EMERGING MARKETS AND South African fixed income markets managed to keep their heads above water this quarter, but the water wasn not calm. Local bonds produced a negative return in US dollar terms, in large part due to the poor performance of the rand. The local currency fell victim to a broader sell-off in emerging market currencies, which was driven in large part by the sell-off in the Turkish lira and Argentine peso.

Argentina and Turkey face similar issues of very high and increasing inflation as well as large external deficits which, until recently, have predominantly been financed by portfolio flows (foreign flow into the bond or equity market), making them rather vulnerable to global monetary policy tightening. During the quarter, the authorities in both countries acted in earnest to stem the depreciation of their currencies. In Argentina, authorities agreed the terms and structure of a $50 billion loan from the IMF, while in Turkey, the central bank hiked rates by 6.5%, in addition to implementing other supportive measures for the lira. This helped emerging markets to recover some of the losses incurred over the quarter.

LOCAL POLICY UNCERTAINTY

South Africa did not differentiate itself during the quarter. Economic conditions worsened, with growth materialising below both our and market expectations (-0.7% versus 0.9% expected), which pushed the economy into technical recession. In the context of the weaker emerging markets backdrop, South Africa did not fare well, as evidenced by the poor performance of the rand over the quarter. But South Africa’s problems are by no means as severe as those of Turkey and Argentina. Once the panic eased, both the local currency and domestic bonds recouped some of their losses. The All Bond Index (ALBI) was up 0.8% in the quarter, which was slightly behind cash (1.7%) as the longer end of the curve (maturity longer than 12 years) underperformed the rest of the bond curve. Concerns about growth, the implications for tax revenue and further bailouts for state-owned enterprisess weighed on the fiscal outcomes, which led to this underperformance. Inflation-linked bonds (ILBs) have continued to fare poorly, with returns of 0.5% for the quarter and 0.9% over the last year, well behind cash (6.9%) and the ALBI (7.1%).

The euphoria of the first quarter has quickly faded, as policy uncertainty remains a key obstacle to South Africa’s recovery. The policy trajectory and the intentions of policymakers have moved in the right direction; however, uncertainty around land expropriation without compensationand mining regulations has impeded the translation of confidence into actual spending. Towards, the end of the quarter, a new, more acceptable version of the Mining Charter was released, which should ease concerns from the local mining sector. However, to see an increase in consumption spending, currently contracting quarter on quarter, more clarity on expropriation without compensation is required. Given the current rhetoric from policymakers, this should be resolved over the next couple of quarters, which will then help with a faster recovery in growth in 2019.

Despite the depreciation in the currency and the rise in the oil price, forecasts for inflation still remain contained. Inflation is expected to stay in the target band over the next two to three years and only near the top end of the band in the first half of 2019. The recent South African Reserve Bank (SARB) rhetoric has indicated an eagerness to raise interest rates, which seems puzzling given the subdued growth and inflation outlook. Our expectations are for rates to remain flat until the second half of 2019. In addition, concerns around a blowout in South Africa’s fiscal deficit and implications for a further credit downgrade (which would trigger an exit from the Citigroup World Government Bond Index) are overdone. The economic assumptions behind the February budget still hold and while revenue has underperformed this year, this has been matched (if not exceeded) by expenditure underruns, which place less pressure on the fiscus and allow Moody’s to keep us in investment grade at least until the second half of 2019. Thus, the local environment for South African government bonds remains fairly supportive.

CASH OR BONDS?

The change in risk sentiment andglobal monetary policy will continue to pose a threat to emerging market sentiment and asset performance. This by implication suggests that there might be further downside to holding local government bonds. As long-term investors, we focus on the valuation of underlying assets relative to fundamentals and whether current valuation provides our client portfolios with a sufficient margin of safety in the event of short-term volatility or adverse price movements. The major choice facing local bond investors is whether to be invested in cash or bonds. On the face of it, this seems to be a fairly simple decision, but one which has a major impact on portfolio returns.

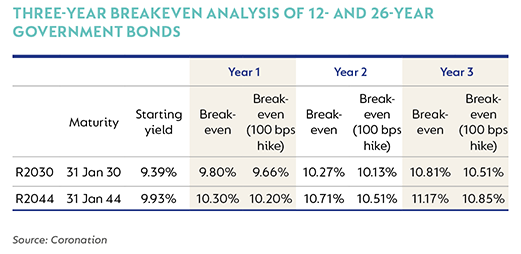

In the table below, we list the 12-year and 26-year government bonds, their market yield to maturities (as at the end of the quarter), and how much yields could sell off before the 1-year, 2-year and 3-year return on the government bonds equate to cash (6.5%).

As the table shows, assuming flat cash rates (6.5%), bond yields can move to 9.81% in the 12-year bond and/or 10.31% in the 26-year before they underperform cash over 1 year. If one assumes that cash rates move higher by 100bps to 7.5% (due to rate hikes, which is an extreme bear case), then the 12-year bond can move to 9.66% and the 26-year to 10.2%. As can be clearly seen, extending the investment horizon period to two or three years, means the breakeven protection increases substantially. Over three years, the 12-year and 26-year bond can move higher by 1.12% and 0.92% respectively before they underperform cash, even if cash rates move up by 1% (yields can move up even further if cash rates do not move higher).

The above analysis does provide comfort for holders of South African government bonds relative to cash. What also comes out of this analysis is that the longer end of the government bond curve offers better value at current levels. It requires a similar magnitude of basis-point movement for both the 12-year and 26-year bond to breakeven relative to cash. In addition, if one is more positive on bond yields (as we will show below), then holding a 26-year fixed rate bond will provide a greater total return than a 12-year government bond, since it trades at a higher yield and has a higher modified duration (capital at risk measure).

