INTERNATIONAL PORTFOLIO UPDATE - July 2017

Europe was the best-performing region in the second quarter, rising 7.7% (in US dollar terms). The weakest return was from North America, which declined -3%. Japan returned 5.2% (in US dollar terms). Pre-Brexit uncertainty did not help sentiment in the UK. The fund continues to be overweight North America and marginally underweight Europe.

Among the global sectors, healthcare (+7%), industrials (+5%) and information technology (+5%) generated the best returns. The worst-performing sectors were energy (-6%), telecoms (-2%) and materials (+2%). On a look-through basis, the fund was positively impacted by its overweight position in information technology and underweight in energy and telecommunication.

Over the quarter, the fund advanced 4.3%, in line with the benchmark gain of 4.3%. Egerton and Conatus were the top performers for the quarter, with alpha of 4% above the market. Egerton benefited from holdings in Ryanair (+24%), Constellation Brands (+20%) and Safran (+16%). Conatus benefited from holdings in PayPal (+25%), Aena (+18%) and AIA Group (+18%). Ryanair reported a 6% rise in earnings despite a difficult trading environment. Safran cut its bid price for acquiring Zodiac Aerospace and Constellation Brands raised its full-year profit forecast. PayPal’s revenue grew 17% year on year and the company announced stock buybacks. Aena announced profits significantly above what the market had expected. AIA Group reported record new business growth of 55% for the first quarter of 2017.

Detractors for the quarter were Contrarius and Vulcan. Contrarius’ energy exposure drove its underperformance as the oil price dropped from $52 to $46 by the end of the quarter. Vulcan was held back by its holdings in National Oilwell Varco (-17.7%) and Discovery Communications (-11%). National Oilwell Varco suffered on the back of the oil price decline and Discovery Communications was hurt by fears over future advertising revenue.

We believe that conditions favour continued resilience in US consumer spending and a modest but synchronised upturn in global growth later this year and into 2018. That said, we believe that the outlook for inflation, and central bank actions, will be vital to understanding market direction in the near future.

After an encouraging start to 2017, global financial markets continued their strong form into the second quarter of the year, buoyed by stronger than anticipated economic news out of Europe. Whilst economic data out of the US have generally been disappointing this year, corporate profits continued to surprise on the upside, providing further stimulus to the strong momentum these markets have enjoyed over the last few quarters. Commodity prices have retreated somewhat during the second quarter, led by the oil price that disappointed despite some decisive action by OPEC to constrain supply. The gold price has also been weak.

From a political perspective, the last three months brought more uncertainty, as president Trump continued to surprise both his supporters and his political adversaries with some of his erratic actions. Much-touted healthcare reform stalled due to a lack of support from within the Republican Party, prompting a reassessment of the likelihood that his promised tax reform will be implemented in 2017. The tepid outcome of the UK election contributed to intensified uncertainty regarding the Brexit negotiations. Despite this, the pound actually strengthened over the three months.

Towards the end of the quarter, global equity markets witnessed some extreme sector rotation prompted by a sellside broker report advising clients to take profits in the highflying technology sector. This correction gained momentum as an unprecedented large fine was levied on Alphabet/ Google by the European Competition Commission. Over any longer time period, technology stocks have, however, outperformed all other sectors by a large margin. Energy, materials and telecommunication stocks were the laggards over the last three months. Over the last 12 months, the energy and telecommunication sectors were significant underperformers, with consumer staples a surprisingly weak spot as well. Besides technology, financial stocks did well over the last year, helped in the last quarter by a renewed focus on the benefits of deregulation in this sector in the US.

The biggest contributors to fund performance over the quarter were the alternative asset managers, which continued to rerate as the prospects for stronger short-term profitability improved with the buoyant equity markets. There was also some positive news regarding further fund raisings. Over the last 12 months, this sector contributed about 70% of the fund’s outperformance, aided by the takeout offer for Fortress. This vindicated our long-held positive view on the sector, which even though it added volatility to the overall portfolio, more than compensated us in terms of superior performance.

Other notable winners over the quarter included L Brands (featured on page 16), Yum China (a small position which we exited during the quarter), American Airlines and PayPal. The airline stocks also feature highly on the 12-month contribution list, as do JD.com and Charter Communications.

