VERY DISAPPOINTINGLY TO us and undoubtedly to investors, 2018 was the worst year by some way in the Coronation Global Emerging Markets Strategy’s 11-year history, underperforming the market by 10.7%, and we apologise for this very poor performance. The strategy’s previous worst year was 2015 when we underperformed the market by 5.9%. Since inception in 2008, the strategy has outperformed the market in seven of the calendar years and underperformed in four (including 2018). In four of the seven years in which we outperformed the market, it was by a double-digit percentage. Because the strategy looks so different to the index (and many peers), with an average active share of 90% over the past 10 years, this type of outperformance (and unfortunately underperformance) does happen, as disappointing and uncomfortable as the latter is for us and for our investors. After a period of poor performance, we tend not to change the portfolio too much (as typically much of what we own has become more, not less, attractive) and strong performance periods usually follow. With the strategy currently showing c. 80% weighted average upside to fair value at the end of December (compared with the long-term average of c. 50%), we are positive on the return prospects for the strategy.

In trying to analyse the reasons for the strategy’s severe underperformance in 2018, there is no one clear factor. This is in contrast, for example, to 2015 when the underperformance was almost entirely due to Brazil, which was going through an unprecedented recession at that time. In the three years leading up to and including 2016, GDP per capita in Brazil contracted by 30% in US dollars. This is as severe as the Great Depression in the late 1920s/early 1930s, when US GDP per capita contracted by 28%.

To summarise the underperformance in 2018, the strategy somewhat unusually saw five disparate businesses among its top 15 positions decline by c. 50% in US dollars, for different reasons. At the same time, there were simply not enough winners to offset the impact. The five largest negative detractors for the year were Kroton (2.6% negative contribution), British American Tobacco (-1.7%), Magnit (-1.5%), Tata Motors (-1.3%) and JD.com (-0.9%). In total, these five stocks account for over 70% of the strategy’s underperformance. On the positive side, Adidas (0.6% positive attribution), Airbus (+0.6%), Housing Development Finance Corporation (HDFC) (+0.4%) and Banorte (0.4%) contributed, but as mentioned, this was not sufficient to offset the impact of the negative contributors.

We have covered most of these five stocks in detail in various strategy commentaries during the course of the last year, but given the extent to which they detracted from performance in 2018, it is worth providing a summary of what went wrong, as well as our current view on each share.

- Kroton (the top private education operator in Brazil; 3.1% of strategy). In our view, the sharp decline in the share price was due to a combination of disappointing earnings, concerns relating to its student base (with government-funded students graduating and being replaced by students funded by Kroton) and an expensive (at face value) acquisition to enter the K-12 market. We would agree that Kroton is experiencing challenges in the short term and faces a tough 2019 after experiencing a difficult 2018. However, we believe the long-term prospects remain very attractive (underpenetration of the tertiary education sector in Brazil, in what is a scale business in which Kroton is the no. 1 player, with an exceptional management team). Kroton trades on less than 10 times 2019 earnings, with a 3.5% dividend yield and c. 80% upside to fair value.

- British American Tobacco (the second-largest global tobacco company; 4.0% of strategy). The sharp share price decline was arguably due to a number of factors, the most important of which was a proposal by the US Food and Drug Administration to ban menthol cigarettes in the US (which make up c. 23% of British American Tobacco’s earnings), as well as general concerns over the transition to alternative nicotine products, including e-cigarettes. In our view, and clearly very different to the consensus market view, the prospects for the global tobacco companies are better than they have been for many years. For the first time, these companies have credible alternative (much lower risk) products, which make these businesses more sustainable over the long term. On the proposed menthol ban in the US, there are still many hurdles to overcome before anything materialises, and this may take a long time. Additionally, in the event of an eventual menthol ban in the US, in our view British American Tobacco will retain a large percentage of its menthol smokers by switching them to alternative products. The share price is now at a seven-year low (and rating near a 20-year low) and trades on less than nine times 2019 earnings, with a dividend yield of 8% and c. 70% upside to our estimate of fair value.

