Bond Outlook

01 October 2013 - Kanyane Matlou

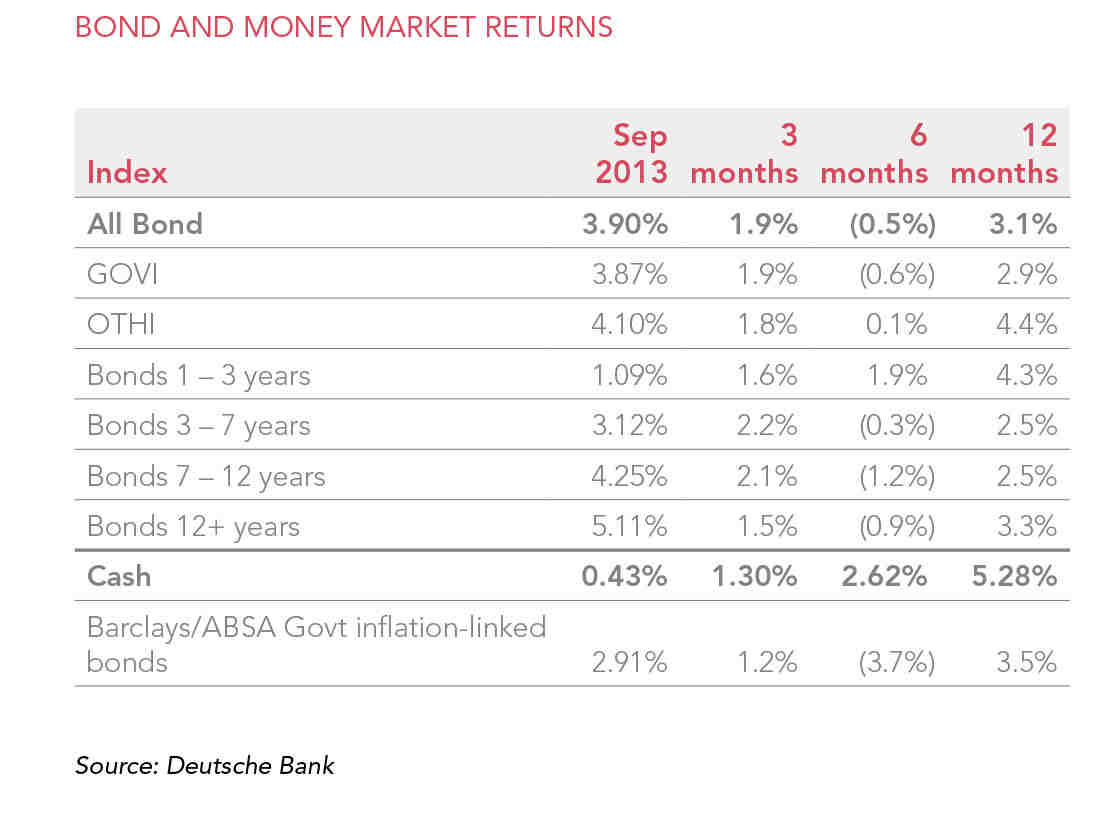

September marked a turning point in the fixed interest market’s losing streak, recording the first positive month since May. The All Bond Index (ALBI) rose 3.9% in September, beating cash at 0.43% and inflation-linked bonds (ILBs) at 2.91%. Long-dated bonds were the better performing area of the curve, running well ahead of the short end. Vanilla bonds were the superior performers for the quarter, returning 1.9%, compared to cash at 1.3% and ILBs at 1.2%. While this latest uptick improved the longer-term performance of vanilla bonds, the ALBI is still lagging ILBs and cash over the 12-month period.

In line with the trend of the past few months, the local bond market took its cue from developments around quantitative easing (QE) in the US and its expected scaling back in the near future. Given the level of talk around QE tapering (since May) the market had largely expected an announcement at the September FOMC meeting. This was, however, not the case and a rally in US Treasuries, emerging market currencies and bond markets (including South Africa) ensued. It should be noted that, given the levels of US Treasuries before the May announcement, the US bond market has in fact still sold off aggressively. QE may not have been scaled back as yet, but it will happen at some point in the future.

At the time of writing, the gridlock in Washington has now taken centre stage. The US government has gone into shutdown as Republicans and Democrats fail to approve budget for the upcoming fiscal year. Implications for US growth stemming from this development are that QE may remain in place for some time still, possibly delaying the normalisation in yields across global bond markets.