Detractors over the last months included Liberty Global (following an immaterial restatement of financials due to fraudulent misrepresentation), Schaeffler (poor trading update), Urban Outfitters (very poor newsflow from conventional US retailers) and Estácio (its proposed merger with Kroton has been rejected by Brazilian competition authorities). Read more about the latter development in the following section.

We have continued to add to our exposure in some of the retailers under pressure, with L Brands now in a top-five position. We also introduced another consumer finance company, Discover Financial Services, in addition to our exposure to Capital One. We see their low ratings as an attractive investment opportunity, especially as their strong capital position affords them flexibility in terms of capital allocation, despite the recent regulatory Comprehensive Capital Analysis and Review setback for Capital One. We reduced our exposure to some of the consumer staple names, as they continued to rerate after their sell-off towards the end of 2016. We continue to rate these companies highly in terms of quality, but have become more concerned about valuation levels.

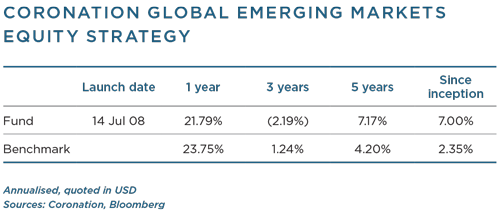

The Coronation Global Emerging Markets Strategy returned 7.1% during the quarter, compared to the 6.3% of the benchmark MSCI Emerging Markets Total Return Index, representing outperformance of 0.8% for the period.

The biggest contributor to alpha for the period was JD.com, with the share up 26%. (JD.com is discussed later on in this section.) Yum China, which had previously been a detractor since being spun out from Yum! Brands, was up 44% in the quarter. Other notable contributors were 58.com (+25%), Naspers (+12%), Heineken (+15%) and Melco Resorts & Entertainment (+22%). The positive contribution from Naspers was more than offset by not owning Tencent directly, as the value of the Naspers stake in Tencent increased by even more, rising ever higher above the market value of Naspers standalone (the value of Naspers’ stake in Tencent is now 35% higher than Naspers’ market capitalisation).

Year to date, the largest detractor from performance has been Magnit, which has declined by 22%. In this regard, we spent the last week of June in Russia, visiting Moscow (X5 Retail Group's base), Krasnodar (home of Magnit) and St. Petersburg (Lenta’s home town). We met with senior management of the three food retailers: Magnit (COO and CFO), X5 (CEO) and Lenta (CEO). In summary, our positive view on the sector and these three individual companies (which together make up 7% of the strategy) was confirmed.

In particular, our conclusion on Magnit (which at 4% of strategy is the largest position of the three) was that its current issues are of a short-term, cyclical nature as opposed to being structural. Over the past year or so, Magnit has gone from being a market darling to being almost universally disliked (with X5, it is the exact opposite) due to negative like-for-like sales, and the usual extrapolation of current experience by short-term focused market participants. We believe that Magnit management is making the right adjustments to its value proposition as well as doing the required refurbishments to keep up with a newly invigorated X5, which is increasingly moving into its markets. These changes take several quarters to reflect in results, but should eventually see a return to positive same-store sales and contribute to maintaining its margins. In addition to this, the long-term opportunity still holds: large formal retailers will continue to take market share.

We bought three new positions during the quarter: a 1.7% position in Naver, the leading search engine in South Korea; a 1.4% position in Alibaba (although the strategy has effectively owned Alibaba since July 2014 through a position in Yahoo, with Alibaba representing 80% of its valuation); and a 0.7% position in Indiabulls Housing Finance, one of the leading housing finance companies in India. We also added to the strategy’s positions in Naspers, JD.com and 58.com.

JD.com reported excellent first-quarter results in April that beat consensus by some margin. It has historically been one of the most attractive stocks in our investment universe in terms of upside to fair value, but the evolution of its business has exceeded even our expectations. After repeated losses since its initial public offering (although it has always generated decent cash from suppliers funding its working capital, even when making accounting losses), JD.com has now become profitable due to an increase in gross margins.

This has been driven by a mix effect and growth of its 3P business relative to its 1P business. Both 1P and 3P are very attractive businesses, but the 3P model has a higher margin – there is little cost involved in selling someone else’s product on your established platform. As 3P becomes a larger proportion of the overall mix, JD.com’s margins will continue to rise. When we first assessed JD.com in 2014, we believed it could eventually earn (operating) margins of 4% to 5% due to gross profit margin expansion and achieving sufficient scale to dilute the high fixed costs involved in rolling out a massive distribution and logistics network.

