International portfolio update - January 2017

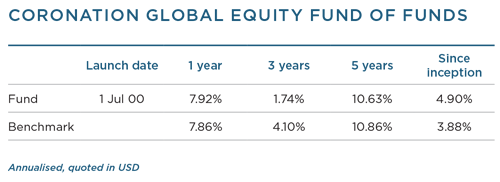

The fund declined 1% against the benchmark advance of 1.2% for the quarter. This brings the rolling 12-month performance to 7.9%, in line with the MSCI All Country World Index.

The election of Donald Trump as US president in early November took many by surprise and set off a strong rally in the US equity markets, especially among the energy, materials and financial sectors. This was in response to Trump’s campaign promises of fiscal stimulus through tax cuts, increased spending on infrastructure and defence and other measures including, among others, the lifting of restrictions on energy production and deregulation in the banking sector.

The US Federal Reserve also delivered on the widely anticipated 0.25% rise in interest rates in December and further indicated that it may raise rates three times during 2017. A strengthening in the US dollar meant that strong equity market performance in Europe and Japan was somewhat muted in the fund’s base currency.

North America was the best performing region by a large margin, rising 3.5% (in US dollar terms). Asia ex-Japan declined 2.7% (in US dollar terms) and was the weakest region this quarter. Japan was marginally negative, declining 0.2%, while Europe declined 0.4% (both in US dollar terms). Emerging markets underperformed developed markets by 5.8% (in US dollar terms). The fund’s regional positioning had a negative impact on performance.

Among the global sectors, financials (+14.1%), energy (+6.7%) and materials (+2.7%) generated the best returns. The worst performing sectors were real estate (-6.5%), consumer staples (-6%) and healthcare (-5.6%). On a look-through basis, the fund was negatively impacted by its sector positioning, principally as a result of having an underweight position in financials and energy and an overweight position in the IT sector. Low exposure to healthcare and utilities had a small positive impact.

In general, the underlying managers struggled over the quarter and detracted from the portfolio’s performance.

Maverick Capital declined 1.8%, with large positions in Anheuser-Busch InBev (-18.5%), Universal Health Services (-13.6%), Sabre Corporation (-11.0%) and Seven & I (-6.4%) the key drivers behind the manager’s negative performance. Although currency hedging and positions such as CommScope (+23.6%) and Waste Connections (+5.5%) performed well, they were not enough to compensate for the detractors.

Conatus Capital had a weak quarter, driven by top holdings including Constellation Brands (-7.7%), PayPal (-3.7%), Activision Blizzard (-18.5%) and Facebook (-10.3%). Maverick and Conatus both have excellent long-term track records and we remain confident in their ability to deliver going forward.

Viking Capital, which has had a stellar track record in recent years, also underperformed over the quarter, driven by its technology exposure (Facebook -10.3%, Amazon -10.4% and Alphabet -1.4%).

On the positive side, Egerton Capital enjoyed a good quarter, outperforming the index, with positions in Airbus (+16.7%), Safran (+8%) and Charter Communications (+6.7%) contributing to this performance.

After a poor run, Vulcan Value Partners delivered strong returns as the likes of Swiss Re (+10.1%), Anthem Inc. (+15.3%), Axis Capital (+20.8%) and State Street Corporation (+12.25) all performed strongly on the outcome of the Trump victory.

The global economy and markets enter 2017 in a considerably better position than this time last year. There is an improved outlook for developed economies, with growth momentum picking up and risk assets rallying in the wake of the US presidential election. Markets are indicating that the new US leadership should have a fundamentally positive impact on the US economy. A faster growing US economy is good for the global economy, although it will take some time before its impact is felt outside of the US.

In Europe, the year ahead is filled with elections and referendums that may reshape the political landscape. Together with the start of the long-awaited Brexit negotiations in March 2017, these risks should not be ignored. Emerging markets face near-term challenges as the stronger US dollar leads to capital outflows and rising interest rates. Trump’s views on globalisation remain a risk and any strong action in this regard may cause further global stress.

The event that overshadowed financial markets this past quarter (and for that matter, the entire 2016) was the election of Donald Trump as the 45th US president. For the second time during the 12-month period, opinion polls got the final result of a major election or referendum dead wrong. While commentators were united in expecting the worst for equity markets in the event of a shock result, the opposite happened. The market upheaval has been spectacular, and these newly established trends were continuing to play out at the time of writing.

