Investment views

SA bonds rudderless amidst uncertain policy direction and poor policy implementation

The Quick Take

- SA’s risk premium on the rise as fundamentals continue to deteriorate, compounded by election year jitters

- Inflation to remain sticky amid high food prices, weak currency, and higher cost of doing business in SA

- Risk sentiment tempered by Fed monetary policy expectations but remains positive for emerging market flows

- SA bond valuations still embed significant risk premium amid a precarious backdrop

- Investors need to remain vigilant amid unseen risks in fixed income portfolios emanating from corporate credit

Markets started 2024 intoxicated with the euphoria of the Federal Reserve Board’s (Fed’s) impending monetary policy pivot. Risk assets rode high on the wave of optimism for most of the first quarter (Q1-24), with emerging markets doing especially well. Unfortunately, as is generally the case, this optimism faded towards the end of the quarter, with the market’s initial pricing of 175 basis points (bps) of rate cuts for 2024 tapering to the Fed’s projections of only 75bps. South Africa (SA) has done little to positively differentiate itself from the rest of the emerging market basket. Uncertainty on the outcome of the local elections, possible coalitions and the policy implications thereof weighed on the performance of the rand and bonds, causing further underperformance relative to emerging market peers.

The FTSE/JSE All Bond Index (ALBI) was down 1.8% over the quarter, driven by its poor performance in February and March, as bond yields rose close to 100bps, inching closer to the highs last seen during the Covid crisis. Most of this poor performance was driven by the performance of the long end of the yield curve (>12 years). Inflation-linked bonds (ILBs) performed slightly better, returning -0.37%, as elevated real yields and stubborn inflation continued to help the asset class. However, over the last 12 months, both the ALBI’s (4.2%) and ILB’s (5.7%) performance remain significantly behind cash (8.2%). Given that the rand was also down c.5% versus the US dollar over the last 12 months, SA bond performance translated to dollars would have fared only marginally better than global bond performance over the same period (FTSE World Government Bond Index [WGBI] was down 0.8% in US dollars).

