Personal finance

Overview

For any investor, one of the best investment strategies is to ensure that your asset base is appropriately diversified.

By not putting all your “eggs” into a single (and notably small) basket, you spread your investment risk and return opportunities across geographies, industries and, importantly, jurisdictions.

This edition of Corolab demonstrates:

- our established global offering and what sets us apart;

- the benefits of strategic diversification into international markets; and

- how best to take action given your individual investment goals.

An established and proven global offering

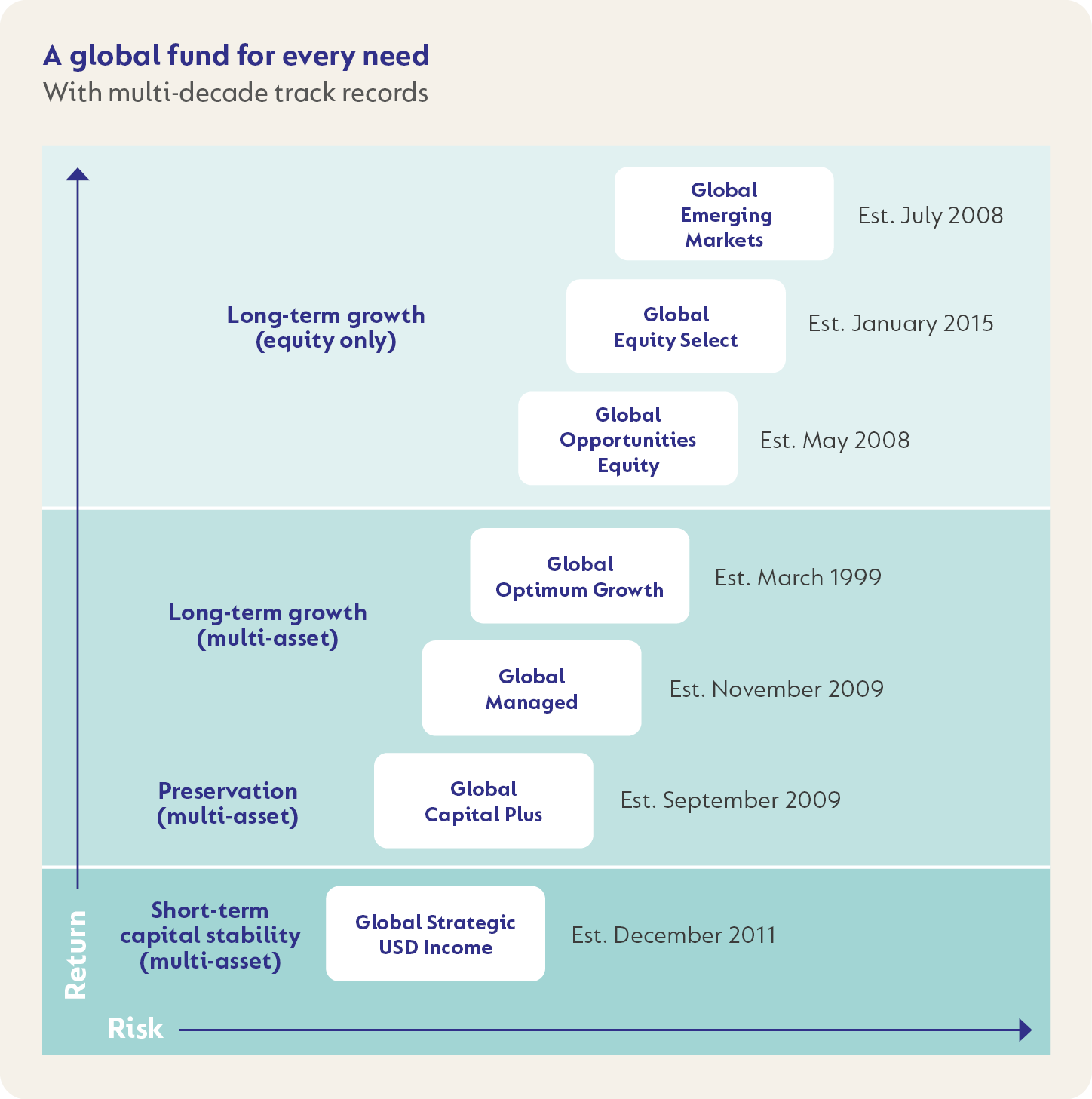

We’ve spent the last 25+ years refining a deliberate and methodical approach to building a comprehensive global fund range that meets the needs of South African investors.

This range gives you access to the best global opportunities through multi-asset class or building block solutions, all of which have demonstrable track records.

Download the comprehensive fact sheets here.