Equity markets declined sharply for a short while on 9 November 2016 (the day after the US presidential election), but the Standard & Poor’s (S&P) 500 Index closed the day up 1.1%. Since the election date, the S&P 500 Index has gained more than 6%. However, the most volatility has been experienced within sectors. Trump’s promises and threats regarding taxes and global trade reverberated across the markets with spectacular results.

Financial shares (more specifically banks) stood out and outperformed strongly, with the sector being up 21% for the quarter. This rally was fuelled by the promises of higher economic growth, lower effective tax rates and less regulation.

Most cyclical shares rebounded, especially those that should benefit from the promised infrastructural investment programme and the ‘Made in the USA’ initiative. The energy sector benefited from both the anticipation that less regulation will facilitate volume growth and a renewed effort by the major oil producers to curtail production to prop up the oil price. The losers in this rotation exercise were healthcare (even though a Clinton election would arguably have been worse for the sector), consumer staples (also impacted by a sharp increase in long-term interest rates, discussed below in more detail) and information technology (although this sector should benefit from the proposed capital repatriation relaxation).

Some of these themes had a significant impact on other assets classes. The promise of stronger economic growth, lower tax rates (implying a higher budget deficit) and some hawkish comments in response to the actions of the US Federal Reserve led to a sharp adjustment in interest rate expectations. The US ten-year yield moved from 1.85% on election day to 2.05% two days later, and finished the year at 2.44% − a massive adjustment of 60 basis points in a very short space of time.

Expectations for short rates also kicked up, albeit not as dramatically. As a result of these moves, the real estate sector sold off, becoming the second worst performing sector over the quarter after healthcare. The US dollar strengthened from more than $1.10 to the euro to its current level of around $1.05, but emerging market currencies perversely strengthened on the prospect of better global economic growth. The gold price fell from $1 275 to a low of $1 130 on higher inflationary expectations and the stronger US dollar, while most commodity prices (especially copper) rose.

All of this culminated in one of the most memorable quarters in financial markets in recent history. The global index (MSCI All Country World Index) returned 1.2% over the quarter and 7.9% for the last year. Within developed markets, the UK was a notable underperformer, given the continued uncertainty after the Brexit vote.

Over the course of 2016, US equities performed strongly, outperforming the global index by around 4%. While emerging equity markets underperformed during the final quarter of the year as Chinese stocks declined on Trump’s anti-China rhetoric, they still outperformed the global index by 4.5% over the year. Brazil and Russia were the two stand-out performers of 2016, supported by both currency strength and a strong equity rerating.

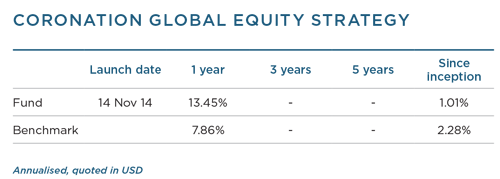

The strategy performed well against this volatile backdrop. Its quarterly return of 2% outperformed the benchmark by 0.8%. More importantly, the strategy’s annual return of 13.5% outperformed the benchmark by a very respectable 5.6%. This was a very satisfying outcome given the strategy’s poor relative performance in 2015. The strategy has now clawed back almost all of the initial underperformance since its launch in November 2014. We remain committed to not only erase this deficit, but to also justify our active approach to fund management by achieving positive alpha over the medium to longer term.

Another satisfying feature of our more recent returns is the higher hit ratio we achieved over the past quarter. This ratio of 1.57, which represents the fund’s winners relative to losers in terms of individual stock positions, is the highest since inception. While the ratio in itself does not guarantee good performance (it is far more important to avoid big losers and upsize your winners), it is indicative of an investment process that adds value in terms of tilting the odds of outperformance in our favour. As a matter of interest, this number is still below one since inception, as initially a number of our emerging market positions cost us dearly.

For the quarter, most of our positions in the more cyclical shares and alternative asset managers made a positive contribution to performance. Notable contributors include KKR, Apollo Global Management and Blackstone, as well as Tempur Sealy, American Express and the strategy’s US airline positions.

TripAdvisor continued to disappoint (after another poor set of results), while some of our technology positions such as Amazon and Facebook suffered from the vicious sector rotation. The fact that the strategy still outperformed, despite being materially underweight US banks, shows that the bulk of the rest of the portfolio was very supportive.

The biggest contributors to the strategy’s strong performance were Kroton/Estácio (Brazilian education companies currently merging), Apollo Global Management (with the alternative asset manager having bounced back strongly after a prolonged period of poor share price performance), NetEase (a Chinese gaming company subsequently sold after a very strong share price rerating), Charter Communications (still a big position within the strategy) and Urban Outfitters (which we sold out of and recently reintroduced into the portfolio).