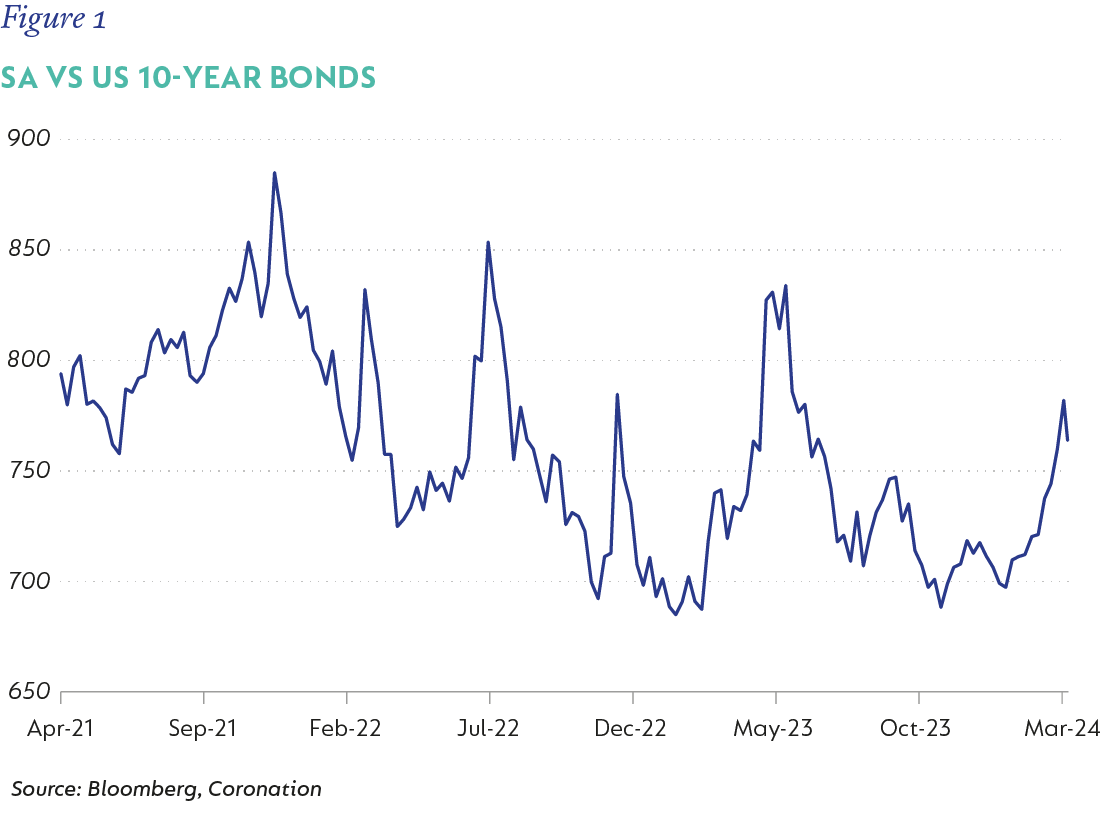

Figures 1 and 2 illustrate that SA’s risk premium has been steadily on the rise, as exhibited by the widening of bond yields relative to both the US and its emerging market peer group. This can be attributed partially to further fundamental deterioration and increased policy uncertainty due to the upcoming national elections.