A tried-and-tested yet agile approach

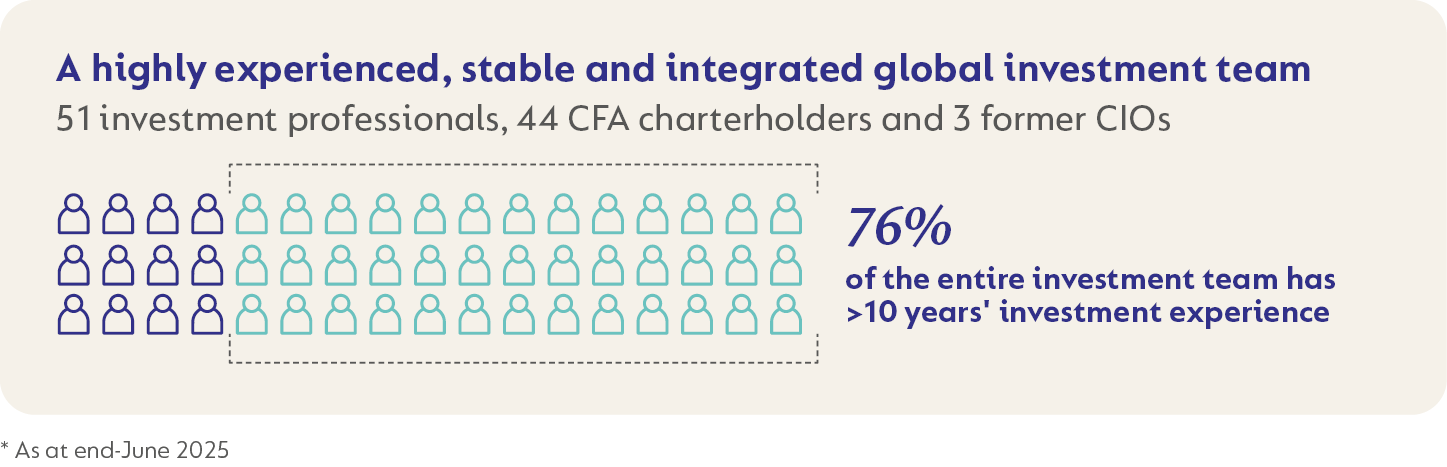

We are proud to be one of the few South African investment firms with:

- Critical mass to build world-class teams in both the domestic and global markets, More than $15bn of our total AUM* is entrusted to these global mandates;

- Top performing multi-decade track records across our global fund range; and

- A team of more than 20 professionals who solely focus on global markets, including 17 experts with >10 years of investment experience.

When investing offshore with us, you benefit from a single, valuation-driven investment philosophy that has been tested through many market crises and applied by a global team of skilled investment professionals who consistently collaborate to identify the most attractive opportunities (regardless of asset class or geography) for our global funds.

While our philosophy has remained consistent over the decades, we continue to refine our investment approach to remain agile and relevant in a constantly changing world.

