Equity market update (Commentary for the fourth quarter of 2012)

01 February 2013 - Coronation Insights

The world today, just over four years since the global financial crisis, is characterised by low economic growth, low inflation, very high levels of government debt and very low interest rates. In short, the global economy remains in a precarious state. Yet, financial markets continue to trend higher with the S&P 500 Composite Index, currently only 6% off its pre-crisis peak.

There remains a clear disconnect between financial markets and underlying economic reality. In a low interest rate environment, where money is essentially free, capital scours the globe in search of yield. This has resulted in significant capital flows into high yielding emerging markets, pushing up equity prices and compressing bond yields. South Africa has been no exception. At the time of writing, the FTSE/JSE All Share Index is at an all-time high.

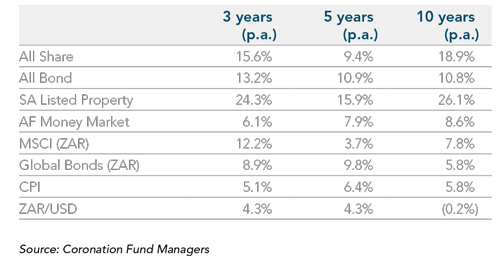

The last decade has really been a purple patch for local investors, with very healthy returns earned across all asset classes as shown in the table below:

An investment in domestic equities and listed property would have increased by approximately 6 and 10 times respectively over the last decade. Local investors benefited from significant tailwinds over this period: a strengthening currency for most of the decade, strong economic growth, benign inflation, an explosion in corporate earnings and re-rating of equities, bonds and property. Over the same period, global equities (as indicated by the MSCI World Index) returned 7.8% p.a. in rands – below the returns generated by local cash.

Given this backdrop, we think returns over the next decade will be more muted. Many of the tailwinds that buoyed returns are unlikely to be repeated: local asset prices are high, corporate earnings are high, local fundamentals are deteriorating as evidenced by the size of the current account deficit and numerous service delivery protests and inflation risks are to the upside (administered prices and real wage increases).

Domestic equities, in general, remain fully valued. Global equities, on the other hand, are discounting some of the concerns around Europe, government indebtedness in the world’s major economies, political brinkmanship in the US and an economic slowdown in China. Unlike the height of the dotcom bubble, ratings are attractive. Many multinational blue chip companies are trading on 13 times PE multiples, with strong balance sheets and attractive dividend yields of 2% – 3% (in hard currency). Our domestic balanced funds remain at the maximum 25% offshore limit.

There is a consensus view that interest rates are likely to remain low for the foreseeable future. This is fuelling what we believe to be a bubble in nominal bonds. Foreign investors now hold meaningful amounts of emerging market government bonds; South Africa is no exception, with nearly a third of its government bonds in foreign hands. A widening current account deficit (now around 6% of GDP) means that South Africa has become increasingly reliant on capital flows to balance the books. This makes the rand very vulnerable to any reversal in foreign sentiment. We therefore continue to favour quality global stocks that happen to be domiciled in South Africa, such as MTN, British American Tobacco, SABMiller, Naspers as well as Capital Shopping Centres and Capital & Counties. They remain attractively valued, relative to pure domestic businesses, and have robust business models as a result of being diversified across numerous geographies and currencies. At year end, approximately 75% of our equity portfolios was invested in rand hedge counters.

The All Share Index returned 10.3% for the quarter. Industrials were the best performer with a 12.4% return, financials produced 9.9% and resources lagged at 7.3%. Resource stocks have now underperformed financials and industrials over 3, 5 and 10 years. We maintain a healthy exposure to resources in our equity and balanced funds with selected resource shares trading at less than 10 times our assessment of normal earnings. Our preferred holdings remain the diversified miners (specifically Anglo American), Sasol and Mondi. We do not have any exposure to gold miners as we remain concerned by continued pressure arisingfrom declining grades and rising costs (labour, electricity and water). South Africa produces a small portion of the world’s gold and, as such, our gold producers lack the pricing power required to pass on these cost pressures in the form of higher metal prices. This is contrary to the platinum producers. South Africa mines approximately 70% of the world’s platinum, which will allow local platinum producers to recoup rising costs in the form of higher metal prices over time. Our preference remains the low cost producers, Impala and Northam.

Banks returned 11.8% for the quarter, outperforming other financials. While we believe earnings for the large commercial banks are not high, we used the period of share price strength to take profits.

We remain concerned over the earnings base of the average industrial company, especially consumer-facing businesses. Aggressive buying by foreigners has resulted in a significant re-rating of these businesses and current valuations now combine a high rating with a high earnings base. Consequently, we have virtually no exposure to retailers.

The investment environment is likely to remain volatile and challenging for the foreseeable future, making stock picking and alpha generation that much more important. In the short term, alpha is incontrovertibly random – patience, courage and a long time horizon are required to make rational, long-term decisions. A long time horizon is more relevant in today’s volatile financial markets where asset prices are determined by the news of the day. In a world where time horizons are collapsing, we remain committed to our proven philosophy of investing for the long term.

QUINTON IVAN joined as an equity analyst in 2005 and was appointed Head of Equity Research in 2012. He currently analyses retail, construction and pharmaceutical stocks and co-manages the Coronation Equity and Balanced Plus funds as well as Houseview Portfolios.

If you require any further information, please contact:

Louise Pelser

T: +27 21 680 2216

M: +27 76 282 3995

Notes to the editor:

Coronation Fund Managers Limited is one of southern Africa’s most successful third-party fund management companies. As a pure fund management business it provides individual and institutional investors with expertise across Developed Markets, Emerging Markets and Africa. Clients include some of the largest retirement funds, medical schemes and multi-manager companies in South Africa, many of the major banking and insurance groups, selected investment advisory businesses, prominent independent financial advisors, high-net worth individuals and direct unit trust accounts. We are 29% staff-owned, have offices in Cape Town, Johannesburg, Pretoria, Durban, Gaborone, Windhoek, London and Dublin and are listed on the Johannesburg Stock Exchange. As at the December 2012 quarter-end, assets under management total R375 billion.

South Africa - Institutional

South Africa - Institutional