Bond Outlook

01 May 2014 - Mark le Roux

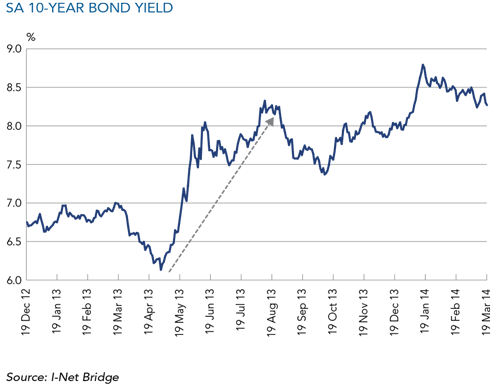

We started the year with a slightly more upbeat stance with respect to long bonds, after the relatively poor previous 12 months. Heading into 2014, a fair amount of bad news was already in the price: 2013 had seen a meaningful sell-off in yields; the currency had materially depreciated and continued to do so in January; and QE tapering had been announced and implemented by the US Fed. Coupled with this, the trade account started showing tentative signs of improvement, and inflation pass through from the currency weakness appeared fairly muted due to a sluggish domestic economy. With long bond yields around the 9.50% level they were now starting to move closer to what we believe to be fair value.

The month of January saw the SARB Governor hike the repo rate by 50 basis points for the first time in her tenure, citing inflation concerns as the currency continued to weaken. While the hike provided the desired stabilising effect on the rand (which at one point was pushing through R/$ 11.30) it put the fixed interest markets into freefall as they moved to price in a much more aggressive hiking policy than anticipated. The All Bond Index (ALBI) ended January down 3.25%, with the Government Inflation-Linked Bond Index (GILBI) losing almost 4% for the month.

In February and March the fixed interest markets recovered as the Governor explained her rationale for the rate hike and expected trajectory going forward. This was combined with a strong recovery in the rand. For the quarter, both the ALBI and the GILBI ended in positive territory, up 1% and 1.7% respectively.

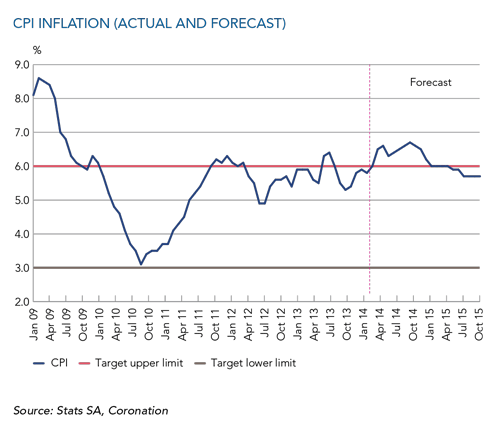

Inflation has started moving towards the upper end of the target range, printing 5.9% in February. We expect inflation to continue this upward trajectory, moving to between 6.5% and 7.0% towards the latter part of the year, before moving back inside the target band into 2015. Risks to the upside come in the form of food prices, especially maize prices which have been up 40% on a year-on-year basis. This has a major impact further down the food chain, namely with poultry and meat prices. We would expect the monetary policy committee to continue the rate hiking cycle in lockstep with rising inflation; however, the Governor has stated that the South African economy is not yet in a position for positive real rates. On that basis we would expect the repo rate to top out at around the same level that we see inflation peaking, namely around 7.0%.

After the rand’s material depreciation over the past few years, the long-awaited improvement in the trade and current accounts looks like it is finally starting to materialise. Hiking short rates in January should also help on the import side. An improving current account deficit will lend further support to an already undervalued currency and assist in forming an improved inflation outlook, which in turn is likely to provide underlying support to SA long bond valuations.

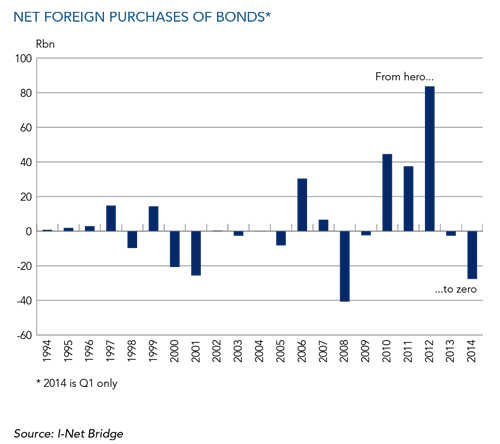

A further positive was that we saw foreign ‘hot money’ exit the SA bond market en masse. Around R25 billion of foreign bond sales were recorded in January. A number of these positions would have been severely underwater due to last year’s sell-off in bonds and the rand. This stock overhang appears to have moved to domestic institutional investors who have found some value around the 9.25% to 9.50% yield level.

Looking forward, we continue to believe that a fair amount of ‘bad news’ is now reflected in the yield available from SA long bonds. While we do not expect much in the form of capital gain or loss this year, we do expect a total return outcome from bonds in line with current yields.

MARK LE ROUX is responsible for the fixed interest investment process and portfolio management functions for both institutional and retail portfolios. Mark has more than 20 years’ experience in managing both traditional and alternative portfolios.

If you require any further information, please contact:

Louise Pelser

T: +27 21 680 2216

M: +27 76 282 3995

E: lpelser@coronation.co.za

Notes to the editor:

Coronation Fund Managers Limited is one of southern Africa’s most successful third-party fund management companies. As a pure fund management business it provides individual and institutional investors with expertise across Developed Markets, Emerging Markets and Africa. Clients include some of the largest retirement funds, medical schemes and multi-manager companies in South Africa, many of the major banking and insurance groups, selected investment advisory businesses, prominent independent financial advisors, high-net worth individuals and direct unit trust accounts. We are 25% staff-owned, have offices in Cape Town, Johannesburg, Pretoria, Durban, Gaborone, Windhoek, London and Dublin and are listed on the Johannesburg Stock Exchange. As at the March 2014 quarter-end, assets under management total R547 billion.

Disclaimer:

All information and opinions provided are of a general nature and are not intended to address the circumstances of any particular individual or entity. Coronation is not acting and does not purport to act in any way as an advisor. Any representation or opinion is provided for information purposes only. Collective Investment Schemes in Securities (Unit trusts) are generally medium to long term investments. The value of participatory interests (units) may go down as well as up and past performance is not necessarily a guide to the future. Coronation Fund Managers will not be held liable or responsible for any direct or consequential loss or damage suffered by any party as a result of that party acting on or failing to act on the basis of the information provided in this document. Coronation Asset Management (Pty) Ltd is an authorised Financial Services Provider (FSP no. 548).

South Africa - Institutional

South Africa - Institutional