As mentioned previously, the business was loss-making at the time and the lack of profits meant the market struggled to value JD.com appropriately. Investors focused on misleading short-term metrics, like quarterly gross merchandise value (the total value of all goods sold on its platform). The business has developed considerably since then and, together with the impact of the growth in its 3P business, management believes they can earn operating margins of 6% to 8%. It is this kind of profitability target that has driven the share price rally in recent weeks. Yet despite the move, we believe the share remains very undervalued – even if it only reaches the bottom end of this margin range in the long term.

As previously mentioned, the strategy also bought a new position in Alibaba, although we have held an indirect stake in Alibaba for the past three years due to owning Yahoo. Alibaba operates a consumer-to-consumer marketplace (think of eBay) and a business-to-consumer marketplace for merchants. We have historically (and still do) favoured the JD.com business model over that of Alibaba, due to the competitive advantages of the fulfilment model that JD.com (and indeed Amazon) operates, that results in total control of the customer experience.

With time, however, whilst we continue to believe that Alibaba will lose overall market share (and JD.com will gain share), we are more convinced that Alibaba is a formidable business with a number of very promising assets besides its traditional e-commerce business. This includes its cloud business and the payments business, Alipay. In fact, the e-commerce offerings from JD.com and Alibaba are largely complementary. The strategy also continues to hold Yahoo (now renamed Altaba after the sale of the core business to Verizon) where the upside to fair value is even higher than Alibaba if tax can be minimised.

The quarter also saw the completion of the antitrust assessment process of the proposed merger between the two Brazilian education holdings Estácio and Kroton. Despite the best efforts of Kroton to propose remedies that would allay antitrust fears, the board of the antitrust authority voted against approving the merger. We had expected that, on a balance of probabilities, the merger would be approved – but had always positioned the fund for the risk of a rejection. Estácio never quite traded at the final agreed swap ratio of approximately 1.28 Kroton shares.

We maintained the strategy’s overall Kroton/Estácio relative exposure at similar levels (two to two-and-a-half times Kroton weight vs Estácio weight) to when the deal was first announced. This reflected our view that in the event the merger was vetoed or approved with too many conditions, we would want to own both companies, just as we had for the 18 months prior to the merger developments, but would want a bigger position in Kroton.

Now that the deal has been rejected, the share prices had, by quarter-end, pretty much converged back to parity – which is where they were a year ago when this whole process started. We believe both businesses remain extremely attractive on a standalone basis, with over 60% upside to fair value for both.

Kroton trades on less than 11 times earnings and is a 5.2% position in the strategy, while Estácio trades on less than 10 times and represents 2.2% of the strategy. They remain the largest and second-largest players in the industry, with massive scale advantages over their smaller peers which generally only trade at marginal profitability. We also believe that Estácio is very likely to be a participant in further industry consolidation.

Overall this quarter proved to be a busy one, with team members spending a lot of time travelling to meet the management of portfolio holdings, competitors or looking for new ideas in Brazil, Russia, Hong Kong, China, Singapore, Macau and Indonesia. The weighted average upside to fair value of the strategy at the end of June was around 50%, which is broadly in line with the historical five-year average.

The MSCI All Country World Index (ACWI) returned just over 4% over the quarter, bringing the year-to-date return to 11.5% and the 12-month lagging return to an impressive 18.8%. Emerging markets outperformed their developed peers over all of these time periods, with the 12-month emerging market performance being just over 5% higher than that of the ACWI. Europe outperformed the US during the quarter as the economic news out of the region surprised on the upside. The stronger euro also contributed to the outperformance. Over the last 12 months these markets have now produced very similar returns.

Global bond yields drifted down over the quarter, but rose quite sharply after the fairly hawkish statements by European Central Bank (ECB) president Mario Draghi towards the end of June, as detailed in the Coronation Global Bond Fund commentary on page 42. This resulted in bond markets yielding small positive numbers over the three months in local currencies, with some return pick-up due to US dollar weakness. Credit continued to perform well, with improving economic news around the world.

