Markets remained extremely volatile throughout this quarter as global markets digested the real possibility of higher interest rates for longer to deal with stickier inflation. Concerns about sovereign debt levels, both at home and abroad, also added pressure to longer-term interest rates. Ultimately, these rates impact all asset classes as they represent the benchmark risk-free rate used in the pricing of assets.

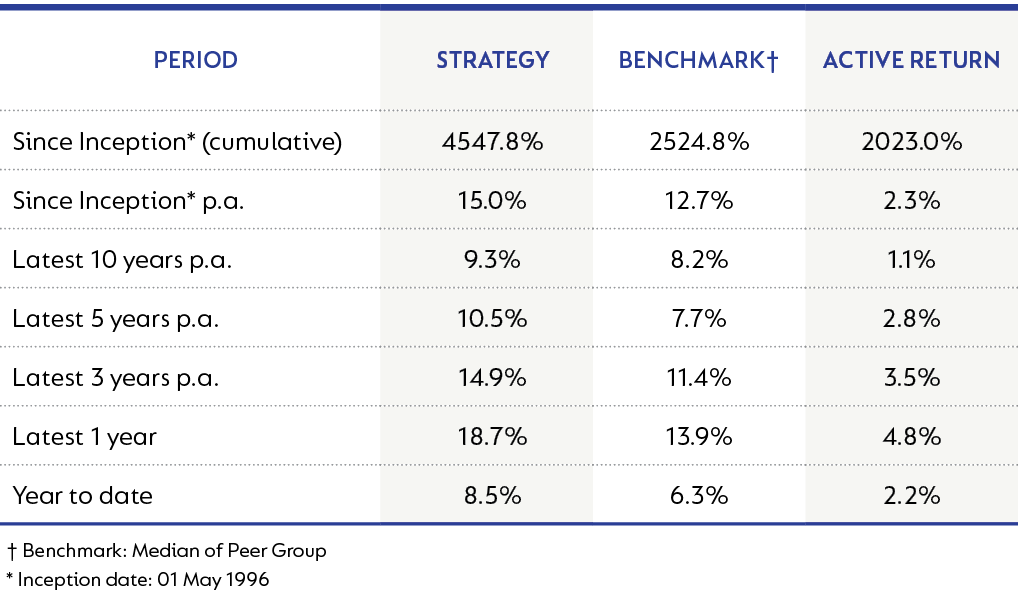

The Strategy continues to deliver compelling performance, with one year returns well ahead of inflation and the benchmark. The outperformance was driven by good asset allocation decisions, as well stock picking within the Strategy’s equity, bond, and property allocations. Periods of volatility should provide attractive opportunities for active managers, and this certainly has been the case over the past year, where some of the significant moves provided good entry points for longer-term investors. Performance over more meaningful longer term time periods also remains pleasing.

The Strategy’s performance as at 30 September 2023 is shown below:

For many years, we have used a normal level of 4% for the US 10-year long bond. This is the base building block amongst almost all assets globally. For over a decade, rates have been well below this level, causing many shorter-term investors and capital allocators to misallocate capital based on the presumption that rates would remain this low for the foreseeable future. Now, for the first time since 2007, 10-year rates are sitting above 4%, and even close to 5%. After years of there being no alternatives to equities with which to achieve mid-single digit returns in US dollars, the large and deep bond market now offers investors and savers a very real alternative, resulting in the reduction of a lot of speculative investing as there is a real cost attached to this activity.

Despite offering more attractive yields, some caution is however still required when considering US Treasuries. The US is highly indebted, and the political ructions in a divided Congress have seen the risk of US default raised by rating agencies as the Democrats and Republicans tussle over the debt ceiling. The key point is that a significant guiding light in the valuation of all assets has changed significantly, and the impact has yet to be fully reflected across all asset prices.

