Investment views

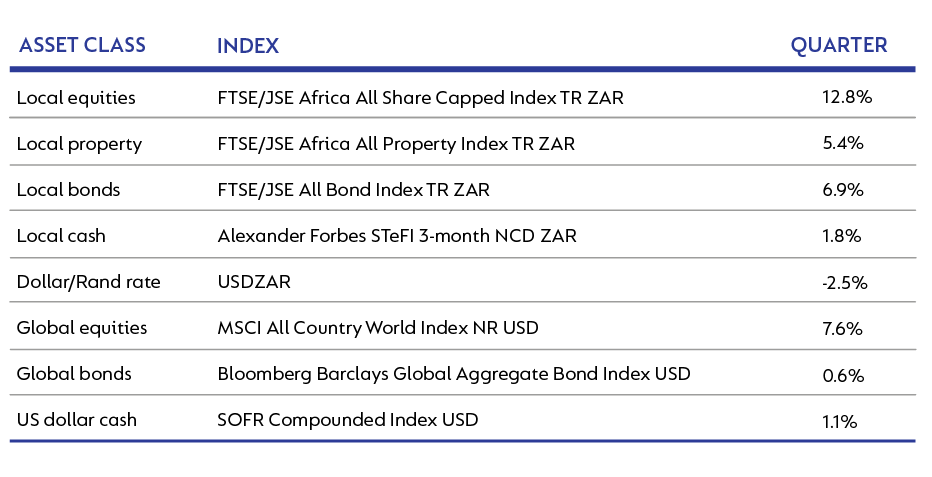

Global equity markets delivered solid gains in the third quarter of 2025, supported by continued optimism about artificial intelligence, signs of cooling inflation and growing expectations that major central banks will cut interest rates before year-end. Meanwhile, Chinese authorities stepped up fiscal and monetary stimulus. Emerging markets outperformed developed markets for the third consecutive quarter.

South African markets participated in the global risk-on rally, with precious metals shares again posting particularly strong gains. Listed property also advanced, while local bonds enjoyed a strong quarter as investors anticipated eventual rate cuts from the South African Reserve Bank. The rand strengthened against the US dollar, reversing some of the weakness it had shown earlier in the year. However, domestic fundamentals remain fragile, with growth sluggish and fiscal risks weighing on investor sentiment. Inflation has remained contained, creating space for potential monetary easing.

More information on specific funds' positioning and performance will be available on our website later this month.

South Africa - Institutional

South Africa - Institutional