), Yes Bank (+29.2%) and Tata Motors (+20.1%) also drove performance over the period.

Eminence and Viking delivered similar returns for the quarter. Viking benefited from commodity-related exposure with positions such as Southwestern Energy (+55.9%), Cabot Oil & Gas (+13.4%) and Range Resources (+33.3%). Positions in Amazon (+20.6%), Envision Healthcare (+24.4%) and Eli Lilly (+10.4%) also added value. A significant contributor to performance for Eminence was its large position in LinkedIn (+65.5%). The fund also benefited from strong returns from Zynga Inc (+9.2%), CalAtlantic Group (+10.0%) and Intercontinental Group (+9.2%).

After a sustained period of strong performance, Lansdowne Developed Markets saw a steep decline over the quarter. This was largely driven by its positions in consumer discretionary stocks including Nike (-9.9%), L Brands (-22.8%) and Apple (-11.8%). Lloyds Bank (-18.1%), a long-term winner for the fund over a number of years, was a victim of the UK’s referendum vote and detracted from performance over the quarter. Declines in share prices were also recorded by Delta Airlines (-25.0%), Visa (-2.9%) and MasterCard (-6.6%).

Egerton also suffered a negative return, again after a long period of substantial outperformance. Airline-related stocks were among the main detractors, including Ryanair (-20.1%), Southwest Airlines (-12.3%) and Airbus (-9.2%). Exposure to UK homebuilders, which were among the biggest victims of the referendum vote, also contributed to the negative performance, as did positions in Microsoft, Alphabet and Priceline.

We have recently reduced our exposure to Vulcan Value Partners following a disappointing run in performance. The fund declined over the quarter, following another disappointing performance by Fossil (-35.8%). It also held Visa and MasterCard, as well as Check Point Technology (-8.9%).

The economic uncertainty created by Brexit did not only affect the UK as ‘Project Fear’ predicted, but also rippled across the rest of Europe and the broader global economy. The result is widely expected to spark debates around membership in other EU countries at a time when the union is already dealing with major issues including Greece’s debt, a banking bailout in Italy and the ongoing migrant crisis.

The economic uncertainty associated with Brexit is sure to continue for a substantial period of time. The major central banks have stepped in to provide liquidity and stabilise the currency markets, and expectations for a rate hike in the US are moving out towards 2017. This should be supportive, but global growth is expected to slow. In combination with the prospect of electioneering in Europe and the US over the next two quarters, this will no doubt create some market volatility in the medium term.

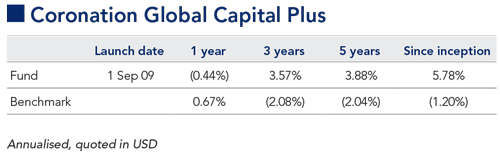

The fund performed reasonably well during this turbulent time, returning 0.2% over the quarter. For the year to date, the fund’s return of 3.3% is commendable, although the slight negative numbers over the most recent one- and two-year periods are still well below expectations. Over longer-term periods, the fund return remains satisfactory, especially the annualised number of 5.8% since inception almost seven years ago.

The fund benefited from its exposure to gold, while the credit positions contributed marginally. Its other commodity holdings added somewhat to performance, but its exposure to the pound detracted towards the end of the period.

Our decision not to hold any government bonds detracted from performance.

Within equities, our preference for US stocks proved to be correct, but our equity holdings within this market disappointed against the backdrop of further volatility. We do not own many consumer staples as we consider a number of these stocks to be fully valued. However, it is understandable that during times of crises, investors will seek safety in the more defensive sectors, and hence the consumer staples continued to rerate and outperform.

We also do not have any exposure to energy-related stocks, as we remain concerned that a lower oil price could affect these companies more than expected. In addition, it is very difficult to build a high-conviction argument around where the oil price will settle in the medium to longer term.

The fund’s exposure to alternative asset managers was the main contributor to underperformance over the quarter. We have written about the investment case for these managers before, and continue to maintain high conviction in the longer-term performance of these stocks. While there is a strong case to make that the current market conditions allow these managers to acquire assets at attractive prices, which will bode well for future fund (and shareholder) returns, these shares will always be susceptible to market volatility. Together with Porsche, our positions in alternative asset managers are responsible for the bulk of the underperformance experienced over the last 12 months. Over the longer term, our overweight position in emerging markets detracted.