Losers over the period include TripAdvisor, JD.com (a Chinese e-commerce operator still building scale), LPL Financial Holdings (a financial advisory business sold after disappointing operational and strategic results) and Pershing Square (the listed vehicle of the prominent investor Bill Ackman, and still one of the strategy’s biggest positions).

Investors who follow the portfolio closely will notice that for the first time since inception we have added meaningfully to the so-called consumer staple sector. We added roughly 8% of the portfolio to a basket of these shares during the quarter.

The biggest buys include British American Tobacco (1.7%), Anheuser-Busch InBev (1.4%), Unilever (1.2%) and Heineken (1.2%). Seeing that we expect the long bond yield in the US to continue rising over the next few years, we might get more opportunities to buy some of these high-quality companies at attractive valuation levels, and we are standing ready to do so. However, we will always be conscious of valuation, wanting to pay a fair entry price, as this will be the key determinant in whether a holding will add value to the overall portfolio performance.

The global economy and markets enter 2017 on considerably firmer footing than last year. However, markets have moved quickly to reprice assets that should benefit from this improved outlook.

As such, we have become slightly more conservative in our portfolio positioning. The aforementioned holdings in consumer staples have added to the reduced risk profile. We have also bought some put options to protect the fund against unforeseen hiccups, as the cost of these protection strategies remains attractive, in our opinion.

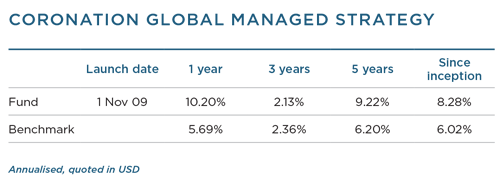

The strategy performed well against the volatile backdrop (as discussed in the Global Equity Strategy commentary). Its quarterly return of 0.6% outperformed the benchmark by a significant 2.8%. More importantly, the strategy return of 10.2% exceeded the benchmark return by a very satisfying 4.5% for the 12-month period. This was a very gratifying outcome, given the strategy’s poor relative and absolute performance in 2015. Since inception more than six years ago, the strategy has outperformed its benchmark by just more than 2% per annum on a gross basis − a noteworthy performance.

The robust performance over the last year was partly due to very strong equity selection, with the strategy’s equity carve-out outperforming the MSCI All Country World Index benchmark by a strong 6%. This was also due to a pleasing result from our merger arbitrage bucket, which returned 14.3% for the year. At year-end, we still had a few positions open, but the opportunity set has shrunk somewhat.

In addition, by being very hawkish on the outlook for developed market government bonds, and therefore hedging out the interest rate risk in our credit holdings, we have managed to avoid the bulk of the bond market carnage over the quarter. As an illustration, our credit carve-out returned a very marginal -0.1% over the quarter, and a pleasing 7.7% for the year.

The negative contributors to performance include our property holdings (particularly over the last year) and our position in physical gold. The gold position was only initiated during 2016, and was considered a form of protection or diversification, but the poor performance in the price of gold was still disappointing. We also held a few protection strategies against our physical equity holdings which, given the Trump rally, have cost us some insurance premium. We will continue to add some protection to the portfolio to manage overall risk.

Within equities, most of our positions in the more cyclical shares and alternative asset managers contributed positively over the quarter (as highlighted in the Global Equity Strategy commentary).

Within property, we have reduced some of our positions, but also added to other holdings such as Cromwell (as the market sold off during the first six weeks of the quarter). We continue to monitor opportunities in the US, but have not acted on any as yet. In terms of credit, we are in the process of reducing the strategy’s exposure, as the Trump rally has positively impacted credit spreads. In turn, we have added to our gold position over the quarter into price weakness.

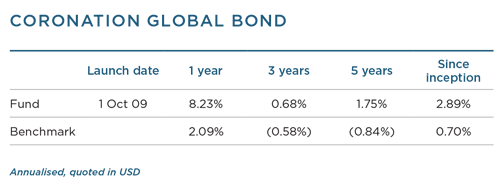

Global bonds as measured by the Bloomberg Barclays Global Aggregate Bond Index fell by 7.1% during the fourth quarter as international bond yields rose sharply. US 10-year bond yields rose from 1.6% to 2.6%, with the bulk of the increase following the US election result. While much of the new presidency’s policy details remain highly uncertain, fiscal policy should again become more influential, as we highlighted in previous commentaries.

