The year in review - January 2017

2016 was an unsettling year on many fronts. For Coronation investors, however, the year brought reassuringly strong returns as many of our key long-term positions came to fruition.

Equities continued to be our preferred asset class for producing inflation-beating returns. We favoured global over domestic equities on the basis of valuation, and remain at the maximum offshore limit for most funds. In US dollars, the MSCI All Country World Index returned 1.2% for the fourth quarter and 7.9% for the calendar year, while the MSCI Emerging Markets Index declined 4.2% for the quarter, but delivered 11.2% for the calendar year.

As expected, the US Federal Reserve raised interest rates by 25 basis points (bps) in December. Our base case remains that the pace of interest rate normalisation will be gradual and that interest rates will remain at historically low levels for longer. Despite the obvious political uncertainties inherent in a Trump presidency, markets have taken the view that accommodative monetary policies, fiscal stimulus (lower taxes and increased state spending on infrastructure), and a commitment from the US government to cut regulation and support business will be very positive for equities.

Locally, the FTSE/JSE All Share Index (ALSI) returned -1.9% for the quarter and 15.9% for the calendar year in US dollars. Given the significant strengthening of the rand (+11.5% against the US dollar), this translated into a rand return of 2.6% for the index for the calendar year.

SA economic growth remains subdued with risk to the downside, given the backdrop of a weak global economy, instability caused by political infighting and the risk of a credit downgrade to junk status. Recent rand strength has improved inflation expectations and, together with weak economic growth, this means that the SA Reserve Bank is unlikely to hike interest rates further.

Domestic equities appear moderately attractive. While the ALSI is near its peak in rand terms, it has basically tracked sideways for the last five years in US dollar terms. We believe the global businesses listed in SA are attractively valued and as such, our portfolios have healthy weightings in stocks such as Naspers, Steinhoff International Holdings, British American Tobacco (BAT) and Anheuser-Busch InBev (ABI).

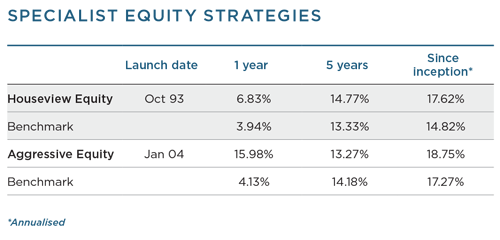

Both the Houseview Equity and Aggressive Equity portfolios delivered strong alpha over the past year, and were well positioned to capture the strong rally in the commodity sector. The Aggressive Equity portfolio offered an outstanding return of 15.98% over the year, outperforming its benchmark by 11.85%, while Houseview Equity’s return was 6.83% for the year, delivering alpha of 2.89%.

Resource shares rallied by more than 34% for the year and our selected holdings in the sector were star performers. Anglo American, a blue-chip company which has been in existence for over a hundred years and which some commentators were claiming would go bust in 2016, delivered a phenomenal 183% return for the 12-month period.

Exxaro delivered a 103% return – as we have explained many times before, it is not that exposed to floating price contracts for its coal sales and was not expected to fall like other resource companies. Finally, Impala Platinum came through with a 70% return over the 12-month period.

Our funds started accumulating an overweight position in resource shares in 2014 and 2015, which detracted from performance over that period and made holding resources at the beginning of 2016 a challenging view to many investors. Headlines were pervasively negative and many questioned the sustainability of these business models if spot prices prevailed. Our focus was on company valuations based on normalised commodity prices, which suggested that resource companies were looking extremely cheap. This view was not indiscriminate. We held shares where underlying commodity exposure was supported by long-term supply-demand fundamentals. As such, we not only benefited from the resource rally, but our specific holdings have outperformed the sector.

Despite the recovery we still have a healthy weighting to resources, as valuations on a through-the-cycle basis are still compelling. We have, however, trimmed some positions, given the reduced margin of safety. Our preferred holdings remain Anglo American, Mondi, Exxaro and the platinum producers. We continue to favour platinum over gold producers and prefer the low-cost platinum producers Northam and Impala Platinum.

