Investment views

Now is not the time to turn your back on emerging market equities

The Quick Take

- We are currently positive on an allocation to emerging market equities for long-term investors, notwithstanding the uphill battle of the past decade

- Understanding the reasons for the underperformance of the asset class indicates that the past is not a great indication of the future

- Today’s emerging markets offer a whole new breed of opportunities, distinct from those of the past

- We find that current markets offer fertile ground for active managers to secure outperformance for long-term investors

The past 10 years have not been kind to emerging market investors. Over the 10 years to the end of March 2024, the asset class has returned less than 3% p.a., which contrasts starkly with the returns of broader equity indices such as the MSCI All Country World Index (ACWI) and the US S&P 500, which have generated returns of 8.7% p.a. and 13.0% p.a., respectively. To illustrate the disparity in returns, consider that US$100 invested in emerging markets 10 years ago would have grown to US$134 today[1], while the same investment would have yielded US$229 in MSCI ACWI and US$338 in the US equity market.

The primary driver of emerging markets’ underperformance has really been the strength of the US market, in particular, the tech stocks whose names have given rise to acronyms like “FAANG” and more recently, the "Magnificent Seven”. The tech-heavy Nasdaq has outperformed the S&P 500 by a large margin, such that your US$100 investment 10 years ago would be worth US$562 now.

Given the experience over the past decade, it is understandable that many investors have given up on the asset class. Yet, we remain constructive on a long-term allocation and believe that the factors that led to the historic underperformance are unlikely to persist going forward. Here’s why.

LOOKING AT THE LAST DECADE

The absolute return generated from the MSCI’s emerging markets equity index has been poor for a variety of reasons, not least of which is the poor returns of several of the top countries that were a significant part of the index over the past decade. For example, Brazil started the decade at a 10% weight and returned only 1.8% p.a. over the last 10 years, well below the 14% p.a. generated over the 10 years prior, while South Africa, with a 7% weight a decade ago, returned -1.1% p.a. over the same period. Even China, the economic powerhouse of the last decade, which comprised 20% of the index, managed only a paltry 1.2% p.a. Finally, Russia comprised 6% of the market a decade back, saw its weight fall to about 3% at the time of the full-scale invasion of Ukraine just over two years ago and was subsequently removed from the market entirely, effectively resulting in -100% performance for its 6% weight over the period.

With four of the top seven countries performing so poorly, the outcome of the last decade is not surprising in absolute terms. In addition, both the strong returns from the US market and the strong dollar contributed to massive differences in relative performance with broader world indices. In the cases of South Africa and Brazil, much of the poor returns came from dollar strength and the poor performance of commodity exporters in general. China is a bit more complicated. There have been several drivers of underperformance, including many self-inflicted setbacks by the government in regulatory matters. These have had a major impact on the country’s attractiveness as an investment destination by Western investors.

It is important to highlight that without the strong US market returns (driven largely by a handful of companies), broader world markets would have returned figures that were more in line with those we have seen from emerging market equities.

