Bond outlook

01 May 2013 - Mark le Roux

South African bonds were reasonably resilient over the quarter, despite the high level of news impacting the bond market. Continued foreign inflows provided the major support, while local fundamentals presented a backdrop of overall negative newsflow.

Inflation-linked bonds (ILBs) returned 1.84% for the quarter and the All Bond Index (ALBI) eked out a 1% return, lagging cash at 1.3%. Over the rolling 12-month period, ILBs remain the best performer in the local fixed interest arena, returning 18.4% versus 14.4% of the ALBI and 5.5% of cash.

The rand weakened significantly over the quarter. It started the year at R/$ 8.40, weakened to around R/$ 9.32 in March and recovered slightly to close the quarter at R/$ 9.23. It also fared poorly on a trade-weighted basis (although somewhat better against the US dollar due to the weaker euro), depreciating by 5.7%. A trend of a stronger dollar/weaker euro (partly driven by eurozone fears on the back of the Cyprus bailout) contributed to the decline, but the main blame for rand weakness lies firmly with the trade/current account deficit.

The current account deficit was 6.3% of GDP in 2012, reaching 6.8% and 6.5% in the third and final quarter respectively. This slight narrowing of the gap provides little comfort given the extent of the deficit. Trade data releases in the early part of this year continued to reflect sizeable deficits; January showed a record monthly trade deficit in both rand and dollar terms, and February registered the largest deficit on record for that particular month. While the current account may be over the worst, we do not expect to see a significant narrowing in 2013 versus 2012. The wide deficit will continue to leave the rand vulnerable to any deterioration in foreign sentiment and thus in capital inflows.

In February, CPI had risen to just under the upper end of the target range at 5.9%. This is due in part to some passthrough from the rand depreciation in 2012, yet the increase in the overall number has occurred despite recent softer to stable food and energy inflation (in contrast, core inflation has been rising). We maintain our view that CPI will breach the upper end of the target in the next month or two, and expect it to remain above target for most of 2013 and into early 2014.

In the 2013 budget speech presented on 27 February, the need for upward revisions to the bond market funding requirement was announced (due to the wider deficits). This put some pressure on bond yields, particularly at the longer end. Concerns remain around the slow pace of fiscal consolidation in South Africa, which is in sharp contrast to the progress made by other emerging markets following the crisis-induced budget deterioration.

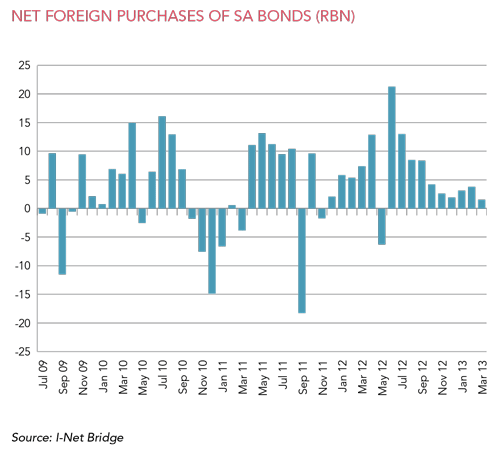

In line with continued global inflows to the emerging markets bond asset class, foreigners continued to buy South African bonds over the quarter. Net purchases in March of R1.6 billion brought the quarterly total to R8.5 billion. The pace of foreign inflows has, however, slowed since our entry into the Citigroup World Government Bond Index in October 2012.

Looking ahead, we continue to believe that the South African bond market (like most bond markets around the world) is currently stretched in terms of fundamental valuation, and that the risks are for weakening. Global bond markets are being supported by the current ‘ultra-easy monetary policy’, including quantitative easing, and the flush of liquidity that results from this is also buoying emerging markets. However, markets will always be vulnerable when liquidity is the principal supporting factor.

Key for the South African market this year will be US bonds, global risk appetite, the rand, the fiscus and inflation. The situation may, however, continue to be mitigated in the shorter term by a continuing dovish stance by the South African Reserve Bank (which remains very concerned about growth) and foreign flows.

Under the current economic backdrop, we continue to position our clients’ fixed interest portfolios with a shorter than benchmark duration combined with a holding in inflation-linked bonds.

MARK LE ROUX is responsible for the fixed interest investment process and portfolio management functions for both institutional and retail portfolios. Mark has more than 20 years’ experience in managing both traditional and alternative portfolios.

If you require any further information, please contact:

Louise Pelser

T: +27 21 680 2216

M: +27 76 282 3995

E: lpelser@coronation.co.za

Notes to the editor:

Coronation Fund Managers Limited is one of southern Africa’s most successful third-party fund management companies. As a pure fund management business it provides individual and institutional investors with expertise across Developed Markets, Emerging Markets and Africa. Clients include some of the largest retirement funds, medical schemes and multi-manager companies in South Africa, many of the major banking and insurance groups, selected investment advisory businesses, prominent independent financial advisors, high-net worth individuals and direct unit trust accounts. We are 29% staff-owned, have offices in Cape Town, Johannesburg, Pretoria, Durban, Gaborone, Windhoek, London and Dublin and are listed on the Johannesburg Stock Exchange. As at the March 2013 quarter-end, assets under management total R409 billion.

South Africa - Institutional

South Africa - Institutional