Investment views

Gold

Cheap insurance at a time of heightened risk

- We believe the monetary and fiscal policy responses to Covid-19 are supportive of the gold price

- AngloGold and Gold Fields have vastly improved their businesses, yet can be bought at a discount

- Historically, due to poor fundamentals, we have not held gold shares; this has changed

OVER THE LAST two years, the gold spot price has risen strongly, from $1 200 to $1 800, after peaking at $2 035 an ounce. The uncertainty brought about by the Covid-19 pandemic drove a flight to safety into the yellow metal in 2020, as record capital flowed into gold-backed exchange-traded funds (ETFs). In addition to the pandemic itself, the policy response from governments and central banks stands to support the gold price over the medium to long term. The global policy response has seen dramatic money printing, the expansion of central bank balance sheets and novel fiscal policies that put money directly into consumer pockets. Combined with a 13-year global equity bull market, we think that risks in the system are high. Gold is an inexpensive insurance against risk, and we believe that the gold equities currently provide historically cheap exposure to gold.

The gold price has performed well as a hedge over time, displaying a negative correlation to most financial assets. Unlike the rest of the commodity suite, the gold price does not have a strong relationship with typical supply/demand fundamentals or cost curve dynamics. In recent years, gold has exhibited a very strong relationship with real yields, which have become increasingly negative in developed markets, with gold rallying in this environment. Viewed as a risk-free/insurance asset, the zero yield on gold becomes more attractive as the real yield on other risk-free assets, such as government bonds, goes more negative. With the potential for higher inflation in the coming years and greater central bank tolerance of this, we believe the environment for the gold price is supportive.

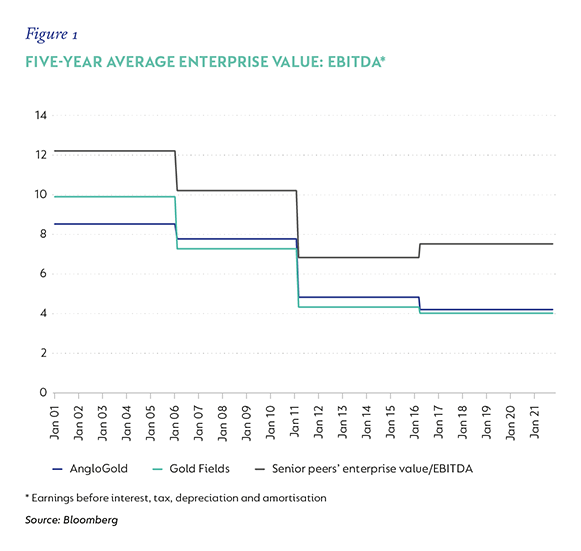

Elevated gold prices and negative real interest rates are both indicative of a desire for risk protection. Before the advent of gold ETFs in the early 2000s, if investors wanted risk protection through gold, the only way to access this was to own gold equities. For this reason, the premium paid for risk protection was particularly high, with investors accustomed to paying multiples of net present value for the privilege of gold exposure. ETFs provided the opportunity for exposure to the gold price without the cost inflation, capital allocation missteps and operational risk that have been endemic to the miners over time. Poor capital allocation over time from the gold miners and an attractive alternative in the ETF market contributed to a meaningful de-rating within the gold sector, with the South African (SA)-listed gold companies performing worse than their peers, and gold equities underperforming the gold price and the stock market over meaningful time periods. Multiples have come down dramatically over all time periods and the premiums investors used to pay have now turned into discounts (Figure 1). At the end of June 2021, the top eight gold miners in the world had a combined market capitalisation of $153 billion, lower than the $180 billion invested in ETFs.

