Economic views

Global outlook

Post-pandemic recovery in the balance of vaccines and a return of confidence

- Good prospects of an H2-21 recovery in global markets despite second lockdowns

- Vaccines and confidence will determine the degree of recovery

- Fiscal and monetary policy interventions should support economic activity and restore confidence

- Emerging markets with pre-pandemic debt burdens will lag in recovery

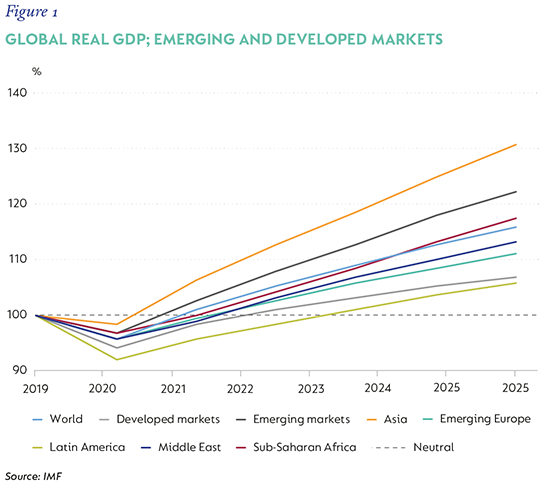

Covid-19 (and the subsequent lockdowns) is the most severe exogenous shock to the global economy in modern history. More akin to a natural disaster or war than a financial crisis, the supply shock the pandemic imposed on the global economy stunned a healthy system into the deepest recession in 70 years. Containment policies, which necessarily restricted mobility, were largely to blame for the massive loss of output in the first half of 2020 (H1-20). But unprecedented, broad-based and aggressive policy responses across the globe were able to cushion the impact of the pandemic on incomes, financial systems and governments’ ability to intervene, assisting in a sharp recovery in the second half of 2020 (H2-20). Given these events, the global economy managed to achieve a remarkable, if uneven, recovery during late-2020.

The pandemic’s second wave has prompted renewed lockdowns in Europe, Japan, the UK and the US, as well as in many emerging markets, and will stall some of this recovery momentum into the new year. With many earlier relief programmes coming to an end, the economic impact may be exaggerated until further support is felt. Despite this, the prospects for recovery in H2-21 are still good. Not only is there positive news of a widening availability of prioritised vaccines, but the nature of the crisis, which has seen little financial sector damage and relatively targeted income and employment protection, bodes well for a growth recovery in the year ahead. That said, the strength of the recovery will depend on how the balance of forces evolves.

Most analysts expect the global economy to see 2021 growth off a shattered base. However, there is quite a range of opinion as to how strong and fast the recovery to pre-pandemic GDP levels, and the trajectory, will be. Two key factors will determine the strength of the recovery – first, the speed with which effective vaccines are deployed, and second, the degree to which the impact of breaking the link between containment and mobility sees a return of confidence to economies that were in relatively good shape before the crisis hit.

- The prospects of a widely available vaccine in 2021 have improved, and many countries are already implementing administration programmes. While there is still some friction between the speed with which vaccines can be produced and how widely and quickly they are accepted and can be administered, it seems sensible that vaccines that offer protection at low risk will be popular. The availability of such vaccines in emerging markets will probably take longer than in advanced economies, but with commitment by producers to help, there should be incremental and accelerating rollout globally this year.

- The size and nature of policy response to the pandemic in 2020 were remarkable, and facilitated a sharp recovery in H2-2020. Income-targeted policies of a scale not seen before accounted for the bulk of fiscal interventions, which the IMF estimates added nearly four percentage points (ppts) to global growth in 2020. This may become less supportive as some emergency programmes roll off, and in economies – largely emerging markets – where fiscal space is more constrained.

However, there is clear debate globally about the need to avoid a ‘fiscal cliff’ prompted by the premature withdrawal of policy support. The recently approved US expenditure package is indicative of a change in thinking. The early withdrawal of fiscal support after the 2008/2009 Global Financial Crisis (GFC) undoubtedly slowed the economic recovery. Governments are less likely to enforce the same degree of consolidation in 2021, although capacity to sustain expansions varies greatly by country, again, with visible constraints in emerging markets.