The US dollar continued to weaken against other major currencies as investors re-evaluated the prospects for the greenback. The euro was almost 7% stronger against the US dollar, and has now strengthened by just under 10% since the end of 2016. Emerging market currencies deteriorated in line with weaker commodity prices, although some of their equity markets continued to perform well.

Global property had a strong quarter in most regions, with Europe, Singapore and Hong Kong leading the pack. The quarterly return of 3% was also positively impacted by the weak dollar. Japan produced poor returns, as did Australia, as concerns over the impact of online retail hurt the listed mall owners.

The fund performed satisfactorily over the quarter, slightly underperforming its benchmark. The three-month number of 3.7% and the year-to-date return of 10.5% are strong absolute numbers. It has outperformed its benchmark over almost all periods by a significant margin after all costs and fees, highlighting the value proposition in this medium-risk product.

The fund continues to be defensively positioned, as evidenced by its low equity exposure (relative to the 60% benchmark weighting). We believe that equity markets have started discounting a very benign outcome to the various political and economic challenges the world faces, and as such caution is warranted. We still hold some put options to protect the equity holdings to some extent, should there be a widespread sell-off. Over the quarter we increased the fund’s exposure to property, with US mall Real Estate Investment Trusts introduced for the first time after they sold off in response to poor retailer trading numbers. We believe we have invested in the best quality portfolios, which should remain relevant in a digital world. Proactive management teams will need to continue to manage these dominant shopping centres to remain attractive to consumers and tenants alike. We have reduced exposure to credit by letting some positions mature.

Given the increased uncertainty regarding the outcome of the Brexit negotiations, it came as no surprise that the UK property sector remained in the doldrums. We used this period of heightened uncertainty to add to our position in Intu Properties, making it a very material position in the fund. Intu owns a high-quality portfolio of dominant retail centres in the UK, and whilst we cannot predict which way the negotiations will settle, we do think that over time this portfolio will retain its quality and relevance to the UK consumer, even in a world of increased online retail penetration. The share is trading at a significant discount to estimated net asset value, highlighting a stock that is discounting the worst possible outcome in our assessment. It also pays out a healthy dividend, with the share maintaining a dividend yield of 5.3%.

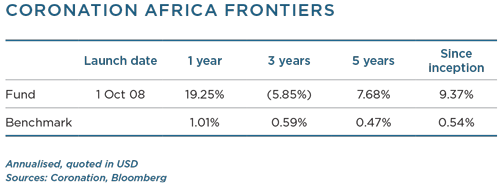

Over the past three months the performance of markets across Africa was strong, with the FTSE/JSE All Africa ex- SA Index gaining 11.3%, compared to the fund return of 16%.

Egypt remains our largest country exposure. Although the Egyptian market was only up 4%, our investments within Egypt performed well, with the fund’s largest holding, Eastern Tobacco, gaining 33% (in US dollar terms) during the quarter. Zimbabwe was up 41% with investors continuing to invest excess cash in real assets, driven to a large extent by the scarcity of dollars and concerns over the Zimbabwean bond notes that were introduced at the end of last year. However, we would caution against taking this performance at face value, given that it is impossible to repatriate funds through normal mechanisms and significant discounts are applicable to alternative repatriation methods. Kenya also performed well, with an increase of 16%, and Morocco was up 10% over the past three months. A key driver of the performance this quarter was Nigeria, which gained 26% on the back of renewed optimism following the introduction of the new currency exchange window (NAFEX) in April 2017. It is noteworthy that, compared to a year ago when three major markets in Africa had dysfunctional currency regimes (Egypt, Nigeria and Zimbabwe), today Zimbabwe is the only one remaining.

Nigeria’s new window is predominantly aimed at exporters and portfolio investors who are now able to bring money into Nigeria at a more favourable exchange rate. In June, participation in the window was further liberalised by allowing banks to match trades among all of their clients – previously banks could only match foreign exchange trades within their own clients. Official reports indicate that there is decent (and improving) liquidity, with $3 billion transacted in the first eight weeks. While this is certainly a step in the right direction, our understanding is that these volumes are still to a large extent the result of liquidity injected by the Central Bank of Nigeria (CBN). Businesses have started to report improved dollar availability; however, we understand that this too is driven more by the activity of the CBN through increased forward transactions, rather than the NAFEX window.