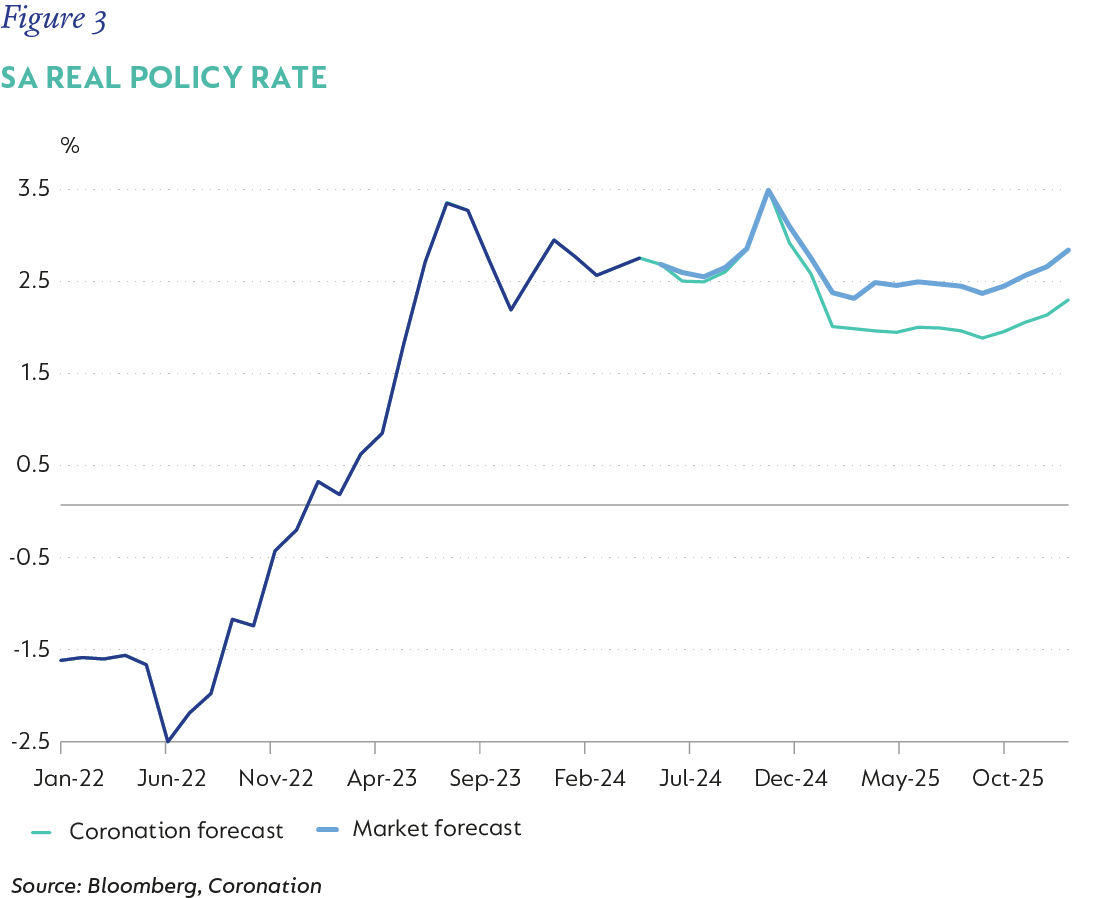

Furthermore, as at the end of December 2023, the market was pricing that the South African Reserve Bank’s Monetary Policy Committee would cut the repo rate by 75bps by the end of 2024, but recent pricing suggests that the repo rate will remain unchanged until the end of 2025. Market expectations for inflation are for it to average 4.5% in 2025, which implies a real repo rate of c.3.5% for most of the forecast period (Figure 3). We expect inflation to remain stickier and average 5.4% in 2025. Our stickier inflation forecasts are all supply-side based due to higher food prices driven by the effects of El Niño, a weaker rand translating into higher imported inflation and the higher cost of doing business in SA as a consequence of inadequate network infrastructure. However, as we have previously argued, with real growth struggling to break above 1.5%, policy settings could be regarded as excessively restrictive and, as such, we would view a reduction in the policy rate of 0.5%-0.75% starting in November 2024. This would still maintain a real policy rate of 2% based on our inflation forecasts.

FISCAL DEFICIT TOO WIDE FOR COMFORT

The outcome for the election will do little to improve the current trajectory of fiscal policy, which remains the Achilles heel of the economy. National Treasury continues to project a picture of fiscal consolidation based on expenditure restraint and reallocation. Unfortunately, with infrastructure across the country crumbling, from the municipal to the national level, it is highly unlikely that this restraint will materialise. Furthermore, funding markets are demanding a higher risk premium for SA, elevating fixed rate funding levels. Fixed rate funding still forms the majority of National Treasury’s funding plan and, as such, financing costs remain well above nominal growth. This implies that the fiscal deficit will continue to remain wide unless growth picks up substantially or the funding mix is changed to lower the cost of funding. The growth lever will take much longer to enact, which only leaves the funding mix as a means to buy time. Options here are numerous, including floating rate notes, short-term government bonds, concessional financing and shortening the issuance profile. All of which could delay a day of reckoning in funding markets to buy time for much-needed reforms to be enacted timeously.

