Bond Outlook - October 2016

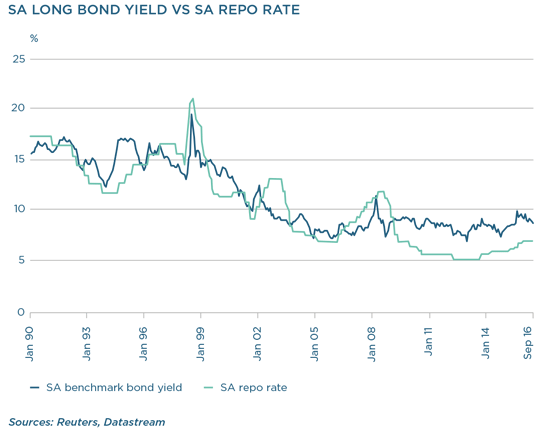

At the start of this year, the SA bond market was battered and bruised, having survived the turmoil of three finance ministers in one month. Yields were under pressure, confidence was at crisis levels and the outlook for 2016 seemed ominous. The benchmark government 10-year bond (commonly quoted as the R186) opened the year at almost a double-digit yield of 9.75% and the rand had blown out to a level of R15.50-odd to the US dollar. Expectations of a spike in inflation in the coming year were widely held and in January the SA Reserve Bank’s (SARB) Monetary Policy Committee (MPC) stepped in and hiked the policy (repo) rate by a full 50 basis points to 6.75%.

However, as is often the case, the best opportunities usually present themselves at times of crisis. At the time, fear of a very unstable domestic political economy presented a great buying opportunity in local bonds. Yields have rallied strongly over the past nine months to around 8.5%, with the bond market producing an eye-watering 15.5% year-to-date return. Throughout this period, finance minister Pravin Gordhan fought the good and righteous fight to steady the country’s fiscal ship, trying to block the patronage network at every turn and putting policies in place to try to avert a country downgrade to junk by the ratings agencies.

The bond market responded positively to these developments, an important vote of confidence in the outlook for sustainable fiscal policy. Importantly, lower yields also reduce the interest burden on the fiscus, allowing greater flexibility for expenditure on other things.

So where to for the local bond market from here? With yields around 8.5%, are there more gains to come?

While we are reasonably positive on the fundamental outlook for bond prices, the fluid political situation may affect political risk premium. Nonetheless, the underlying fundamentals should continue to dominate the valuation of these instruments. And the biggest fundamental driver of bond yields is the trajectory of inflation.

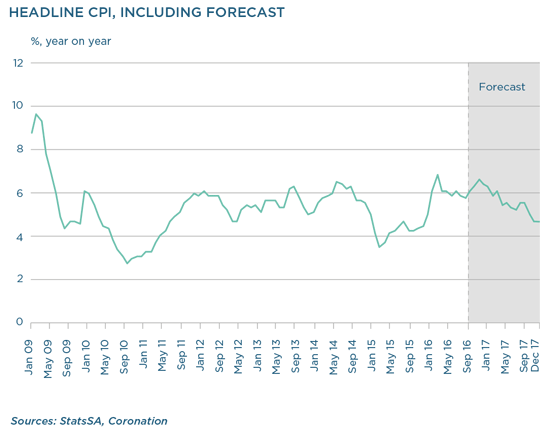

Inflation is expected to peak in the upcoming quarter at around 6.7% and then fall steadily into next year to average around 5.7% for 2017. The main driver is expected to be a relatively sharp deceleration in food price inflation, which now looks close to a peak. Our view is reinforced by the improvement in rainfall – perhaps increasing evidence that La Niña is coming and farmers are more likely to generate a more normal harvest this summer season after last year’s debilitating drought.

The next strongest driver (and greatest potential uncertainty) is the relative stability seen in the exchange rate, despite ongoing bouts of political uncertainty. The rand has rallied around 11% to R14.20 versus the US dollar since the start of the year. Underlying improvements in the trade account added impetus to the rand’s performance after its big depreciation last year.

We think that the improved inflation outlook means that the SARB will not hike rates further. If sustained, it should also have a positive impact on inflation expectations. In the most recent MPC communiqué issued in late September, the MPC made it clear that if its inflation forecast is realised, then the current hiking cycle is close to peaking. However, they did caution the market not to start pricing in rate cuts too soon because ‘the bar to monetary accommodation remains high’. Despite this, the suggestion that the hiking cycle may be over should provide underlying support to bond yields, also resulting in a flatter yield curve.

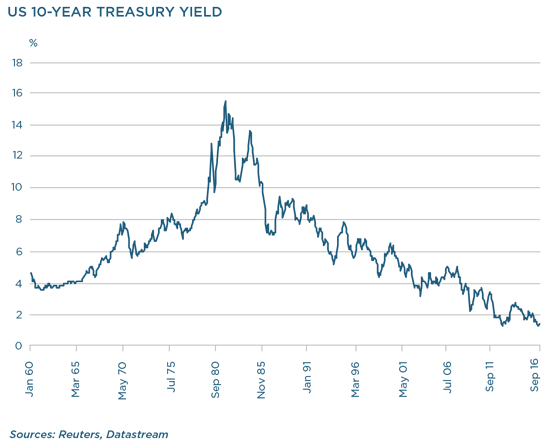

As always, nothing is straightforward and risks remain. We are concerned about two things. The first is a pending rate hike in the US and the possibility that it puts upward pressure on US bond yields which, in turn, would likely hurt the pricing of the bond yields in other countries, including here in SA.

The second is the still relatively high probability that SA’s sovereign rating is downgraded to junk status when the ratings agencies give their assessments before the end of the year. A ratings downgrade would be material to the pricing of our bond yields and could result in a major sell-off. Our view is that the odds are about even. If we do get a medium-term budget policy statement at the end of October that manages to hold the current fiscal line and the finance minister continues to demonstrate his fighting spirit, we could get a stay of execution into next year. This, in turn, may give a window of opportunity for policymakers to address some of the much-needed structural issues and reforms that would improve the outlook for growth in the longer term.

Although there are clear risks to domestic bond pricing, we do believe that the fundamental valuation argument provides a decent underpin at current levels. As such, our funds continue to hold and accumulate domestic government bonds at these yields.

South Africa - Personal

South Africa - Personal