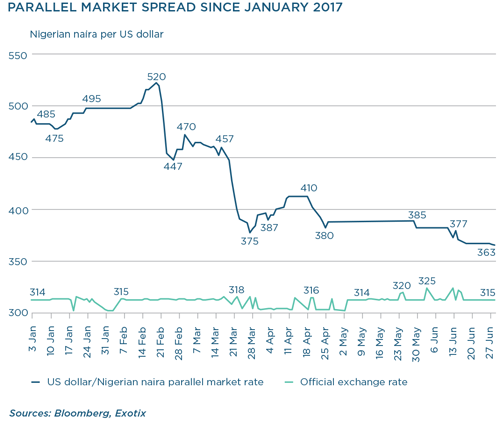

Until now the impact has been positive, with the parallel market rate reducing from a high of around 500 naira/US dollar in February 2016 to virtually converging with the new NAFEX rate of around 370 naira/US dollar by the end of June (see the graph below). This also contributed to Nigeria (at least temporarily) avoiding a potential downgrade out of the Frontier Markets Index by the MSCI in its semi-annual review in May. During the quarter we took the decision to value our Nigerian holdings using the new, more conservative NAFEX exchange rate. Indices such as MSCI still use the official exchange rate, which overstates the return of the index in our view.

Further positive news out of Nigeria was the lifting of the force majeure on the Forcados terminal in June 2017. This should increase Nigeria’s oil production by at least 15%. Following all these developments, Nigeria saw renewed interest from global investors. The market was up strongly and average daily volumes doubled during the quarter. Many companies look cheap on near-term multiples, however we remain cautious. In June 2016 we saw similar optimism when the Nigerian naira was allowed to ‘float freely’. However, it quickly became apparent that the new stable official exchange rate was not reflective of true supply and demand dynamics and, as a result, liquidity dried up quickly. Oil prices remain low and many companies still have large foreign currency payables, which have already resulted in a number of forced rights issues. In the banking sector, we believe that the tough economy has not yet been fully reflected in the loan impairments and we expect that a number of banks will have to raise capital at some point. Many banks have exposure to Etisalat Nigeria, which recently defaulted – a reminder of just how tough conditions in Nigeria are.

Over the longer term, we still view Nigeria as one of the most attractive markets globally and it continues to represent a sizable portion of the portfolio. Still, we remain very selective in our Nigerian exposures. In the banking sector, we own Stanbic IBTC Bank. In addition to an attractive valuation, this bank has demonstrated in the past that it is proactive in recognising nonperforming loans. We continue to avoid businesses with large dollar-denominated liabilities and prefer to hold those that should benefit from a weaker currency. One such business is Seplat Petroleum. This London-listed company is a large direct beneficiary of the reopening of the Forcados terminal and gained 42% during the quarter. We still view this as a very attractive investment opportunity, with attractive cashflow dynamics and a growing gas business, which is becoming strategically important in Nigeria due to the dependence of power plants on the gas supplied by Seplat.

We believe Nigeria’s multiple exchange rates with limited transparency leaves the door open for abuse, but we are hopeful that the measures that have been put in place will eventually lead to a liberalisation of the exchange rate. In the near term, conditions in Nigeria remain tough, but from a bottom-up perspective there are a number of high-quality businesses in Nigeria at attractive valuations, which should provide attractive returns to investors willing to take a longer-term view.

As in previous quarters, our return (+13.8%) differed materially from that of the MSCI Frontier Markets Index, which was up 4.4% over this period. Frontier markets that performed well during the quarter were Nigeria (+26%), Kenya (+16%), Vietnam (+11%) and Sri Lanka (+10%), while Pakistan was down 2%, Bangladesh down 2%, Kuwait down 3% and Argentina virtually flat.

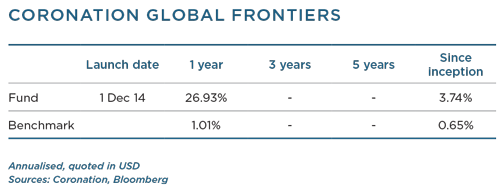

At Coronation, we construct clean-slate portfolios. Among its peers, this is a big differentiator for the Global Frontiers Strategy. We believe there is more value in focusing on absolute returns rather than outperforming an index benchmark that is often poorly constructed. This is particularly true in the case of frontier markets where the MSCI Frontier Markets Index is the most widely used benchmark.