The sell-off in developed market government bonds also reflects a rising risk premium within bond valuations, as well as elevated expectations for future interest rates, as global growth has surprised to the upside and inflation expectations have risen. Emerging markets and corporate bonds performed well under the circumstances as investors continued to seek out yield. The fund returned -4.41% during the quarter.

While the magnitude of the rise in yield may appear extreme, one needs to reflect on how extended valuations had become. By mid-2016, longer-dated breakeven rates of inflation in the US had fallen to 1.5%, as investors effectively priced in an undershoot of the US Federal Reserve’s (Fed) inflation target for years to come. At the same time, the Fed grew increasingly vocal about the level of slack in the labour market, signalling that they expected rate increases of well above those priced by the market. Meanwhile, the limitations of loose monetary policy were increasingly debated and a greater role for fiscal policy widely advocated. Both presidential candidates in the US election proposed more expansive fiscal policies.

The election of Donald Trump and his much-vaunted focus on infrastructure spending merely brought the debate to the centre stage. At this juncture, we know the thrust of Trump’s policies, but not the detail, the timelines or how successful he may be in implementing his objectives. In the short term, the new administration’s ‘America First’ approach is likely to be very positive for growth, and econometric modelling suggests that rates may need to rise by considerably more than priced by the market, even after the recent sell-off. Whether policy changes can actually boost the long-term growth rate of the US economy beyond the first few years remains more uncertain.

As expected, the Federal Open Market Committee (FOMC) increased the target range for the federal funds rate by 0.25% (from 0.5% to 0.75%) in December, and also raised its profile of future rate expectations for the first time since mid-2014 (which followed a run of eight successive cuts). Minutes of the meeting revealed FOMC members saw an upside risk to their growth forecasts on the provisional assumption that fiscal policy would be more expansionary.

Concern was also expressed about an undesired undershooting of the natural rate of unemployment. When asked about Trump’s fiscal plans, chairperson Janet Yellen suggested that a fiscal expansion would be more appropriate when unemployment was higher, while also stressing she had never advocated a policy of ‘letting the economy run hot’. The fund took advantage of the sell-off in yields to increase its duration slightly and reduce some of its inflation-linked bond exposure in favour of fixed rate Treasuries after the widening in breakeven rates.

Meanwhile in Europe, economic momentum has surprised to the upside on the back of better domestic demand, as lower oil prices and less austerity boosted consumers. In some countries such as Germany, the weaker euro has helped exporters and low rates have aided construction. The improving picture has increased the European Central Bank’s (ECB) confidence that economic recovery is on track and that deflation is no longer an issue. In fact, European breakeven rates of inflation have recovered by the same magnitude as those in the US during the last six months. At the December meeting of the ECB, the decision was taken to scale back the Asset Purchase Programme from €80 billion to €60 billion per month, with further reductions (most likely in the second half of 2017) under consideration as inflation adjusts towards 2%. Policy rates meanwhile are set to remain on hold for a considerable time. Much of the market’s focus in 2017 is likely to be on politics, with elections in Germany, France, the Netherlands and probably Italy. After the political surprises of 2016, investors are more conscious of the risks, with Eurosceptic parties in Italy and in particular in France opening up existential risks.

Emerging market bonds came under pressure in mid- November after the US election, with the spread on the Emerging Market Bond Index (EMBI) widening as much as 50 basis points (bps) to just over 400 bps. However, this appears to have been driven by selling from exchange traded funds and, for the most part, markets regained some of their poise as the markets’ indigestion abated. For 2016 as a whole, emerging market bonds performed well, with the EMBI spread closing at 360 bps – a far cry from the 540 bps in mid-February. In the local currency space, emerging market bond yields performed better than might have been expected given the rise in US yields.

There were a few exceptions, with Mexico the most obvious casualty of a Trump presidency. The fund has increased its exposure to emerging market assets by buying SA local currency government debt and also hard currency debt denominated in euro. The fund initially increased its allocation but subsequently halved its exposure to Mexico following the US elections. A position was established in Turkey via a short-dated currency forward position and also through hard-currency US dollar bonds. The fund took a small position in Egypt and Argentina via currency forwards after significant moves in the currencies.

In emerging markets, currency moves often dwarf moves in underlying bonds, but the fourth quarter also witnessed sharp falls in major developed market currencies against a stronger dollar. Of the G10 currencies, the yen weakened the most – down just over 13%, as widening interest rate differentials once again became a major driving force behind currency moves.

