Economic views

Beware the comfortable consensus

“Nothing is more obstinate than a fashionable consensus. ” - Margaret Thatcher, British Prime Minister, 1979 - 1990

The Quick Take

- The emerging consensus of a developed economy ‘soft landing’ needs to be considered with care

- A heavy global political calendar and a concerning geopolitical environment imply new and elevated levels of uncertainty

- SA’s growth challenges have intensified, but inefficiencies and a weak fiscal position limit room for policy rates to fall

Early-year economic predictions seldom materialise as envisaged, even though part-predictions may. This is largely because policies work with long and variable lags that may be influenced by unpredictable events. Sometimes the impact of slow-moving variables like demographics emerge in unexpected ways, or crises surprise, with unforeseen consequences for economic activity and asset prices.

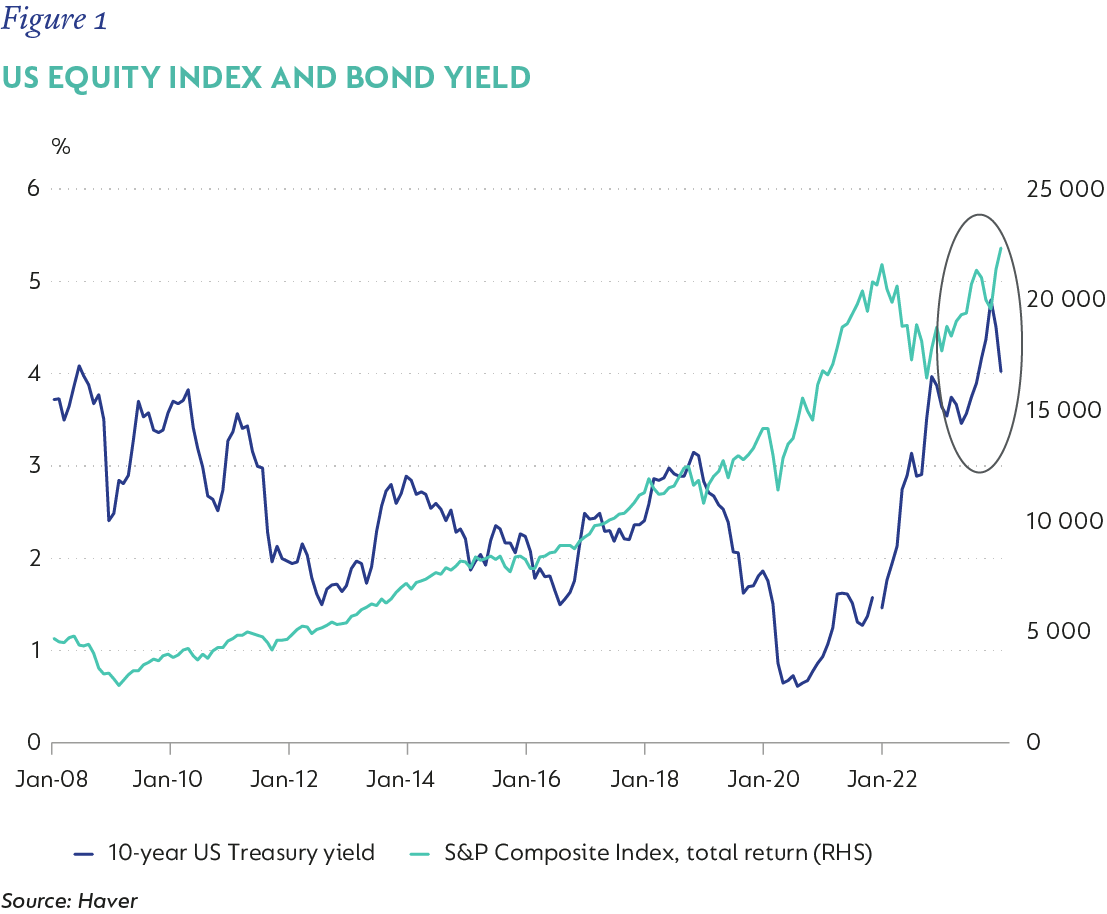

This time last year, the strong consensus was that the US and Europe would fall into early recession, that central banks were at or close to peak policy rates, and that inflation was likely to fall only slowly. While growth did slow, there were no recessions in the US, Europe, or the UK. Central banks continued to hike for longer than initially expected, but, by year-end, inflation had eased faster than most forecasts predicted, as supply chains continued to heal and oil prices fell. This helped equity markets rally and saw bond yields fall (Figure 1).