Significant value creation

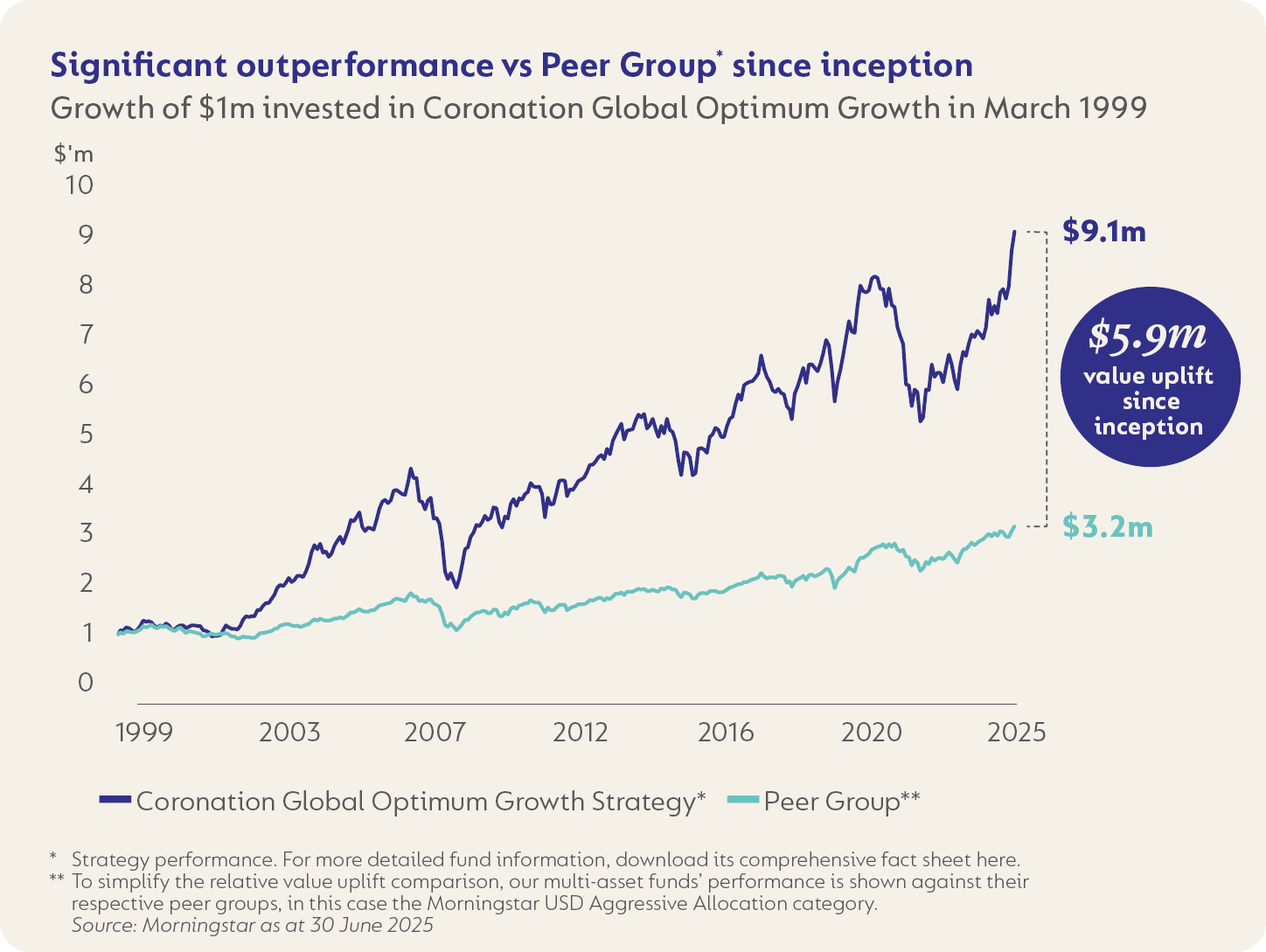

Our proven capabilities to invest across markets and asset classes have generated significant value for investors over the long term, as demonstrated by the 26-year track record of one of South Africa's longest-running global multi-asset class strategies, Coronation Global Optimum Growth.

The Fund is an unconstrained global portfolio that is well suited to long-term investors who want to grow their wealth by investing in a diversified mix of growth opportunities across both developed and emerging markets. It is best suited to those with an investment horizon of 10 years or more.

For more detailed fund information, download its comprehensive fact sheet here.

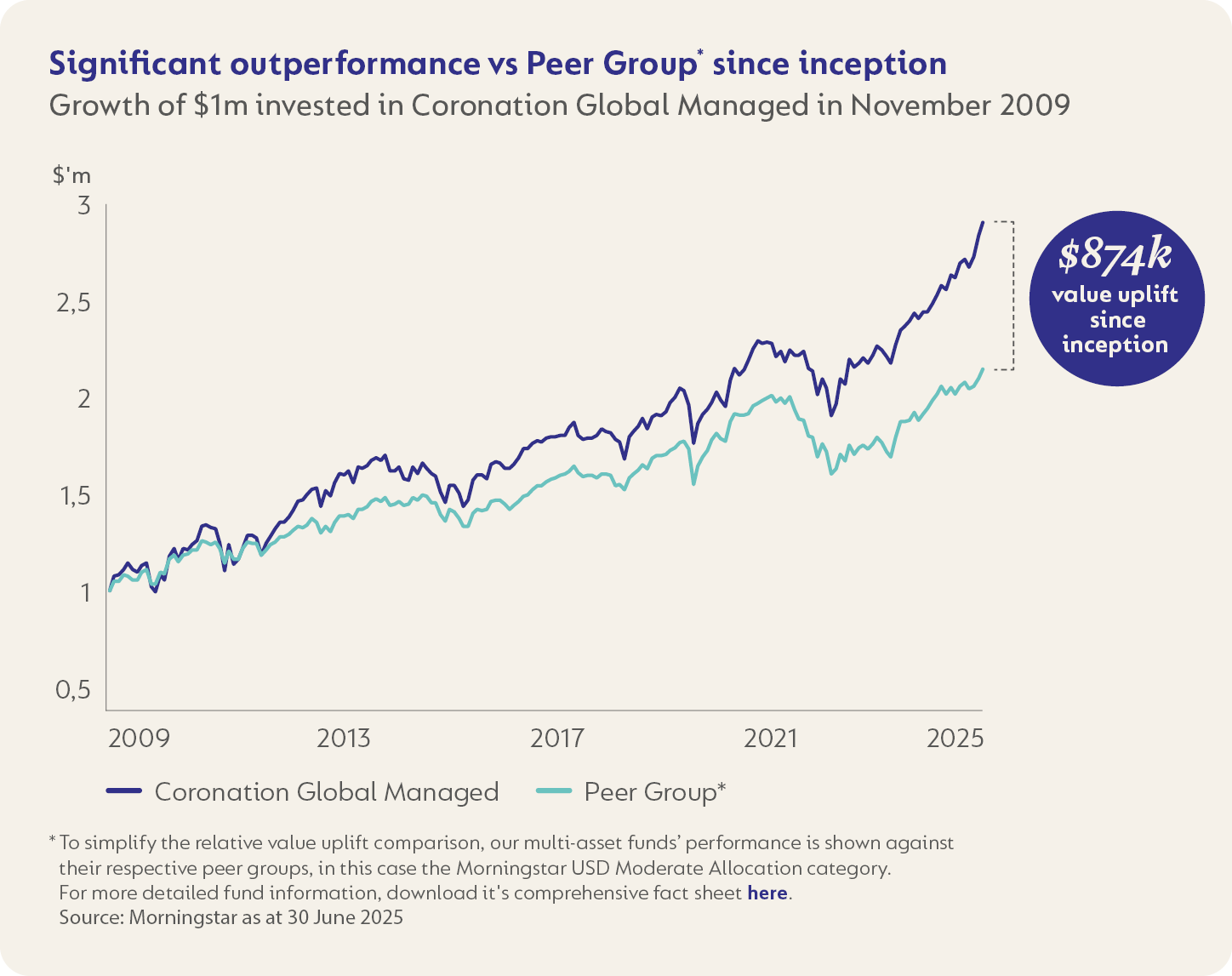

Coronation Global Managed, a developed market focused balanced fund, also boasts an enviable track record. This fund is suitable for investors who want to grow their wealth through a globally diversified portfolio that strikes a balance between long-term growth and managing risk. It may suit those who prefer a smoother investment journey compared to those in Coronation Global Optimum Growth with an investment time horizon of at least five years.

