Economic views

The politics of policy

A challenging balance between inflation and growth

The Quick Take

- Globally households are under pressure as policymakers curb spending with brutal monetary tightening amidst high cost-of-living increases

- The decline in growth prospects off Q1-21 highs is historically precipitous

- Conditions are ripe for a global recession, putting policymakers in the driver’s seat

Recent moves in financial markets highlight the tension emerging between the mandates and policy independence of inflation targeting central banks and the interventions of governments whose voters are affected by high inflation and sharply moderating growth. But therein lies the rub. As central banks’ commitment to bringing inflation back within targeted ranges has intensified, they are telling markets that they are willing to over-tighten to move into economically painful ‘restrictive’ territory, while governments are attempting to provide some relief to households facing cost-of-living increases not seen in many decades. The problem is that the fiscal support for household incomes may make the central banks’ jobs harder, as the inflation that has taken hold has no easy resolution, even as growth slows. In the most coordinated action seen in decades, global central banks have been tightening into weakening growth. However it may not take much to tip the world into recession.

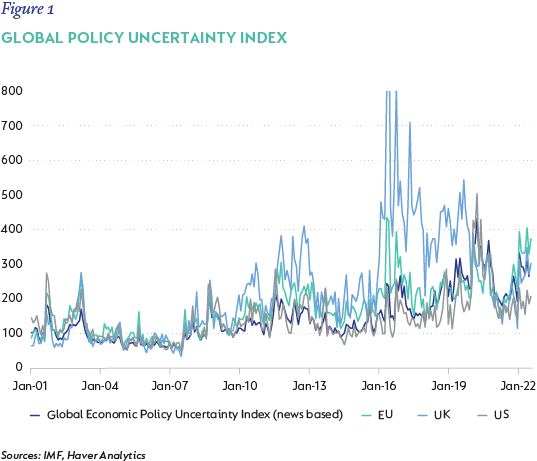

This extraordinary tension has led to deep and widespread uncertainty which, in itself, is a further headwind. This is illustrated by Figure 1, which shows an increase in negative, policy-related global newsflow. While the construct of this index is not data-specific, it highlights the increase in market and public uncertainty related to economic policy.

A DOWNHILL SLOPE

Global activity indicators peaked in the middle of 2021. The weakening trend thereafter reflects rising pressure on real incomes, in some cases tighter monetary policy settings (initially from emerging markets and, more reluctantly, from their developed market peers), ongoing supply disruptions associated with Covid and geopolitical developments. From early 2022, these trends were magnified by Russia’s invasion of the Ukraine, and the impact on both commodity prices and supply disruptions triggered by this event, coupled with a more aggressive commitment from central banks to raise interest rates to rein in inflation.

There have been material downgrades to global growth forecasts. A year ago, the IMF forecast for global growth in 2022 was 4.9%, and 3.6% in 2023. In this year’s October World Economic Outlook update, this is now 3.2% and 2.7%. While downgrades have been concentrated in developed economies, few regions have escaped the trend. Growth expectations for Europe have been hit the hardest, followed by the UK and US. Looking further east things remain subdued, with China’s current forecast at 3.2% in 2022, and for a muted recovery to 4.4% in 2023. Much of the resilience implied by many of the forecasts for 2022 reflect the strong start to the year. Expectations into 2023 are considerably weaker.

THE ANATOMY OF A RECESSION

While some moderation in growth in 2022 was to be expected given the sharp post-pandemic rebound, the widening breadth of data signaling slower activity coupled with the sharpness of the deceleration is historically severe. With central banks signaling more monetary tightening to come, this has raised concerns that we are on the brink of a global recession (a ‘global recession’ has a range of definitions – one is a contraction in global real per capita GDP, another sets a threshold for global GDP, say of 2%. Certainly, both imply a severe moderation in economic growth that would impose a similarly painful experience on most economies).