- Magnit (the second-largest food retailer in Russia; 3.7% of strategy). Magnit was beset by poor operational performance (in large part due to underinvestment in its stores), as well as the resignation of its founder and CEO, Sergey Galitsky, who sold his 30% stake in the business at the time of his resignation in February 2018. Under the new CEO, Olga Naumova (who was largely responsible for the turnaround of Magnit’s main competitor, X5 Retail, during her five years there) and a new board, a number of positive changes have taken place, including the accelerated refurbishment of stores, changes in the product mix and the introduction of a management incentive scheme. This has already started to reflect positively on the company’s results, with an improvement in like-for-like sales. The two leaders in the Russian food retail market, Magnit and X5 Retail, both strategy holdings, only have c. 9% market share apiece (with no. 3 having only 3% market share), and we believe that they can roll out stores and grow market share for many years to come. Magnit trades on c. 13 times 2019 earnings, with a 3% dividend yield and over 100% upside to our estimate of fair value.

- JD.com (the no. 2 e-commerce company in China, after Alibaba; 3.0% of strategy). In our view, the share price decline was driven by three factors: an approximately 20% to 30% decline in all Chinese internet stocks, slightly poorer-than-expected operational performance from JD.com, and an allegation of rape against the CEO in the US (authorities in the US have subsequently decided not to prosecute due to a lack of evidence). In our view, JD.com has created a very strong e-commerce business over the past decade by building its own fulfilment infrastructure (replicating the Amazon model), which is sufficiently differentiated from Alibaba’s to enable both companies to win in the fast-growing Chinese e-commerce market. (Alibaba is also a strategy holding, albeit a smaller position at 1.5%).

Over the past five years, JD.com has increased its revenue from $11 billion to $65 billion, and in the process has taken its gross merchandise volume market share from c. 6% to 17%. The market cap of JD.com currently is c. $33 billion, meaning it trades on 0.5 times revenue. From a profitability point of view, the business swings in and out of profitability depending on the level of investment; however, on any normal operating profit (earnings before interest and taxes, EBIT) margin, we believe that the business is cheap. A few reference points underscore this view: Amazon’s (more mature) US retail business delivers EBIT margins of close to 10%, while high street physical retailers achieve margins anywhere between 3% and 20% (depending on the product being sold, with food at the low end and clothing at the high end). JD.com management targets a high single-digit EBIT margin. Given its current revenue (assuming no further revenue growth, even though JD.com should be able to grow its topline at c. 15% to 20% for many years) and assuming a 3% EBIT margin, JD.com trades on 20 times historic (2018) earnings. Its core marketplace margins are already 2%, so a 3% margin is very conservative and JD.com is very cheap in our view. Its upside to fair value is c. 150%.

Tata Motors (owner of Jaguar Land Rover; 0% of strategy). This was a poor investment and a mistake in our view, and we sold out of the position during 2018. A combination of internal factors (including poor cost control measures and mediocre new product launches) and external factors (such as Brexit, EU emissions legislation and US-China trade wars) led to a sharp decline in profits. Given the very thin current margins, combined with high debt levels and an uncertain future, both in terms of alternative vehicles and Brexit (the UK represents 20% of sales, with a large part of the manufacturing base being in the UK), we felt that the risk/reward became unattractive and sold the position.

Of these five stocks, if one compares our earnings estimates at the beginning of 2018 to what the companies are likely to actually report for 2018, we overestimated earnings in two cases: Kroton and Tata Motors, with the latter having been sold. In Kroton’s case, earnings are likely to be down c. 10% in 2018, yet the share price declined by c. 50%. In two of the cases (British American Tobacco and Magnit), our revenue and profit forecasts were largely in line. In the case of JD.com, our revenue forecasts were within 5% of what the company is likely to report for 2018, as is the profitability of the core marketplace business, but investment in the logistics business was larger than expected, depressing group profitability.