For more detailed fund information, download its comprehensive fact sheet here.

The benefits of global diversification

Diversification into international markets holds the following benefits for your portfolio:

1. Enhanced returns

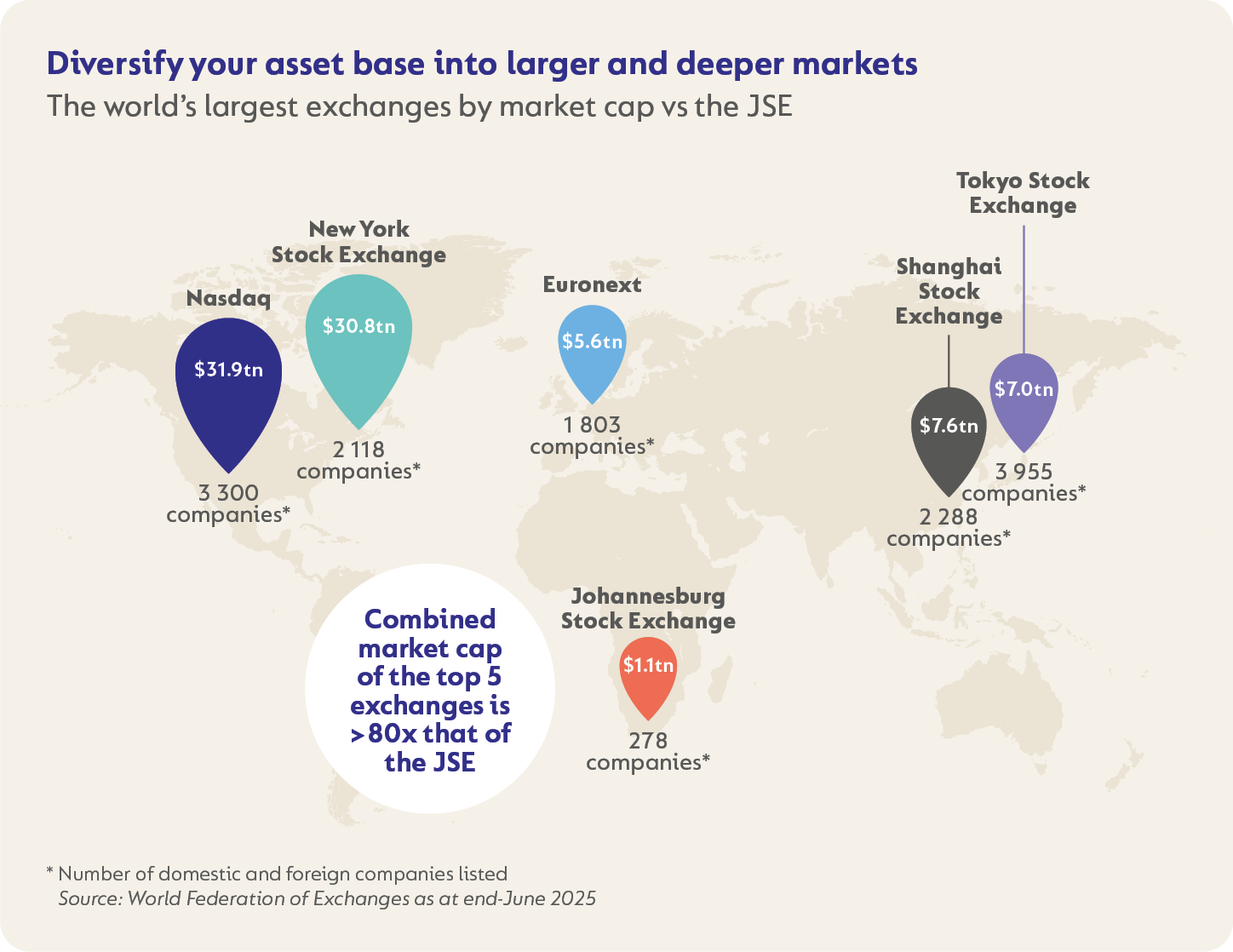

The sheer magnitude of investment opportunities outside South Africa is evident in the combined market capitalisation of the world’s top five exchanges*, which exceeded $80 trillion (and comprises more than 13 000 listed companies) compared to the JSE’s ~$1 trillion (and universe of 278 listed companies) as at end-June 2025.

By expanding your investment universe, you unlock access to more opportunities of innovation and growth, tapping into industries and opportunities that may be underrepresented in the domestic market. This strategic diversification enhances portfolio resilience and optimises long-term investment outcomes.