It’s hard to clearly separate the influences that proved early predictions incorrect, but several factors were more influential on outcomes than expected:

- Oil prices played a significant role, not only in determining the pace of decline in headline inflation but also in supporting incomes and consumer spending via both lower transport costs and utility bills.

- Fiscal policies in developed markets remained generally expansionary and supportive of growth, even when direct Covid support ended. This helped sustain both economic activity and employment/wage momentum for longer than expected.

- The impact of slow-moving demographic trends, exacerbated by Covid and Brexit, on labour markets in key economies helped sustain tighter conditions and facilitated stronger wage formation. This in turn bolstered consumer spending and services-related inflation. This is likely to have a sustained influence.

- The wealth effects of accrued savings and asset price appreciation had a more meaningful impact on consumers than anticipated, especially in the US.

Taken together, these factors helped support growth in the face of considerably tighter monetary conditions.

ELECTION OUTCOMES WILL IMPACT

Recognising these influences provides valuable instruction for the year ahead, especially as a new consensus is emerging: the trifecta of more resilient growth than was expected in 2023, lower headline inflation and more dovish central bank commentary has coalesced into a ‘soft landing’ consensus. A recession is thus avoided, but growth slows to below potential, helping inflation ease towards target through 2024. This would allow the Federal Reserve Board (the Fed) – and other central banks – to start cutting policy rates during the year. This scenario would support both equity and bond market returns, and markets have rallied in response.

Given the available data, this also seems a reasonable baseline expectation at this stage. But the risks that drove concerns about growth and inflation in 2023 are still valid. The first is that while growth – especially in the US – was resilient to tighter monetary policy, the sources of support are fading, and policy rates have continued to rise. Other factors include:

- Oil prices are not expected to fall in the year ahead, with the Middle East conflict now presenting an upside risk.

- Labour market dynamics are critical to both inflation and growth outcomes. For now, labour markets have remained strong, which could help support growth and inflation, while looser labour markets could see less support from consumption

- Wealth effects may be less supportive if housing markets come under pressure as interest costs catch up.

- Fiscal policy – again, especially in the US – may be less supportive as the impulse turns negative

- Debt service costs will continue to rise as the lagged impact of higher policy rates on contractual borrowing feeds through.

