WE STARTED THE year cautiously optimistic that a cyclical recovery, driven by some acceleration in consumer spending, was a reasonable expectation for the year ahead. However, we cautioned that anything more durable needed a commitment to accelerated policy reform and that time to deliver was short. We also cautioned that Eskom remained the biggest, most immediate threat to growth. At the end of the first quarter of 2019, we must reset these expectations. We still expect consumer spending to be the biggest driver of growth, and for growth to be marginally better than last year, but the starting point has weakened, time is even more of the essence and Eskom has indeed become the biggest threat to growth.

ESKOM ELEMENT 2.0

The shock escalation in load shedding in March, following a mild (although also unexpected) period in the last quarter of 2018, has materially increased downside growth risk. It is difficult to incorporate or make allowance for unprecedented uncertainty in an economic forecast, specifically the risk embodied by Eskom, which is clear and present, but unscheduled and prone to randomness.

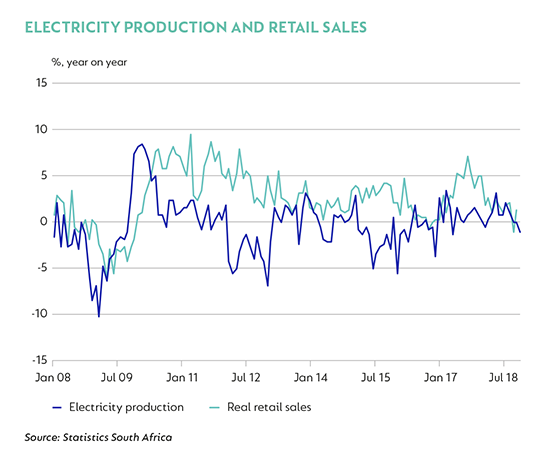

The direct impact on numbers at this stage is limited by the relatively short period of actual Stage 4 outages. Anecdotal evidence suggests large users had the capacity to mitigate most of the impact associated with unscheduled outages and managed production accordingly. Some users could protect core operations using generators (which still cost more), while small and medium enterprises are likely to have been most affected by production downtime, stalled supply chains, a backup in inventories and weak sales. However, historic data show only a loose relationship between blackout periods and a change in retail sales volume.

The broader impact on the fiscus, should more financial support be needed, and importantly on sentiment is harder to estimate. However, it seems reasonable to expect further delays in any planned capex, and disruptions to consumption. We remain very concerned that the escalation in March load shedding reflects a significantly more decrepit underlying generation fleet than previously assumed and that the prospects of stabilising long-term energy availability and the associated cost are all unknown. This will have a material impact on sentiment, and such aggravated uncertainty is the enemy of growth.

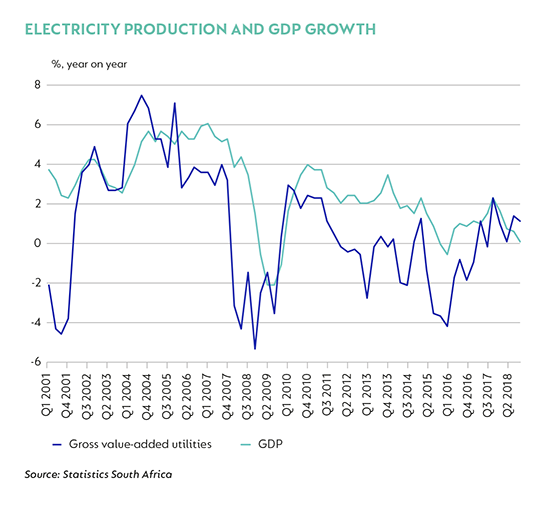

Past periods of failing energy production and rolling blackouts have reduced GDP by 0.2 to 0.4 of a percentage point. These periods were prolonged relative to what we have seen now, although the recent load shedding was even more severe. Experience has also improved communication between users and Eskom, with some corporates better prepared to mitigate the impact on production than before.

GDP REVISITED

For now, we have shaved 0.3 of a percentage point off our 2019 GDP estimate, and lowered the 2019 and 2020 estimates to 1.3% and 1.7% respectively. There is still downside risk to these numbers, but until we have better information about Eskom’s future supply and actual impact from hard data, we are reluctant to extrapolate this relatively short-lived, although severe and alarming, episode.

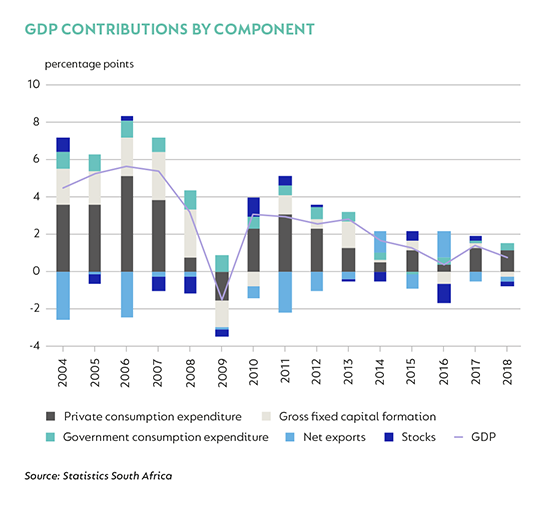

The domestic economy grew 0.8% in 2018, in line with our expectation and the poor average GDP of the past decade. Within this, consumer spending was the biggest contributor, with real household spending up 1.8% year on year (y/y), but slower than 2017’s 2.1%. Government added at the margin, but this was disappointingly offset by outright contractions in gross fixed capital formation, net exports and a large drawdown in stocks.

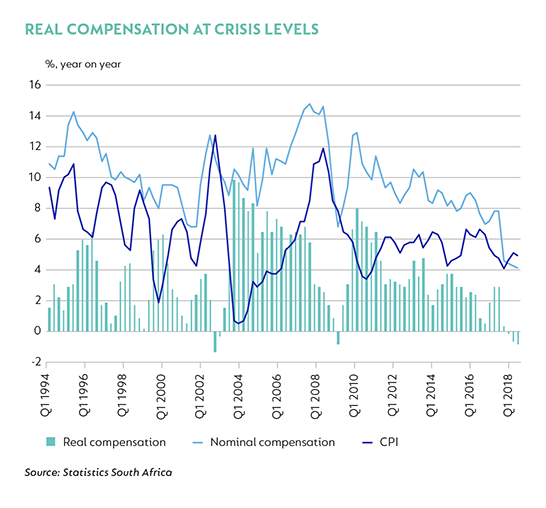

The outlook for consumer spending is still critical to any improvement in activity in the year ahead. In this regard, the publication of full-year GDP data held several negative surprises. Most important was a significant revision to the underlying estimates for compensation. Compensation and employment are the biggest drivers of consumer spending, in turn 60% of GDP. In the last Corospondent, we flagged the downside risk to spending due to a slowing in compensation. New data show that household compensation indeed slowed – in nominal terms – to 4.1% y/y at the end of 2018. This is the lowest ever since 1994 and represents an outright inflation-adjusted contraction of 0.8% in both the third and fourth quarters of 2018. This is a deeper contraction and more prolonged than we saw in the depths of the crisis in 2009 when formal employment fell 5% from the 2008 peak.

When we adjust for other income and deduct taxes and social contributions, we can derive households’ disposable income – the bit left over with which households purchase all consumer goods and services. At 4.9% y/y in nominal terms, disposable income outpaced compensation, because income from investments increased sharply last year. In real terms, disposable income was flat last year (0% y/y in the fourth quarter of 2018).

This massive deterioration in spending capacity not only reflects weakness in employment, but very constrained economic circumstances – compensation data capture salaries, overtime and bonuses, and pressure on all avenues of earning ability reflects an overall exceptionally constrained economy. While this is a ‘backward-looking’ data point, it not only explains a considerable amount about the bleak retail environment of the past year, but also represents a considerably weaker starting point from which households are operating.

Credit extension to households has picked up, providing a boost to spending late last year. We expect this to continue and look for a stabilisation in nominal compensation growth this year. Low inflation should assist stability in real disposable incomes, although rising fuel prices and the possibility of higher food inflation are an additional risk as the year progresses, particularly if employment and compensation remain under pressure. Overall, we think household spending will grow 1.9% y/y in real terms in 2019 and accelerate to 2.5% in 2020.

We have never counted on an acceleration in capital investment over our forecast period. This is typically a late-cycle phenomenon in South Africa, and we believe there are still binding structural and cyclical constraints on investment. This remains the case, although the downside risk (off a weak base) has increased materially with Eskom’s failing fleet.