2. Reduces overall risk

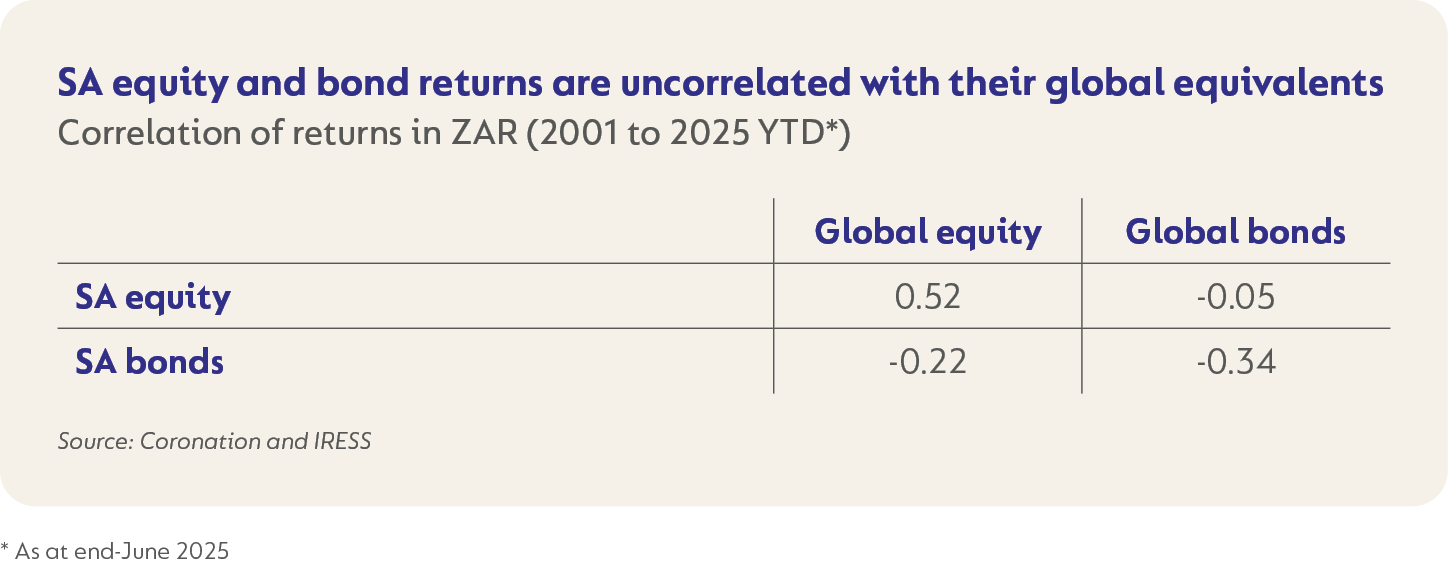

When considering which asset classes to include in your overall investment portfolio, it is vital to consider correlation. Correlation measures how closely the price movements of two asset classes are related.

One way to reduce the overall risk of your investment portfolio is by combining asset classes with negative or no correlation. This means that if one asset class in your portfolio declines during a market downturn, other asset classes will either rise or remain unaffected. This can result in a better overall outcome and reduced overall risk.

In a severe risk-off event, the inclusion of developed market assets (specifically bonds), gold and cash can offer much-needed diversification at a time when equities (global and SA) typically sell off and emerging market bonds depreciate.

The following table illustrates the benefits of incorporating global assets into your South African portfolio.

South African equities and bonds exhibit a low to negative correlation with their global equivalent asset classes, and this correlation is even lower when examining the relationship between specific asset classes (i.e., SA equity to global bonds and SA bonds to global equity).

The key takeaway from this exercise is that by allocating money internationally, you add another asset class or set of asset classes to your overall investment portfolio that behave differently from those in your local asset class mix, especially when factoring in the impact of the local currency.