![]()

CENTRAL BANK POLICY AND ACTION ARE KEY DRIVERS TO RESTORE CONFIDENCE

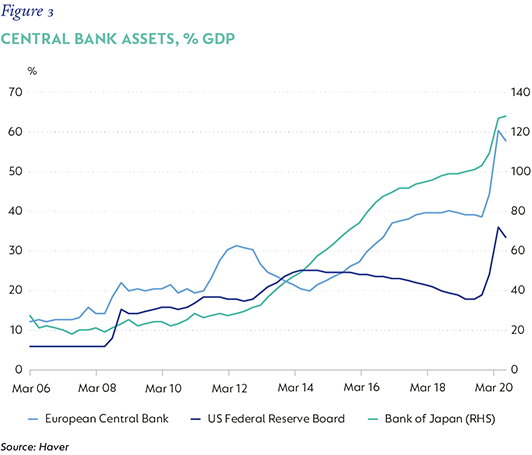

Fiscal support is being underwritten by monetary policies. Central banks in most developed economies cut policy rates and deployed their balance sheets in stunning size to support fiscal sustainability during 2020. Utilising unconventional policies initiated in the wake of the financial crisis, developed market central banks were able to ensure ongoing market liquidity to fund fiscal policies and ensure overall borrowing costs remain exceptionally low. Some emerging market central banks followed, employing quantitative easing strategies and credit policies to limit the impact of lockdowns on financial markets and the spillovers to the real economy.

Available data suggest the combined quantitative easing and credit policies of the G4 (Brazil, India, Germany and Japan) central banks added $8 trillion to their balance sheets in 2020, boosting the size of these by 20ppts – compared to 7ppts in the aftermath of the GFC. As the recovery stalled in late 2020, the large central banks have committed to ongoing monetary accommodation, which should provide support for fiscal policies in developed economies, as well as emerging markets, as investors seek yield in a low-yield world.

EASING OF GEOPOLITICAL TENSIONS

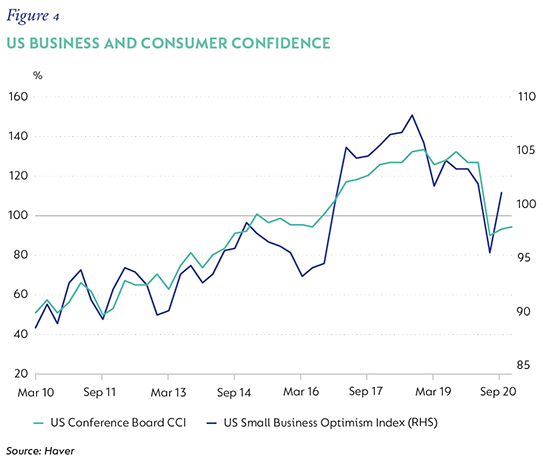

Geopolitical uncertainty should also diminish in the year ahead, creating a more constructive political narrative. The transition to a new, more conciliatory and cooperative US administration should ease the tension brought on by the uncertainty of the past four years, help reduce aggravated trade risks and see traditional allegiances strengthened, rather than weakened. The conclusion of a Brexit deal eliminates the risk of a ‘hard’ no-deal, even if the economic cost to the UK of full withdrawal is likely to linger. Overall, however, this should be positive for global trade and general sentiment. All the factors discussed above provide the basis for a growth recovery of some strength in 2021. But, critical to the economic recovery prospects for this year will be the degree to which these interventions combine to restore consumer and business confidence. For the recovery to be complete – for global GDP to return to pre-pandemic levels – employment and investment need to recover to the same degree.

LINGERING EFFECTS

One area where recovery will undoubtedly lag is the services sector, notably travel and tourism, but also parts of retail and business services. With inter-regional mobility constrained in most parts of the world until a vaccine is widely and compellingly implemented, a full employment recovery in these critical sectors is unlikely. Cross-border restrictions are also likely to continue even as vaccines are rolled out.

The labour market may be ‘scarred’ for some time. A slow recovery will undermine the pace of employment growth, and long periods of under-employment tend to be reinforcing. That said, the impact on incomes and domestic demand is less negative. Data from the US and Europe (and South Africa) suggest that a large proportion of job losses have been in lower-income occupations (mostly in the services sectors). Fewer high-income jobs have been lost (unlike during the GFC) and ongoing income support for these households should cushion the economic impact of employment loss for some time. Importantly, savings rates have surged, presenting a large potential source of demand on recovery.

