Personal finance

Why let tax slow down your future plans?

Tax-free investing can make a bigger difference than you might think.

When you invest for the future, you often have more than one goal in mind. Alongside planning for retirement, you might also be building an education fund, saving towards a new home, or putting something aside for the next generation.

As you choose your investment strategy, many important questions tend to surface. How long do I have to save? How much can I set aside regularly? And, over time, how much tax will I pay on my returns?

With tax-free investing, the answer to the last question is simple: none.

What if tax never touched your investments?

Money invested through a tax-free investment account grows without local tax taking a share of your earnings along the way. Over time, this makes a noticeable difference. Growth that would otherwise have been taxed remains invested, allowing returns to build and compound.

There are a few limits to keep in mind, including your annual allowance, which Treasury recently increased. From 1 March 2026, you can invest up to R46,000 tax free each year until you reach your total lifetime tax-free allowance of R500,000. It’s also worth remembering that if you withdraw money along the way, that portion of your allowance remains used and cannot be replaced.

How tax-free investing supports different goals

Given enough time, tax-free compounding can turn steady contributions into a substantial pool of capital, capable of supporting a range of long-term goals. The scenarios that follow show how different investors could use tax-free investing to support different priorities in their own lives and those of their loved ones.

Scenario 1: Saving for a child’s education

Imagine a young couple who became parents for the first time in 2015, which happens to be the year that tax-free investing was introduced in South Africa. Early on, they recognised that this could be a powerful way to save for their child’s education. Each parent opened a tax-free investment account and set up a third in their child’s name.

Every year, they contributed the full tax-free allowances available to their family, giving their education nest egg more room to grow over time. They did so knowing that, when the time came, the funds would be available without any tax being payable.

How much would they have now?

If just one family member had invested the full tax-free allowance each year from 2015 in Coronation Market Plus, they would have an investment worth around R739,000 by January 2026 – almost double the amount contributed.

If each family member followed the same approach, their combined education fund would be worth more than R2.2 million, with no local tax payable on that amount at withdrawal.

While this is a backward-looking example and future returns and rules may differ, it shows just how powerful a growth-oriented fund can be when returns are tax free.

Scenario 2: A grandparent investing for their grandchild’s future

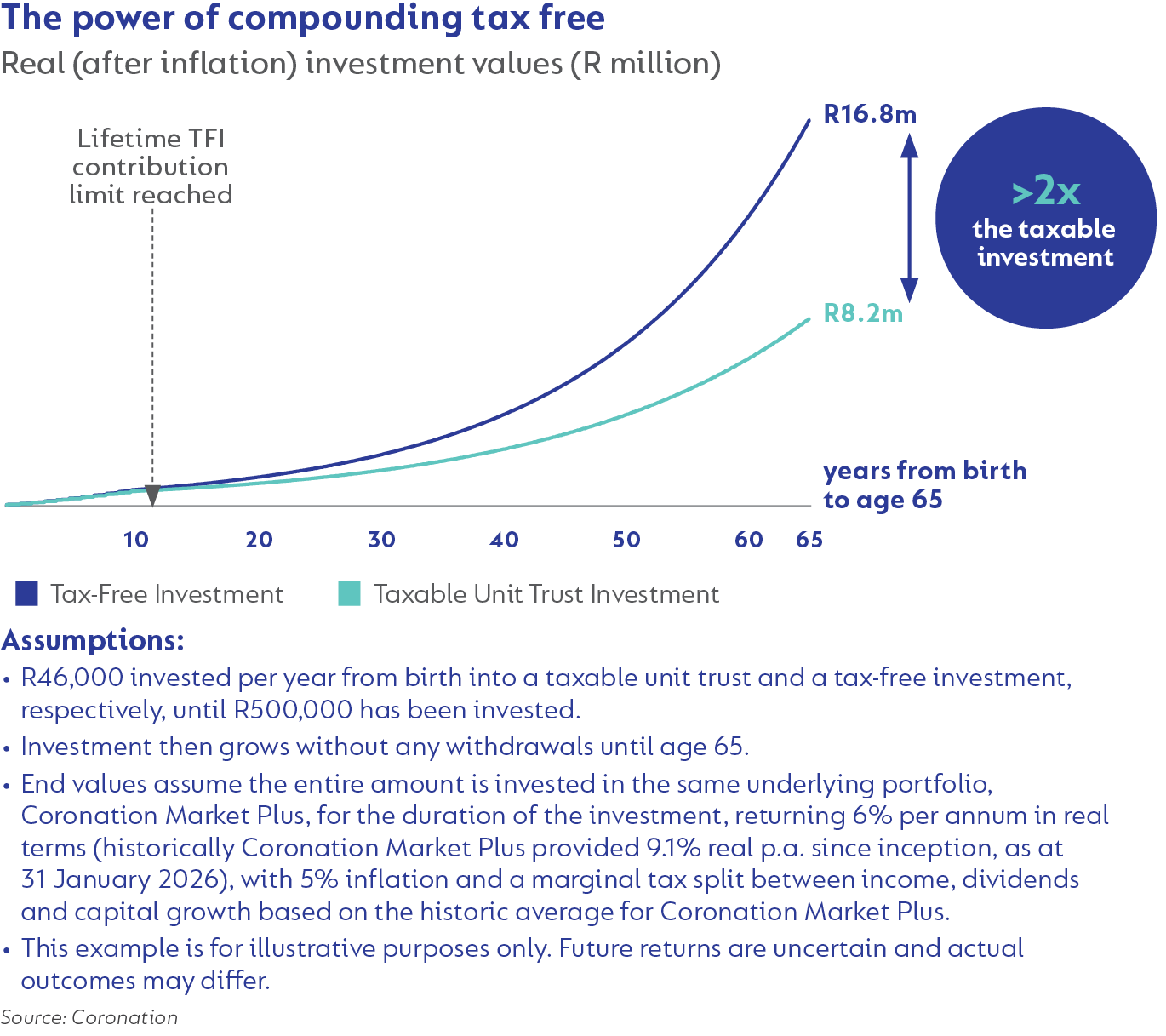

Consider a grandparent who opens a tax-free investment account in their granddaughter’s name to give her a financial head-start. From birth, they contribute the maximum amount each year, with the intention of continuing until the lifetime limit is reached, which would happen in the 11th year of investing. From that point, the investment – if left untouched – would continue to grow free from tax, building a substantial pool of capital to support greater financial freedom in adulthood.

Based on reasonable assumptions about returns, inflation and tax, a tax-free investment could be worth around twice as much, in real (inflation-adjusted) terms, as the same investment held in a fully taxed unit trust when the granddaughter turns 65.

That means that the granddaughter could have a tax-free investment worth R16.8m million by the time she reaches her grandparent’s age.

As these examples show, taking tax out of the equation means more of your money stays invested, giving it more room to grow and compound over time. Whatever your goals, the principle is the same: with regular contributions, tax-free investing can be a powerful way to build capital for the future you imagine.

South Africa - Personal

South Africa - Personal