Outlook for platinum group metals remains positive despite new vehicle technology

The South African platinum group metal (PGM) industry has been in a near decade long downturn as demand shocks and a pessimistic outlook pushed prices to what we believe to be unsustainably low levels. Unprofitable supply has been slow to reduce due to high barriers to exit. Sentiment towards the sector is incredibly low due to the deep-level, labour intensive nature of the South African industry as well as concerns surrounding the long-term demand for PGMs as the European diesel share declines and the world shifts towards electric vehicles. The negative sentiment is so great that despite a 36% increase in the industry’s rand revenue basket to near all-time highs, most equity prices continue to trade at distressed levels. Only Amplats has had a positive return over this period.

Platinum group metals comprise five precious metals, of which platinum, palladium and rhodium are the most important. These are referred to as 3E metals. The demand side of the 3E market is dominated by catalytic converters for internal combustion engine (ICE) vehicles, making up 70% of global demand. We are optimistic about the market:

- The outlook for global vehicle sales is good, driven by emerging markets.

- We expect 3E demand to grow over the next decade as environmental legislation in China and the rest of the world forces automakers to use more metal in their vehicles.

- We feel these new legislations are being underestimated. In the next five years, China, the largest vehicle market, will have the strictest emissions standards in the world.

The balance of the market is split between jewellery and industrial catalysts with 9% and 21% respectively. We expect this portion of demand to see slight growth over the next decade. The negativity on the demand side has been driven by the outlook for European diesel sales as well as the rise of battery electric vehicles (BEVs). While the outlook for European diesel is negative, it is important to note that it is only 12% of 3E demand and we do expect this to decline.

We are believers in the long-term prospects of BEVs but are cognisant of the various challenges currently facing the technology. The primary hurdles to rapid adoption are range anxiety, lack of infrastructure, high costs and long charging times. We have done a huge amount of work on the future of the automotive industry, travelling the world talking to industry players and working with automotive consultants. The mega-trends of electrifying the drive train, as well as using cars as a service (Uber and autonomous vehicles) instead of individual ownership, will shape the industry over the next few decades. Our key takeaway from the work that we have done is that the transition of the industry will be evolutionary rather than revolutionary; it is not all going to change overnight.

Importantly, we see a period of mass hybridisation over the next decade before BEVs start to become more affordable for the mass market. We anticipate a shift towards a portfolio of technologies including BEVs, a variety of hybrids as well as fuel cell vehicles. As investors in the PGM sector, our biggest worry is BEV adoption, as these have no PGMs in the vehicle at all. In our forecasts out to 2030, we expect BEVs to make up 19% of global light duty vehicle sales, up from 1% today. We expect the traditional ICE as we know it to decline from 96% today to 28%. There is some potential for fuel cells in the vehicle mix given their suitability in long distance and haulage applications. In addition, the Chinese and Japanese are championing the technology and are investing hard behind it, which cannot be ignored. Fuel cells are very PGM intensive and stand to be a material boost to demand if successful.

Currently, gasoline vehicles use predominantly palladium in the converter, instead of platinum. Palladium is in material deficit and now trades at a $180/oz premium to platinum where it historically traded at large discounts. Industry feedback we have gathered is that platinum is a superior metal for catalysis and that a growing price differential will swing the OEMs back towards platinum in the fullness of time. Many in the market look at the platinum surplus and declare that the metal is doomed; our view is that, given their fungibility, platinum and palladium must be considered together. When looked at this way, the market is in a growing deficit. Out of the 3E metals, platinum is most important for the South African producers as it is makes up 60% of the ounces extracted from the ground.

Considering all our demand expectations, we see 3E demand actually increasing 11% by 2030, where the market rhetoric seems set on declining demand. The negativity surrounding the PGM markets is not dissimilar to that surrounding thermal coal a few years ago. It has now become clear that despite being a sunset industry, thermal coal will be around for a few decades to come and thermal coal prices are up over 100%. The outlook for mined supply of 3E metals over this period is muted, with growth from Russia offsetting declines from South Africa. Secondary supply of PGMs through the recycling channel is set to increase materially off today’s base. Beyond 2030, we see large reductions in South African supply as many mines come to the end of their economic lives.

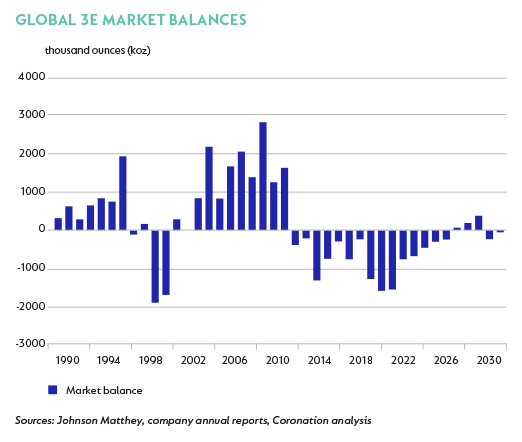

Coupling our supply and demand expectations gives us an average market deficit of 500koz, or 2.6% of annual demand each year, over the next 12 years. These deficits are substantially more pronounced in the near term and we expect prices to react strongly over this time frame. We have excluded potential investment demand from these balances, which may prove conservative.

Negativity towards the industry also stems from the deep-level, high cost nature of the majority of the South African mines. We have mitigated this through the selection of the highest quality plays in the sector, Northam and Amplats.

Northam is a medium-size producer with two producing mines, run by an entrepreneurial management team who have taken advantage of the downturn in the industry by making smart acquisitions. Production growth from its Booysendal mine over the next five years will help the group double production. Booysendal is the key asset in Northam’s portfolio and while it is underground, it is shallow, capital light and mechanised – meaning a smaller labour component. Northam is well positioned to generate cash flows and at these metal prices will earn R4 in the 2019 year, a 9xPE.

Amplats is the largest producer of PGMs and has undergone a remarkable portfolio transition in the last five years. Shedding itself of high cost, deep underground mines and focusing on the key Mogalakwena asset has allowed Amplats to pay the first dividend in the sector since 2013. Mogalakwena is a unique asset as it is an open pit, which means it comes with significantly less operational complexity and standout margins. It has material expansion capability over the next decade and we believe management will pursue this. Amplats has several options to expand the size of the portfolio over the next decade with high quality, low labour ounces. At today’s spot prices Amplats trades on an11xPE for the 2019 year

The sentiment surrounding PGMs has left the equity prices in the sector lagging recent improvements in the basket price. Thanks to their high quality operations both Northam and Amplats can generate material cash flows in today’s price environment and we believe equities are yet to reflect this fact. Combined together, and on a look through basis with Anglo American, we have 6% exposure to the PGM sector in our house portfolios.

Disclaimer

United States - Institutional

United States - Institutional