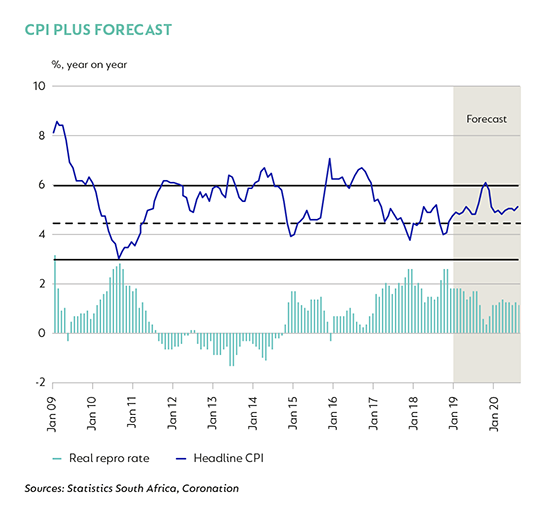

INFLATION BENIGN FOR NOW

Consumer inflation remains low, printing 4.5% y/y in March, following benign 4.1% in February and 4.0% in January. The acceleration in March mostly reflects the rise in retail fuel prices and Budget-related implementation of various taxes. However, behind the March headline acceleration was a very sharp drop in rental and owners’ equivalent rent (OER) to 3.5% y/y and 2.6% y/y from 4.2% y/y and 3.5% y/y, respectively. Rentals are typically slow-moving, and the sharp deceleration reflects a very constrained consumer and housing environment. With food inflation and 2.3% this further moderation in rental (services) inflation provide a large anchor for headline CPI, which we expect to average 4.7% in 2019 and 5.3% in 2020.

The March Monetary Policy Committee meeting resulted in a unanimous vote to leave the repo rate unchanged at 6.75%, and detailed a downwardly-revised 2021 CPI forecast at 4.7%, from 4.8%. Within a low domestic growth, globally benign context the MPC is in a more comfortable position as it assesses the outlook for inflation than before. A moderation in inflation expectations has help reinforce more moderate forecasts. By mid-year, data confirming weak GDP data for the first quarter of 2019, which could be negative sequentially, low inflation and some possible compositional change within the MPC may well see some members consider cutting the policy rate at coming meetings. For now, our base case remains that the repo rate will be unchanged through the end of the forecast horizon, allowing the already accommodative stance to increase as inflation rises moderately.

FISCAL POLICY – DOWNSIDE RISK OVERWHELMS UPSIDE POSSIBILITIES

The February Budget presented a worse set of fiscal data than we had expected. The fiscal deficit was revised larger, reflecting weaker revenue outcomes and greater support for Eskom than expected at the time of the Medium-Term Budget Policy Statement in October. Provisional financing data released by the South African Revenue Service (SARS) for the end of the fiscal year showed a R14.6 billion shortfall relative to the Budget expectations and a R57 billion (1.2% of GDP) miss compared to the Budget in 2018. It also implies that the 2018/2019 consolidated deficit will widen relative to the -4.2% of GDP Budget expectations.

Looking ahead, it is uncertain whether committed support for Eskom will grow, given the unknown outlook for the entity. On the revenue side, weaker growth may well put pressure on projections, although we are hopeful that efforts to rehabilitate SARS and the permanent appointment of a new Commissioner will offset some of this risk.

Moody’s, the only ratings agency with South Africa’s sovereign rating within investment grade, did not review the rating in March and maintained an unchanged rating at Baa3 (stable). This provides a near-term reprieve, although downside risks for both growth and the fiscal position suggest that a ratings action in due course remains a considerable risk.

THE ELECTION AND STRUCTURAL REFORM

The 8 May election outcome may provide President Cyril Ramaphosa with a decisive win and a stronger mandate to appoint a Cabinet better equipped to change the tone and focus of economic policy. Almost regardless of the outcome, we still expect the President will try to ensure that key economically systemic ministries are headed by capable people and that this, combined with interventions at key institutions, should help provide some stability where uncertainty in the past has been deeply detrimental to growth.

A coordinated vision of the ANC’s election manifesto, which aims to transform the economy through job creation, sustainable land reform and addressing anticompetitive corporate concentration, is necessary to encourage investment. While we expect Eskom’s role as the country’s sole energy provider to diminish over time, the way in which government manages the crisis will give us some insight into its broader capacity for reform. A clear signal of the administration’s ability to deliver a new vision for economic policy will not just be its ability to stabilise the entity in the short term, but having a clear, decisive and far-reaching vision for long-term energy supply as well as making the political decisions this entails.

GLOBAL GROWTH SLOWED through most of 2018. But the pace of slowing accelerated meaningfully from mid-2018 into the first quarter of 2019. ‘Recession indicators’ started rising in the US, and growth concerns in Europe and China were reinforced by an escalation in trade tensions and ongoing deterioration in an increasingly wide set of economic data. Uncertainty about the future interconnectivity of the global economy will undoubtedly play a bigger long-term role in the global growth moderation than the direct impact of trade weakness, but the current situation has undeniably been exacerbated by idiosyncratic issues in several key economies, which should ease. The longer-term cost of heightened uncertainty is still to be counted.