We strongly believe that you should own a stock because it is trading below its intrinsic value and not because it happens to have a large weighting in an index. For a number of companies, the very reason they are large in the index is because they are overvalued. This is clearly demonstrated by the country exposure of the fund. Argentina is now 20% of the MSCI Frontier Markets Index and Kuwait 17%, but we have no exposure to these two countries, as we currently see more value in businesses in other frontier markets. In contrast, our investments in Sri Lankan companies represent almost 14% of the fund, while the country represents less than 2% of the MSCI Frontier Markets Index.

In fact, one of our best-performing investments is Hemas Holdings, which is not even in the index. Hemas is a familycontrolled Sri Lankan conglomerate with a high-quality fast-moving consumer goods business, a market-leading pharmaceutical distribution business and a portfolio of hospitals on the island. When the current CEO was appointed in 2013, he was specifically tasked with transforming the business into a professional outfit. Today, the business is run with a strong focus on shareholder returns and value is starting to be unlocked. While not in the index, it is a business we find very attractive and it accounts for more than 4% of the portfolio. The value of owning a business like this is evident in the fact that the company’s share price was up 38% during the quarter and up 66% since we first invested in this business in June 2016.

During the past three months, a number of countries have been affected by MSCI’s review of its Frontier Markets Index. As announced last year, Pakistan was moved from the Frontier Markets Index to the Emerging Markets Index. Overnight, Pakistan went from 9% of the index to zero. Whether or not a business is included in the Frontier Markets Index does not change our view on the company and we continue to hold the businesses in Pakistan which we find attractive.

For two countries in the Frontier Markets Index it was what was not decided that impacted investor sentiment. The decision on whether Nigeria should be removed from the index was delayed until November. This was largely as a result of the introduction of the new NAFEX exchange window. On the other side of the spectrum, the decision on whether to upgrade Argentina from ‘frontier’ to ‘emerging’ was delayed until June 2018. This disappointed investors, who expected an upgrade, and some of the large-cap stocks in Argentina came under pressure.

In our view, these announcements have virtually no impact on the underlying fundamentals of businesses and the investor reaction is an example of the inefficiencies that can exist in financial markets. Frontier markets in particular are more susceptible to this as they are often less researched, illiquid and more volatile. We believe this presents unique opportunities for bottom-up, valuation-driven investors willing to take a long-term view.

The fund performed strongly during the second quarter, up 3.3% against a return of 2.6% for the Bloomberg Barclays Global Aggregate Bond Index over the same period. The second quarter saw central banks in many developed countries begin to discuss the eventual unwinding of unconventional monetary policies. The US Federal Reserve (Fed) chose to look past the recent softer economic data and hiked the Fed Funds rate again in June, whilst robust growth in Europe will have reinforced the ECB’s view that temporary factors have been responsible for the weakness in inflation. Bond yields in most developed markets rose slightly, while a sustained appetite for risk allowed higher-yielding markets to continue to outperform. Movements in foreign exchange markets were, however, the dominant factor in total returns, with the trade-weighted US Dollar Index weakening by 4.7% during the second quarter.

US economic data consistently disappointed in the second quarter, challenging the more optimistic view portrayed in sentiment surveys. Markets reacted to the softer data and the lack of tax and infrastructure plans from the new administration by pricing out the Trump rally that followed the US election. Softer US inflation added to concerns that US activity may be stalling and helped US 10-year yields fall from 2.4% to as low as 2.1%. The Federal Open Market Committee (FOMC) disregarded the weakness and raised the Fed Funds rate by a further 0.25% (to a range of 1% to 1.25%) mid-June.

The hawkish Fed combined with a more dovish market flattened the yield curve with two-year yields rising 0.13%, (1.25% to 1.38%), while 30-year yields fell 0.17% (3% to 2.83%). Breakeven rates of inflation also narrowed (10-year from 1.98% to 1.73%) as inflation fell short of expectations. The softer oil price (down 9%) merely added to the negative sentiment towards Treasury Inflation Protected Securities. The fund reduced duration during June, reversing the position that had been taken in the first quarter, when yields were 35 basis points higher.