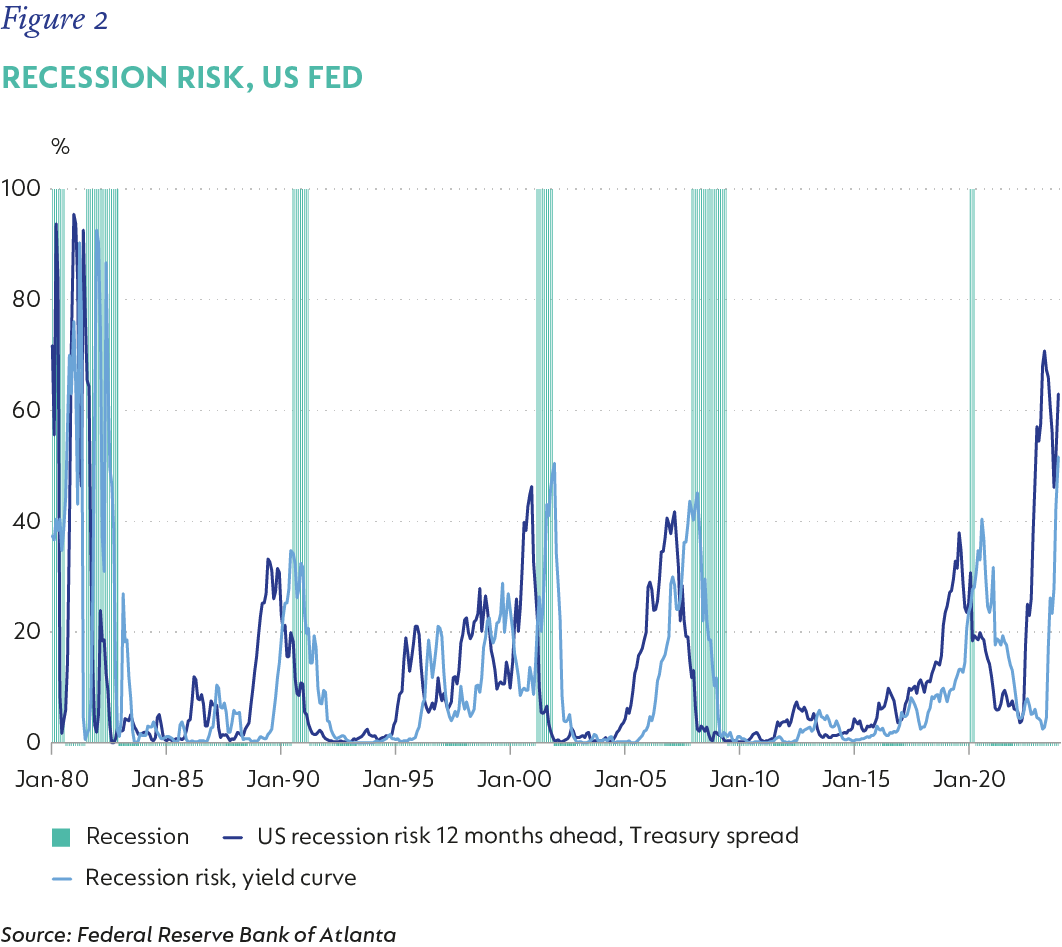

On balance, we think the recession risk for the US, Europe and the UK remains in play in 2024 (Figure 2), but current momentum may still take time to fade, which complicates the outlook for monetary policy.

Growth is a key concern for central banks, but it is the outlook for inflation that will decide monetary policy actions in 2024. The drivers of the 2023 moderation are unlikely to be as impactful this year, and some may reverse. Importantly, the easing of supply constraints is already slowing, and oil prices seem to have bottomed, while shipping costs have started rising, posing an upside risk to goods inflation. Labour markets remain tight and wage growth is positive, albeit weaker in Europe than elsewhere, but this will still make the ‘last stretch’ to bring inflation into target ranges difficult. We expect central banks to remain cautious, and ease more slowly than current market expectations. The risk of reversal should also not be ignored.

Politics, globally, will also play a more prominent role in the macro agenda this year. Almost half of the global adult population will go to polls in 2024, as 66 countries hold national or local elections. The US election, due in November, will undoubtedly be the most visible. Both large party candidates face personal challenges, and neither has decisive national support. This means that the outcome might be decided by a small margin and may be contested. An uncertain US democratic process may have domestic political and social implications as well as broader global political repercussions. There are also two ‘hot’ wars waging on, which both carry the risk of regional contagion. Election outcomes will also influence these conflicts, as well as the tensions between China and Taiwan, the growing largely non-democratic political alliances outside of the West, and the policies and politics of the US itself.

Through a wider lens, today’s political and economic uncertainties reflect an ongoing gearshift in the global integration that dominated the period from the 1970s through the early 1990s. Globalisation is being re-imagined with the intensification of geopolitical competition between the US and China, the challenges to liberal democracies, and the rise of the Global South. Politics may well be the economic spoiler of 2024.

HOMEGROWN HEADACHES

South Africa’s (SA) economic challenges are compounded by global dynamics but are largely of its own making. For much of last year, SA managed to deliver better growth than the sharp intensification of loadshedding implied was likely, largely because of ongoing investment in own-generation and a slow recovery in services sectors. This only partially offset the contraction in primary and secondary sector activity, which suffered the double blow of power and logistics failures. Inflation was more mixed, given the sharp rise in operating costs which was offset by very weak domestic demand, and falling fuel prices. The South African Reserve Bank (SARB) remained resolute and raised the repo rate 100 basis points (bps) to 8.25%. But, by year-end, data showed growth contracted in the third quarter of 2023, and high-frequency data pointed to an economy in recession in the second half of last year.

