PERFORMANCE AND FUND POSITIONING

The Fund returned 10.1% during the quarter under review, somewhat lagging the 10.6% return of its benchmark, the MSCI Emerging Markets (Net) Total Return Index. For the calendar year, the Fund is 4.6% ahead of the benchmark, over one year it is 2.5% ahead, and over three years it is ahead by 2.3% per annum (p.a.). We continue to work on generating outperformance to raise the important five-year number above the benchmark. Since inception over 17 years ago, the Fund is marginally ahead of the benchmark.

The strong absolute performance of both the Fund and the asset class this year (the best year for emerging markets since 2009) is very pleasing, as for some time, emerging markets had been lagging global market returns. At the time of writing, the weighted average upside of the Fund (a good measure of valuation attractiveness) was 55% - above the long-term average since inception. The five-year weighted average expected internal rate of return (a measure that captures earnings growth, dividends, and any projected change in rating) is 18% p.a., also above long-term averages.

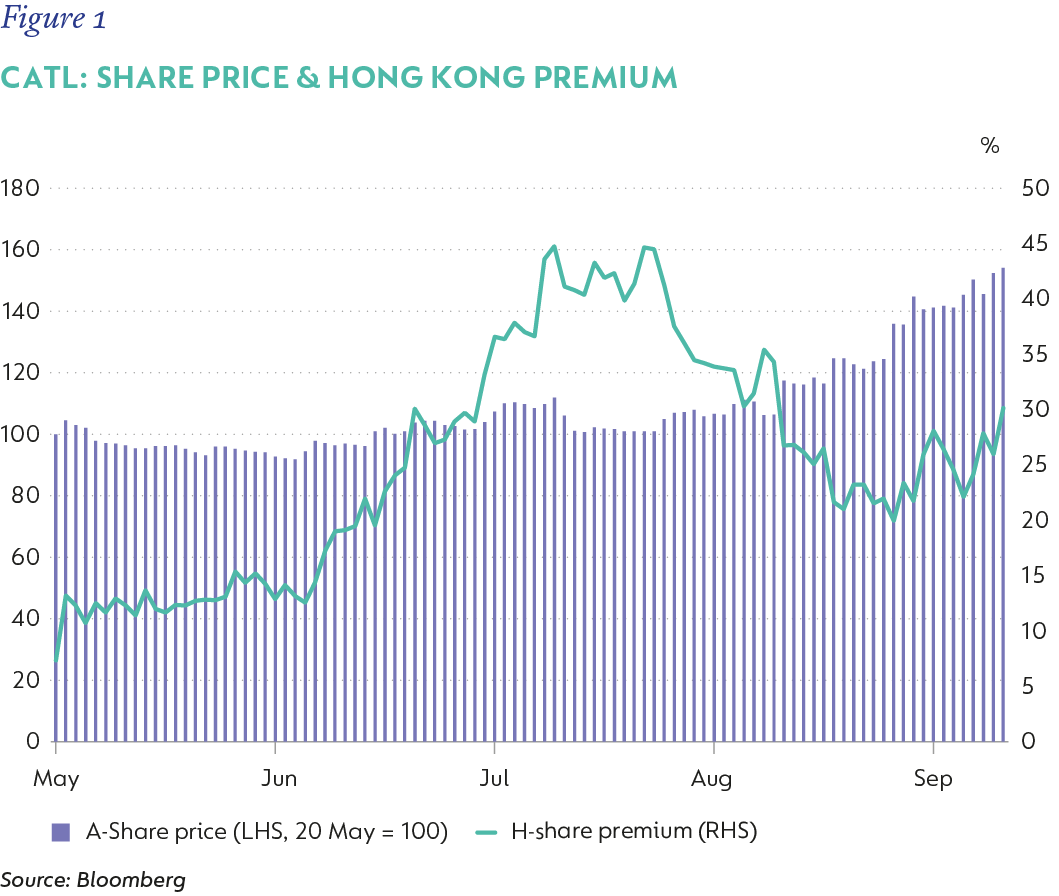

The biggest positive contributor to relative return (or alpha) during the quarter was Chinese battery maker CATL, which returned 61% and provided a relative contribution of 1.5%. CATL raised $4bn in its Hong Kong listing in May this year. With most investors being unable to access