German bond yields traded sideways for most of the quarter, with much of the attention focused on the French election and banking issues on the European periphery. At the ECB meeting on 8 June, there was no change in rates or movement in its asset purchase programme. The ECB revised its outlook for growth marginally higher, but lowered its forecast for inflation, which was above that of the market. However, ECB president Mario Draghi’s speech at end-June in Portugal significantly changed the narrative. He indicated that increasingly robust data and the view that deflationary risks have abated are raising the prospect of a much earlier end to unconventional stimulus than the market had anticipated. Rates were anticipated to remain on hold until the asset purchase programme was wound down from €60 billion per month to zero, which was expected to happen during 2018. Since the speech, the market has moved to price in a rate rise during the course of 2018. Longer-dated yields also moved higher, ending the quarter at 0.46%. After quarter-end, yields have breached the previous range high of 0.5%, threatening a more substantive sell-off. The fund unwound its position in French government bonds after bonds outperformed post the election of Emmanuel Macron as president.

If the outlook for the UK was not opaque enough, the decision by the prime minister to hold early elections in the hope of consolidating her mandate has backfired and delivered her a wafer-thin majority via a problematic coalition. The UK’s cards at the Brexit negotiating table do not look like a winning hand.

While other central banks may be discussing unwinding quantitative easing, the Bank of Japan (BOJ) remains committed to its current framework and its price-stability target of 2%. The BOJ now owns around 44% of all outstanding government bonds via its asset purchase programme, which raises interesting questions about how losses will impact on confidence when yields eventually rise.

Emerging markets maintained their relative strong performance as investors continued to seek out yield. The Emerging Market Bond Index spread rallied to 3.15% in May, but ended the quarter unchanged at 3.3%. In SA the finance minister was fired at the end of March, leading to heightened economic uncertainty. In April, president Erdoğan’s authoritarian regime in Turkey secured a narrow victory in a referendum granting him greater powers.

Brazilian bonds suffered a setback in May after its president became embroiled in corruption charges, potentially derailing important reforms. The fund remains active within emerging markets, adding exposure to Brazil in May after the market fell sharply. The fund reduced its exposure to SA government bonds around the same time and shortened its exposure after the Mexican curve flattened. The fund also increased its exposure to Egypt via Treasury Bills during May.

Corporate bonds continued to perform strongly, with investment-grade credit outperforming government bonds by about 1% during the quarter, taking the year-to-date outperformance to around 1.5%. Rising government bond yields and reductions in central bank purchases remain a key test for the market, and we remain cautious of valuations. The fund reduced its exposure to SA dollar-denominated bonds and to MTN as the bonds were seen as vulnerable to ratings downgrades.

Within foreign exchange markets, the US dollar has continued to disappoint, with its weakness extending beyond interest rate differentials. The euro performed particularly well, up 7% over the quarter as economic data surprised on the upside and speculation that the ECB will begin to tighten monetary conditions led many investors to reduce their underweight positions. The yen briefly rallied as equities suffered rare bouts of weakness, but ultimately the decision by the BOJ to hold bond yields at close to zero means that the yen is vulnerable as global yields rise. Emerging market currencies experienced mixed fortunes as the Turkish, Mexican and SA currencies all strengthened against the US dollar, while the Brazilian real, Russian rouble and Argentine peso all weakened. The fund has reduced some of its emerging market exposure (Mexico, Turkey and SA) and has begun to add to its US dollar position. The fund switched its Swedish exposure into euros during April to reduce its vulnerability to a squeeze in the euro. The fund remains underweight the yen.

Last quarter, we highlighted that there was a growing sense that central banks were about to embark on unwinding the exceptionally accommodative polices that have been in place for many years. In the last month, we have seen policymakers say as much, and the Bank for International Settlements has called upon policymakers to take advantage of growth tailwinds to build greater economic resilience. The fund remains underweight duration and has scaled back its exposure to assets deemed most vulnerable to policy normalisation. The global economy may still have its vulnerabilities, but there is a growing realisation that the time of ultra loose policy is running out, and its extension risks exacerbating potentially damaging side effects in areas such as housing and consumer debt. Normalisation, to whatever that level may turn out to be, will be gradual but the greater fool theory of investing may soon be tested.

South Africa - Institutional

South Africa - Institutional