A recent report by the World Bank* offers some salient insights into the common features of the five ‘global recessions’ experienced since 1970, using the definition of a contraction in real per capita GDP as the benchmark. While none were identical, the conditions present in the run up to these events, the policy decisions taken at the time and the economic consequences bear close consideration in the current fragile environment. There are two features common to all five:

- In all cases, a sharp slowing in global economic activity preceded the recession. Causes of the moderation range from the Oil Crisis of 1973, which evolved into the global recession of 1975; a sharp tightening in policy rates in the early 1980s was the catalyst for the recession in 1982; and the 2009 recession was the result of the Global Financial Crisis (GFC), in turn triggered by the collapse in the US housing bubble.

- The economies of large, globally significant countries went into recession. The US is of historic relevance, but Europe and China carry a large weight in the global economy, and both are highly integrated regionally.

THE OUTLOOK FOR THE US, EUROPE, THE UK AND CHINA

For now, there are few confident predictions of a pending recession in the US, although the economy entered a ‘technical’ recession in the first half of 2022 with two consecutive quarters of negative growth. The IMF’s growth forecast for 2022 is 1.6% slowing to just 1.0% in 2023. Amongst the most supportive arguments for resilience are the tightness of the US labour market, rising wage growth and a modest recovery in consumer sentiment. However, these areas of economic strength make it difficult for the Federal Reserve Board (the Fed) to force inflation back within target and raise the risk of the Fed ‘over-tightening’, which could cause the economy to contract. In addition, the US housing market, which has been not only a support for growth but also to incomes and balance sheets, is increasingly vulnerable to the sharp upward adjustment in borrowing costs as the Fed raises policy rates.

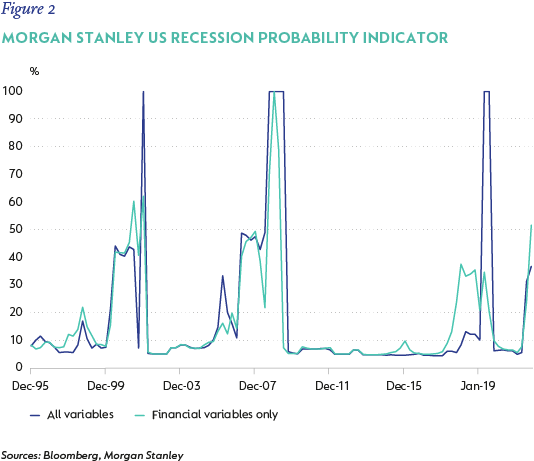

A combination of economic activity and financial indicators are now pointing to a greater probability of the US economy entering recession (Figure 2).

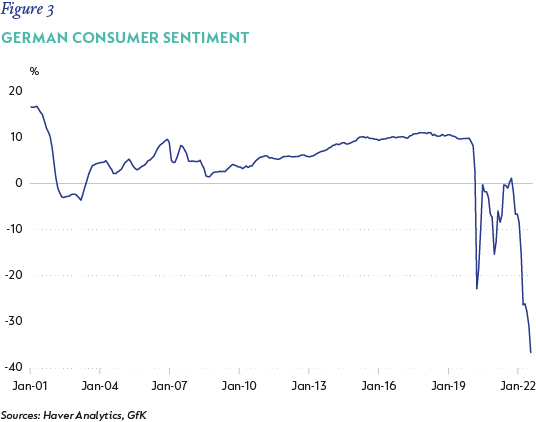

Europe is visibly more exposed. Not only is inflation historically high, but average wage growth is also lower than in the US, and energy prices are set to rise further into winter as the impact of crisis gas prices feed through from wholesale to retail prices. Europe is also much closer to the conflict and literally on the frontline of Russia’s weaponisation of sourced gas. The constrained gas supply is a material threat, not only to the region’s ability to produce output but also to consumer sentiment. Figure 3 shows how German consumer sentiment has plummeted to decade lows.