The positive equity performers over the quarter include Kroton and Estácio, the two biggest players in the Brazilian private education market. The investment case for these holdings is outlined in the Coronation Global Emerging Markets (GEM) commentary below.

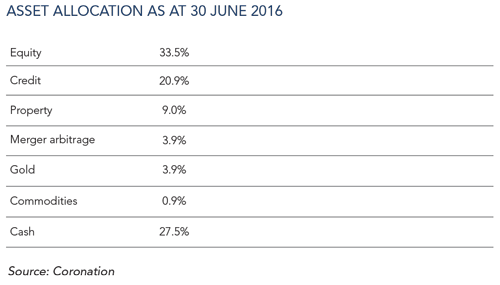

In terms of asset allocation, a relatively new category worth mentioning is merger arbitrage, which includes companies involved in corporate transactions where we think the odds of the deal and the potential payoff favour patient investors. We currently have five positions in place, and have already profitably exited another two positions. We will limit the fund’s total exposure to this strategy, and will only enter positions where we have some insight into the deal process. As at the quarter-end, the fund’s asset allocation was as follows:

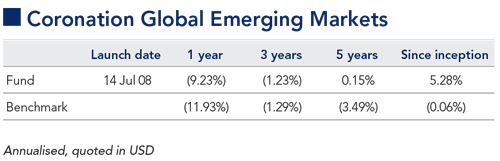

The GEM strategy returned 4.8% for the quarter, outperforming the benchmark by 4.1%. After a tough couple of quarters, there has been a marked improvement in the strategy’s shorter-term performance − one-year rolling alpha now sits at 2.7%, after negative numbers over the previous two to three quarters. The quick turnaround illustrates why we dislike shorter-term measures of performance and instead prefer to look at longerterm returns, which we believe are more meaningful when analysing the capabilities of a manager. In this regard, the strategy’s alpha over periods of five years (3.6% per annum), seven years (3.5% per annum) and since inception (5.3% per annum) is strong, and within or above our long-term target of 3% to 4% per annum.

The biggest news for the strategy during the quarter came at the start of June when the largest Brazilian private sector education operator, Kroton Educacional, launched an offer to purchase the second-largest provider, Estácio Participações.

At the time, the strategy’s position sizes in these two stocks amounted to 4.2% and 2.0% respectively. By the end of June, the market reaction to the deal took these positions to 5.5% and 3.5% respectively. We are very positive on the education sector in Brazil. During the course of 2015, we significantly increased the strategy’s position in Kroton (and introduced a holding in Estácio for the first time) as the shares tumbled following the government’s decision to reduce student aid. The two companies’ share prices more than halved during the course of the year.

In our view, the reduction in student loans has a small negative impact on our assessment of fair value for the two businesses. The share price reaction in both cases was excessive. Part of the overreaction was due to the wholesale aversion to Brazilian assets, which saw investors sell most Brazilian stocks regardless of their underlying business fundamentals. The material decline in the real against the US dollar meant that the portfolio impact of these share price declines was even more pronounced.

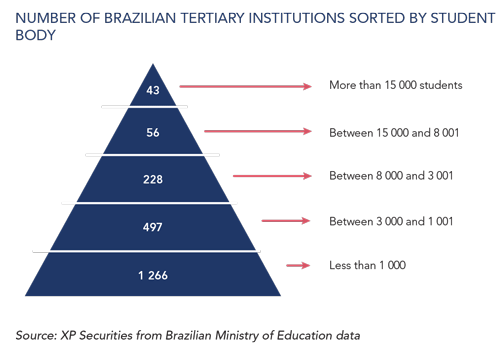

We have long argued the investment case for the Brazilian providers of private education. By some estimates there are over 2 000 private institutions in the country, the vast majority of which has less than 8 000 students (see the figure overleaf). As can be expected, the quality of the institutions’ offerings varies greatly, particularly since many of the private sector players only have a single campus with a few hundred students. This sort of fragmentation makes the market ripe for consolidation; education institutions have a large number of fixed central costs that can be diluted down across a larger student base. This became evident to private equity groups ten to 15 years ago and a few large groups emerged, some of which subsequently became listed entities.

