Fixed interest - the benefits of an unconstrained mandate

01 October 2013 - Tracy Burton

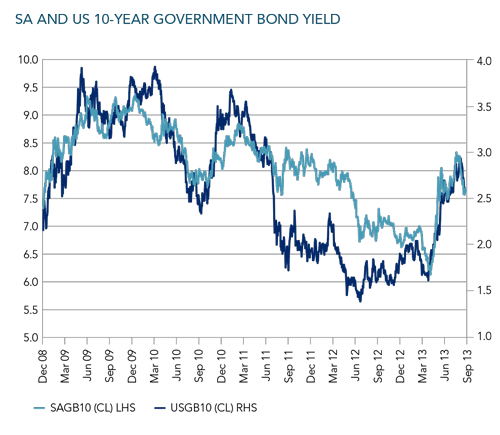

Quantitative easing and the US Fed’s zero interest rate policy have propped up the price of government bonds and kept yields at artificially low levels. This ‘unsustainable reality’ was brought squarely into focus as bond yields rose sharply on the news of the Fed’s intention to taper its bond buying programme. The US 10-year bond increased 61% from 1.63% at the beginning of May, to 2.62% at the end of September. In the first week of September, the benchmark rate touched a high of 3% and has since retreated. Because the price of bonds falls as rates rise, bond holders incurred a loss of 6.8%.

In response, the South Africa government 10-year bond yield weakened 24% from its record low of 6.13% in May to 7.62% at 30 September 2013.

For the 12 months to end September, the All Bond Index (ALBI) has returned 3.09% and 0.49% for the year-to-date. The ALBI currently has a duration of about six years, which means that if rates were to rise 1%, the price of the index would fall 6%.

Over the past two years, we have held the view that nominal government bonds have been too expensive and hence we have owned very little duration in our multi-asset portfolios. We held the same view in our specialist bond portfolios (but had to curb the extent of this view given the tight duration limits of the mandate). The sell-off in bond yields resulted in capital loss in ALBI-benchmarked funds. This could have been avoided in an unconstrained fixed interest mandate.

Mandate restrictions and benchmark awareness prevent managers from deviating too far from the ALBI in specialist bond funds. In other words, bond managers benchmarked to the ALBI typically have a duration risk tolerance of +/-1 year about that of the ALBI. Given that their performance is measured relative to the benchmark, it is also unlikely that most would deviate too far from the index.

National Treasury’s funding is concentrated in the long end of the yield curve, causing the duration of the ALBI to increase continually. This means specialist bond managers are forced to hold long bonds regardless of whether they find them attractive. The ALBI’s duration has increased from 4.65 to 6.15 years over the past 10 years as a result of long duration issuance and declining yields.

Market capitalisation weighted fixed income benchmarks are fundamentally flawed in that they are designed to lend money to the issuers that are already most in debt, regardless of their ability to repay. Conversely, they will lend the least to those who may have the best future prospects. We find this to be the biggest flaw in bond indices around the world.

Specialist building block funds cater for investors who prefer to make their own asset allocation decisions. Those who adopt a strategic allocation modelling process tend to favour ALBI and cash benchmarked allocations. These allocations will work as long as history repeats itself, and there are no structural shifts in the economy or market that result in the asset class (or classes) performing very differently for prolonged periods of time. This is not the case in South Africa where we have experienced a structural change with the adoption of inflation targeting and our re-entry into the global market. The market is dynamic and there’s a benefit to adjusting the portfolio to market conditions by increasing risk allocations in cheap markets and reducing allocation and protecting in expensive markets. The fixed interest manager is best placed to make the asset allocation call between cash, short-term and long-term bonds, inflation linkers and other income-bearing assets. In addition, yields move so swiftly in the fixed interest market that a large portion of the opportunity can be missed if delays are experienced in implementing asset allocation decisions.

The investment discretion that is afforded to unconstrained strategies allows additional flexibility to help minimise the potential for negative returns over periods of reasonable length by defensively positioning the portfolio as warranted.