Like most market participants, we had no crystal ball with which to predict that 2016 would be the year in which commodity prices would stabilise and share prices would rally. What we did do differently to the market was to be prepared to invest when we felt that the long-term value of the businesses, as informed by our assessment of long-term commodity prices, was incredibly cheap. The recovery in the resources sector was swift and sharp, and we benefited fully thanks to our early positioning.

Given the weak domestic economy, it will be a challenge for the average business to defend (let alone grow) earnings in real terms. In such an environment, high-quality businesses thrive and take market share from the weaker ones. To this end, we hold reasonable positions in food retailers and producers as well as selected consumer-facing businesses (Foschini and Woolworths). These businesses are well managed and trade below our assessment of fair value.

We have added some new positions to the Aggressive Equity portfolio over the past quarter, including Sasol, which the fund has not owned for some time. We believe the company is now discounting most of the bad news around the Lake Charles ethane cracker plant. Other recent additions include Netcare and the SA fast-moving consumer goods business Spar, which has successfully expanded into Ireland and, more recently, Switzerland.

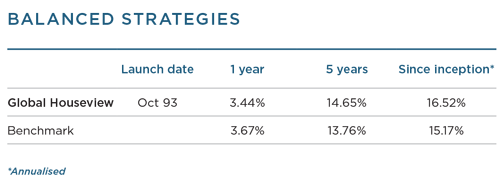

Our balanced portfolios have continued to deliver respectable returns, with the Global Houseview portfolio outperforming its benchmark over the final quarter as well as longer, more meaningful time periods.

Through the year, we have held a full exposure to offshore assets. Over the 12-month period, the strength of the local currency had a negative impact on the rand returns from these assets, but the rally in commodity stocks provided some support, as did our sustained bearish position on global bonds. At the start of last year, our very low weighting in global bonds detracted from performance, as we remain steadfast in our view that very low bond yields provide no incentive to invest, with the risk of significant capital losses should these markets revert to mean. This position was validated in 2016, as a sustained sell-off in US government bonds took hold.

We do, however, believe that the yields on local bonds are attractive, especially given a more favourable outlook for inflation in SA over the medium term. The risk premium implied when comparing the yields of local bonds to other developed and emerging market bonds suggests that the market has largely priced in most of the political uncertainties in SA. The domestic bond market returned 15.5% for the year. These returns are flattered somewhat by the low base, with bonds performing very poorly in the month of December 2015 following the sell-off in the wake of Nenegate.

Our SA equity allocation was focused on JSE-listed global businesses that are attractively valued, including Naspers, Steinhoff, BAT and ABI. These businesses are exceptionally well managed and are diversified across numerous geographies and currencies, which make for a robust business model and protect the companies from an earnings shock in any single market. High weightings in these stocks reflect our view on underlying valuations and not a view on the currency. We do not currently have a strong view on the currency, believing it to be fairly priced.

We believe the valuations of local banks remain reasonable on both a price-to-earnings and price-to-book basis. These businesses are well capitalised, well provided for and trade on attractive dividend yields. Our preferred holdings are Standard Bank, Nedbank and FirstRand, and we have increased our exposure to the sector over the last six months. Among life insurers, we prefer Old Mutual and MMI Holdings, both of which trade on attractive dividend yields and below our assessment of their intrinsic value.

Listed domestic property offered a return of 10.2% for the year. We expect domestic properties to show reasonable mid-single-digit growth in distributions over the medium term. Reasonable distribution growth, combined with a fair initial yield, should result in an attractive holding period return. Within our property holdings, we continue to hold the ‘A’ shares and higher-quality names, which we believe will produce better returns than bonds and cash over the long term.