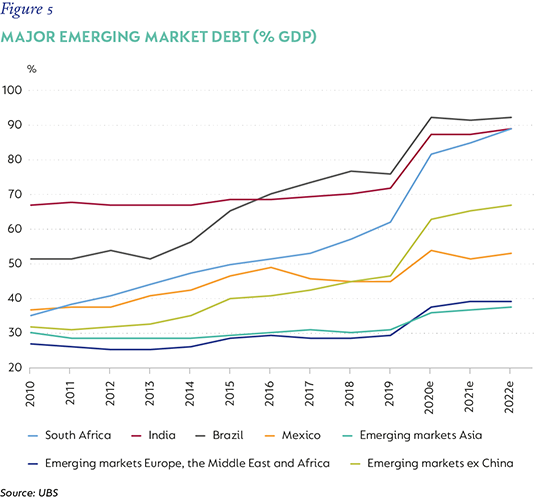

DEBT WEIGHS ON EMERGING MARKETS

It isn’t clear cut how emerging markets will fare in the year ahead, as large imbalances have been exposed and have worsened during the crisis, with striking intra-country variance. There are good prospects for growth to recover, even if at a lag, as vaccines become effective. Global tailwinds will also provide an important boost to emerging markets. However, fiscal fault lines may become more fragile in the year ahead. Many emerging markets entered the crisis with persistent deficits, already-large stocks of debt and limited fiscal headroom to support an economic recovery. Necessary fiscal provision and revenue losses have pushed these economies into uncertain fiscal positions, with doubtful sustainability.

While the G20 has recognised the dire position of many emerging markets and implemented the Debt Service Suspension Initiative (DSSI) for 73 qualifying countries (the DSSI does not cover middle-income countries like South Africa), appeals to private creditors to do the same have been unsuccessful. The Institute for International Finance estimates that nearly $7 trillion in emerging market debt will fall due in 2021 – three times the amount owed in 2020. While low interest rates globally have been a considerable support for emerging market government yields and will certainly continue to contribute to easier financing conditions, this may not be enough in 2021.

Several factors will determine these countries’ fiscal prospects. These include the strength of pandemic management, the starting fiscal position, the pace of recovery – supported by domestic growth strategies and policy implementation – and each country’s ability to leverage global demand. The US reflationary policy stance should boost emerging market exports, and the ongoing recovery in China should be positive for commodity producers.

However, some emerging markets will have to consolidate last year’s fiscal largesse, and this may be an offsetting drag on growth, possibly reinforcing areas of fiscal and political instability.

RECOVERY MARKERS

Consensus seems to lie in a cautious recovery outlook, with an incomplete recovery as the base-line for 2021. On balance, we are more positive about the prospects for a close-to-full global recovery in 2021, notwithstanding the plethora of tightening lockdowns currently under way.

Ultimately, what will drive ‘completion’ is a sufficient recovery in business and consumer confidence based largely on credible fiscal and monetary policy support to propel new investment and re-employment. Here we see advanced economies, and China, as being best able to capitalise on the current levels of policy support, for longer.

INFLATION SURPRISES ARE NOT FAR-FETCHED

It is also worth highlighting that, while there is clearly some debate about the strength of a global recovery this year, there is less debate about the risk of higher inflation. If GDP fails to recover to pre-pandemic levels, the implied global output gap should persist, and demand pressure is likely to remain low. This scenario certainly currently underpins the monetary policy positioning and communication of most global central banks.

However, a stronger recovery built on massive policy support, especially for incomes, and with a foundation of relatively healthy household balance sheets, supported by a robust financial system and healthy credit pathways amidst strong growth in transaction money, could certainly see inflation pick up ahead of current expectations.

A number of additional drivers are also possible, including shifting supply chains in the wake of the pandemic and retreating globalisation, a less constrained regulatory environment, the active promotion of credit extension, and central banks explicitly targeting higher inflation.

The unexpected can happen. Markets and analysts are less focused on this risk than on a weaker global recovery, despite its greater potential to disrupt financial and asset markets. +

Disclaimer:

SA readers

Global (ex-US) readers

US readers

South Africa - Institutional

South Africa - Institutional