In addition, specialist benchmark managers are unable to allocate meaningful exposure to preference shares, convertible bonds, inflation linkers or any non-benchmark holdings, even if they are relatively attractive on a risk-adjusted basis. Investors can benefit enormously from managers being more opportunistic, particularly in times when cash is yielding less than inflation.

Based on our inflation expectation and outlook for real yields, we have meaningful allocations to inflation linkers where the investor’s inflation-adjusted return remains the same irrespective of the inflation rate. We currently hold more than 15% in the Coronation Flexible Fixed Income Fund of which two thirds are shorterdated inflation-linked corporates. We have also been increasing our allocation to preference shares which are trading at very attractive yields on a pre-tax basis. The dividends adjust upwards as rates rise. The flexible fund mandates also include a potential allocation to listed property, subject to a maximum of 15%. We have often argued that listed property is the forgotten asset class in a specialist building block environment – not having the high beta of an equity and having the unlimited duration and high volatility compared to traditional fixed interest.

Coronation has been running a number of fixed interest asset allocation funds, the first of which launched in 2001. These mandates have varying degrees of flexibility and different targets.

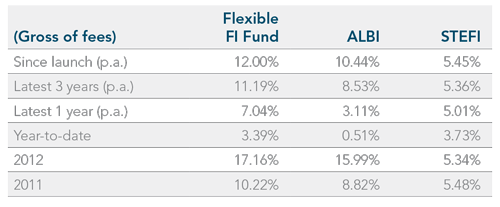

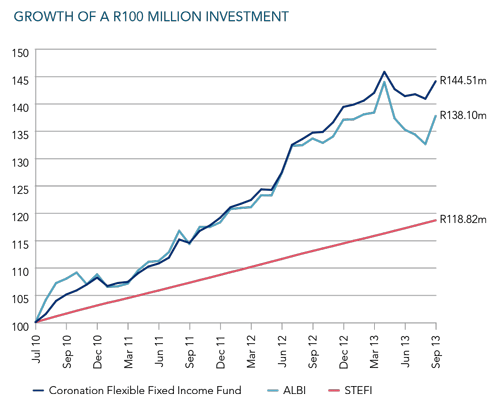

We launched our Flexible Fixed Income Fund a little over three years ago in July 2010. The aim of this fund is to outperform the better of bonds and cash over rolling 3-year periods. It further aims to prevent negative returns over rolling 12-month periods through asset allocation, security selection and the use of derivatives to manage downside risk.

The track record table of returns versus the ALBI and STefi for the fund is shown below:

The emergence of a far more complex investment environment makes a flexible fixed interest mandate one of the best propositions currently on offer to fixed interest investors. And in an environment of rising rates, the flexibility to manage duration around a wide band can provide a much needed layer of protection.

The strategies are complex with managers taking on a significant level of active risk. Poor decisions could result in larger than average losses. In addition, these are relatively new strategies with limited track records, so qualitative due diligence is required to determine which managers offer the greatest likelihood of future success. Coronation has a 12-year track record of managing multi-asset fixed interest portfolios. These are difficult portfolios to manage, with challenging objectives. However, through good, disciplined asset allocation and fixed interest security selection the right manager can add enormous value to a portfolio.

TRACY BURTON is an institutional fund manager. She has 18 years’ experience, specialising in fixed interest security selection and portfolio management, as well as manager selection and asset allocation.

If you require any further information, please contact:

Louise Pelser

T: +27 21 680 2216

M: +27 76 282 3995

E: lpelser@coronation.co.za

Notes to the editor:

Coronation Fund Managers Limited is one of southern Africa’s most successful third-party fund management companies. As a pure fund management business it provides individual and institutional investors with expertise across Developed Markets, Emerging Markets and Africa. Clients include some of the largest retirement funds, medical schemes and multi-manager companies in South Africa, many of the major banking and insurance groups, selected investment advisory businesses, prominent independent financial advisors, high-net worth individuals and direct unit trust accounts. We are 25% staff-owned, have offices in Cape Town, Johannesburg, Pretoria, Durban, Gaborone, Windhoek, London and Dublin and are listed on the Johannesburg Stock Exchange. As at the September 2013 quarter-end, assets under management total R492 billion.

South Africa - Institutional

South Africa - Institutional