Within this context, it is instructive to try to identify the sources of economic weakness and uncertainty, and then assess how durable the effects may be. These seem to fall broadly into three buckets:

1. CHINESE ECONOMIC ACTIVITY

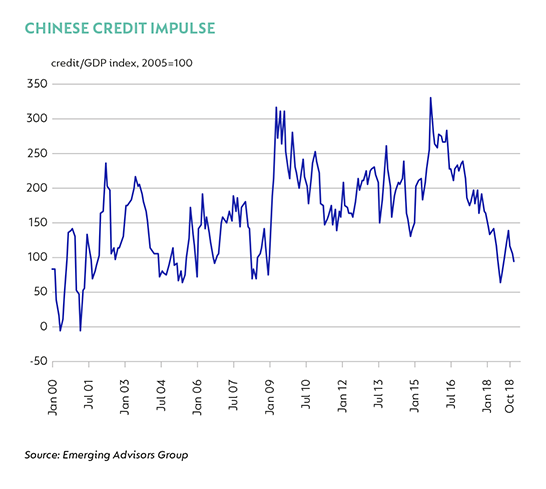

The internal, policy-driven moderation in Chinese economic activity started in 2017. Successive stimulus interventions have seen an unprecedented accumulation of debt relative to GDP in China, which peaked at an estimated 250% of GDP in mid-2017. Reasonable concerns about the sustainability of both the stock and the rate at which it has increased prompted policymakers to moderate credit availability from the end of 2016. The impact of credit withdrawal led to a moderation in growth momentum, which affected domestic activity and then rippled into global trade.

2. US-SINO TRADE TENSION

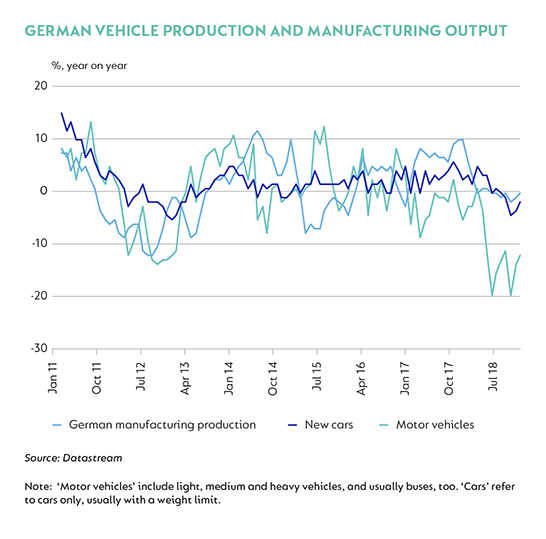

The above factors coincided with the escalation of US-Sino trade tension, which saw the US initially impose 10% tariffs on $200 billion of Chinese imports in mid-September, followed by retaliatory tariffs from China on $60 billion of US imports. While the US and China’s negotiations are still ongoing, global trade indicators remain weak. The knock-on has started to affect global manufacturing and, more broadly, sentiment and business investment. The hardest hit have been large trading economies, including Germany, much of Asia and Japan.

3. INDIVIDUAL MARKET EVENTS

More randomly, there are a number of idiosyncratic events which have either materially exacerbated the impact of the above, such as the change in emissions regulations in Germany, or had the effect of weakening broader sentiment and hard data, such as a combination of US market volatility, the polar vortex and the shutdown of the Federal government in February. Elsewhere, political tension in France and the chaotic Brexit negotiations have negatively affected confidence and biased growth weaker.

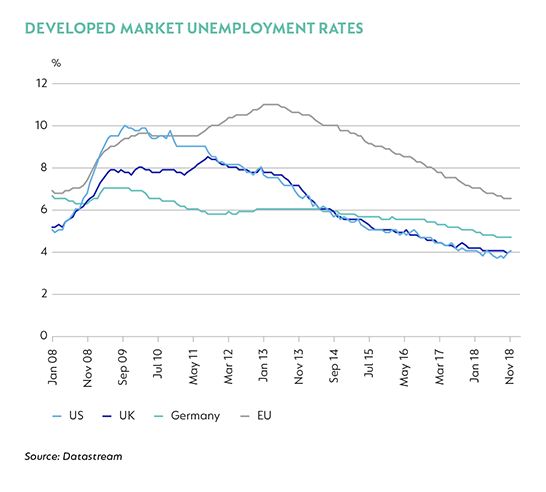

For all this weakness, the resilience of domestic demand in these economies has provided a relatively robust buffer. Across a broadbase of developed and some emerging markets, the current economic cycle has seen unemployment fall to multi-decade lows. While there are ongoing questions about the quality of this employment growth, low levels of unemployment support wage growth – and we have seen earnings pick up in the US, UK, Japan and parts of Europe, to the extent that developed markets’ income growth now rivals the last expansion. This has not been enough to mitigate all the headwinds, but it is an important source of stability.