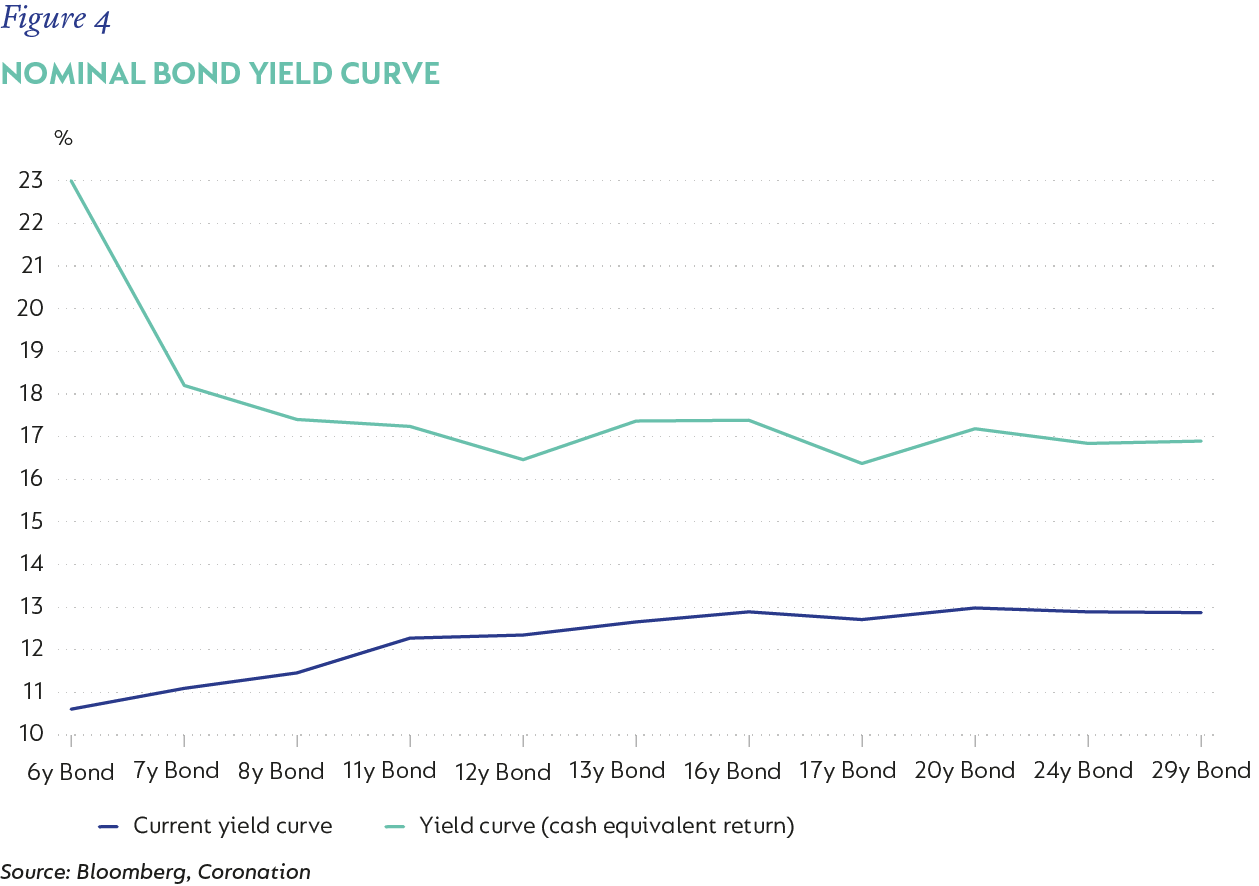

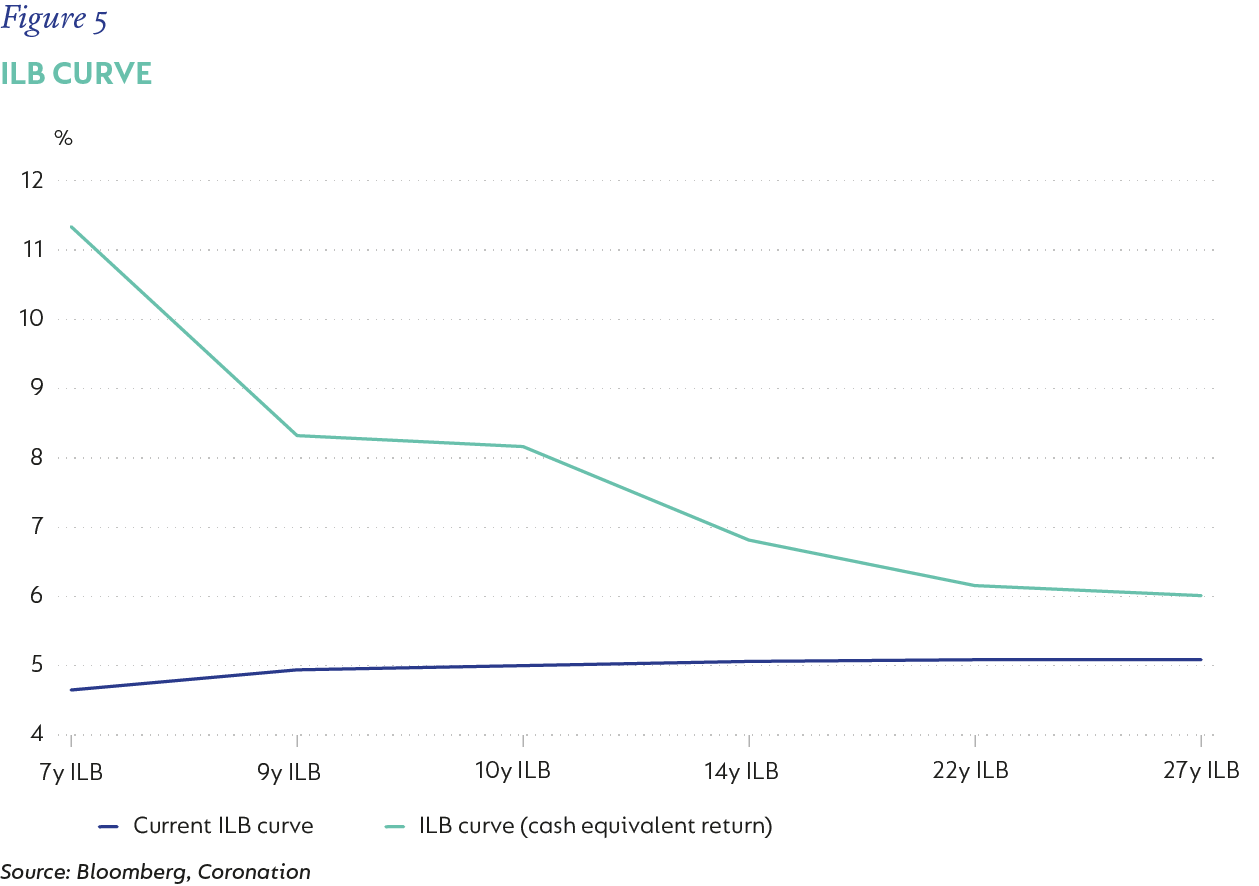

Fortunately, the current elevated levels of bond yields provide quite a bit of protection over a medium term horizon. Figures 4 and 5 show where the current nominal and ILB bond curves are trading and where yields can rise to over the next five years, so that the total return from each of the bonds delivers a return of 9.25% (our expected cash return in a bearish scenario).

Nominal bonds offer a significant amount of protection with yields able to rise anywhere between 13%-3%, to levels of 23%-17%, depending on maturity. The shorter-dated maturities, because of their high yields and lower modified duration (capital placed at risk to interest rate movements), offer the most amount of breakeven protection, suggesting these maturities of less than 12 years should be favoured within bond portfolios.

ILBs tell a very similar story, but the magnitude of the allowed real widening is limited given the higher duration that these instruments carry, even though we assume average inflation of 6.5% over the five-year period. Real yields are only able to reach levels on average of about 8% (3% higher than current), with the exception of the I2031[1], which can widen to c.11% (7% higher than the current yield). In addition, the forward inflation breakevens (difference between nominal and ILB yields in our stressed scenario) widen significantly in the longer-dated maturities to c.10%. This again highlights the attractive protection and valuation that ILBs with a maturity of less than 10 years offer. Despite current inflation breakevens being close to 6%, we still believe that an allocation to these sub-10-year ILBs is prudent for portfolio diversification and protection.

SA CORPORATE CREDIT UNATTRACTIVE DUE TO TIGHT SPREADS IN A WEAK ECONOMY

Corporate credit is an incredibly effective tool that can be used to enhance the yield and longer-term performance of fixed income portfolios. However, it is important to understand that yield is earned over a multi-year investment horizon, and a long-term focus is essential when analysing and investing in the asset class. Managing credit risk is broader than just focusing on the specifics of an individual lend. Rather, we must consider the incremental risk a corporate credit adds to a portfolio in relation to its overall risk profile as well as the effect on portfolio liquidity and ensure that positions are sized correctly.

Low levels of issuance and tightening spreads have created a guise of safety when it comes to investing in the local credit markets. SA credit remains an illiquid market that necessitates detailed scrutiny of underlying fundamentals and relative attractiveness, especially within a deteriorating macroeconomic environment like SA.