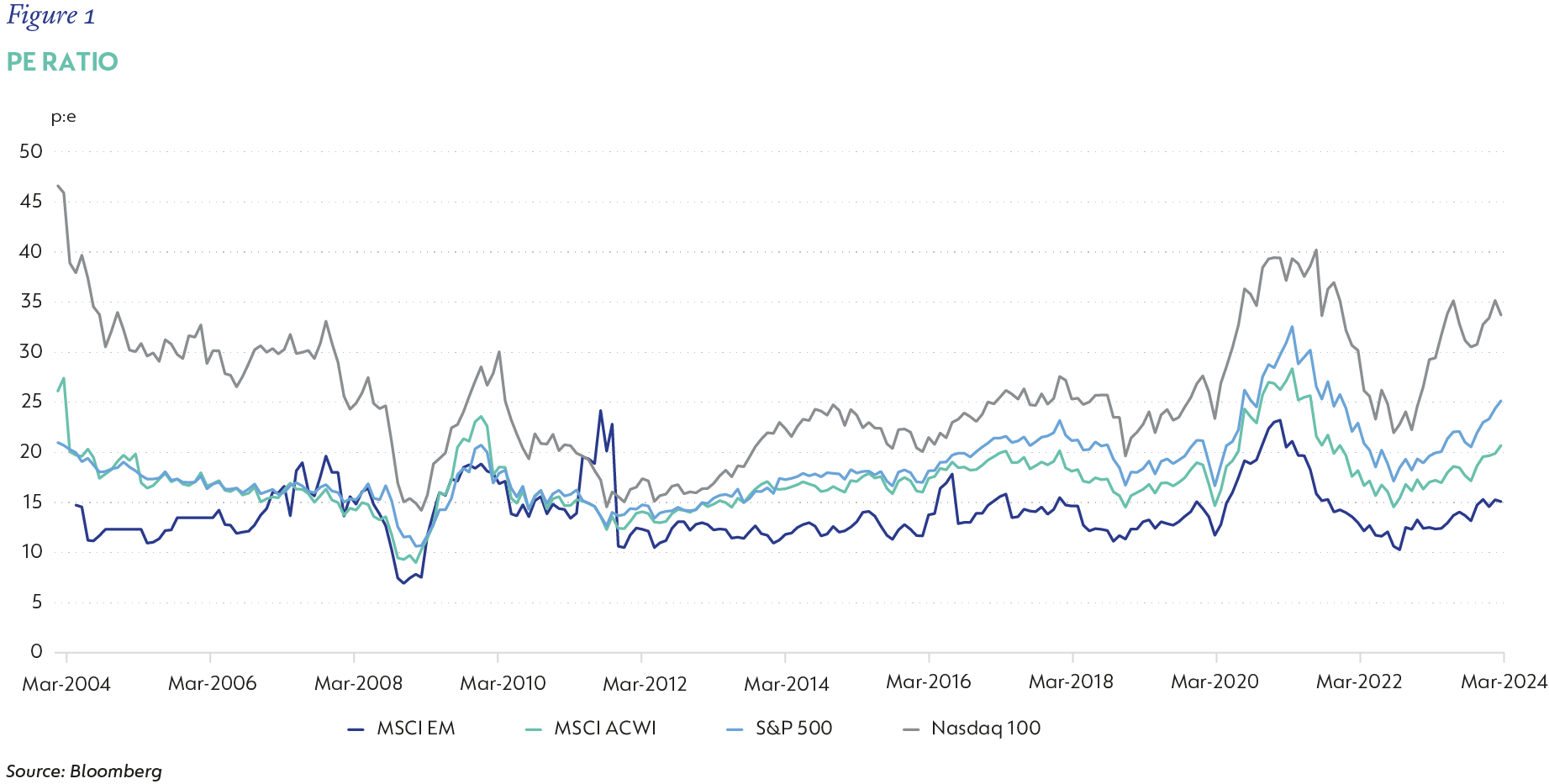

As such, and looking at the historical context, we believe that emerging markets look quite cheap relative to the broader MSCI ACWI and the two US market indices. Conversely, US indices are looking quite expensive, with some metrics of US tech stocks showing valuation levels similar to the early 2000s, in the aftermath of the TMT bubble (see Figure 1).

THE SHIFTING LANDSCAPE

Sure, markets can be cheap for valid reasons, yet we believe that the shifting landscape of emerging markets is poised to drive more compelling returns going forward. We have witnessed a total transformation in the MSCI Emerging Markets Index, with the less commodity-dependent countries such as China, India, Taiwan, and Korea now comprising in excess of 70% of the market.

India stands out as the most exciting large economy in the world today, reminiscent of where China stood 15 years ago on most development metrics. With India now accounting for 20% of the emerging market investment universe and experiencing rapid growth, it is likely to take a disproportionate share of capital flows as valuations in developed markets look relatively high.

Another significant change is that many of the larger emerging market investment opportunities today are simply better businesses than those that were dominant 20 years ago. It’s hard to imagine that State-owned oil producer Petrobras in Brazil was the largest company in the emerging markets index 20 years ago, with similarly State-owned telecommunications company China Mobile running second. Today, they have been replaced by great businesses like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics. These two companies, together with Intel, are the only companies in the world capable of producing the most intricate chips required to power the world in the information and AI age. To illustrate the valuation gap: TSMC stands as NVIDIA’s primary supplier, a partnership crucial for NVIDIA’s survival, yet TSMC relies on NVIDIA for only about 11% of its revenue. Interestingly, NVIDIA’s market capitalisation is three times that of TSMC’s. The disappearance of TSMC could disrupt global operations, significantly affecting our daily lives. Conversely, should NVIDIA vanish, the impact on the majority of us would likely be minimal. These valuation anomalies seem unjustified.

Another key driver for emerging market investment opportunities is the greater scope for wealth creation compared with developed markets. By way of example, in the developed world, banking is largely a utility with little opportunity for meaningful earnings growth from loans and credit (investment banking remains the main attraction). However, for many emerging market countries, credit penetration is currently low, the savings culture is still being established, and very few people have credit cards. The banks therefore offer an excellent opportunity for sustained earnings growth as this industry develops. Equally, some of the best investment opportunities we are finding globally in retail, construction, household products, white goods (appliances) and manufacturing are all in emerging markets.

POSITIVE OUTLOOK

In our view, the emerging markets universe offers exciting and compelling opportunities for investors today. The asset class is extremely disliked, driven by weak sentiment. But we believe that the fundamentals of many emerging markets businesses remain strong and current times represent a great time to buy. In contrast, developed markets, and the US in particular, appear expensive and performance has largely been driven by a narrow range of stocks. As active stock pickers, our strategy focuses on identifying these precise opportunities, best illustrated by the significant upside potential we are currently seeing in the Coronation Global Emerging Markets equity strategy. The potential upside sits at around 65%, well in excess of the long-term average of 45%. Although risks such as geopolitical tensions remain, we are of the view that positive fundamental factors will drive better long-term returns in the years ahead.

[1] As of 30 March 2024

Disclaimer

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Institutional

South Africa - Institutional