In summary, the share price declines have therefore largely come not from getting the earnings very wrong, but from a significant de-rating in four of the five stocks. Of course, one can argue that markets are forward looking and that these de-ratings were for valid reasons, but in our view they have gone way too far, given the current operational performance and, more importantly, the attractive long-term prospects for these companies.

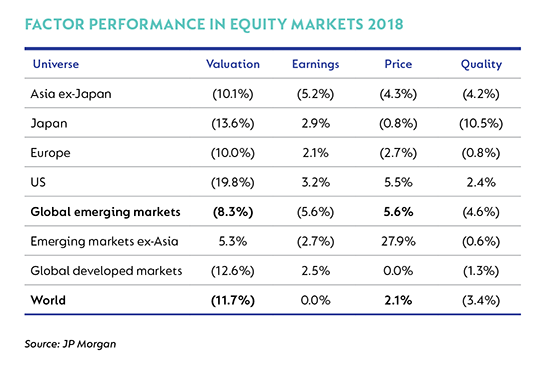

As can be seen from the table below left, 2018 was a year in which valuation severely underperformed in all major equity markets and price (momentum) was notably the best-performing factor.

Coronation’s investment philosophy (long-term, valuation-driven investing) is clearly in the ‘valuation’ camp as opposed to the ‘price’ camp. While this is not an excuse, the reality is that the significant flow of assets into passive investing, as well as the rise of quant funds and the increased use of algorithms generally have changed the structure of the market. Arguably, this has created dislocations and additional risks.

By some estimates, only 10% of the volume in US markets today, for example, is in the hands of long-term fundamental investors. The implication of this (which can arguably be seen in many stock examples) is that price discovery does not happen as it used to. ‘It’s in the price’ does not seem to exist any more, and what is going up, keeps on going up – and what is going down, keeps on going down (the table below left supports this point). This arguably makes investing more challenging, particularly for investors who are not momentum orientated. Of a group of 135 emerging market funds that we would consider to be our peers, 106 underperformed the market (to varying degrees) in 2018. Similarly, and to illustrate the effect of passives and momentum, an equal-weighted custom index of the 20 largest stocks in the emerging markets index would have outperformed the index by a considerable 5% in 2018.

With volatility at above-average levels in emerging markets, we were more active than usual, having made six new buys of greater than 1% in the fourth quarter under review, totalling 8% of the strategy. Four of these new buys (Russian internet business Yandex, Melco Resorts, Pão de Açúcar, the largest food retailer in Brazil, and luxury goods company Kering) are companies that we have covered for years and that the strategy has owned in the past, while two of the buys are companies that we have not owned before (Latin American e-commerce platform MercadoLibre and HDFC Bank).

The new buys were not concentrated in any particular region (one stock in each of Brazil, China, India, Russia, and Latin America, and one global company). By industry, two of these companies fall within the technology (internet) sector, three are in the consumer sector and one is in the financial sector. In terms of other buying activity, we continued to add to the strategy’s position in New Oriental Education (taking it from a 2.3% position at 30 September 2018 to a 3.4% position at 31 December 2018), as the share price continued to decline. We also increased the position size of HDFC (from 3.0% to 4.3% of strategy), as Indian financials declined due to concerns about stress in the system. We further increased the position in Wuliangye, the second-largest Chinese baijiu producer (from 1.2% to 2.0%).

In terms of sells during the quarter, we sold out of three stocks – Chinese internet business NetEase and Visa (both largely on valuation), and Altaba (adding to existing positions in more attractive opportunities within the sector, namely 58.com and JD.com, and not wanting to further increase overall China internet exposure). The position in multinational technology company Baidu was also reduced for the same reason. In terms of geographic exposure, there were no material changes, with the only changes of more than 1% being an increase in China (from 25.3% to 27.3%, largely due to the activity mentioned above), an increase in India (from 11.2% to 13.5%, largely due to the additional buying of HDFC and the new HDFC Bank buy) and a decrease in developed markets exposure (from 23.2% to 20.3%, largely due to the poor performance of global tobacco stocks and a reduction in the Porsche position).