The euro fell by 6.4% and sterling by 5% against the US dollar during the quarter. With a potentially more hawkish Fed, US corporate tax reform and a potential tax holiday on the repatriation of US offshore earnings, continued US dollar strength is a compelling view, but arguably one that is already backed by significant consensus.

Continued capital outflows from China, the Brexit overhang in the UK, elections within Europe and a yield targeting regime in Japan all reinforce the US dollar strength story. Continued dollar strength will likely depend on how much fiscal stimulus actually transpires, with Fed members suggesting every 1% equivalent of GDP may translate into 50 bps of rate rises. Within emerging markets, we have seen a number of sizeable moves in exchange rates. The Mexican peso has been a high-profile casualty of Trump’s election, while in Turkey, deteriorating macro conditions and heightened political risks have seen the lira weaken considerably. In frontier markets, Egypt allowed its currency to float freely (triggering a fall of over 50%) after finalising a $12 billion loan with the International Monetary Fund. The fund has continued to run an overweight US dollar position, while maintaining an underweight position in euro and yen. The fund is now neutral on sterling and has been increasing its recent emerging market exposure from its overweight dollar position.

The initial reaction of markets to the US election has been positive for riskier assets, which have rallied on the back of expectations of a stronger US economy. Fears of an impending slowdown in the US have been cast aside, and equity markets in developed markets have rallied just shy of 10% since the election.

The increased optimism was also felt in corporate bond markets, which took their lead from equities and rallied strongly post the election. Despite a record $1.43 trillion of new issuance in US investment grade names and $681 billion of net new issuance, demand for yield again seemed insatiable as the broad investment grade index generated returns of approximately 1.5% more than US government bonds in the fourth quarter and 4.4% for 2016 as a whole.

Asset purchase programmes in Europe, and more recently in the UK, have also provided a strong backstop for markets. The fund invested in new issue from MTN and also purchased some Intu convertible bonds, while selling its exposure in Standard Chartered.

The fund continues to run an underweight duration position, principally via Europe and Japan, while the yield on the portfolio remains comfortably above that of its benchmark. The forthcoming presidency of Donald Trump has been billed by some as one of the most significant events of recent times, but at this stage, given the lack of clarity on key policies, it is difficult to gauge how the world’s most important and influential bond and currency markets will be shaped. It does seem, however, that the period of strong cross-asset correlations may be over, and with that comes greater opportunities.

Frontier markets produced a mixed performance over the quarter. Sri Lanka, which is now the strategy’s largest country exposure, was down 6.7%. Egypt (our second largest country exposure) fully embraced its move to a floating exchange rate regime in November 2016, the short-term impact of which resulted in a 51% currency devaluation and a drag on the strategy’s performance over the period.

The decision to float the currency, coupled with subsidy removal and a $12.4 billion International Monetary Fund deal, sees the economy completely reset and the country well positioned for growth. The Egyptian market was down 24.4%, despite the market increasing 54.4% in local currency terms over the quarter.

In contrast, there was strong demand for equities in Zimbabwe, partly due to the introduction of the new ‘bond notes’, which resulted in the Zimbabwean market being up 46% for the quarter. Pakistan gained 18%, while Bangladesh was up 7.3%. Against this backdrop the strategy was flat (0.1%), compared to the 3 Month USD Libor, which was up 0.2% and the MSCI Frontier Markets Index, which rose 0.5% for the quarter.

2016 as a whole also saw a mixed performance across the frontier universe: Pakistan (+46.4%), Morocco (+27.4%), Zimbabwe (+25.8%), Vietnam (+14.8%) and Bangladesh (+9.0%) all did well, while Egypt (-25.5%) and Nigeria (-40.7%) were negative, largely due to significant currency devaluations during the year. Sri Lanka returned -12.6%. For 2016, the strategy delivered +7%, which is well ahead of both the 3 Month USD Libor (+0.8%) and the MSCI Frontier Markets Index (+3.2%).

The largest contributors to performance in 2016 were Guararapes (a Brazilian clothing retailer) and Beximco (a pharmaceutical company in Bangladesh), while the largest detractors were Bulgartabac (a Bulgarian tobacco company) and Qalaa Holdings (an Egyptian conglomerate with interests in energy assets).