The UK’s in-part homegrown challenges include its own brand of politics and accompanying policy changes as well as a combination of the same challenges as seen in the US and Europe: high inflation, negative real income growth, massive increases in inflation largely – but not only – owing to energy and food prices. Core inflation has increased by 2ppt since end-2021 to 6.4%, before the winter gas tariff increase. The rise in interest rates will have an even more pronounced impact on the housing market in the UK as fixed-rate mortgages start to roll over at interest rates significantly higher than at any time in the past decade. In the Bank of England’s September Monetary Policy Committee summary, Governor Andrew Bailey speculated that the UK may already be in recession.

While China is not expected to enter a recession, growth forecasts have also been relentlessly revised lower because of the economic impact of the government’s zero-Covid policies and uncertainty related to the impact of evolving policies on the domestic property sector. At the end of 2021, the IMF expected GDP growth of 5.6% in 2022, and 5.3% in 2023. The latest revisions take 2022 to 3.2% and 2023 to 4.4% – on the expectation that Covid restrictions ease, but that domestic growth strategies remain challenging.

The above sample covers about 60% of global GDP (nominal, measured in USD) and suggests that, given the current weak growth outlook, even a moderate shock could push these countries into painfully slower growth, or recession.

POLICY MOVES WILL DETERMINE THE DAY

The evolution of policy choices will continue to play a critical role in determining economic outcomes, and there are no easy choices ahead. Referring again to the work of the World Bank that highlights that monetary and fiscal accommodation (growth-supportive) policies that were maintained despite high inflation in the crises of the 1970s, contributed materially to the painful tightening of monetary policy in the early 1980s, in turn inflicting more severe penalties on the economies of the US, Germany and the UK in terms of lost output and rising unemployment than would have been the case if monetary policy had been more proactive. So, the key lesson is that in the face of elevated inflation the lesser of two evils is to force inflation down, even if this exacts a painful contraction in near-term growth. Targeted fiscal support can help cushion the most vulnerable, but may make the job of the central bankers harder.

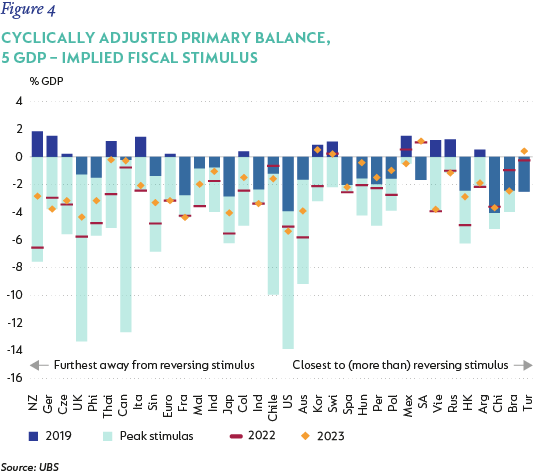

Most countries extended meaningful levels of monetary and fiscal support during 2020 to mitigate the economic impact of the pandemic. While fading fiscal support contributed to moderating growth, as governments consolidated their positions in the aftermath of the pandemic, most of them have done something to provide relief to households from the soaring cost of living. In aggregate, these measures still don’t reverse the process of consolidation. As Figure 4 shows, fiscal support will continue in 2023 relative to pre-Covid levels but should continue to fade.

The emergence of inflation in late-2020 did not prompt an urgent enough response by central banks, and subsequent accommodation has helped rising prices become entrenched. It was only by early 2022 that global central banks really ‘pivoted’ and took seriously to the challenge of high inflation. By July, the number of central banks hiking policy rates was the highest ever, and rate hikes are expected to continue into 2023.

A TOUGH ENVIRONMENT FOR EMERGING MARKETS

Tightening global financial conditions create a deeply challenging environment for emerging markets. More fragile coming out of the Covid pandemic with a lower growth recovery rate and higher aggregate debt, emerging markets running large current account deficit are particularly vulnerable as the cost of servicing USD-denominated debt has increased materially, and the ability to fund imports has deteriorated.

