MUCH HAS BEEN written about Google’s dominance in search. In this article we explore the culture of the business and some of the hidden yet very valuable other assets of its parent company, Alphabet.

In his 2015 shareholder letter, Alphabet's CEO Larry Page wrote that "incrementalism leads to irrelevance over time, especially in technology, because change tends to be revolutionary, not evolutionary".

Alphabet is the holding company of Google. From its founding in 1998, Alphabet has worked to avoid the tendency of companies to become less innovative and more bureaucratic as they grow, allowing it to escape the fate of many prior tech titans like Nokia and Kodak. The company’s continuous investment and innovation, driven by its ambitious goals, are likely to bear fruit over the short-, medium- and long-term time horizons. Besides the Google search engine, Alphabet has many ‘hidden’ assets. Seven of its products, many of which are in the early stages of monetisation, have over one billion users: Google Search, YouTube, Google Maps, Google Play, Android, Google Chrome and Gmail.

YouTube is now the most watched TV network globally, with over one billion hours watched per day. Google Maps has arguably the most comprehensive building and location information of any map provider. (Justin O’Beirne, a leading US cartographer and software engineer, estimates that Google Maps has a lead equal to six years on Apple Maps.) The Android mobile device operating system, with its Google Play app store, is accessed by two billion people every month. The Chrome browser is estimated to have a 55%, and growing, market share.

Longer term, seemingly the most successful ‘moonshot’ (or highly ambitious) project is Alphabet’s self-driving car business, which has logged 30 times the autonomous miles in California of its peers, combined. Many of Google’s platforms benefit from a first-mover advantage and network effects which create a moat that new entrants will struggle to overcome.

CULTURE

Warren Buffett talks about the “institutional imperative” – the tendency of an institution to resist change to its current direction and to mindlessly follow company leaders or competitors. He tries to invest in companies that are alert to the problem.

Alphabet is such a company. This is evident in Larry Page’s emphasis on first-principles thinking and “being unencumbered by the traditional way of doing things”. As a manifestation of this, Google ran a revolutionary auction-based initial public offering in 2004, which upended the opaque practice of allowing a bank to allocate shares to chosen investors at a recommended price. Another example was how YouTube CEO Susan Wojcicki changed the way the company thought about its budget. Typically, companies allocate their budget according to the size of existing business segments. Her view was that the amount allocated should instead be related to the investments required to achieve the potential of the business. Luckily she did not give in to the institutional imperative; YouTube may otherwise not be Alphabet’s next leg of growth today.

At Alphabet, people think about ‘10X goals’, or building products and services that one day can be 10 times the size they are today. They believe that “if you hire the right people and set big enough dreams, you’ll usually get there”.

Alphabet management also emphasises the importance of small, entrepreneurial teams. Today, developing the best products is key, as customers have more information about products than ever before, distribution is practically free due to mobile devices being ubiquitous, and the cost of developing products is very low due to public cloud infrastructure. Small entrepreneurial teams allow Alphabet to iterate fast in order to make better products than competitors.

YOUTUBE

YouTube is the ‘hidden asset’ likely to make the biggest impact in the medium term. YouTube reportedly has 1.5 billion logged-in users who view videos every month. It is accessible across multiple devices and has a massive content library. Much of the content, often created by independent content creators, appeals to niche groups. Ever heard of PewDiePie, a Swedish gaming enthusiast with 56 million subscribers, or Smosh, a sketch comedy channel with 22 million subscribers? Traditional broadcast television is technically unsuited to deliver customised content to smaller groups at different times, giving YouTube a clear advantage.

YouTube had an early-mover advantage and now benefits from network effects, making it difficult for new entrants to disrupt its position. It was one of the first online video platforms and Alphabet invested heavily in its infrastructure, incurring losses for years. It built up a lead as a result of its ever-growing audience, which resulted in more content creators being attracted to the platform. Content creators are attracted by their ability to earn a commission of about 45% of advertising revenue generated from advertisements shown with their content. In turn, audiences are attracted to YouTube because it has the most content creators.

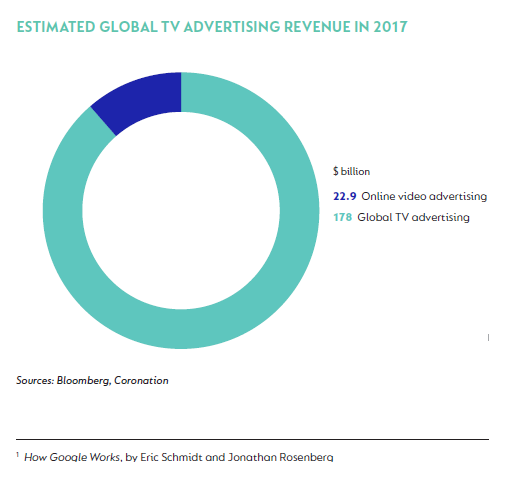

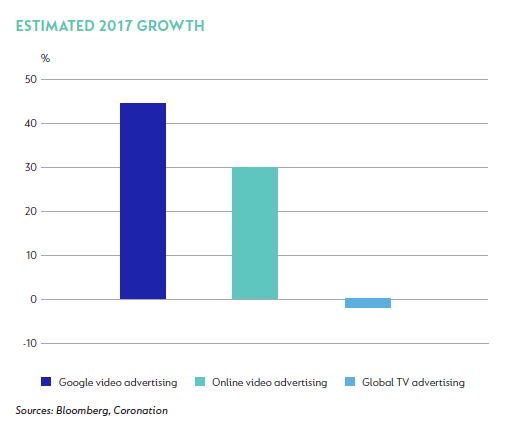

Traditional TV advertising captures about 35% of the total advertising market globally (down from 40% in 2014), amounting to a potential income opportunity of about $178 billion currently. Global online video advertising is still a fraction of this at c. 13% of total TV advertising spend – but it is growing rapidly.