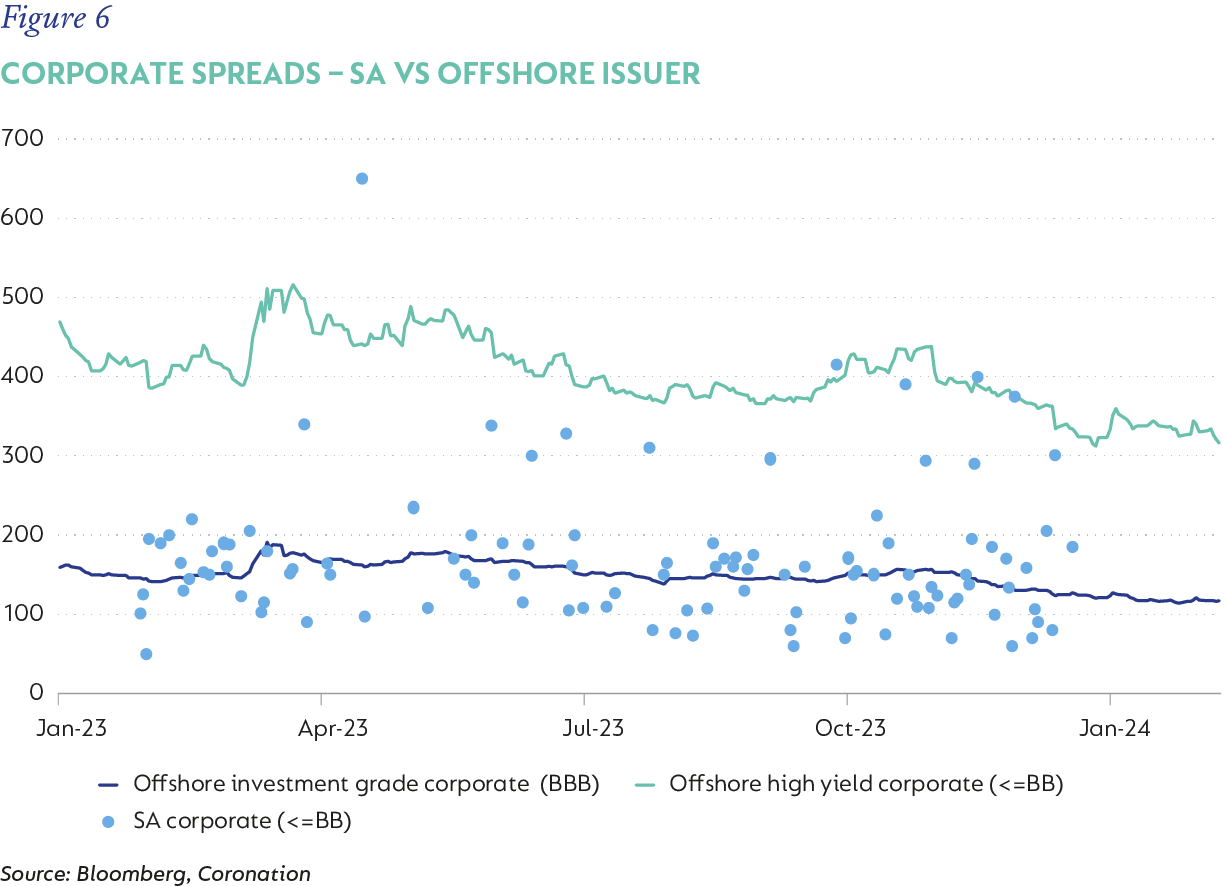

We believe that allocating significant amounts of capital to the local credit market is unwise and would represent a substantial opportunity cost in the face of attractive valuations in other, more liquid asset classes. The current level of credit spreads on offer are at historically compressed levels, despite SA being in its weakest economic position. Corporate profitability and credit worthiness are inevitably tied to economic outcomes, with significant polarisation in performance. SA is a sub-investment grade economy and, thus, local credit should trade at high yield spreads. However, as Figure 6 exhibits, SA trades as an investment grade issuer. The only spreads that trade at the high yield equivalent are riskier issues coming from taxi financing, subordinated tranches of securitisations and bank debt. This also shows how much better value there currently is in offshore credit, which offers higher credit quality and better diversity at much more attractive valuation levels.