the local A-shares (which the Fund owns), the Hong Kong H-shares increased significantly for the first few months, leaving us somewhat frustrated as the A-shares did little. This behaviour is a reversal of the usual "pattern" whereby the A-shares typically trade at a premium to the Hong Kong equivalent due to capital controls in China keeping money in the domestic market. The premium has since subsided to under 20% as the A-share has outperformed the H-share in recent weeks.

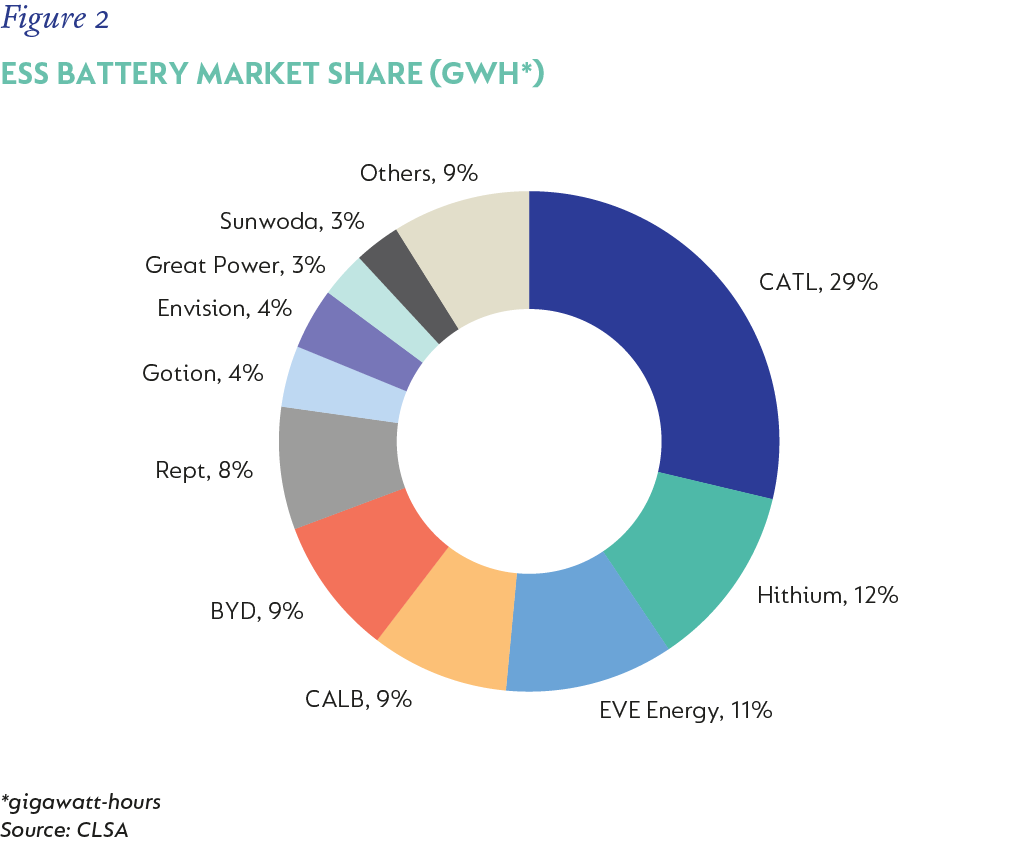

The upward move in CATL means it is now a 4.4% position in the Fund, reflecting our view that it is a unique business that will be dominant in the provision of batteries for electric vehicles (EV) and energy storage systems (ESS). In a business where scale really matters, CATL is already close to 2.5 times the size of its nearest competitor in ESS and is growing faster than the industry, showing that the gap is widening rather than narrowing. CATL is also the largest producer of batteries for EVs, where it, along with BYD, is likely to be the only company making a decent return on investment currently (based on publicly available data). Scale brings down the production cost per unit of storage produced, giving a gross profit margin advantage of several percentage points. This, together with higher absolute revenues, allows CATL to invest more absolute dollars into research and development than anyone else.