Google, with a market share of more than 50% of the online video ad market, stands to take advantage of the shift towards online video advertising – and to take even more market share. Interestingly, reaching one billion hours of video viewing in 2017 was the achievement of a ‘10X goal’ set in 2012 when viewers watched 100 million hours a day.

GOOGLE PLAY

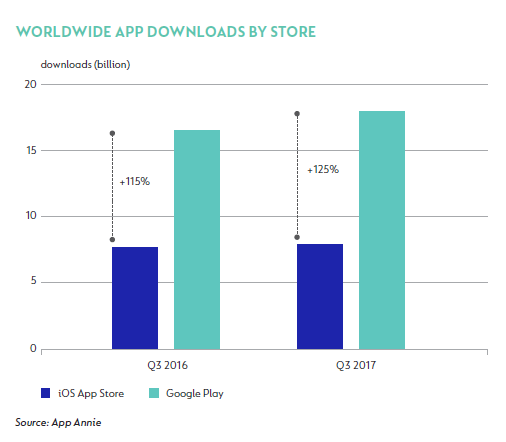

A second underearning asset is Google Play, Google’s app store. It generates revenue through mobile app sales and is a wonderful tollgate on digital consumption. Google takes a 30% commission of the revenue generated from app downloads and pays the remaining 70% to the app’s creator.

Google Play has always been distributed together with Google’s open-source Android operating system (which is now used by 87% of smartphones sold), affording it a massive advantage in building its user base. This early lead kick-started a network effect between app users and developers. The Google brand provides some level of comfort that payments will be managed properly, and app rankings give customers confidence in app quality. Together these features create a powerful moat which makes it difficult for competitors to displace Google Play and which could lead to search-like margins over time.

Android has an installed base of two billion users and Android smartphones outsells Apple by about six to one.

Apple recently stated a goal of driving $50 billion of software and service sales by 2020. Stripping out non-app revenue from this, Apple could conceivably generate $30 billion in app store revenue by 2021.

Even if it only achieves average revenue per user of 40% of that of Apple, the Google Play store has the opportunity to reach a similar size, given its massive and rapidly growing installed base in emerging markets.

MOONSHOT

Alphabet’s ‘moonshot’ projects are the epitome of the think-big culture of the firm. The seeds planted today will likely see the company well positioned 10 years from now.

Waymo, Alphabet’s self-driving car project seems to be furthest along among Alphabet’s ‘moonshots’. Many are aware of Tesla’s autopilot function and Uber’s self-driving plans, but Waymo is improving rapidly, below the radar.

Between December 2015 and November 2016, Waymo drove 635 868 autonomous miles on public Californian roads. That is equivalent to driving from Cape Town to Johannesburg 732 times. When a Waymo car struggles with a decision, it disengages, allowing the driver to take over. Waymo disengaged only 0.2 times per 1 000 miles driven (equal to about once in five trips from Cape Town to Johannesburg). According to a recent report, this was four times better than the year before. This is phenomenal, considering the many complex scenarios and events that the car must consider.

The California Department of Motor Vehicles also recorded the autonomous miles driven by the 11 other firms registered to test cars in California. Together, they travelled just 20 000 miles, or 3% of Waymo’s distance.

The above is an illustration of the big ambition and relentless pursuit of goals that have served Google so well over the years.

VALUATION

Alphabet’s significant investment spending has resulted in near-term margins being depressed. Its overall operating margins are estimated to be 27% for 2017, compared to its search business margins of c. 50%. (Margins of similar businesses like Facebook are around 45%.) Clearly, many of Alphabet’s younger businesses are immature and not yet operating at normalised margins. It is not inconceivable that YouTube could generate margins of 25% in time, or that Google Play could achieve search-like margins given the moats described earlier.

Last quarter, Alphabet reported net cash just shy of $100 billion (13% of its market cap). Its impressive chief financial officer, Ruth Porat, previously from Morgan Stanley, instituted the first share repurchase when she joined Alphabet in 2015. It looks increasingly likely that US tax reform could result in a tax holiday for repatriated cash, which could mean that more cash will be returned to Alphabet shareholders. Alphabet converts much more of its net income to free cash flow than the average business (about 106% compared to under 80% for the average company). Accordingly, a price/free cash flow multiple offers a better yardstick than a price/earnings ratio.

Stripping out net cash, Alphabet trades at 20.6 times its one-year forward free cash flow. This is less than the MSCI World Index’s average multiple of 20.9 times (remember, the index constituents convert less of their earnings to cash). We believe this is good value for a business with leading market shares in attractive sectors that will drive growth at two to three times the market for many years.

United States - Institutional

United States - Institutional