Kroton and Estácio are two such examples, with Kroton resulting from a 2014 merger between the original Kroton and Anhanguera Educacional, the then no. 2 player in the market. In turn, the merger created a clear industry leader with a market share of approximately 15%. Thus, Kroton’s move to buy Estácio (7% market share) will further entrench its dominant position.

Prior to Kroton’s bid, Estácio’s share price had underperformed that of Kroton significantly this year – down 22% to end-May compared with Kroton, which was up 16% over the same period (both in local currency), resulting in a relative underperformance of 38%. In fact, Estácio is one of the few Brazilian stocks we cover that did not benefit from more positive Brazilian market sentiment in response to impeachment proceedings against the (currently suspended) President Dilma Rousseff. Kroton management seized the opportunity to bid for control of the company, offering just less than one Kroton share (0.977 to be exact) for every Estácio share held. The offer was in line with the ratio of the two firms’ share prices over the prior 30 days.

Not surprisingly, Estácio’s board felt this offer was opportunistic and undervalued their business significantly. In their view, the ratio of the two firms’ share prices had been closer to 1.5 times over the 23-month period since the merger of Kroton and Anhanguera, which Estácio believed was the more appropriate benchmark to reference any bid. With quite a large gap in expectations between the two parties, it was fairly possible for the deal to fall through. However, shareholders strongly favoured the two firms coming to an agreement and for the Estácio board not to risk the deal by demanding too high a price. The departure of the Estácio CEO and COO (who was previously the company CFO) during the negotiation period added to the urgency of finding a suitable solution. Two competing bids from a large Estácio shareholder (to take control) and from another smaller education group (to merge with Estácio) were not, in our view, worth serious consideration.

Coronation played a leading role in advocating the merits of the Kroton bid. We based our support solely on our view of the quality of management at the respective firms: we believe that Kroton’s management would be able to realise much more value from Estácio’s assets than the latter’s management (particularly after the aforementioned executive departures). Kroton also believed they could realise significant synergies upon merging with Estácio, which we estimate could be in the region of R$3 billion to R$4 billion in present value terms. At the time the bid was launched, Estácio’s market capitalisation was only R$3.5 billion, making this a great deal for Kroton shareholders, but less so for those in Estácio. We still believed, however, that the deal should be supported if Kroton made an appropriate revised offer. The difference in management quality should ultimately prove very beneficial to Estácio shareholders; receiving Kroton shares instead of cash means they should continue to benefit from the growth in the combined entity under Kroton management.

Kroton’s management has an exceptional track record, clearly demonstrated over recent years. At the end of 2011, the capitalisation of Kroton and Estácio was almost the same. Since then, and prior to the bid, Kroton’s market capitalisation has increased to more than five times that of Estácio. Even accounting for the Anhanguera acquisition, this is still a big divergence in performance. The compound annual return delivered to Kroton shareholders over the period has been 42.2% per annum compared to 14.7% per annum for Estácio – a difference of 27.5% per annum. The share price divergence has mirrored the difference in operational performance – in particular, our preferred metric of free cash flow (operating cash flow less capital investments), where Kroton has delivered six times the free cash flow of Estácio over the period. When Kroton bought Anhanguera in 2014, the two firms had EBITDA margins of 36% and 19% respectively. Today, the combined firm has EBITDA margins of 41%. Kroton targeted annual synergies of R$300 million by 2018 from the combined entity – by 2015 it had already realised almost R$400 million worth of synergies. It has exceeded targets by so much that the final synergies number was revised up to R$620 million by 2018. We believe the Kroton management team is capable of replicating its previous feat with Estácio’s assets. (In our view the company CEO, Rodrigo Galindo, is among the best we have ever come across in emerging markets.)

We lobbied hard for Estácio to negotiate with Kroton to reach a mutually acceptable deal. This included letters to the board of directors and chairman of Estácio’s board, as well as numerous conversations with various parties in which we outlined the importance of making the correct decision that will ultimately benefit shareholders most. After lobbying by Coronation and other shareholders to both parties, Kroton eventually increased its offer to 1.25 shares for every Estácio share, a 28% increase from the initial offer. Further negotiations first resulted in an improved offer of 1.281 Kroton shares, together with a special dividend to Estácio shareholders of R$0.55 per share, and later in a final offer with the same swap ratio and a dividend of R$1.37, which was accepted by the Estácio board. This takes the final offer to approximately 1.38 Kroton shares per Estácio share. At the time of writing, with Kroton’s share price having appreciated by around 26% since its first offer, Estácio’s shareholders will receive an effective premium of 67% to the p re-offer share price. We did not want to accept a cash offer − it would have meant that we do not participate to the same degree in the upside of the combined entity. As an all-share offer (aside from the special cash dividend), however, the offer has much more merit.