Yandex was the largest new buy (2.0% of fund) during the quarter. We have covered Yandex for several years and have owned it before. The share price declined from a peak of $44 in February 2018 to its current levels in the mid-high $20s (partly due to Russia and partly due to the technology sell-off globally), bringing it into buying range. Yandex is the no. 1 search engine in what is an effective duopoly in Russian search, with the company having a market share of c. 57% and Google owning the balance.

We believe the prospects for search in general and for Yandex in particular are favourable (for example, low online ad penetration and Yandex taking mobile market share from Google) and that the search business alone is worth well north of the current share price. In addition, Yandex has net cash and a number of other smaller businesses that are currently growing revenue at a rapid rate (but that are still loss-making). While some of these businesses may never make money, there are a few that we believe have the potential to do so, including the taxi ride business (which is dominant after merging with Uber Russia and in which Yandex owns a 59% stake) and the e-commerce joint venture with Sberbank. Yandex trades on c. 20 times 2019 earnings (with profits depressed due to its investment in the various smaller businesses) and in our view is attractive at current levels.

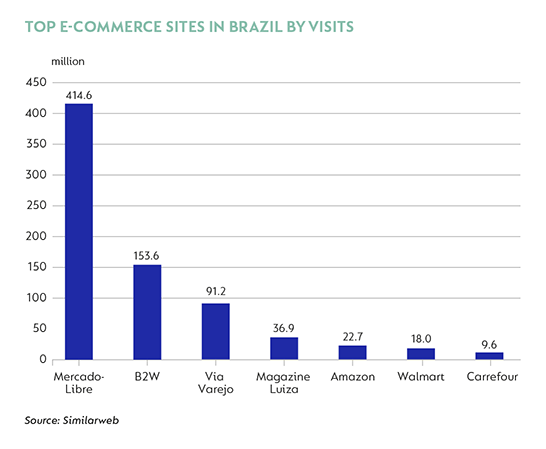

The other new technology (internet) buy was a 1.3% new position in MercadoLibre, the largest e-commerce platform (third-party marketplace) in Latin America. MercadoLibre has operations in 18 countries and holds a no. 1 position in 10 of them, including Brazil and Argentina, the two biggest contributors today. The company was founded 20 years ago; the CEO and founder, Marcos Galperin, still owns a meaningful stake (9%) in the business and continues to be very involved. MercadoLibre’s revenue has grown by 31% per annum in US dollars over the past seven years and continues to grow at a high rate.

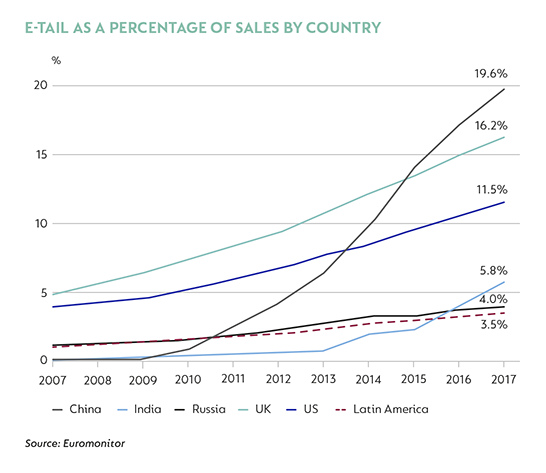

E-commerce penetration in Latin American is very low and MercadoLibre is the leader in Brazil (see the graphs below left and above right), which today contributes 70% of group earnings. Besides the e-commerce business, the long-term opportunity for the payments business (Pago) is also potentially significant, having only a 1% market share of card payments today. Profitability is well below normal in our view (EBIT margins of 9% currently versus a peak of 30%), and we believe MercadoLibre can grow both its topline and profits at a high rate for many years to come.

Melco Resorts and Entertainment is one of the casino operators in Macau that we have owned before but sold out of as it reached our estimate of fair value. The 45% decline in its share price in 2018, due to economic concerns over China and the Macau region, presented us with the opportunity to reintroduce Melco (1.4% position of strategy). Macau undoubtedly holds its own set of risks (as does any company in China and, indeed, in emerging markets in general), which include economic sensitivity and the regulatory environment, of which the upcoming gaming licence renewal is one. At the same time, the long-term prospects for Macau, not only as a gambling destination but also increasingly as a mass market holiday destination, remain attractive, with only a small percentage of the Chinese population having visited Macau.

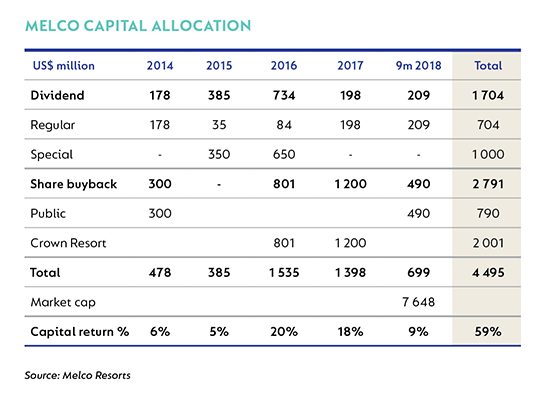

Our attraction to Melco in particular (above the other five casino and hotel operators in Macau) is three-fold. First is its exposure to the mass market, which, along with Sands China, is the highest in the industry. In our view, a mass business is better than a VIP-focused business, as it is less cyclical and has a much larger potential market. Secondly, we are attracted to Melco’s capital allocation. In this regard, the table on the previous page (over and above the company’s c. 35% return on invested capital) shows the capital allocation of Melco over the past five years – 60% of Melco’s market cap has been returned to shareholders in the past five years through dividends and share buy-backs. Importantly, the share buybacks have typically been done at attractive price levels. Lastly, Melco has the most attractive valuation of all the operators: a 2019 free cash flow yield of c. 11% versus 6% to 7% for the other five operators.

We have owned HDFC in the strategy for the past three years and today it is a 4.3% position. By owning HDFC, the strategy has indirectly owned HDFC Bank (as HDFC owns a 22% stake in HDFC Bank, which represents c. 35% of HDFC’s value) but have never directly owned it, even though we have covered it for several years. The long-term fundamentals of the Indian financial services market are very attractive, in particular the low financial services penetration and the fact that the State banks (which are poorly managed and balance sheet constrained) still have 70% market share. This backdrop has formed a key part of our investment case for other Indian financials, which the strategy has and continues to own, including HDFC, Yes Bank and Indiabulls. HDFC Bank obviously also benefits from these tailwinds and, in addition to this, is arguably the highest-quality large bank in India, being the leader in digital, having the second-highest return on assets, the highest provision-coverage ratio, the lowest cost-to-income ratio and high retail exposure. This means that it is currently well placed to continue and even accelerate its market share gains, given the current troubles faced by a number of Indian banks. While the share has done very well over long periods of time, it has been flat over the past year, which, combined with improved prospects due to the current turmoil, made it attractive enough to warrant a 1% position.

The strategy’s weighted average upside to fair value at the end of December was approaching 80%, well above its long-term average of c. 50% and close to the highest it has ever been. As such, and after a very disappointing year, today we are very positive on the prospects of the strategy going forward.

Members of our Global Emerging Markets team continue to travel extensively to enhance our understanding of the businesses we own in the strategy, their competitors and the countries in which they operate, as well as to find potential new ideas. In this regard, over the past two years we have done detailed work (modelling, fair value and research) on 57 new companies, 17 of which have made it into the portfolio over this period, representing 33% of the strategy today. In the fourth quarter, there were three trips to China, one to India and one to Brazil. The coming months will see a further two China trips (including one trip specifically focusing on the baijiu industry) and two trips to India.

South Africa - Institutional

South Africa - Institutional