Prospects for a strong recovery in 2024 are limited. Firstly, while the energy constraint may ease, the recent publication of the government’s long-term energy roadmap (the Integrated Resource Plan, 2023) does not envisage an end to loadshedding in the medium term. Bringing Kusile Unit 5 back online in December has helped energy availability and facilitated better maintenance, but the performance of the existing fleet is critical and unpredictable. We expect an ‘average Stage 2’ this year, which should support ongoing private investment in generation capacity. Negatively, freight rail function has become severely constrained, and the general operating environment for primary and secondary industries remains ineffective and expensive.

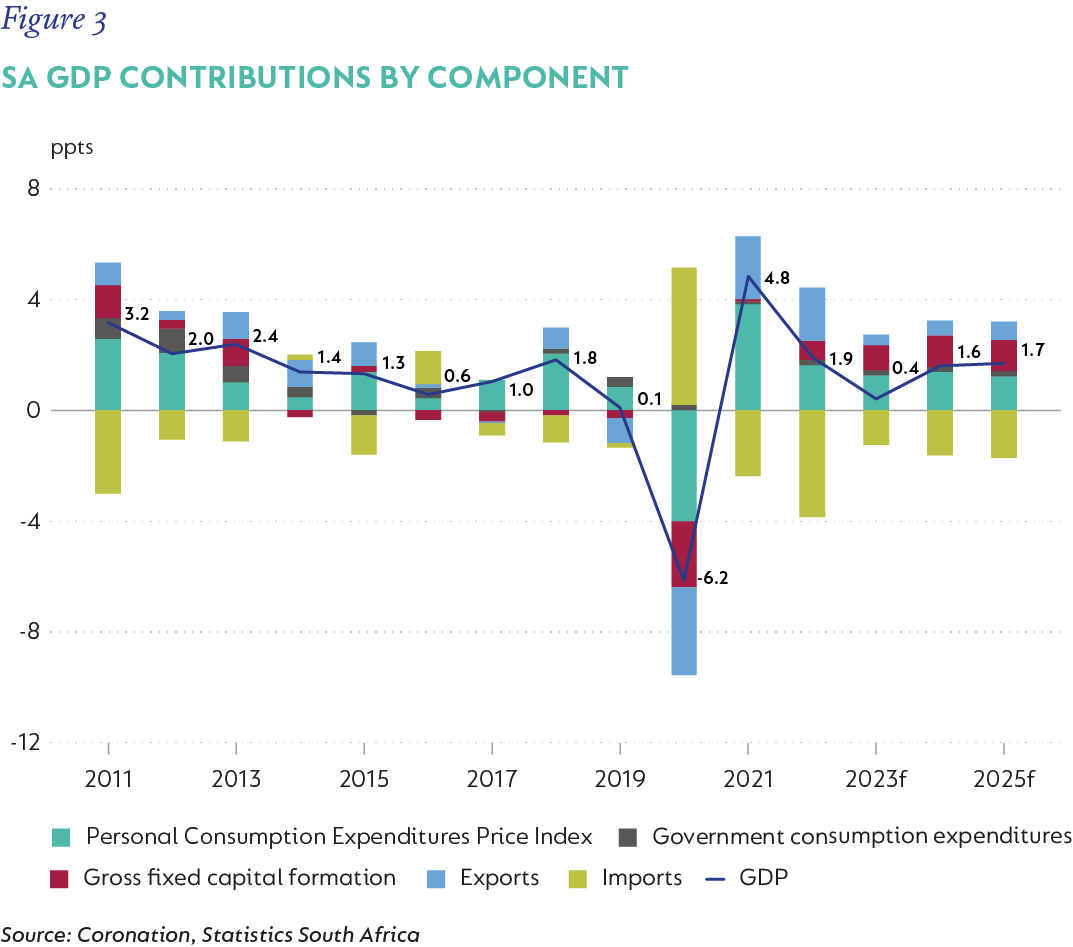

We expect slow progress in addressing these challenges but acknowledge that Operation Vulindlela’s inroads in addressing red tape and other structural headwinds to growth continue. The recent appointment of a board for the National Transmission Company as well as renewed focus on Transnet’s problems and leadership are also positive steps forward. In 2023, the services sector managed to grow, and this helped return employment to pre-Covid levels. The current tourism season could see some upside for the sector, while financial opportunities related to the energy transition and the prospects for new infrastructure investment are potential positive areas for growth. Consumers should feel some reprieve from lower inflation and stable interest rates. On balance, we expect GDP to accelerate to 1.6% in 2024 from 0.4% in 2023 (Figure 3). To achieve long-term growth that significantly exceeds this will require a meaningful improvement in the functioning of network industries and a range of regulatory reform – including labour markets - which has been inadequate to date.

The real challenge is accommodating the impact of logistics and institutional system failures on long-term growth estimates. These systems have come under pressure over a long time, so the lags are hard to calculate, and then they fail fast. Eskom is a long-term lesson, but 2023 saw Transnet and municipal water availability face operational failures that worsened materially during the year. There is little concrete evidence that these will be effectively addressed in the next year – or beyond. As such, they will remain as constraints to any recovery, as well as SA’s long-term potential.

Weak growth has been a key driver of fiscal deterioration because revenues have not been able to keep up with generous expenditure allocations to State-owned enterprises (SOEs), wages and necessary social support, especially for distressed recipients. Put differently, the government continues to spend considerably more than it receives in revenues, with frequent in-year revisions to the expenditure baseline. SA’s vulnerable fiscal position will not change while these dynamics remain in play. In the year ahead, wages are likely to exceed the current budget allocation, SOEs will receive more funding than budgeted, and we expect the social relief of distress grant to be made permanent. There is also the risk that additional funding is required for critical infrastructure like water and road networks, especially at local government level. Compounding risks to the fiscal position have raised risk premia and borrowing costs ahead of nominal GDP growth, which means SA must borrow to fund both its deficit and its interest cost.