3. Optimising for risk and return

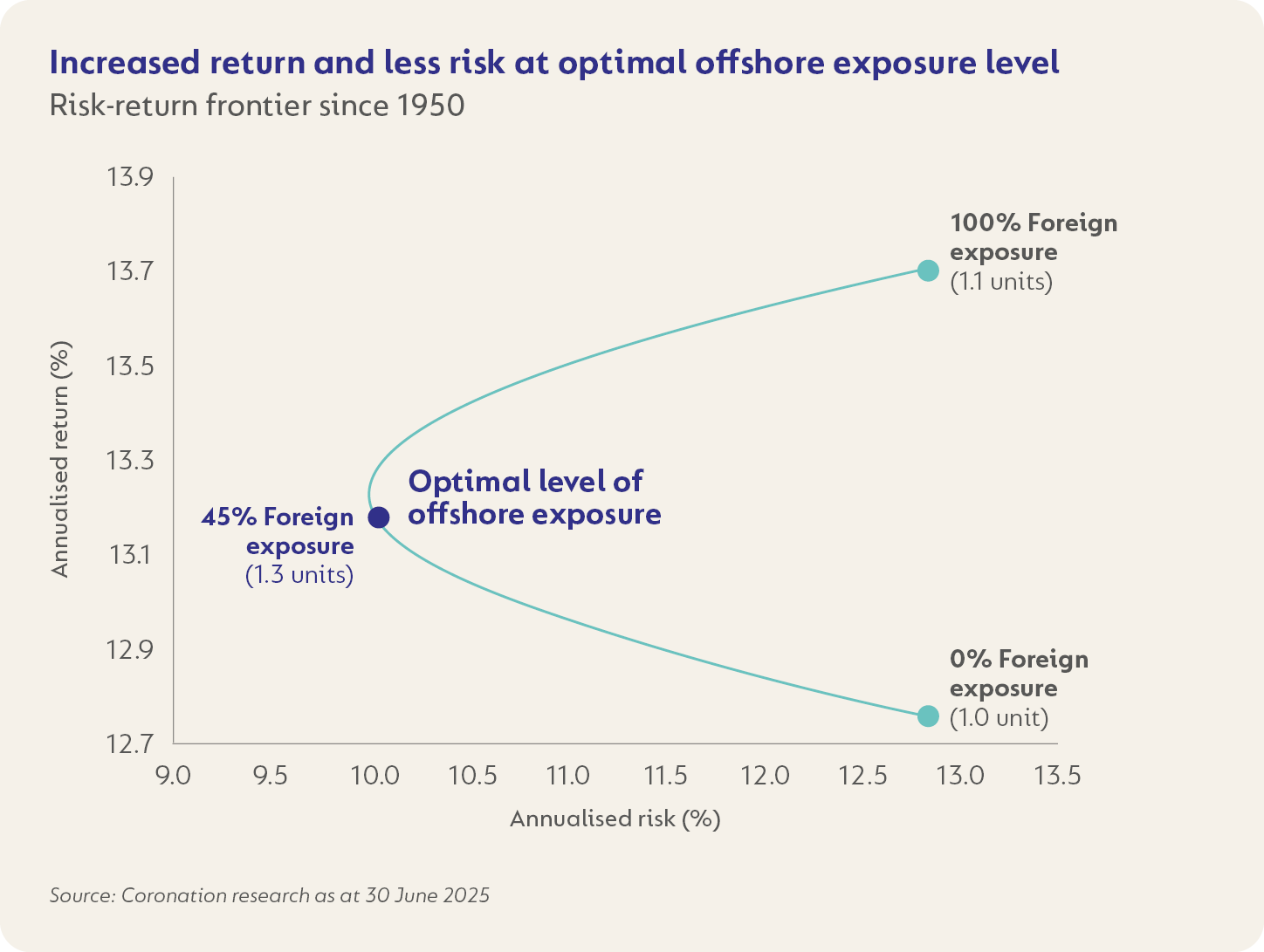

The graph below shows how adding international exposure can improve the long-term investment outcomes for South African investors. At 0% offshore exposure (see data point in the bottom right of the graph), the risk and return are equal: investors earn 1 unit of return for every unit of risk taken.

However, by diversifying globally, investors can reduce overall portfolio risk while improving returns. At the optimal point of 45% offshore exposure, the risk-adjusted return improves significantly, with investors earning 1.33 units of return for every unit of risk taken.

4. A hedge against your future expenses

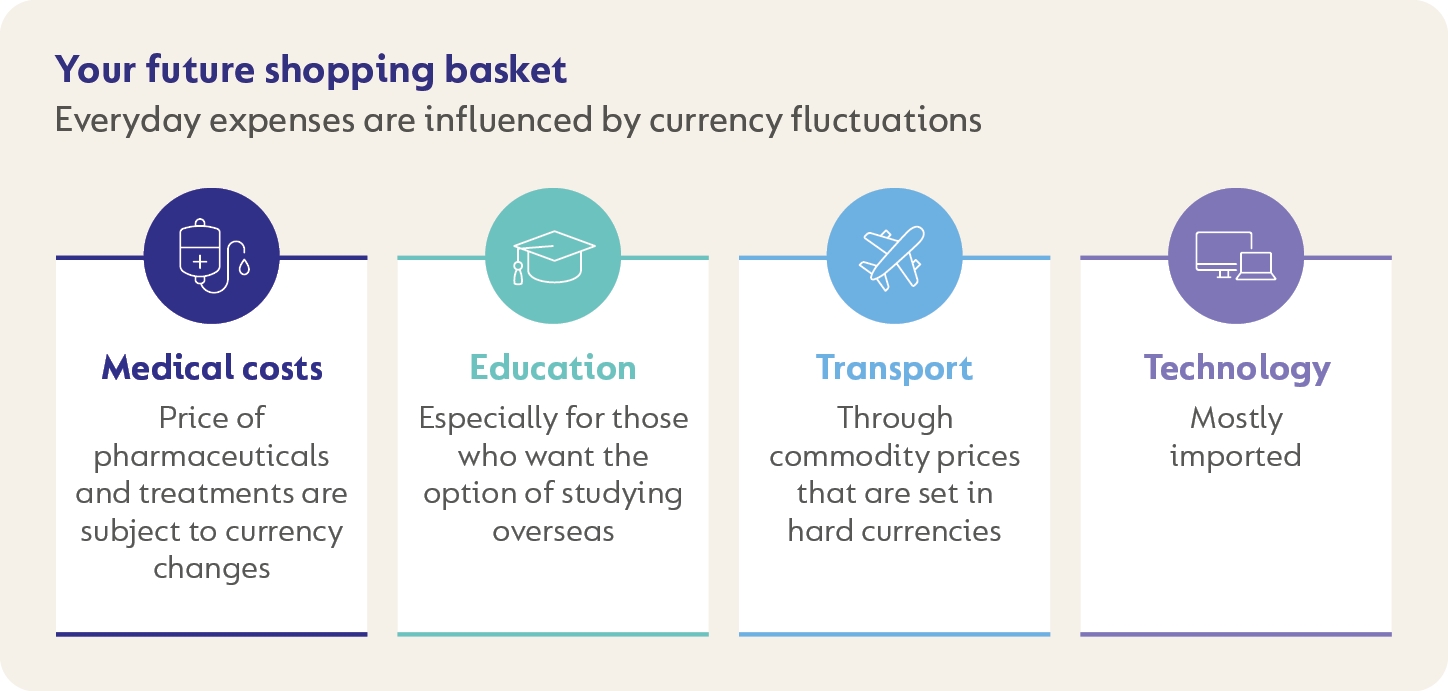

Many items in the South African consumer’s shopping basket (from fuel to food to healthcare and household goods) are largely priced in foreign currencies as the inputs are either commodities (with prices struck in global markets) or heavily reliant on imported content.