Despite all the bad news, at the time of writing, there is mounting evidence that the first quarter of 2019 may be the low point of global growth. Several ‘nowcast’ models (UBS and JP Morgan), which track changes in high-frequency data to monitor the state of the economy in real time, are pointing to an improvement in global growth momentum. While the activity data are still mixed, there is enough evidence to suggest that, at the minimum, disruptions in the US and parts of Europe are normalising, and policy intervention is gaining traction in China.

This base is narrow because global trade-related activity and associated indicators are still uniformly weak. Data published by Morgan Stanley suggest that global trade volumes slowed to just 0.5% year on year in March, from 1.0% in February, based on export expectations in the IFO Institute for Economic Research survey and hard export volume data from Korea captured by their trade indicator. For better certainty of a recovery in global growth, we need a few things to go ‘right’:

Firstly, China’s outlook is critical to the prospects and magnitude of a global recovery, given its significant contribution to the global demand weakness over the past six to nine months. The main drag on growth remains property construction and manufacturing capex. This should be countered by an improvement in consumer spending and the support from fiscal stimulus. The rise in China’s Purchasing Managers’ Index new orders for the second consecutive month is encouraging.

Secondly, some resolution to the US-Sino trade tension is needed in the form of an agreement on terms and implementation between the US and China. Not only is this key to an improvement in trade volumes; a better framework for dispute resolution is also a necessary condition to avoid a repeat of the past year’s standoff or a deterioration to something more hostile. The likelihood of achieving a robust agreement with long-term solutions is questionable given the US and China’s very different economic policies, but a stabilisation in tariff uncertainty should support confidence lost in the current state of flux.

Then, we need to continue to see the influence of the ‘one-offs’fade, especially the disruptions to US activity and spending after February, and the lesser influence of the manufacturing disruptions in Germany. The US Federal Reserve’s commitment to ‘patience’ should also provide a meaningful fillip by keeping global financial conditions easy for a prolonged period, although better growth could also see an uptick in inflation and ultimately put pressure on the Federal Open Market Committee to continue raising rates. Similar very dovish guidance from the European Central Bank suggests it will take a considerable change to conditions to alter its outlook, and we assume monetary policy will stay accommodative in coming months, even as activity picks up again.

Lastly, the ‘red flags’ raisedduring this period of slowing growth need to be tested. Not all the decline in growth momentum that we have seen in the past two quarters can be fully explained by the events listed above and, in some cases, these have not been resolved.

In China, we assume that much of the slowdown started with tighter credit conditions, which have started to ease modestly, and that fiscal interventions will buoy activity in the second half of 2019. It is possible, however, that the impact of credit withdrawal has not yet fully played out, notably on the property market, and that we have yet to feel the full impact of the trade war with the US. Both factors are considerable uncertainties, and hard to quantify.

For the US, the combined sluggishness in the housing market – which is at odds with the very supportive macro factors, including employment and wage growth, household formation and very supportive financing conditions – and emerging weakness in business investment are traditional signs of cyclical weakness, which are important to monitor.

In Europe, the impact of protracted weakness in the external sector may have a much deeper effect on growth. Global trade is a much stronger driver of internal growth momentum than in the US or China. Political uncertainty will play in the background and is not limited to Brexit. It also includes the outcome of the European Parliamentary elections, taking into account more populist and less traditional leadership in several member countries, as well as the impact of weak growth on Italian fiscal metrics, especially under the coalition government.

The umbrella risk is that the uncertainty imposed by all these factors becomes reinforcing in a global economy that is weaker and more fragile than it was at the start of 2018. Our base case, however, is that one-offs correct – and a few things go right – aided by strong domestic demand conditions in key economies and very supportive monetary policies.

We expect global growth to slow to about 3.4%, from 3.8% in 2018, and to recover to 3.7% in 2020. Within this, growth from emerging markets should be supported by recovering economies hard hit in 2018, including Argentina and Turkey, with emerging market aggregate growth expected to be 4.7% in 2019 from 5.0% in 2018, and 5.1% by 2021. Developed economies are more likely to remain under pressure, with the growth forecast flat at 1.8% in 2019 and 2020 as momentum from 2018 is lost and the US tax boost fades.

Disclaimer

South Africa - Institutional

South Africa - Institutional