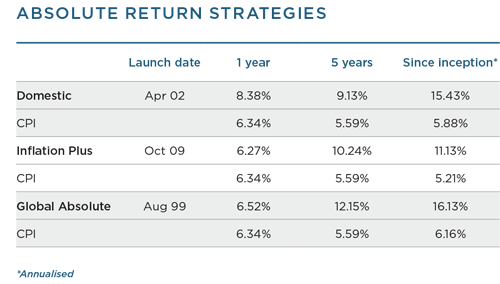

Our absolute return strategies protected investors against inflation, with our Domestic Absolute, Inflation Plus and Global Absolute strategies delivering strong alpha over meaningful periods.

Our resources positioning delivered the bulk of the positive returns over the past year, while the strategies’ outperformance was also supported by the active management of bond positions, including buying when the SA 10-year bond was in the 9% yield region and selling some 50 bps or more lower. Within the bond component, less than 3% of our holdings comprises longer-dated fixed government bonds. Floating-rate stocks and corporate bonds remain the major constituents of our total bond exposure, by a significant margin. We have used the volatility in the rand and the local bond market to good effect, reducing global exposure through currency futures when the rand was weaker and reversing those positions when it recovered.

Our bank holdings have also performed well in 2016. Recent reported earnings from Standard Bank and Nedbank indicate businesses that have managed to deliver quality earnings growth through good cost containment and conservative provisioning. Capital levels remain healthy, which means that these banks should be able to support decent dividend yields even in a tougher economic environment.

Our absolute return strategies aim to deliver a return above inflation while also attempting never to reflect a negative return over any rolling 12-month period. We protected capital and are reasonably satisfied with one-year returns that are slightly better than inflation. Targets of inflation plus 5% to 6% are very tough to meet in a low-return world where companies are struggling to grow earnings and interest rates are in many cases negative in real terms. It is in these challenging times that protecting capital is vital, and our absolute return strategies are managed accordingly.

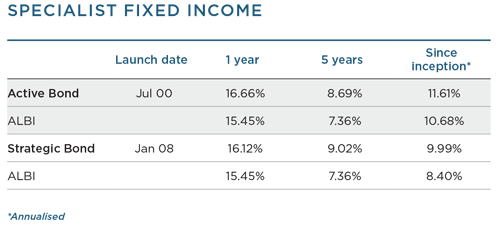

Our fixed income strategies delivered healthy returns over 2016, and strong outperformances over all meaningful periods.

As stated, we believe that yields on global government bonds are currently too low and do not offer value. However, the combination of a more favourable inflation outlook in SA (with risks to the downside), flat local policy rates, an SA risk premium that prices in a good deal of conservatism and a global bond environment that should remain relatively stable, suggests a more encouraging environment for SA government bonds. SA’s 10-year and 20-year government bonds trade close to 9% and 9.6% respectively, which, when taken against an inflation expectation of 5.5% to 6%, suggest a range of real returns of 2.8% to 3.9%. This is a very attractive level, both from a historical and absolute perspective, enhancing the attractiveness of SA government bonds. The main risk to this outlook remains a resurgence in local political volatility that negatively influences the country’s ability to implement policy effectively. While political uncertainty has forced a more tempered approach over the previous year as well as the very near term, we maintain a more positive and constructive view on medium- to longer-term outcomes.

Our fixed income strategies continue to hold reasonable positions in selected corporate bonds where we believe that spreads adequately compensate investors for the risk undertaken. Valuations on inflation-linked bonds still do not support a more meaningful allocation at this point.

Listed property returned -0.7% for the quarter. We expect domestic properties to grow distributions at levels close to inflation over the medium term, even if one assumes an uptick in tenant vacancies. This real growth, combined with a fair initial yield, offers an attractive holding period return. In our multi-asset fixed income strategies, we continue to hold the higher-quality property names, which we believe will produce better returns than bonds and cash over the long term.

As we start a new year, we are bombarded with predictions from numerous financial experts about what lies ahead in 2017. History has taught us that our ability to forecast the immediate future is limited. We will remain focused on long-term valuations and will seek to take advantage of whatever attractive opportunities the market will present to generate long-term rewards for our investors. In an incredibly uncertain world, we continue to strive to build diversified portfolios that can absorb the many surprises that are likely to come our way in 2017.

South Africa - Institutional

South Africa - Institutional