HISTORICALLY POOR ALLOCATORS OF CAPITAL

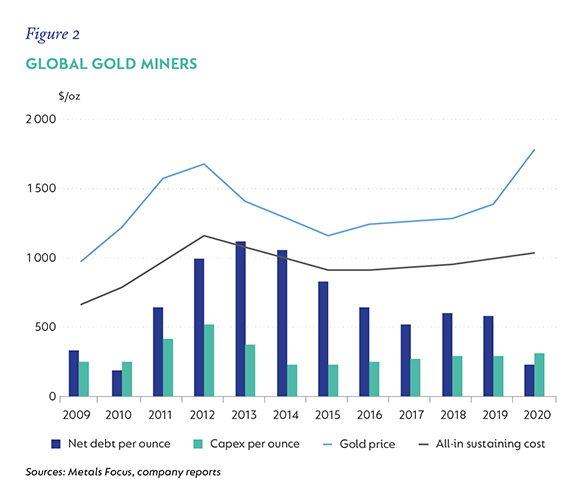

At the top of the last gold bull cycle in 2012, the gold sector, on average, continued to invest heavily in growth projects, and mergers and acquisitions. When the gold price began to decline, these capital commitments were met with debt as operating cash flows subsided. This left the entire industry needing to reduce costs, which had run up aggressively with the gold price, and reduce debt over a multi-year period. The gold sector’s poor cost control, poor capital allocation and high valuations all contributed to Coronation not having had a meaningful position in gold equities for nearly two decades. We believe a lot has changed.

In recent years, the gold industry has displayed far better control over unit cost and capital expenditure, enabling companies and their shareholders to capture more of the rising gold price. Now that balance sheets are repaired and cost control has improved, the surplus free cash flow generated stands to be invested in smaller value-accretive growth projects and paid back to shareholders in the form of dividends. Several of the top global gold miners have increased their payouts to shareholders and we strongly believe there is further room for improvement.

Despite these improvements, investors are now able to buy the stocks at large discounts due to general disenchantment with the mining sector, and the gold miners in particular. While the gold sector is improving from a capital returns perspective, it lags the diversified mining sector and even the platinum sector. We believe that the gold sector overall has learnt valuable lessons from the last few cycles, much like we have seen in the diversified miners. Figure 2 shows this very nicely.

SA GOLD COMPANIES’ IMPROVED RELATIVE POSITION

The SA-listed gold stocks have long traded at increasingly large discounts to their global peers, something they have largely deserved until now. We believe a discount is warranted due to shorter mine lives and higher costs, but nowhere near the c.50% discount they currently trade at. The relative discount stands at the widest it has ever been, at a point in time when we believe the relative differential is at its smallest. Our analysis shows that the primary drivers of rating differentials over time are production outlook and cost curve position. Over the next five years, the production and cost outlook for AngloGold and Gold Fields has not been this good for two decades, and they stand to dramatically improve their position versus their peers. This is not being reflected in valuations.

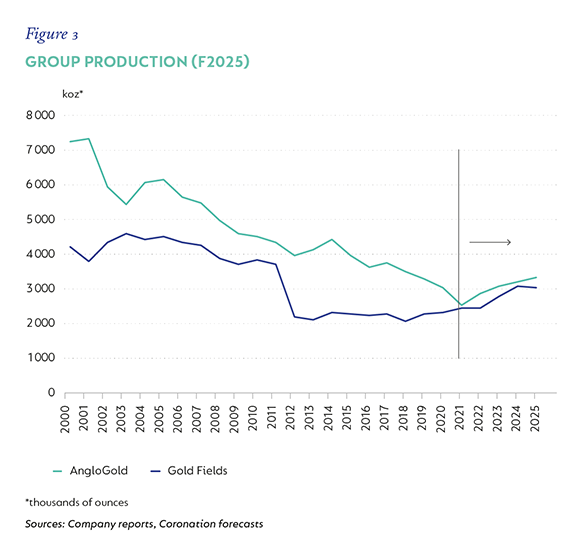

Both AngloGold and Gold Fields have greenfield and brownfield projects available to them, with the potential to boost production by 31% and 25%, respectively, from 2021 to 2025 (Figure 3). This is in stark contrast to the last two decades and, importantly, from a shareholder perspective, the projects are high quality and low cost, all with the potential to bring down average group production costs. Delivery on these is critical, but in mining nothing is ever easy, as the recent fall of ground at AngloGold’s Obuasi mine has highlighted. Over the next five years versus their major international peers, AngloGold and Gold Fields have the strongest volume outlook; delivering on this could go some way to narrowing the rating differential.