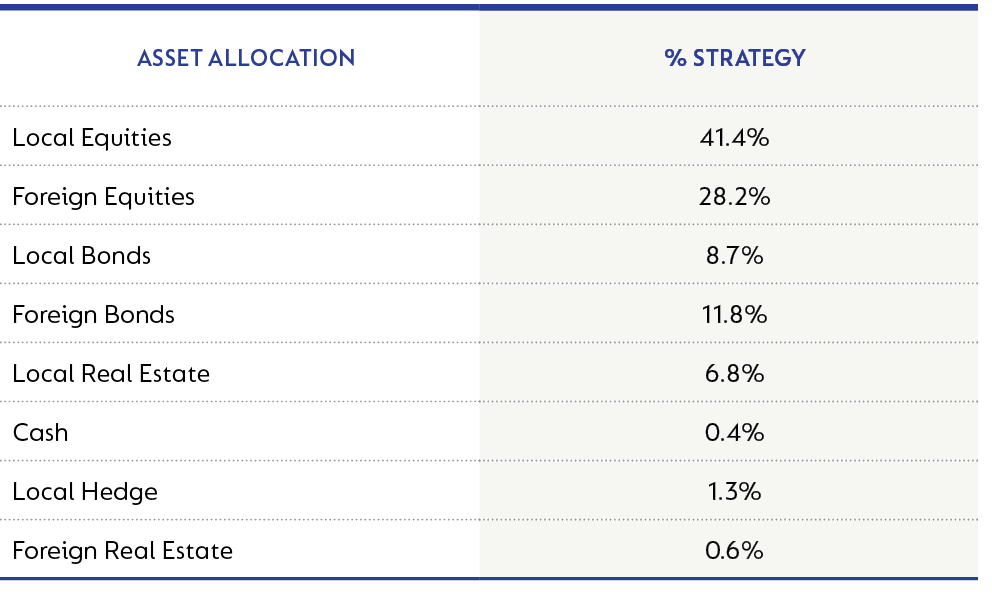

The Strategy did well over the past 12 months by increasing global exposure early in the financial year and benefiting from the recovery in global markets, driven by the peaking and decline in inflation rates. We have subsequently reduced some of our offshore exposure, both through outright selling and through buying of put protection. One of the peculiarities of equity markets is that as they trend upwards, the cost of buying protection (volatility) declines, making it cheaper to buy put protection when markets are highly priced.

We have found the offshore fixed income credit space particularly attractive. While sovereign bond yields have picked up, we remain concerned about levels of indebtedness. Counter to this, global corporate credit spreads remain wide, and with base rates having risen worldwide, we can identify attractive credit risk exposures, offering us yields in US dollars and euros close to 10%. We now have a diversified portfolio of credits, making up close to 10% of the Strategy, offering good returns and diversification away from pure South African (SA) risks.

In our domestic equity allocation, we have not cut the exposure, principally due to the upside returns we can identify from specific names on the JSE. The bias is still towards global businesses and resource companies whose drivers are not closely linked to the fate of the SA economy. As Eskom (still without a CEO after 10 months) and Transnet (now also without a CEO) have dragged down the local economy, it is hard to find any reason that will see domestic businesses thrive. The only local businesses that are seeing growth are those that are replacing government services or facilitating companies that replace the services that the government used to provide. The local banks are a great example of this, as they are seeing very good asset growth for retail and corporate customers' financing of self-provided power.

The market valuation of many SA businesses is at very low levels. Some of these businesses will be ‘value traps’ struggling with no top-line growth amid ongoing cost pressures, while others will manage to defend their top line by taking market share and managing their costs. The latter will offer investors great returns as the market starts to differentiate between the winners and losers. We have taken advantage of this and have built up a Strategy comprising several smaller positions in domestic businesses that we think offer the prospect of decent returns.

These positions have been funded by selling down our exposure to the life companies. These companies bore the brunt of Covid costs during 2021 and 2022, resulting in short-term negative market price moves, which allowed us to build up significant positions at very attractive prices, generally at large discounts to their embedded value. As earnings have bounced back, we have seen a strong recovery in these share prices, and we have prudently cut back on these holdings.

While not having a large holding in domestic property, the Strategy benefited from our two largest exposures in the property sector, both due to corporate activity. Our holding in L2D rallied strongly on the announcement of a takeout by Standard Bank, and our holding in Attacq benefited from the announced sale of a portion of its top-class Waterfall estate to the Government Employees Pension Fund. Now, we see some opportunities in the global property stocks listed in SA; they are trading on very attractive yields but aren’t facing the same challenges as local landlords with high vacancies and double-digit administered costs.

Our domestic bond holdings have reduced as we funded the global bond positions referred to above. Local credit spreads and sovereign fiscal worries are keeping us away from the domestic markets as we don't think yields sufficiently reward investors for the inherent risks.

Our asset allocation as at 30 September 2023 is shown below:

Our top 10 holdings and sector exposure as at 30 September 2023 is shown below:

A year ago, we certainly would not have forecast the very strong return that the Strategy managed to generate, even though we could see asset classes were cheap. Once again, we sit in a position where we can see significant upside in our Strategy holdings but have no foresight of what short-term market returns will bring. Yet, we are confident that over the longer term, the rebasing higher of global risk rates implicitly means better long-term returns for investors and savers in future.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional