Mining in South Africa

01 July 2013 - Neville Chester

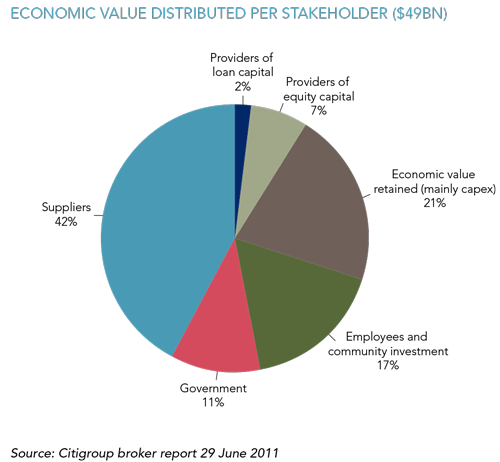

Resource mining around the world has always elicited much interest from governments, employees and populations in general. The concept of extracting wealth from sovereign territory has always led to vexing questions about how the wealth and proceeds are split between those that are prepared to invest the capital, those that do the dirty (and often dangerous) work and the people and government that live in and run the country.

These questions, and the rhetoric and noise around them, always become more heated during periods of high commodity prices as the prize is worth a lot more, and generally it dies down as commodity prices fall and the relative attractiveness of the industry wanes. This is what makes the current imbroglio in the South African mining industry so peculiar, in that it is happening at a point in time when very few South African mines are profitable on a cash basis, let alone before repaying their cost of capital.

Before we get into the nuts and bolts of what is happening currently in the South African mining sector it is worth reviewing the industry generally and how investors have historically made their returns and what risks are faced in doing this. Mining has always been, and remains, a risky business. This is why we generally view mining as a ‘discount’ business, one where over time we as investors would expect and demand a higher return, on average, to account for the risks we take in the sector.

Risks

Mining is a capital intensive business. It requires large amounts of capital be spent upfront, before any revenue has been generated. Bigger mines tend to be more profitable over time due to the benefits of scale, but they do run the risk of overspend or miscalculations as to the richness of the orebody being mined. Once the capital has been committed, and the earth moved, and buildings and shafts built, this infrastructure is fixed and cannot be moved. The investor is therefore often taking a view on returns over a long period, at least 20 years or longer, during which time a lot of things can and do go wrong. The construction itself often takes years to be completed during which time debt incurs interest costs while no earnings are being generated. All of this ultimately needs to be repaid. The implied political risk is also significant as governments can and do change many times during the life of a mine, exposing the operation to changing regulatory risks.

Geological mapping and resource testing have become a lot more sophisticated from the days when a statement of ‘There’s gold in them thar hills’ was enough to spur a gold rush and a mining town boom. However, it is still not an exact science and determining the richness and ease of extracting orebodies remains a huge risk. Large scale open pit mining is definitely easier than deep level mining which characterises South Africa’s precious metals industry, but even these mines are exposed to catastrophic risk from time to time. The recent pit wall failure at Rio Tinto’s Bingham Canyon copper mine in Utah is a case in point. While fatalities were avoided the likely recovery costs will run into billions of dollars and the mine will not be back to full production for well over a year.

Deep level mining exposes one to even more risks, and none are more exposed than the people sent underground on a daily basis. Due to the depths and narrowness of the orebody, to date very little mechanisation has taken place in deep level mining in South Africa. Consequently thousands of people have to travel deep underground to manually drill and blast to extract platinum and gold. Due to sheer numbers of people involved and the risks of seismic activity at these depths it has inevitably led to deaths. Although much work has been done to improve safety one cannot compare the risks of mining two kilometres underground to the big open pit operations that characterise most Australian mining ventures.

Mineral resources are also known as ‘commodities’ for a reason. There is very little differentiation between iron ore mined in Brazil, South Africa or Australia. It is a commodity business which generally means mines are price takers. They have very little control over the price at which they get to sell the commodities they produce. At some points in a cycle, demand outstrips supply so prices rise and profits are good. At other points in a cycle, supply outstrips demand and prices collapse and many mines make huge losses. At the same time, cost of production can also be out of their control; power, whether it is diesel for open pit mines, or electricity for deep level mines, is a big part of their cost base and often as volatile as the underlying commodity they are mining. In deep level mining labour makes up an enormous part of their cost base and, around the world, this has been increasing at levels well above inflation.

Finally, because of the sensitivities surrounding mining in communities, the environmental impact, and the fact that mines are mining assets belonging to a country and its people, they are continuously exposed to the risk of additional taxation during periods of high profitability, environmental taxes and the persistent threats of nationalisation. The nationalisation of the big American and European oil companies in the Middle East in the seventies being the most extreme example of this.

All of these risks require that investors in mining earn a significantly higher return on their capital than on investments into more staid and predictable industries. This is where the opportunities lie. The astute investor, who is able to assess the risks and make a calculated decision, can earn superior returns because of the risk implicit in mining. Particularly due to the cyclical nature of commodities those investors, with a long enough time horizon, can make the best returns by investing into the ‘unloved’ commodity sectors where prices are low and valuations compelling and reap the returns as the cycle turns. Xstrata, the successful resource business that was recently bought out by Glencore, was a classic example of a business built up by buying out of favour mines and reaping the profits as the cycle turned.