This positive flywheel shows no sign of abating; in fact, CATL and BYD are continuously announcing technological breakthroughs that leave competitors further behind. It is our view that the explosion in renewable energy demand, the need to power data centres, and the shift towards EVs as well as hybrids means that the cost leader in batteries will generate a disproportionate share of the profits in the industry, which is the reason for the large position in CATL today.

The second largest contributor to outperformance (23% return, 0.5% alpha) was ASML, a manufacturer of advanced lithography machines essential for producing computer chips. Whilst being a Dutch company, 80% of revenue comes from emerging markets (mainly South Korea, China, and Taiwan). Although other companies compete with ASML in this industry, ASML is the only producer capable of providing the machines necessary to manufacture the most advanced chips required in high-end computing. Management commentary about being unable to provide guidance for 2026 due to uncertainty linked to big customers like Intel and Samsung caused the share to sell off in July. We used the opportunity to increase the position size, and the share has since rebounded from the sell-off and contributed positively to Fund returns. ASML and TSMC are, in our view, two of the most critically important businesses in the modern world, and collectively were almost 10% of Fund at quarter-end.

Other notable positive (relative) contributors were Chinese online travel agency Trip.com (32% return, 0.4% contribution) and Southeast Asia's food delivery and mobility platform Grab Holdings (20% return, 0.3% contribution). Trip.com continues to execute well operationally, recording 16% revenue growth in the second quarter and 10% operating profit growth. Although competitive intensity is picking up in the technology space in general, Trip.com has so far managed to avoid the sort of price war that we are seeing in other sectors like ecommerce and food delivery. Incoming tourists to China are proving to be a significant opportunity, with the company seeing 60% growth in Q2, helped by China's easing of visa policies for inbound tourism from an increasing number of countries. In Grab's case, all key metrics showed considerable growth and/or improvement in the second quarter results. Revenue was up 23% year-on-year (YoY), the company swung from a $68m loss to a $20m profit, and free cash flow (operating cash less capital expenditure) almost tripled to $112m thanks to a big decline in cash being absorbed by operations.

Offsetting these positive contributors were several stocks that detracted from relative performance. The most notable was Alibaba, which the Fund does not own. Alibaba returned just over 60% in the quarter, and by virtue of being a ~3% position in the benchmark, cost the Fund 1.4% in relative performance. We have debated (and written about) the investment case for Alibaba before, but on balance have preferred not to own the stock for a variety of reasons. The core ecommerce business has lost market share steadily to the likes of JD.com (3.5% of Fund) and PDD (not owned). Their food delivery platform Ele.me has historically been a weak No.2 player to Meituan (1% of Fund), and their cloud business, although it is the largest player in China, operates in an intensely competitive market where return on investment is likely to be lower than what we see in global cloud providers like Amazon and Microsoft.

That being said, Alibaba's recent operational performance has shown significant improvement compared to the last few quarters. After bleeding market share, domestic ecommerce is now experiencing double-digit revenue growth, international ecommerce is growing at almost 20% a year, and cloud growth, despite a high revenue base, is at 26% YoY and with nearly double-digit profit margins. All these developments have led to a significant rerating of Alibaba from the historical lows it had reached since its listing. While it is disappointing not to have owned a stock we know well and that gave such strong returns in the short term, we believe that in the fullness of time, other stocks competing with Alibaba will provide bigger and more durable return opportunities, in particular, JD.com. For the moment, JD.com's share price is being weighed down by its foray into food delivery, taking on both Alibaba and Meituan. Losses from food delivery subsidies are likely to have peaked, and with the core ecommerce business showing strong and sustained profitability, it is our view that JD.com will provide attractive returns from here. JD.com (a 3.5% position, making it a top 10 holding) trades on less than 10 times next year’s earnings and has a rock-solid balance sheet with 27% of its market cap in net cash, resulting in it trading on less than 8x earnings ex-cash.

