FACTFILE: CORONATION INFLATION PLUS - July 2017

INCEPTION DATE

01 October 2009

PORTFOLIO MANAGERS

Charles de Kock and Duane Cable. Charles is head of Coronation’s Absolute Return unit with 31 years’ investment experience. Duane is head of SA equity with 10 years’ investment experience.

OVERVIEW

Coronation Inflation Plus is designed to provide investors with a consistent real return while trying to preserve capital over short periods of time. As such, it is suitable for low-risk investors who are either approaching retirement or as part of an investment portfolio after retirement. The strategy has a strong track record of protecting investor returns, while also delivering investment growth over the long term. It is managed as part of our absolute return series of strategies, which Coronation first introduced to SA in 1999.

The strategy’s dual target of positive real returns with an overriding focus on limiting downside returns or portfolio losses means that capital preservation in real terms is equally important as return optimisation.

MANDATE

Coronation Inflation Plus has the dual mandate of protecting capital over all rolling 12-month periods and beating inflation by 3% over rolling three-year periods.

It can invest up to 40% in domestic and foreign equities. The strategy is managed in accordance with the limits of Regulation 28 of the Pension Funds Act.

PORTFOLIO CONSTRUCTION

The Coronation Inflation Plus Strategy is actively managed in terms of both asset allocation and stock selection. Investments are selected on their equal measure of upside return and downside risk. Both return optimisation and investor protection are achieved through the inclusion of non-correlated asset classes.

The strategy is invested in mispriced assets that trade below Coronation’s assessment of their long-term fair value. Only assets that offer a substantial margin of safety compared to our fair value estimates qualify for inclusion in our absolute portfolios. We use our own proprietary models, developed over many years, to assist with optimising the asset allocation in the strategy. The models incorporate our own risk, return and correlation expectations for the different asset classes, and are used to ‘sense check’ the bottom-up construction of the portfolio. Through these tools and continual assessment of portfolio positioning, we focus on avoiding key risks and unintended bets in the strategy.

We do not reference a benchmark in our selection of investments in the strategy, and risk is not equated with tracking error or divergence from a benchmark, but rather with a permanent loss of capital. Given the well-diversified, multi-asset nature of our strategy, we aim to ensure that the portfolio is robustly constructed to withstand unforeseen events.

COMPELLING TRACK RECORD

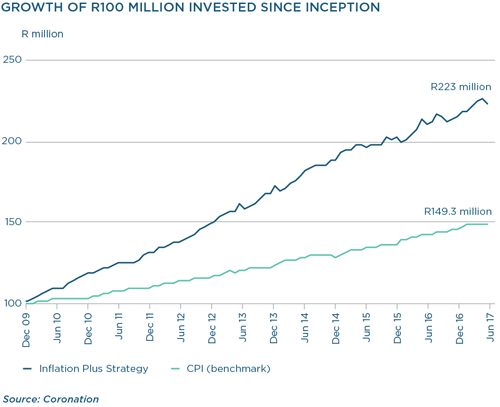

Coronation Inflation Plus has delivered a return of 10.9% per annum since inception, outperforming the CPI (its benchmark) of 5.3% by 5.6% per annum during this time. Equally important is the fact that the fund has never been below zero over any rolling 12-month period.

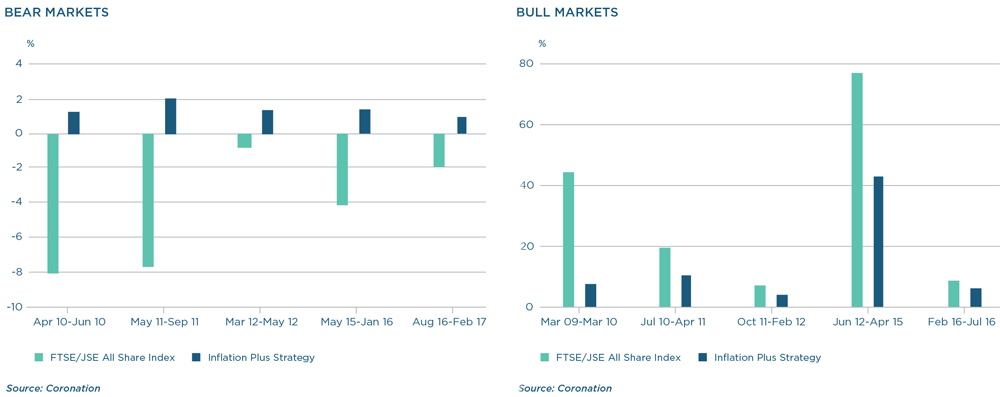

As is clear from the graphs above, Inflation Plus offers a demonstrated ability to protect capital – its losses were much more shallow than those of the market during downswings. As is evident from the second graph, the strategy also enjoyed healthy upside participation in bull markets.

South Africa - Institutional

South Africa - Institutional