Having adequate international exposure within your overall investment portfolio serves as a hedge against long-term changes in the price of this part of your future shopping basket.

Periods of currency weakness will likely remain a strong driver of price increases in the future. Having more than the minimum offshore exposure recommended for retirement savers may also be warranted for those planning for future liabilities in hard currency.

This would include expenses such as overseas travel (for leisure purposes or visiting family members living abroad), business opportunities, investing for your own or a next generation’s education at an international institution, or emigration.

How much international exposure is right for you?

The right amount of international exposure in your long-term investment portfolio depends on your personal circumstances, goals, and financial needs.

Fortunately, all Coronation investors benefit from the same global insights and investment expertise, whether investing in our local or global funds. This is thanks to our integrated investment approach, which ensures consistent application of strategy and views across both domestic and international portfolios.

When might you need more offshore exposure?

For many investors, the offshore allowance available through retirement products (which can invest up to 45% internationally) is sufficient. However, depending on their circumstances and needs, certain investors may benefit from allocating more of their portfolio offshore by using discretionary (non-retirement) savings.

You might consider a larger international allocation if you:

- Spend regularly in foreign currency

- Plan to leave an inheritance to family living abroad

- Do not rely on your investments to provide a regular income in rands

- Have a high net worth in a global context and want greater geographic diversification

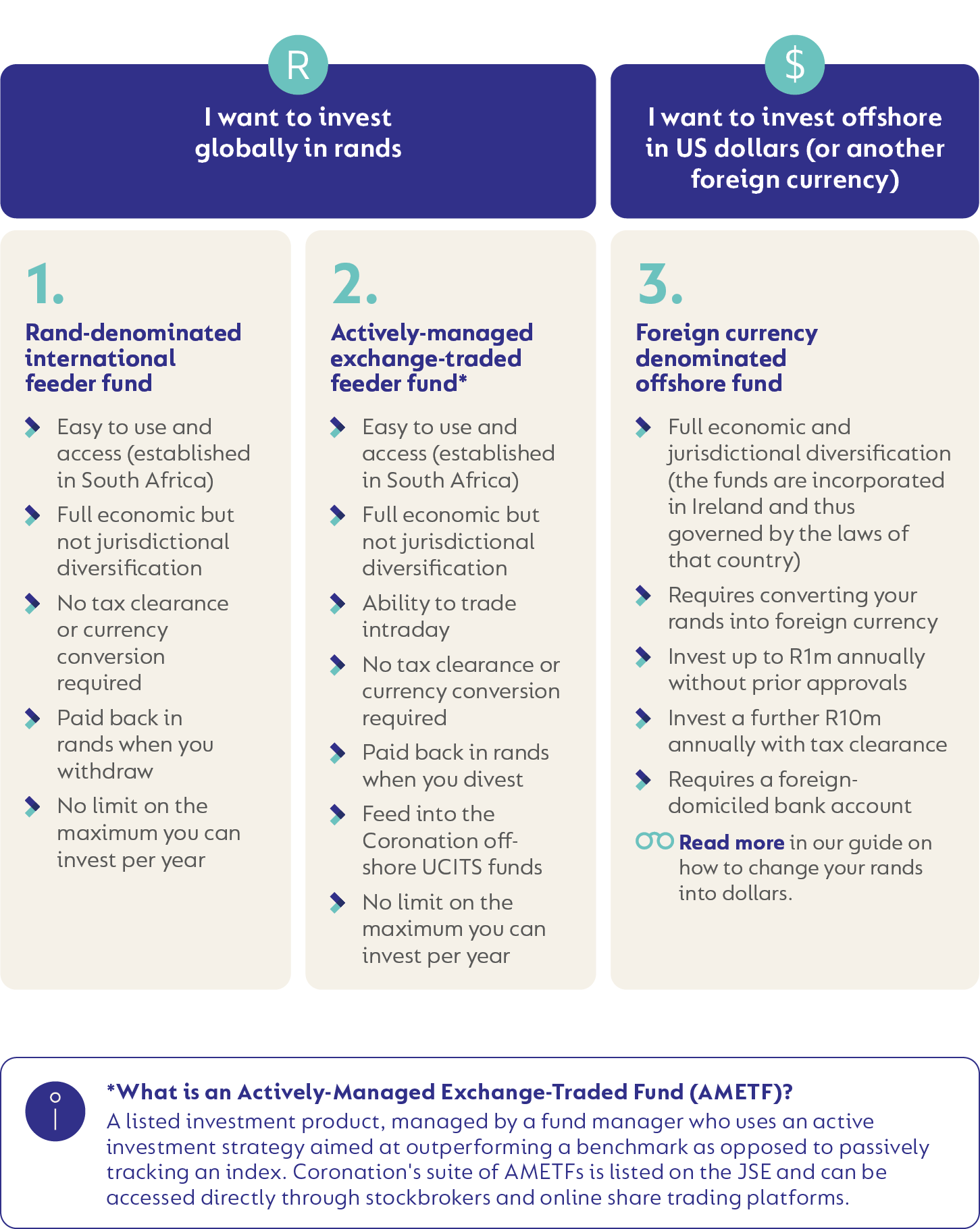

If any of these apply to you, investing directly in a Coronation offshore fund may be an effective way to increase your international exposure. We offer three easy access points to our global portfolios.