National Treasury remains firm in its plans to achieve a sustainable fiscal position, and revenues have held up well, considering. Unfortunately, critical decisions about the long-term allocation of revenue remain political ones. Until spending consolidates or this dynamic shifts through stronger growth, government debt will continue to accumulate.

Consumer inflation slowed into the end of 2023, helped by falling retail fuel prices. Food inflation – the other big driver of headline inflation in early 2023 – moderated slowly as higher operating costs have offset lower commodity prices. Core inflation has been a mixed bag, with services inflation anchored by low rental growth, but goods inflation remained elevated. The outlook is also uncertain. We expect CPI to moderate in coming months as transport costs fall, but we see upside risk to food prices in the second half of 2024 and are cautious about the willingness and ability of price and wage setters to absorb high administered price and indexed-wage increases. With headline and core inflation forecast to average about 5%, and a weak fiscal position, there is limited room for the SARB to manoeuvre. We expect a constrained 75bps easing cycle to start late in the year.

THREE DECADES OF FREEDOM

South Africa will celebrate its 30th year as a democracy in 2024. National elections need to be held before August and are expected around May. The outcomes of an array of polls suggest that the ruling ANC will not achieve a clear majority, but is likely to come relatively close, forcing it to enter a coalition with a smaller party. There is a lot of risk associated with the fracturing of traditional party positionings, but also great opportunity as these dynamics and relationships mature. We do not expect a significant shift in policy priorities or delivery after the election as our baseline, but much will depend on the voter participation, the outcome, and the alliances agreed in the aftermath. The election will, nonetheless, bring additional uncertainty to the challenging economic environment.

Making any foretelling in a dynamic environment with great uncertainty – perhaps especially coming out of several years of unprecedented events in close succession – remains an exercise that needs to be approached with great care. SA’s political and economic position is at a critical juncture, where making sensible, pragmatic decisions could materially improve the outcomes that have been disappointing for so long.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

Global (excl USA) - Institutional

Global (excl USA) - Institutional