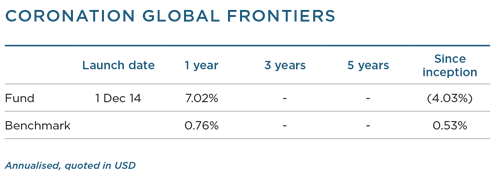

Due to a tough 2015 for frontier markets in general, the strategy’s annualised return since inception is -4.0%. This is lower than the 3 Month USD Libor, which returned +0.5%, but comfortably ahead of the -7.5% recorded by the MSCI Frontier Markets Index.

In 2016, the shining light in global frontier markets was Pakistan. The strong performance of the Karachi Stock Exchange 100 Index (up 46.4%) has been driven by an expansion in energy supply, excitement around the China Pakistan Economic Corridor (CPEC), security improvements and the announcement that MSCI will be upgrading Pakistan to emerging market status in 2017. Pakistan comprises 9.4% of the strategy, making it our third largest country exposure.

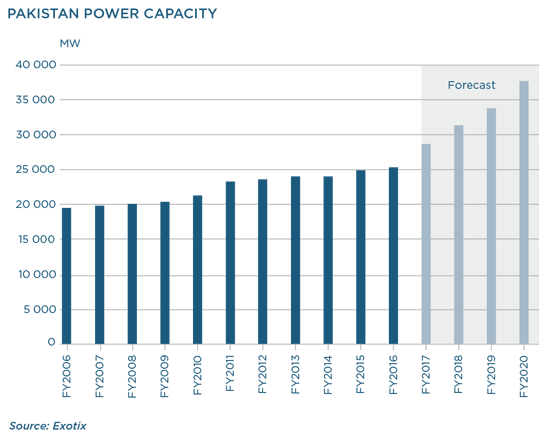

Pakistan has long suffered from insufficient energy supply and a lack of business and consumer confidence due to the ever-present threat of terrorism. The government has prioritised power generation, and a number of projects are due to come online over the next few years (see the following graph).

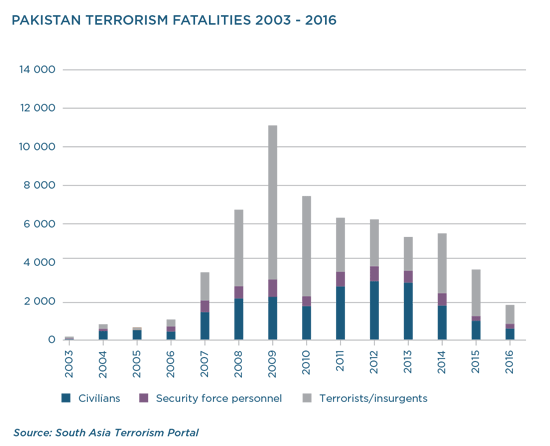

When we visited Karachi and Lahore in March 2014 there was a very real concern around the rule of law and civilian safety. This has changed dramatically since then, as can be seen in the following graph. Total fatalities fell 33% in 2015 and a further 51% in 2016. This has been the safest year in a decade and has resulted in a marked improvement in business sentiment and private consumption.

Another key driver to Pakistan’s performance in 2016 has been the excitement around the CPEC and the impact it is likely to have on corporate earnings over the medium term. The CPEC refers to an economic corridor stretching from Gwadar in southwest Pakistan to Kashgar in western China.

The corridor includes $51 billion of power generation and infrastructure projects, mainly financed by the Chinese. The improvement in infrastructure will see broad-based benefits across the economy from the commercial port in Gwadar, improved road and rail networks, and power generation growth. This should see local banks enjoying a pick-up in private sector credit growth after a number of years of stagnation. The project construction phase should provide a boon to local cement manufacturers, with an estimated four million tonnes per annum needed – 10% to 15% of current industry demand. We are confident that our banking and cement holdings are well positioned to benefit from any incremental demand from the CPEC.

The final driver of Pakistani positivity is the announcement that MSCI will be upgrading the country to emerging market status. We typically place little value on MSCI’s arbitrary country classifications, but there are investors who do. The upgrade has the potential to see emerging market investors look to enter Pakistan, while some frontier investors will be forced to sell. The net impact is, however, likely to be positive and some investors are buying in the run-up to this.

We continue to be excited about the strategy and its underlying companies’ future prospects. We believe that the portfolio holds a number of attractively valued businesses across our frontier market universe. While Pakistan was the very bright star of 2016, we look forward to seeing which markets will deliver in 2017 and beyond.

*All returns are quoted in US dollar terms unless otherwise stated.

Please click here for the Coronation Global Emerging Markets Equity and here for the Africa Frontiers strategies commentaries.

South Africa - Institutional

South Africa - Institutional