BEWARE UNSEEN FIXED INCOME RISK

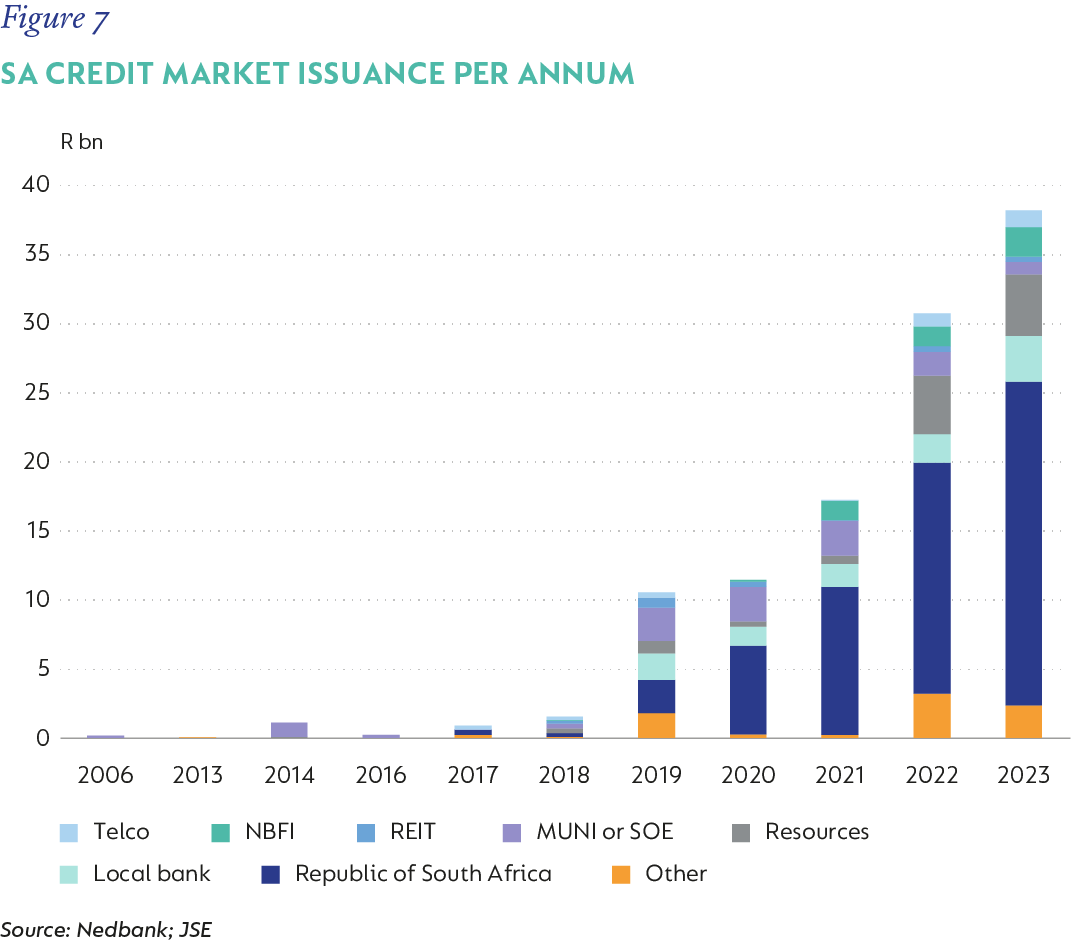

The use of structured products, such as credit-linked notes (CLNs), have become ubiquitous within the local market. This sector of the market has grown exponentially over the last five years and has reached a market size of over R100 billion, but only a third of this market reprices, creating an inaccurate representation of asset volatility and pricing. CLNs mask the underlying/see-through credit risk as the issuing entity (predominantly local banks) is seen as the primary credit risk. The increased usage of CLNs has not expanded the pool of borrowers, rather it has only served to concentrate it. This is due to the ability to limit the volatility of these instruments through not marking them to market[2] based on the underlying asset price movements. This is why CLN repacks of SA government bonds have become so popular over the last five years (Figure 7). The combination of attractive yields and no volatility is an opportunity that not many would pass up, unless, of course, transparency of pricing is important to the underlying investor. As a result, there can be significant unseen risks within fixed income funds. Investors need to remain prudently focused on finding assets whose valuations are correctly aligned with fundamentals and efficient market pricing.

The significant reduction in rate cut expectations over the last quarter has tainted the enthusiasm for risk assets. However, the monetary policy pivot still remains in play and, as such, emerging markets should continue to see supportive flows into their markets. Idiosyncratic SA factors have led to further underperformance of SA assets relative to the peer group. Low growth, sticky inflation and burgeoning deficits will continue to weigh on the longer-term outlook for SA, unless reform implementation is accelerated through increased private sector participation. SA’s bond yields remain elevated but still provide an attractive alternative to cash given their high embedded risk premium. We would advocate slightly overweight positions in bond portfolios, focused on maturities of less than 12 years, together with decent allocation to sub-10-year maturity ILBs and very little allocation to local credit.

[1] Longer-dated inflation-linked bond maturing in 2023

[2]Valuations are not regularly adjusted to mirror their current value

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Institutional

South Africa - Institutional