DIVERSIFICATION

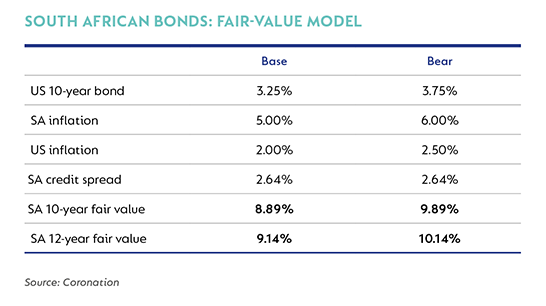

In addition to the above analysis, one has to ensure that current levels of valuation provide an attractive entry point and a decent margin of safety against an adverse movement in the event that the fundamental backdrop deteriorates due to any ‘black swan’ type of events. In the table below, we use our fair value stack-up (with an adjustment for 12-year government bonds) to first check whether current levels are attractive and whether, in an adverse scenario, bonds still provide an attractive return over the long term.

Given our base-case assumptions of a 3.25% US 10-year rate, 5% South African inflation, 2% US inflation and a steady South African credit spread, bonds are currently cheap. Even if our worst-case scenario were to play out over the next two years, local government bonds would provide a cash-type return (12-year bond yields can move to 10.13% before they underperform cash +1%).

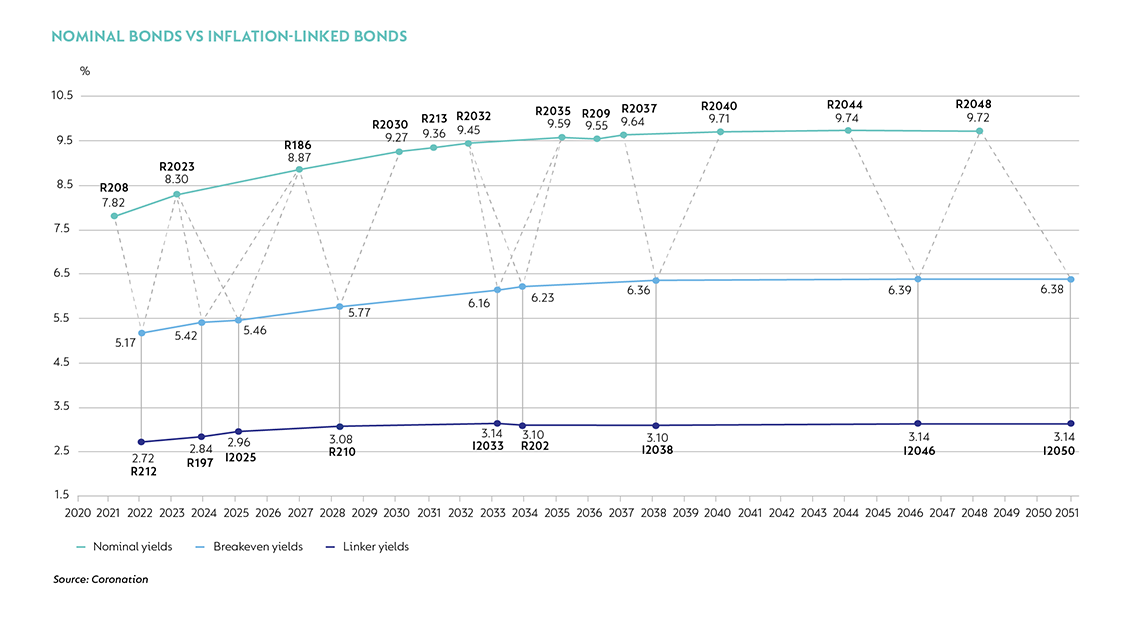

The next thing one has to decide is whether one should be allocating any bond investments towards ILBs to provide some diversification and inflation protection to the portfolio. As a reminder, ILBs are securities designed to help protect investors from inflation. They are indexed to inflation so that principal and interest payments rise and fall with inflation. In the table below, the blue line is the nominal bond curve, the orange line the ILB curve and the red line is the implied breakeven inflation, that is, where the market expects inflation to average over the maturity of the underlying ILB.

As an example, the I2033 matures in the year 2033 and in order for the ILB to outperform its equivalent nominal (R2035), inflation needs to average above 6.16% in order for the ILB to outperform the nominal bond. As is evident by the graph below, one would only hold ILBs which have a breakeven inflation of less than 6%, given that the SARB is an inflation-targeting central bank that has never allowed inflation to average more than 6% over any extended period.

Therefore, any longer ILB (with a maturity longer or equal to 12 years) does not offer value relative to its nominal bond counterpart, because one would need inflation to average well above 6% each year over a period of 12 years for the ILB to just perform in line with nominal bonds. However, a case can be made for shorter-date ILBs, where implied breakeven inflation is around 5.5% with real yields of more than 2.5%. In this case, the shorter-date ILB offers an attractive pickup relative to the real policy rate (currently at 1% to1.5%) and provides one with a ‘free protection’ in the event that inflation moves closer to the top end of the band over the next two to three years.

Recent economic releases have suggested that the local economy is taking much longer than initially anticipated to move onto a sustainable growth path. South Africa’s longer-term growth prospects are being dimmed by shorter-term uncertainty on key policies. Policy pronouncements more recently have signaled policymakers’ intention for a more market-friendly outcome, which should put growth back on an upward trajectory. Local inflation should remain within the target band, even after the recent selloff in the rand and the rally in the oil price. South African government bonds provide an attractive return relative to cash, compare favourably to their emerging market peer group and offer a decent margin of safety against a shorter-term deterioration in fundamentals. At current levels, the yields on offer in the local bond market are attractive relative to their underlying fundamentals and warrant a neutral to overweight allocation.

South Africa - Institutional

South Africa - Institutional