Assuming this deal is accepted by shareholders of both firms (and the regulators), we believe the combined entity will be in a unique position to truly capitalise on the continued growth and consolidation of the education sector in Brazil. Most of the smaller players make very little money as they lack scale (their costs are higher) and their degrees are less recognised than those of the national players (which means they cannot charge as much). Over time many of these players will close, allowing larger players (like Kroton) to really accelerate their organic expansion. Despite the recent share price appreciation, Kroton still trades on 12 times forward earnings, with several years of expected double-digit earnings growth ahead.

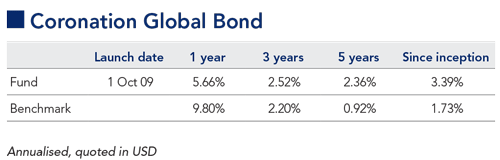

Global bond yields traded in a tight range for the majority of the quarter, but began to fall during June as forecasts for global growth were once again revised lower, the US Federal Open Market Committee (FOMC) continued to exhibit a dovish outlook and the UK voted to leave the EU. This ensured that bonds produced another quarter of solid returns. In local currency terms, the Barclays Aggregate Bond Index was up 2.89% and the fund returned 2.88% for the three-month period.

In terms of global growth, the International Monetary Fund recently revised its expectation lower by 0.2% to 3.2% for 2016 and to 3.5% for 2017, although it believes the risk of weaker growth scenarios has increased. In the absence of an upturn in inflation, which continues to remain subdued, the path of least resistance has been lower for global bond yields. With short-term interest rates very close to zero in many major economies, this has manifested through a material flattening in yield curves over the quarter. Negative yielding instruments are no longer a novelty but a reality for most of core Europe and Japan. In Switzerland, the entire yield curve (out to 50 years) yields less than zero; investors now effectively pay the government to look after their money. The fund remains short duration, with no exposure to Japan and very little in Europe. We retain some exposure to the US market, principally in longer maturities.

The US Federal Reserve (Fed) remains highly data dependent and May’s soft employment report took many by surprise. FOMC members clearly are not prepared to take any chances by raising rates too soon as the minutes reveal that six members now expect only one rate rise during 2016. The sizeable downward revisions in June to the Fed’s dot plot (median of 1.625% in 2017 and 2.375% in 2018) mean the Fed continues to track the market lower. Yet the market continues to reflect a much more aggressive path for rates, with the next full rate rise (of 25 basis points) now only priced in for 2018.

The most immediate challenge for Europe must be dealing with the fallout from the UK’s decision to exit the EU. There is a slim possibility that the UK changes course, but the only real certainty is that of uncertainty. Legal or economic realities will replace political rhetoric in time as both the UK and Europe have much to lose from an acrimonious divorce. In the meantime, however, policymakers stand ready to provide further stimulus. Perhaps the most pressing risk is that an economic shock exacerbates the weakness in the banking sector. Low interest rates remain a challenge for banks’ profitability, and in regions such as Italy the issue of nonperforming loans and concerns about the underlying capital strength of the country’s banks have re-emerged. Europe also faces its own political challenges with opportunities for further disruption resulting from electorate votes. One such example is the referendum tabled by the Italian prime minister, Matteo Renzi, on a wide range of constitutional reforms – a vote on which he has staked his premiership.

Growth concerns relating to China were a feature of early 2016, but the authorities have provided further stimulus via lower interest rates, an easing in the exchange rate and another bout of infrastructure spending. This has allowed the recovery in commodity prices to hold for now. The China bears point to the continued surge in debt and the size of the shadow banking system. The truth is, we do not know how this will play out, but suspect China’s growth rate will ultimately deflate rather than stop abruptly.