Saving for retirement in South Africa but still want to benefit from offshore opportunities?

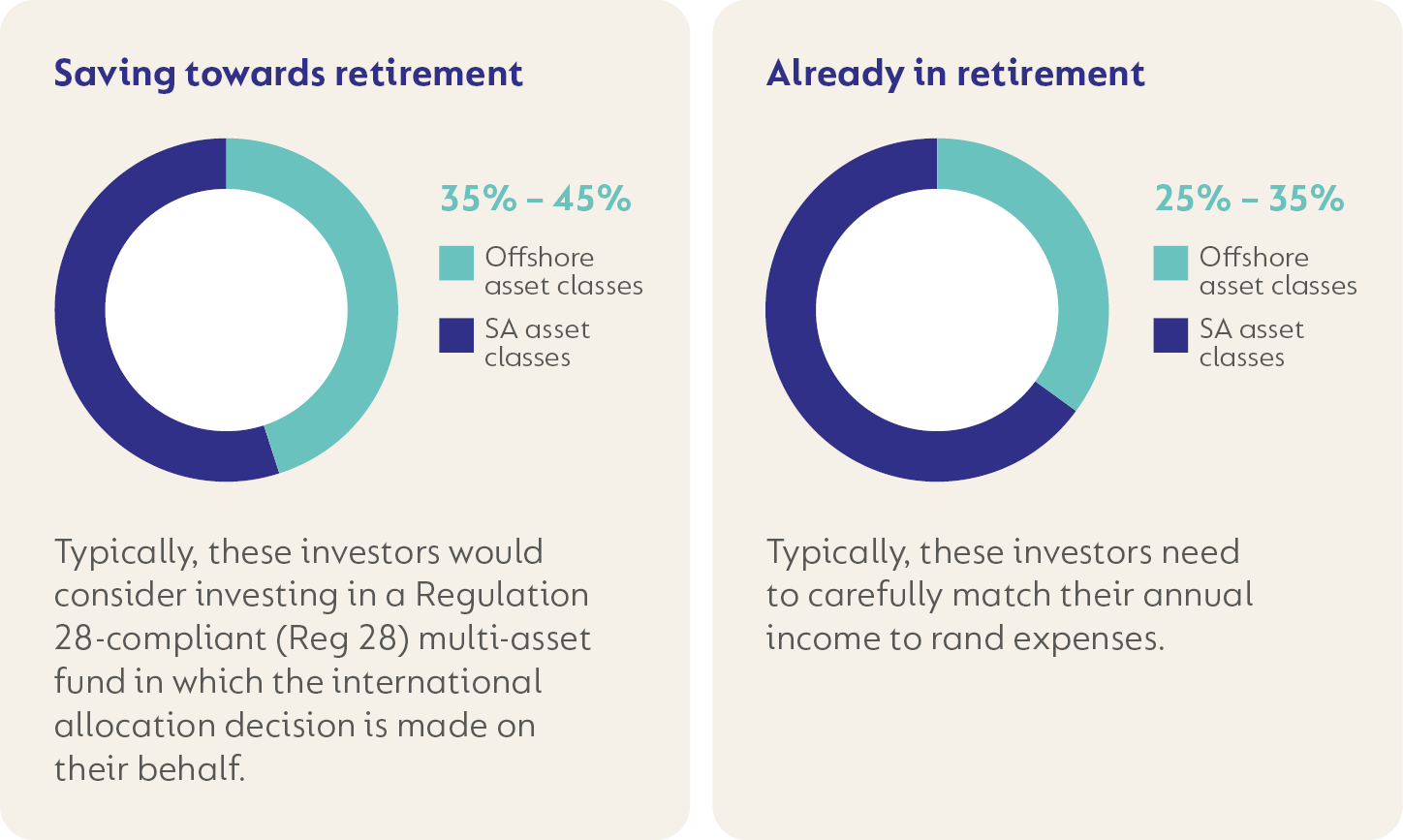

If your current budget only allows you to save through traditional retirement vehicles, such as a Retirement Annuity (RA) or your employer’s retirement fund, you can still benefit from international opportunities, but optimal levels of exposure may depend on whether you are saving towards retirement or already in retirement.

Road more about saving towards retirement in our Investing for Long-Term Growth Corolab or read more about investing in retirement in our Reg 28-compliant multi-asset funds aimed at post retirement investors in our Investing for Income and Growth Corolab.

Conclusion

As we’ve shown in this edition of Corolab, it makes sense for South African investors to diversify their investments globally, whether you're saving for retirement through local funds or seeking additional offshore exposure beyond your retirement fund.

At Coronation, we’ve spent over 25 years building a global fund range specifically designed to meet the needs of South African investors. This global expertise also enhances the longer-term outcomes of our local portfolios.

Our international funds are available in rand and US dollar classes (along with hedged options for more conservative investors) and are managed by a highly experienced global investment team. This team applies one integrated, valuation-driven investment philosophy to uncover the most compelling opportunities – across asset classes, industries, and regions.

Disclaimer

SA retail readers

Global (excl USA) - Institutional

Global (excl USA) - Institutional