Given that production from AngloGold and Gold Fields has declined so precipitously over the years, it is important to understand why. AngloGold has been the worst performer in this regard, and it is worth highlighting that the investment plan that Gold Fields has implemented over the last five-plus years has done good work to stabilise its portfolio and form a base from which to grow.

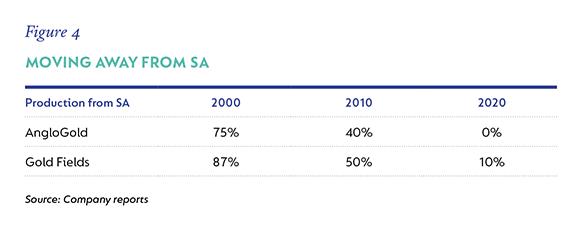

Over longer time periods, the overarching theme across the two businesses has been a move away from their SA assets towards a more international portfolio. SA gold mines are incredibly deep, risky to operate and largely high cost. Through a combination of asset sales, spinoffs and mine asset closures, both companies have reduced their share of production from SA materially (Figure 4). This has been the right strategy, albeit a painfully long one, given the original dominance of SA in their portfolios, and shareholders now stand to reap the rewards. Outside of Barrick Gold Corporation, both AngloGold and Gold Fields have seen the largest production declines of the majors over the long term. As shown in Figure 3 above, this is about to change.

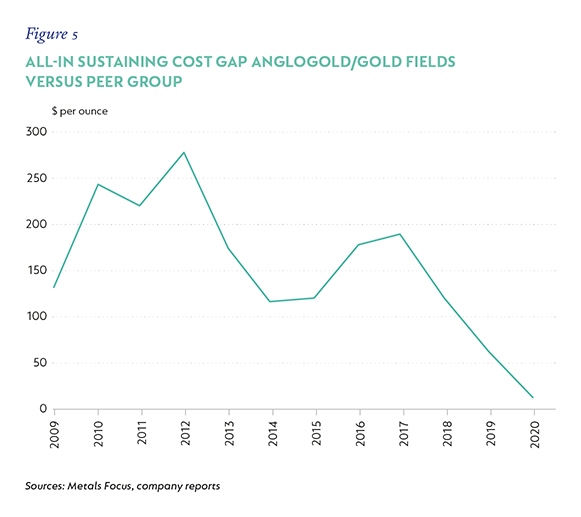

AngloGold and Gold Fields are in the third quarter of the global cost curve, but, due to the flat nature of this curve, there is not too much separating them from their major global peers. The average All-in Sustaining Cost (AISC) of the top eight gold producers in the world for 2020 was $1 050, with both these counters within a percentage point of this average. Additionally, they have both shown better cost control than their peers over the last decade, leading to a narrowing of the cost gap between them. Figure 5 shows how dramatically the cost gap has improved for AngloGold and Gold Fields versus their peers over the last decade.

As previously mentioned, we expect the new projects and internal investment to enable both businesses to close this gap even further over the medium to long term. AngloGold, for example, is targeting a group AISC of $800 to $1 100 in 2025 versus the $1 059 it achieved in 2020. The company is investing heavily in the business in 2021 and 2022, which will see AISC temporarily rise before the investments bear fruit, leaving the business in better shape for the long term. Gold Fields is a few years ahead of AngloGold on the portfolio investment programme, with the results coming through in its operational performance. Both miners are investing in their existing assets to improve their life of mine. Adding reserves ‘through the drill bit’ is the cheapest way of bringing additional ounces into the business and responsible capital allocation.

CONCLUSION

Over the last decade, both AngloGold and Gold Fields have suffered from declining production, over-indebtedness and relatively high costs. As a result of recent and future investments, these drivers stand to reverse and improve dramatically going forward. Both companies have well-funded, high-quality growth projects that are coming online over the next five years, and improved balance sheets mean that surplus free cash flow stands to be returned to shareholders instead of debtholders in this period. Paradoxically, at the time where both of these businesses have the best forward-looking outlook that they have had in two decades, the multiples one is paying have never been lower and the margin of safety never higher.

Combining the pricing of the gold equities with our view on the potential for a strong gold price environment, we believe the protection one buys through exposure to the gold price has never been cheaper than it is today. +

Disclaimer

United States - Institutional

United States - Institutional