The slowdown in global activity does not bode too well for emerging markets, but for now the ‘lower for longer’ interest rate scenario in the developed world continues to provide breathing room. The stimulus in China and recovery in a wide range of commodity prices have also helped sentiment. Ultimately a desire to improve economic efficiency and accountability is required. Brazil remains saddled with considerable challenges, but the suggestion that it is ready to face up to some of those challenges allowed for a strong rebound in its currency and bonds since the impeachment process of President Dilma Rousseff commenced. Argentina also successfully sold $16.5 billion worth of debt as it accessed the international bond market for the first time in 15 years during April.

This followed a change in government in late 2015 and the resolution of a decade-old dispute regarding the repayment of bonds on which it previously defaulted. The fund took advantage of weakness in SA bonds and the local currency during May to invest, but subsequently sold the position after a rally in June. The fund’s principal exposure to emerging markets as at quarter-end was via Brazil and Mexico.

Corporate bonds also benefited from investors’ demand for yield enhancement, but there were pockets of weakness. The broad US corporate bond market produced a return almost 1% above that of comparative government bonds during the quarter, but the European corporate bond market’s return was closer to 0.3% as the financial sector underperformed. Unsurprisingly, UK corporate bonds struggled during June and most sectors underperformed government bonds for the quarter. The European Central Bank (ECB) became a buyer of corporate bonds during the period as part of its quantitative easing programme. It would not be a surprise if the Bank of England were to follow suit should the economy require some support in the wake of the referendum decision. The fund took advantage of the very strong rebound in the mining sector to sell its holdings in Anglo American and Glencore. These positions were established close to their lows reached in February of this year. The fund sold its exposure to Sasol after the credit spread tightened as oil prices rose, the uncertainty surrounding SA’s credit rating continued and capex overruns on its US chemical project suggested limited upside. The fund also sold its exposure to Vonovia Finance hybrid securities after a strong run. Furthermore, we added some corporate bond exposure in the form of several financial stocks. In SA, the fund invested in a tier 1 instrument issued by Nedbank and in the US it invested in JP Morgan and Citigroup preferred securities. Cross-currency dislocations have been growing and the fund took advantage of attractive opportunities in some high-quality international names denominated in Norwegian krone and Swedish krona.

In foreign exchange markets, US dollar strength remains a topic of debate, but for the last year the trade-weighted basket (both broad and narrow measures) have traded in a relatively tight band. For some time, both the euro and yen have been undervalued on traditional metrics, but quantitative easing and interest rate differentials have led many to expect a further rise in the value of the US dollar. This has been called into question by the fall in US rate expectations, and the Bank of Japan’s decision to hold off further stimulus was sufficient to drive a strong recovery in the yen (which has rallied from 120 to 100 against the US dollar during the year).

Investors have been very bearish on the euro, projecting parity with the US dollar. However, capital flows and a shift from lower rates to asset purchases by the ECB has proved marginally more positive for the euro. The big loser of the quarter was sterling, which tumbled to a 30-year low against the US dollar following the referendum decision. The fund has retained a preference for US dollars versus euros and yen, and has recently increased its exposure very slightly. Our principal underweight positions in euros and yen have largely funded our exposure to emerging market currencies such as the Brazilian real, which has been very strong in recent months, and the Mexican peso, which has fared less well.

The fund remains underweight duration, principally via Europe and Japan, but the portfolio yield continues to be higher than the index by virtue of our holdings in emerging markets and corporate credit. Global government bond yields in developed markets appear too low and suggest that a large global slowdown is imminent. While we concede that the global economy is not firing on all cylinders, it would still appear to be muddling through. In such an environment, bond yields should ultimately correct higher.

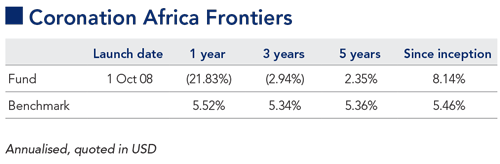

Over the past three months, volatility has remained a theme across the continent and this uncertainty saw the bulk of African stock exchanges close in negative territory for the period. In US dollars, Nigeria was down 17.2%, Egypt by 7.0% and Kenya by 5.4%, while Zimbabwe was up 3.5%. For the quarter, the fund declined by 2.2%, with the JSE All Africa 30 ex SA Index down 2.9% and the benchmark (3-month US dollar Libor + 5%) up 1.4%.