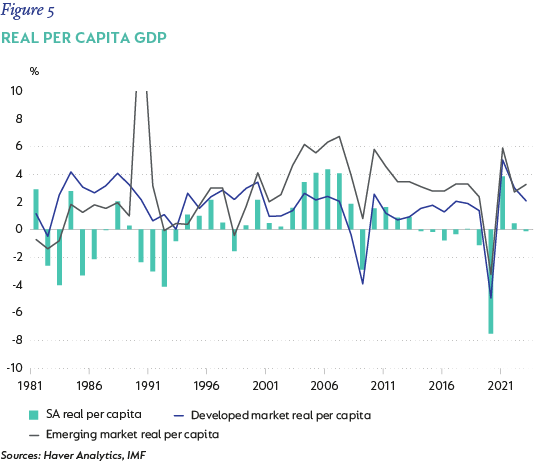

Looking at South Africa (SA) through the lens of the World Bank report presents a more complex picture. The first noteworthy observation is that over the long-term, positive, sustained per capita real GDP growth (Figure 5) was only a feature of the early 2000s. In the pre-democratic period, real GDP growth was low, and in the post-GFC period zero or negative real per capita GDP has been a persistent outcome.

In the aftermath of the pandemic, domestic activity initially recovered strongly, but faltered in the second quarter of 2021, exacerbated by unrest in KwaZulu-Natal and the Omicron variant. A healthy bounce in the first quarter of 2022 faded quickly as strikes, flooding and renewed and aggravated loadshedding saw GDP contract in the second quarter. Forward-looking activity indicators suggest some improvement in the third quarter of 2022 (Q3-22), but as loadshedding has intensified and global growth continues to falter, the outlook for domestic growth sees accumulating headwinds, which could see another contraction in Q3-22 – a technical recession. As elsewhere, forecasts for growth have been steadily revised down. 2022 is expected to grow at about 2%, depending on the impact of Q3-22 loadshedding, but largely reflecting a strong start to the year. As global growth has slowed and domestic inflation has deteriorated, our growth outlook for 2023 is likely around 1.4% (IMFe: 1.1%).

Unlike some of its global peers, the South African Reserve Bank (SARB)’s Monetary Policy Committee (MPC) started the journey of ‘normalising’ interest rates in late 2021. However, despite this proactive approach, the rapid rise in headline inflation – and the slower, but persistent rise in core measures – has meant real interest rates remain below or close to zero on a comparative basis. This is still below the SARB’s neutral rate of 2.3% on a forward-looking basis, and it now also faces the challenging task of balancing weaker underlying economic activity with mounting inflation.

Should headline inflation remain stubbornly above the SARB mid-point, and core inflation continue to accelerate, and then remain above the more comfortable 4.5% level, the MPC is also likely to continue raising interest rates to ensure inflation expectations re-anchor. The hawkish split to the MPC vote at the September meeting, where the Committee decided in a 3:2 vote to raise the repo rate by 75 basis points (bps) to 6.25% with three members looking for 75bps, but two for 100bps, is illustrative of some urgency among members to remain front-footed and avoid the need to impose restrictive interest rates on the domestic economy. However, given the downward adjustment to growth, here too a relatively small move might see growth moderate materially.