The Fund also does not own Tencent Holdings directly, and this cost 1% in relative performance; however, the positive performance from the Fund's holdings in Prosus and Naspers, which trade at a discount to the look-through value of their stake in Tencent, offset most of the negative impact of Tencent. Samsung Electronics (not owned) cost the Fund 70bps in relative performance, as the share rallied 35%.

Of the stocks owned by the Fund, the only material detractors were Mercado Libre (a 4.6% position), which was down 10% in the quarter and cost 0.9% in relative performance, and Bank Mandiri (Mandiri) in Indonesia (-12% return, -0.5% impact). Mercado Libre was driven down late in the quarter by concerns over Argentina's economy (their third-largest market by sales, but more in terms of profits), with the government approaching the US for economic assistance. In Brazil (their largest market by sales), competitive intensity is also heating up with Amazon offering incentives like a free "Fulfilled By Amazon" service for up to four months to sellers to use their platform. Amazon does remain quite small in the Brazilian market. In Mandiri's case, Indonesia's growth and budget metrics have been deteriorating, and there has been some political unrest, all of which has weighed on local asset prices, including Mandiri, which is a state-owned bank.

The Fund bought Adidas during the quarter (1.2% position). About half of profits come from emerging markets, with only around 10% of profits coming from the US. The stock is still trading at the levels it reached when the US tariff announcements hit the entire sector back in April. We bought after the second-quarter results were judged as disappointing (-15% move over a few days), but our view was that underlying sales momentum and product development are still looking strong. Companies like Adidas are finding it difficult to provide guidance due to an uncertain tariff impact and the fact that mitigation measures (moving production that is destined for the US to countries facing lower US tariffs) take a few quarters to implement. What is clear is that the wholesale, retail, and ecommerce (direct to consumer) channels of the business are all seeing double-digit YoY growth. Strong results from performance and lifestyle products have boosted the brand's appeal. Next year's expanded 48-team FIFA World Cup will further keep Adidas top of mind. Using reasonable long-term normal margin assumptions (below what management guides to) Adidas is trading on around 15x earnings for 2027 (once all the tariff issues have been fully digested). For a leading global brand, this is very attractive.

The Fund sold its position in Galaxy, investing part of the proceeds into Melco Resorts as the Macau gaming industry recovers to pre-pandemic visitation levels. In Brazil, we sold Sendas, which recovered strongly from the lows reached earlier this year, but felt the capital could be better deployed elsewhere (such as in Mercado Libre as it fell). Finally, we sold out of Banorte in Mexico as the share's strong performance this year resulted in the potential upside falling below the average for the portfolio as a whole. Still, we retained some Mexican banking exposure through a new position in BBVA (a Spanish bank we have owned before and whose value is more than 60% derived from its high-quality Mexican operation) and our large existing position in Nubank, for whom Mexico is the second largest market.

Within China, the BYD-CATL mix shifted increasingly toward CATL, with most of the position size increase coming at the expense of BYD. We are long-term believers in BYD's investment case, but it is also clear that competitive intensity in the sector has reached astonishing levels with oversupply, falling prices, and rising inventories. BYD is more exposed to this than CATL, as a vertically integrated producer that manufactures both cars and storage systems.

Continued weakness in Make My Trip's share price provided an opportunity for further buying and in Indonesia, we have added to the Bank Central Asia position initiated in Q2.

During the quarter, members of the investment team visited Hong Kong, Korea, and Taiwan, and several trips are planned during the fourth quarter, across Asia in particular.

South Africa - Institutional

South Africa - Institutional