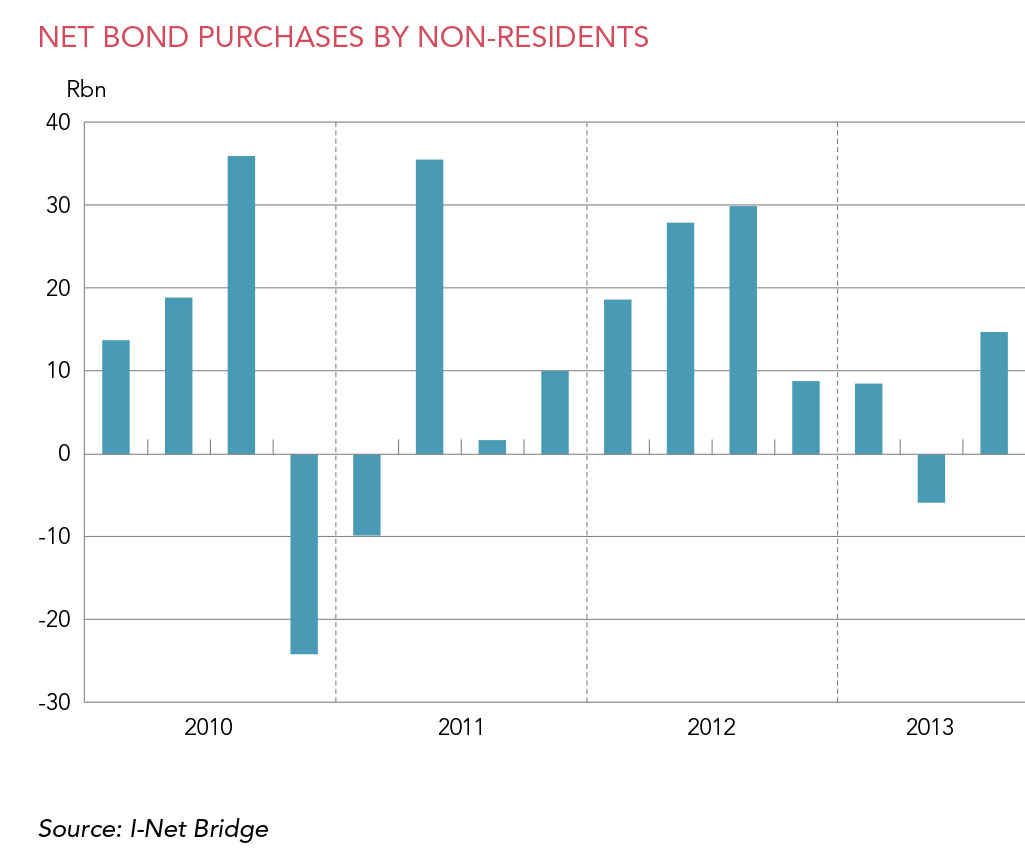

In September the rand rallied against the US dollar, gaining about 25 cents to end the quarter at R10.03/$, albeit still weaker than the prior quarter-end (R9.87/$). Foreign buyers returned to the local bond market, buying almost R12 billion in South African bonds during September – net foreign buying amounted to R14.8 billion for the quarter. This is a recovery from the net selling in the second quarter in which R5.8 billion worth of bonds were sold.

While the market has gyrated amidst the prospects of QE tapering and its subsequent non-delivery, local fundamentals have either remained stuck in poor territory or worsened. The current account deficit deteriorated to 6.5% of GDP in the second quarter, (from 5.8% in the first quarter). Furthermore, the trade deficit remained wide in the first two months of the past quarter, which does not bode well for the full third quarter’s number; South Africa has one of the widest current account deficits among the emerging markets and as such the rand is likely to remain under pressure.

Meanwhile, GDP is poised to remain soft this year, which is not good news for fiscal revenues. Against fiscal expenditure that remains sticky, prospects for the fiscal deficit are not promising. The upcoming Medium Term Budget Policy Statement (MTBPS) on 23 October will likely reveal some worsening in the fiscal metrics, implying that National Treasury’s funding requirement will continue to be under pressure.