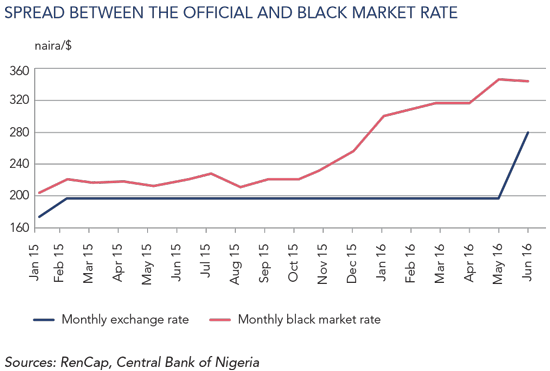

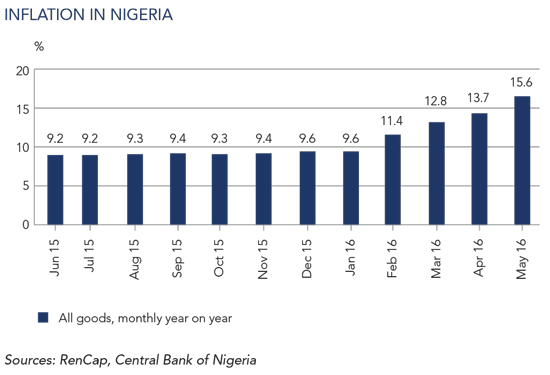

While Nigeria was down in US dollar terms, the market was up 17.0% in local currency (naira) terms over the same period. This was on the back of the Central Bank of Nigeria’s (CBN) decision to remove its exchange rate peg and allow the naira to devalue by around 30%. This decision came in late June, after more than a year during which the CBN stubbornly stuck to an unsustainable peg at N199 to the US dollar. The widening spread between the official and parallel rate, double-digit inflation and US dollar shortages as witnessed during the quarter no doubt served as the proverbial straw that broke the camel’s back.

While the CBN maintains it has moved to a ‘flexible’ rate, the verdict is still out on whether the market functions in a way that allows the rate to fully reflect supply and demand dynamics: the CBN remains the only seller of dollars in the market, banks report variable experiences in filling their dollar orders, and the parallel market still exists and continues to quote a rate well above the current quoted price. In fairness though, we are but a few weeks into the new exchange rate regime.

We are certainly very pleased that the CBN has taken this first step in what is bound to be a painful adjustment process. The Buhari government now needs to address some of the country’s key shortcomings such as a lack of export diversification, its resulting dependence on oil and Nigeria’s growing trade and budget deficits. Despite the president’s good intentions to shelter the people of Nigeria from inflation (one of the key reasons Nigeria held on to the peg), in the short term we do not see any respite in this regard.

Pressure on consumer purchasing power is therefore likely to worsen and this has been the key driver behind our decision to decrease our exposure to consumer-facing businesses. While Nigerian Breweries remains one of the most attractive companies in our universe, we have reduced our position and also sold Guinness Nigeria. We have avoided companies like Nestlé Nigeria, Unilever Nigeria and Flour Mills of Nigeria.

The latter two businesses lack pricing power and while Nestlé Nigeria has pricing power, it holds significant US dollar-denominated debt. We have used the proceeds of our sales to buy stocks that we believe are likely to benefit most from the devaluation and that are least exposed to liabilities denominated in hard currency. Dangote Cement is one such stock. The company has been commissioning cement plants across the continent, which has resulted in an increase in US dollar revenues as a percentage of sales. Any devaluation will benefit Dangote Cement as its revenue from international operations (30% of total revenue) serves to cushion any rising import costs. We have also maintained a healthy exposure to Seplat Petroleum Development, which earns all of its revenue in US dollars and has a significant cost base priced in naira.

We are cognisant that the near-term environment in Nigeria will remain tough, but the decision by the CBN to move away from a fixed exchange rate regime is a very positive one. Over the medium to long term, Nigeria is one of the most attractive markets globally. We remain committed to our bottom-up, valuation-driven approach to stock picking which we believe allows us to take positions in high-quality companies that are undervalued by the market. Holding these positions through the cycle should provide outperformance to our clients over the long term.

South Africa - Institutional

South Africa - Institutional