The current situation in South Africa

For a host of reasons South Africa has largely missed the opportunity to take advantage of the resource boom of the last decade. While we obviously benefited from higher prices, there has been very little growth in production; in fact, our production of precious metals has actually declined over this period. There is no one particular reason but a whole host of reasons which, added up, have made new investments into South Africa’s mining industry unlikely for the time being. Starting with the constant threat of nationalisation (which has since receded with the metals prices), lack of available electricity (deep level mining and the beneficiation of minerals is electricity intensive), increasingly difficult regulatory environment (the loss of mining rights during the recent registration of new order mining rights being a case in point), lack

of available water and, the most recent focus point, the perpetually rising cost of labour allied with increasingly aggressive behaviour from unions.

The recent labour troubles began on Impala Platinum’s mines last March, and were already marked by violent activities with vehicles being torched and workers from opposing unions being attacked and stabbed on their way to work. While it was clear there was trouble brewing, the new union and the increased levels of activity were ignored by authorities until the tragic events at Marikana unfolded in August of last year. One of the many unfortunate consequences of this tragedy was the perception that violent protests were more likely to achieve better outcomes for the workforce, resulting in much more militant labour relations since then and unacceptable levels of violence in the work force.

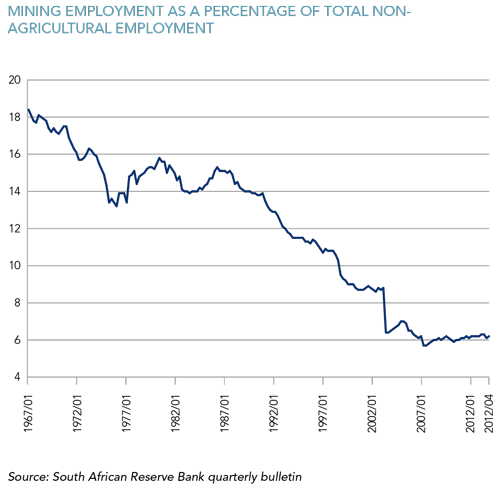

The recent focus by government on the mining industry, and the assigning of deputy president Kgalema Motlanthe to head up a coordination body to deal with these challenges is welcome, but by and large too late to save many jobs in the industry which is now haemorrhaging employees. The simple fundamentals of economics are asserting themselves, as the cost of labour goes up, and mines have no ability to increase the price of the commodities sold, mines are closing down and head count is being reduced.

To make matters worse, in the now very competitive environment between unions to attract members, it appears that the key way to win support is to make even more ridiculous demands of employers, with wage increases of 60% and even 100% being bandied around. Unfortunately, in a country with an official unemployment rate of 25% (unofficially closer to 33%) this is not helpful. In an industry where the majority of the payers are struggling to make a profit it is likely to be the tipping point driving a new approach to mining in this country.

The future of mining in South Africa

In order to save the industry, to ensure there is any mining activity left in this country, drastic action has to be taken. We have seen the initial announcements from Anglo American Platinum where they have taken the decision to shut unprofitable mines and reduce headcount accordingly. Many other mines are following similar processes across all mineral types, looking to rationalise costs by shutting mines which have no hope of being profitable in the current cost climate. This has two benefits for the industry in that it stops cash burn, and it also reduces supply which, in minerals like the platinum group metals (PGM) where South Africa is a major supplier, should result in improved pricing, which helps in the tough cost environment.

Secondly, we have seen a big curtailment in development and capital spending. The appetite for deep level mines, which will be labour and electricity intensive is on the decline. Those few new mines that are developed are likely to be opencast and shallower mines, which facilitate greater mechanisation. The implications of this will be far fewer jobs in future and generally requiring skilled operators as opposed to the current semi-skilled workers.

Thirdly, even in existing mines we are seeing more emphasis on research and development spend to try and mechanise as much as possible. The obvious benefits are reduced injuries and fatalities at depth as well as being able to operate continuously for longer hours with improved production, which may be able to return mines to profitability in a lower price environment. Sadly once again, the mechanisation will be negative for jobs in the sector.

Fourthly, and here I am being a hopeless optimist, if the recently established mining task team, with all three players (government, labour and industry), can finally come to an agreement – one which sees an equitable sharing of risks and rewards and facilitates an environment where labour disruption and strikes becomes an exception and not the rule when it comes to wage negotiations.

If you require any further information, please contact:

Louise Pelser

E: lpelser@coronation.co.za

Notes to the editor:

Coronation Fund Managers Limited is one of southern Africa’s most successful third-party fund management companies. As a pure fund management business it provides individual and institutional investors with expertise across Developed Markets, Emerging Markets and Africa. Clients include some of the largest retirement funds, medical schemes and multi-manager companies in South Africa, many of the major banking and insurance groups, selected investment advisory businesses, prominent independent financial advisors, high-net worth individuals and direct unit trust accounts. We are 25% staff-owned, have offices in Cape Town, Johannesburg, Pretoria, Durban, Gaborone, Windhoek, London and Dublin and are listed on the Johannesburg Stock Exchange. As at the June 2013 quarter-end, assets under management total R434 billion.

South Africa - Institutional

South Africa - Institutional