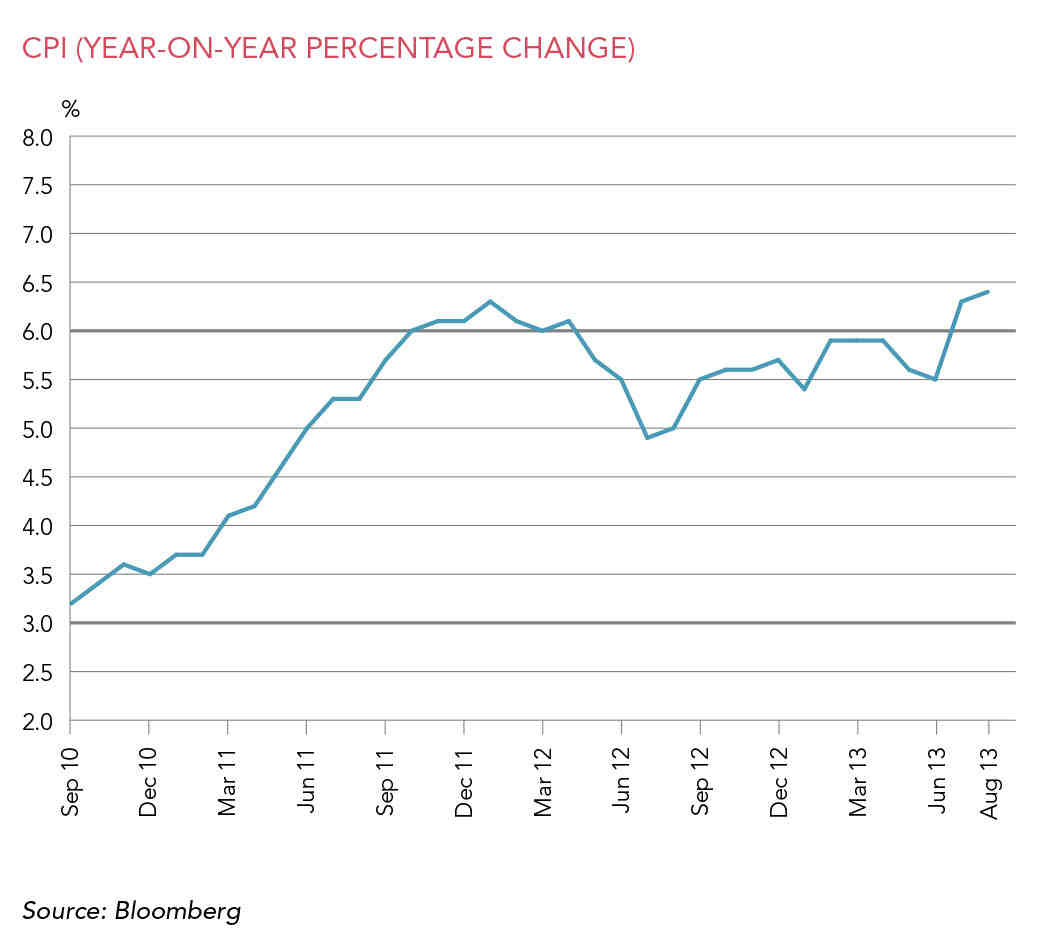

Amidst the deterioration in the twin deficits, consumer inflation rose during the third quarter. CPI in July breached the upper end of the SARB’s target band, registering 6.3% year on year, and rose further in August to 6.4%. The SARB expects this breach to be limited to the third quarter, but has increasingly struck a hawkish tone in response to inflation expectations lying at the upper end of the target band. It has continuously emphasised that it sees inflation risks biased to the upside and will react appropriately should the inflation outlook deteriorate further. We expect CPI to be close to 6%, or slightly above, for much of the next year and agree that risks remain tilted to the upside.

With inflation ticking higher leading to lower real interest rates, and with the generally weaker rand, the SARB’s monetary policy stance is becoming more accommodative. While the market is pricing in some normalisation in policy – about 150bps of interest rate hikes are reflected in the FRA curve to the end of 2014 – the start of policy normalisation is difficult to anticipate (especially in an environment where QE may remain for longer than expected). However, the SARB’s recent statements provide some comfort that monetary policy will react appropriately if inflation outcomes increasingly go above 6%.

Looking ahead, global factors are likely to continue to drive market direction. However, the market is not oblivious to the state of local fundamentals in emerging markets, as highlighted by the August sell-off in the now termed ‘fragile five’ currencies and bond markets. Given that South Africa is part of this group, we remain cautious of a further sell-off, though the scale is unlikely to be as extreme as the rout seen in the second quarter.

After lying in expensive territory for some time, local bonds weakened aggressively in the second and third quarters. While current bond yields are closer to fair value than at the beginning of the year, there is probably room for further weakness. Fundamentals are still poor, and the market remains vulnerable to global risk sentiment. What is more certain is that the eye-watering bond market returns of the cheap money era are behind us. The rising liquidity tide is no longer ‘lifting all boats’ and South Africa’s poor fundamentals in an emerging market context leave our bond market among the more exposed.

KANYANE MATLOU joined the fixed interest team in March 2013 as an analyst. He has various analytical responsibilities within the team and assists with economic research. Prior to joining Coronation, he spent two years at the South African Reserve Bank as an economist in the Macro Models Unit.

If you require any further information, please contact:

Louise Pelser

T: +27 21 680 2216

M: +27 76 282 3995

E: lpelser@coronation.co.za

Notes to the editor:

Coronation Fund Managers Limited is one of southern Africa’s most successful third-party fund management companies. As a pure fund management business it provides individual and institutional investors with expertise across Developed Markets, Emerging Markets and Africa. Clients include some of the largest retirement funds, medical schemes and multi-manager companies in South Africa, many of the major banking and insurance groups, selected investment advisory businesses, prominent independent financial advisors, high-net worth individuals and direct unit trust accounts. We are 25% staff-owned, have offices in Cape Town, Johannesburg, Pretoria, Durban, Gaborone, Windhoek, London and Dublin and are listed on the Johannesburg Stock Exchange. As at the September 2013 quarter-end, assets under management total R492 billion.

South Africa - Institutional

South Africa - Institutional