A GLIMMER OF HOPE

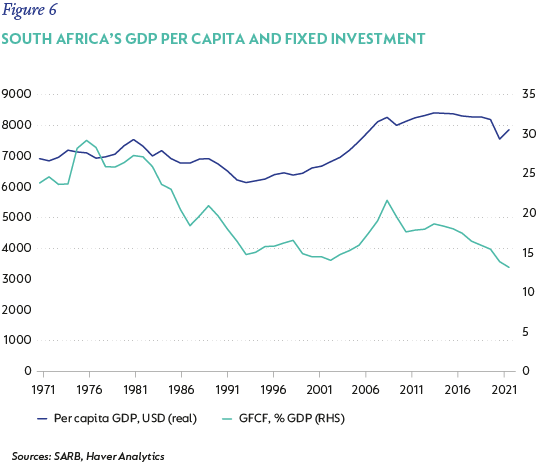

One of the enormous weaknesses of the SA economy has been collapse in gross fixed capital formation (GFCF), which has been a fundamental inhibitor to the economy’s ability to generate sufficient growth momentum and capacity to meaningfully increase inclusivity. This reflects a host of factors, including the deterioration in energy availability, poor investor and business confidence, State Capture, inefficient allocation of resources and rising borrowing costs. The bottom line, however, is that with GFCF accounting for just under 14% of GDP (Figure 6), SA is no longer investing enough to replace utilised capital, let alone to sufficiently increase capacity.

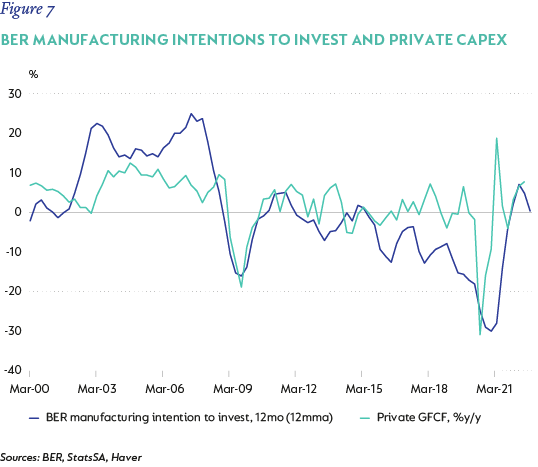

Recent data offers a glimmer of hope. Figure 7 shows the modest recovery in private investment after the GFC, in part reflecting the investment in renewables associated with Bid Window 4 of the Renewable Energy Independent Power Producer Procurement Programme. More recently, there has been a visible acceleration in investment in ‘machinery and equipment’. Although severe loadshedding in Q3-22 dampened some of these plans, the trend has improved.

According to members of Operation Vulindlela – the special task team in the Presidency mandated to accelerate the implementation of critical reforms – the registered pipeline of embedded generation projects has reached 80, with a cumulative capacity total of 6 gigawatts. The National Electricity Crisis Committee is charged with the full implementation of President Ramaphosa’s energy action plan, including the removal of the licensing threshold, and doubling procurement through Bid Window 6 by the end of 2022. Outside of power, the successful spectrum auction and accelerated plan to announce the switching off of analogue systems are possible catalysts for further private sector investment.

HARD BUT NOT IMPOSSIBLE

All things being equal, a simple modeling exercise shows that raising fixed investment by R100 billion would lift our projected GDP forecast from 1.4% in 2023 to 2.4% (including the impact of offsetting the increase in imports). Sustaining a rate of growth towards an average GFCF to GDP ratio of about 25% could see real growth of about 4%-5% p.a. This is well ahead of projected population growth, and would provide much-needed support to employment and be sufficient to cushion the economy against tighter monetary and fiscal policies. Considering this scenario in light of President Ramaphosa’s R1.14 trillion investment commitments over the coming five years (March 2022) perhaps adds perspective.

We don’t expect SA to suffer a protracted weakening of growth or a recession in 2023. The data suggests some sectors of the economy will continue to perform with considerable resilience despite weakening global and domestic factors and the rising risk of recession in key global economies, coupled with a weak economic recovery in China, all of which constitute building headwinds for our small open economy.

However, weak growth remains a material challenge for fiscal policy, and rising global interest rates, as well as tighter broader liquidity conditions, will keep the central bank vigilant and the fiscal position vulnerable. Methodical delivery on key enabling initiatives to boost private sector investment – in energy as well as productive capacity – are critical to a better-performing domestic economy, and its fiscal sustainability. +

*Guenette, Justin Damien; Kose, M. Ayhan and Sugawara, Naotaka; World Bank Group, Equitable Growth, Finance and Institutions Policy Note 4, “Is a Global Recession Imminent?”.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional